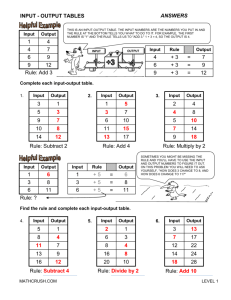

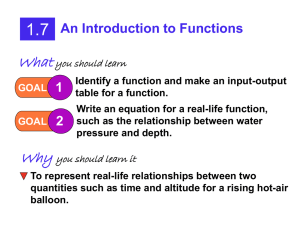

Applications of Leontief's Input

advertisement