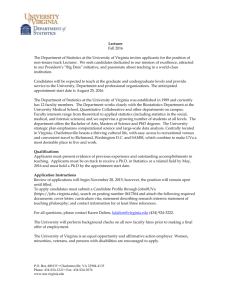

FORM 763 - University of Virginia

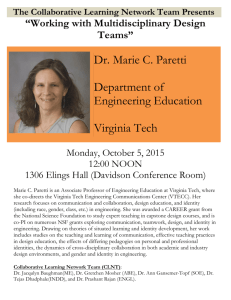

advertisement