The Industrial Revolution - Economics

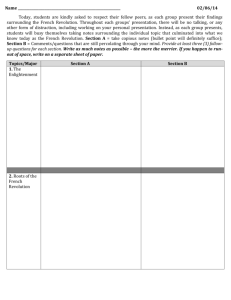

advertisement