Oil & Gas Majors: Fact Sheets

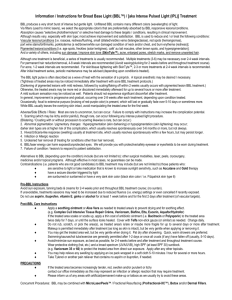

advertisement