2015 Minnesota Withholding Tax Tables

advertisement

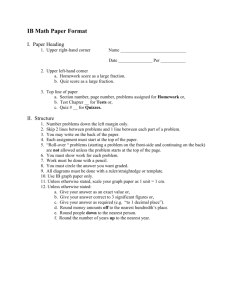

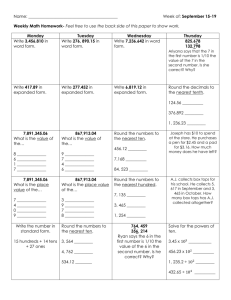

2015 Minnesota Withholding Tax Tables Use the tables on the following pages to determine how much to withhold from your employees’ paychecks. If you make payments such as overtime, commissions, bonuses or other supplemental payments to your employees in addition to their wages, read the section on page 7 before you calculate the withholding. Also read “Backup Withholding” on page 7 to see if it applies to any payments you make to people who perform work for you. There are separate tables for employees paid: • • • • • every day once a week every two weeks twice a month once a month For each type of payroll period, there is one table for single employees and one table for married employees. Use the table that matches each employee’s marital status and payroll-period type. If you use a computer to determine how much to withhold, see page 34 for the formula to set up your program. www.revenue.state.mn.us 15 Revised Jan. 1, 2015 Single employees paid every day If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 24 28 32 36 24 28 32 36 40 0 1 1 1 2 0 0 1 1 1 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 40 44 48 52 56 44 48 52 56 60 2 2 2 3 3 1 2 2 2 2 1 1 1 1 2 0 0 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 60 64 68 72 76 64 68 72 76 80 3 3 3 4 4 2 3 3 3 3 2 2 2 2 3 1 1 2 2 2 1 1 1 1 1 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 80 84 88 92 96 84 88 92 96 100 4 4 5 5 5 3 4 4 4 4 3 3 3 3 4 2 2 3 3 3 2 2 2 2 3 1 1 2 2 2 0 1 1 1 1 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 100 104 104 108 108 112 112 116 116 120 6 6 6 6 7 5 5 5 6 6 4 4 5 5 5 3 4 4 4 4 3 3 3 3 4 2 2 3 3 3 2 2 2 2 2 1 1 1 2 2 0 1 1 1 1 0 0 0 0 1 0 0 0 0 0 120 124 128 132 136 124 128 132 136 140 7 7 8 8 8 6 6 7 7 7 5 6 6 6 7 5 5 5 5 6 4 4 4 5 5 3 3 4 4 4 3 3 3 3 3 2 2 2 3 3 1 2 2 2 2 1 1 1 1 2 0 0 1 1 1 140 144 144 148 148 152 152 156 156 160 8 9 9 9 10 8 8 8 8 9 7 7 7 8 8 6 6 7 7 7 5 6 6 6 6 4 5 5 5 6 4 4 4 5 5 3 3 4 4 4 2 3 3 3 3 2 2 2 3 3 1 2 2 2 2 160 10 3 2 8 7 23 22 7.05 PERCENT (.0705) OF THE EXCESS OVER $160 PLUS (round total to the nearest whole dollar) 235 9 8 7 7 6 5 4 3 7.85 PERCENT (.0785) OF THE EXCESS OVER $235 PLUS (round total to the nearest whole dollar) 235 437 15 14 13 13 12 11 10 9 9 9.85 PERCENT (.0985) OF THE EXCESS OVER $437 PLUS (round total to the nearest whole dollar) 437 and over 16 31 30 29 28 27 26 26 25 24 Married employees paid every day Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 10 at least but less than 0 32 36 40 44 32 36 40 44 48 0 1 1 1 1 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 48 52 56 60 64 52 56 60 64 68 1 2 2 2 2 1 1 1 1 2 0 0 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 68 72 76 80 84 72 76 80 84 88 2 3 3 3 3 2 2 2 3 3 1 1 2 2 2 1 1 1 1 2 0 0 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 88 92 96 100 104 92 96 100 104 108 4 4 4 4 4 3 3 3 4 4 2 3 3 3 3 2 2 2 2 3 1 1 2 2 2 1 1 1 1 1 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 108 112 112 116 116 120 120 124 124 128 5 5 5 5 5 4 4 4 5 5 3 4 4 4 4 3 3 3 3 4 2 2 3 3 3 2 2 2 2 2 1 1 1 2 2 0 1 1 1 1 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 128 132 132 136 136 140 140 144 144 148 6 6 6 7 7 5 5 6 6 6 4 5 5 5 5 4 4 4 5 5 3 4 4 4 4 3 3 3 3 4 2 2 3 3 3 2 2 2 2 2 1 1 1 2 2 0 1 1 1 1 0 0 0 0 1 148 152 156 7 7 8 6 7 7 6 6 6 5 5 5 4 5 5 4 4 4 3 3 4 3 3 3 2 2 2 1 2 2 1 1 1 2 1 20 19 43 43 152 156 160 The amount to withhold (in whole dollars) or more Revised Jan. 1, 2015 If the employee’s wages are 7.05 PERCENT (.0705) OF THE EXCESS OVER $160 PLUS (round total to the nearest whole dollar) 160 428 8 7 6 6 5 4 4 3 3 7.85 PERCENT (.0785) OF THE EXCESS OVER $428 PLUS (round total to the nearest whole dollar) 428 741 27 26 25 24 24 23 22 21 20 9.85 PERCENT (.0985) OF THE EXCESS OVER $741 PLUS (round total to the nearest whole dollar) 741 and over 51 50 50 49 48 47 46 45 44 17 Revised Jan. 1, 2015 Single employees paid once a week 18 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 50 60 70 80 50 60 70 80 90 0 1 1 2 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 90 100 110 120 130 100 110 120 130 140 3 3 4 4 5 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 140 150 160 170 180 150 160 170 180 190 5 6 6 7 8 1 2 2 3 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 190 200 210 220 230 200 210 220 230 240 8 9 9 10 10 4 4 5 6 6 0 0 1 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 240 250 260 270 280 250 260 270 280 290 11 11 12 12 13 7 7 8 8 9 3 3 4 4 5 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 290 300 310 320 330 300 310 320 330 340 13 14 14 15 16 9 10 10 11 11 5 6 6 7 7 1 2 2 3 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 340 350 360 370 380 350 360 370 380 390 16 17 17 18 18 12 13 13 14 14 8 8 9 9 10 4 4 5 5 6 0 0 1 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 390 400 410 420 430 400 410 420 430 440 19 19 20 20 21 15 15 16 16 17 11 11 12 12 13 6 7 7 8 9 2 3 3 4 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 440 450 460 470 480 450 460 470 480 490 21 22 23 23 24 17 18 18 19 19 13 14 14 15 15 9 10 10 11 11 5 6 6 7 7 1 1 2 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 490 500 510 520 530 500 510 520 530 540 24 25 25 26 26 20 21 21 22 22 16 16 17 17 18 12 12 13 13 14 8 8 9 9 10 4 4 5 5 6 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 540 550 560 570 580 550 560 570 580 590 27 28 29 29 30 23 23 24 24 25 19 19 20 20 21 14 15 16 16 17 10 11 11 12 12 6 7 7 8 8 2 3 3 4 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 590 600 610 620 630 600 610 620 630 640 31 31 32 33 33 25 26 27 27 28 21 22 22 23 23 17 18 18 19 19 13 14 14 15 15 9 9 10 10 11 5 5 6 6 7 1 1 2 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Single employees paid once a week at least but less than Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 The amount to withhold (in whole dollars) 10 or more 640 650 660 670 680 650 660 670 680 690 34 35 36 36 37 29 29 30 31 32 24 24 25 26 26 20 20 21 21 22 16 16 17 17 18 12 12 13 13 14 7 8 9 9 10 3 4 4 5 5 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 690 700 710 720 730 700 710 720 730 740 38 38 39 40 41 32 33 34 34 35 27 28 28 29 30 22 23 24 24 25 18 19 19 20 20 14 15 15 16 16 10 11 11 12 12 6 7 7 8 8 2 2 3 3 4 0 0 0 0 0 0 0 0 0 0 740 750 760 770 780 750 760 770 780 790 41 42 43 43 44 36 36 37 38 39 30 31 32 32 33 25 26 26 27 28 21 22 22 23 23 17 17 18 19 19 13 13 14 14 15 9 9 10 10 11 5 5 6 6 7 0 1 2 2 3 0 0 0 0 0 790 800 810 820 830 800 810 820 830 840 45 45 46 47 48 39 40 41 41 42 34 35 35 36 37 28 29 30 31 31 24 24 25 25 26 20 20 21 21 22 15 16 17 17 18 11 12 12 13 13 7 8 8 9 9 3 4 4 5 5 0 0 0 1 1 840 850 860 870 880 850 860 870 880 890 48 49 50 50 51 43 44 44 45 46 37 38 39 40 40 32 33 33 34 35 27 27 28 29 29 22 23 23 24 24 18 19 19 20 20 14 15 15 16 16 10 10 11 12 12 6 6 7 7 8 2 2 3 3 4 890 900 910 920 930 900 910 920 930 940 52 52 53 54 55 46 47 48 48 49 41 42 42 43 44 36 36 37 38 38 30 31 32 32 33 25 25 26 27 27 21 21 22 22 23 17 17 18 18 19 13 13 14 14 15 8 9 10 10 11 4 5 5 6 7 940 950 960 970 980 950 960 970 980 990 55 56 57 57 58 50 51 51 52 53 44 45 46 47 47 39 40 40 41 42 34 34 35 36 36 28 29 30 30 31 23 24 25 25 26 19 20 20 21 22 15 16 16 17 17 11 12 12 13 13 7 8 8 9 9 990 1000 1010 1020 1030 1000 1010 1020 1030 1040 59 60 60 61 62 53 54 55 56 56 48 49 49 50 51 43 43 44 45 45 37 38 39 39 40 32 32 33 34 35 26 27 28 28 29 22 23 23 24 24 18 18 19 20 20 14 14 15 15 16 10 10 11 11 12 1040 1050 1060 1070 1080 1050 1060 1070 1080 1090 62 63 64 64 65 57 58 58 59 60 52 52 53 54 54 46 47 47 48 49 41 41 42 43 43 35 36 37 37 38 30 31 31 32 33 25 25 26 27 27 21 21 22 22 23 17 17 18 18 19 12 13 13 14 15 1090 1100 1110 1120 1130 1100 1110 1120 1130 1140 66 67 67 68 69 60 61 62 63 63 55 56 56 57 58 50 50 51 52 52 44 45 46 46 47 39 39 40 41 42 33 34 35 35 36 28 29 29 30 31 23 24 24 25 25 19 20 20 21 21 15 16 16 17 17 1140 1150 1160 1170 1180 1150 1160 1170 1180 1190 69 70 71 72 72 64 65 65 66 67 59 59 60 61 61 53 54 55 55 56 48 48 49 50 51 42 43 44 44 45 37 38 38 39 40 31 32 33 34 34 26 27 27 28 29 22 22 23 23 24 18 18 19 19 20 1190 1628 7.05 PERCENT (.0705) OF THE EXCESS OVER $1,190 PLUS (round total to the nearest whole dollar) 73 67 62 56 51 45 40 35 29 24 20 3024 7.85 PERCENT (.0785) OF THE EXCESS OVER $1,628 PLUS (round total to the nearest whole dollar) 103 98 93 87 82 76 71 65 60 55 49 3024 and over 9.85 PERCENT (.0985) OF THE EXCESS OVER $3,024 PLUS (round total to the nearest whole dollar) 213 207 201 195 189 183 177 171 165 159 153 1628 Revised Jan. 1, 2015 If the employee’s wages are 19 Revised Jan. 1, 2015 Married employees paid once a week 20 If the employee’s wages are Number of withholding allowances at least but less than The amount to withhold (in whole dollars) 0 170 180 190 200 170 180 190 200 210 0 1 1 2 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 210 220 230 240 250 220 230 240 250 260 3 3 4 4 5 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 260 270 280 290 300 270 280 290 300 310 5 6 6 7 7 1 2 2 3 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 310 320 330 340 350 320 330 340 350 360 8 9 9 10 10 4 4 5 5 6 0 0 1 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 360 370 380 390 400 370 380 390 400 410 11 11 12 12 13 7 7 8 8 9 2 3 4 4 5 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 410 420 430 440 450 420 430 440 450 460 13 14 14 15 15 9 10 10 11 11 5 6 6 7 7 1 2 2 3 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 460 470 480 490 500 470 480 490 500 510 16 17 17 18 18 12 12 13 14 14 8 8 9 9 10 4 4 5 5 6 0 0 1 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 510 520 530 540 550 520 530 540 550 560 19 19 20 20 21 15 15 16 16 17 10 11 12 12 13 6 7 7 8 8 2 3 3 4 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 560 570 580 590 600 570 580 590 600 610 21 22 22 23 24 17 18 18 19 19 13 14 14 15 15 9 10 10 11 11 5 5 6 7 7 1 1 2 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 610 620 630 640 650 620 630 640 650 660 24 25 25 26 26 20 20 21 22 22 16 16 17 17 18 12 12 13 13 14 8 8 9 9 10 3 4 5 5 6 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 660 670 680 690 700 670 680 690 700 710 27 27 28 28 29 23 23 24 24 25 18 19 20 20 21 14 15 15 16 17 10 11 11 12 12 6 7 7 8 8 2 3 3 4 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 2 3 4 5 6 7 8 9 10 or more Married employees paid once a week at least but less than Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 The amount to withhold (in whole dollars) 10 or more 710 720 730 740 750 720 730 740 750 760 29 30 30 31 32 25 26 26 27 27 21 22 22 23 23 17 18 18 19 19 13 13 14 15 15 9 9 10 10 11 5 5 6 6 7 1 1 2 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 760 770 780 790 800 770 780 790 800 810 32 33 33 34 34 28 28 29 30 30 24 24 25 25 26 20 20 21 21 22 16 16 17 17 18 12 12 13 13 14 7 8 8 9 10 3 4 4 5 5 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 810 820 830 840 850 820 830 840 850 860 35 35 36 36 37 31 31 32 32 33 27 27 28 28 29 22 23 23 24 25 18 19 19 20 20 14 15 15 16 16 10 11 11 12 12 6 6 7 8 8 2 2 3 3 4 0 0 0 0 0 0 0 0 0 0 860 870 880 890 900 870 880 890 900 910 37 38 39 39 40 33 34 34 35 35 29 30 30 31 31 25 26 26 27 27 21 22 22 23 23 17 17 18 18 19 13 13 14 14 15 9 9 10 10 11 5 5 6 6 7 0 1 1 2 3 0 0 0 0 0 910 920 930 940 950 920 930 940 950 960 41 42 42 43 44 36 37 37 38 38 32 32 33 33 34 28 28 29 29 30 24 24 25 25 26 20 20 21 21 22 15 16 16 17 18 11 12 12 13 13 7 8 8 9 9 3 4 4 5 5 0 0 0 1 1 960 970 970 980 980 990 990 1000 1000 1010 44 45 46 47 47 39 40 40 41 42 35 35 36 36 37 30 31 32 32 33 26 27 27 28 28 22 23 23 24 24 18 19 19 20 20 14 15 15 16 16 10 10 11 11 12 6 6 7 7 8 2 2 3 3 4 1010 1020 1030 1040 1050 1020 1030 1040 1050 1060 48 49 49 50 51 42 43 44 45 45 37 38 38 39 40 33 34 34 35 35 29 30 30 31 31 25 25 26 26 27 21 21 22 22 23 17 17 18 18 19 13 13 14 14 15 8 9 9 10 11 4 5 5 6 6 1060 1070 1080 1090 1100 1070 1080 1090 1100 1110 51 52 53 54 54 46 47 47 48 49 41 41 42 43 43 36 36 37 37 38 32 32 33 33 34 28 28 29 29 30 23 24 25 25 26 19 20 20 21 21 15 16 16 17 17 11 12 12 13 13 7 8 8 9 9 1110 1120 1130 1140 1150 1120 1130 1140 1150 1160 55 56 56 57 58 50 50 51 52 52 44 45 46 46 47 39 39 40 41 42 34 35 35 36 36 30 31 31 32 32 26 27 27 28 28 22 23 23 24 24 18 18 19 19 20 14 14 15 15 16 10 10 11 11 12 1160 1170 1170 1180 1180 1190 58 59 60 53 54 54 48 48 49 42 43 44 37 38 38 33 33 34 29 29 30 25 25 26 21 21 22 16 17 18 12 13 13 1190 2966 60 18 14 2966 5132 185 137 131 301 295 Revised Jan. 1, 2015 If the employee’s wages are 7.05 PERCENT (.0705) OF THE EXCESS OVER $1,190 PLUS (round total to the nearest whole dollar) 55 49 44 39 34 30 26 22 7.85 PERCENT (.0785) OF THE EXCESS OVER $2,966 PLUS (round total to the nearest whole dollar) 180 175 169 164 158 153 148 142 9.85 PERCENT (.0985) OF THE EXCESS OVER $5,132 PLUS (round total to the nearest whole dollar) 5132 and over 355 349 343 337 331 325 319 313 307 21 Revised Jan. 1, 2015 Single employees paid every two weeks 22 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 100 120 140 160 100 120 140 160 180 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 180 200 220 240 260 200 220 240 260 280 5 7 8 9 10 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 280 300 320 340 360 300 320 340 360 380 11 12 13 14 15 3 4 5 6 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 380 400 420 440 460 400 420 440 460 480 16 17 18 19 20 8 9 10 11 12 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 480 500 520 540 560 500 520 540 560 580 21 23 24 25 26 13 14 15 16 18 5 6 7 8 9 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 580 600 620 640 660 600 620 640 660 680 27 28 29 30 31 19 20 21 22 23 10 11 13 14 15 2 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 680 700 720 740 760 700 720 740 760 780 32 33 34 35 36 24 25 26 27 28 16 17 18 19 20 7 9 10 11 12 0 0 1 2 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 780 800 820 840 860 800 820 840 860 880 38 39 40 41 42 29 30 31 33 34 21 22 23 24 25 13 14 15 16 17 5 6 7 8 9 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 880 900 920 940 960 900 920 940 960 980 43 44 45 46 47 35 36 37 38 39 26 27 29 30 31 18 19 20 21 22 10 11 12 13 14 2 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 980 1000 1020 1040 1060 1000 1020 1040 1060 1080 48 49 50 51 53 40 41 42 43 44 32 33 34 35 36 24 25 26 27 28 15 16 17 19 20 7 8 9 10 11 0 0 1 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1080 1100 1120 1140 1160 1100 1120 1140 1160 1180 54 56 57 58 60 45 46 47 49 50 37 38 39 40 41 29 30 31 32 33 21 22 23 24 25 12 13 15 16 17 4 5 6 7 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1180 1200 1220 1240 1260 1200 1220 1240 1260 1280 61 63 64 65 67 51 52 53 55 56 42 44 45 46 47 34 35 36 37 39 26 27 28 29 30 18 19 20 21 22 10 11 12 13 14 1 2 3 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Single employees paid every two weeks at least but less than Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 The amount to withhold (in whole dollars) 10 or more 1280 1300 1320 1340 1360 1300 1320 1340 1360 1380 68 70 71 73 74 57 59 60 62 63 48 49 50 51 52 40 41 42 43 44 31 32 33 35 36 23 24 25 26 27 15 16 17 18 19 7 8 9 10 11 0 0 1 2 3 0 0 0 0 0 0 0 0 0 0 1380 1400 1420 1440 1460 1400 1420 1440 1460 1480 75 77 78 80 81 65 66 67 69 70 54 55 56 58 59 45 46 47 48 49 37 38 39 40 41 28 30 31 32 33 20 21 22 23 25 12 13 14 15 16 4 5 6 7 8 0 0 0 0 0 0 0 0 0 0 1480 1500 1520 1540 1560 1500 1520 1540 1560 1580 82 84 85 87 88 72 73 74 76 77 61 62 64 65 66 50 51 53 54 56 42 43 44 45 46 34 35 36 37 38 26 27 28 29 30 17 18 20 21 22 9 10 11 12 13 1 2 3 4 5 0 0 0 0 0 1580 1600 1620 1640 1660 1600 1620 1640 1660 1680 89 91 92 94 95 79 80 81 83 84 68 69 71 72 73 57 58 60 61 63 47 48 50 51 52 39 40 41 42 43 31 32 33 34 35 23 24 25 26 27 14 16 17 18 19 6 7 8 9 11 0 0 0 1 2 1680 1700 1720 1740 1760 1700 1720 1740 1760 1780 97 98 99 101 102 86 87 88 90 91 75 76 78 79 80 64 65 67 68 70 53 55 56 57 59 45 46 47 48 49 36 37 38 40 41 28 29 30 31 32 20 21 22 23 24 12 13 14 15 16 3 4 6 7 8 1780 1800 1820 1840 1860 1800 1820 1840 1860 1880 104 105 106 108 109 93 94 96 97 98 82 83 85 86 88 71 72 74 75 77 60 62 63 64 66 50 51 52 54 55 42 43 44 45 46 33 34 36 37 38 25 26 27 28 29 17 18 19 20 21 9 10 11 12 13 1880 1900 1920 1940 1960 1900 1920 1940 1960 1980 111 112 113 115 116 100 101 103 104 105 89 90 92 93 95 78 79 81 82 84 67 69 70 71 73 56 58 59 61 62 47 48 49 50 51 39 40 41 42 43 31 32 33 34 35 22 23 24 26 27 14 15 16 17 18 1980 2000 2020 2040 2060 2000 2020 2040 2060 2080 118 119 120 122 123 107 108 110 111 112 96 97 99 100 102 85 87 88 89 91 74 76 77 79 80 63 65 66 68 69 53 54 55 57 58 44 45 46 47 48 36 37 38 39 40 28 29 30 31 32 19 20 22 23 24 2080 2100 2120 2140 2160 2100 2120 2140 2160 2180 125 126 128 129 130 114 115 117 118 120 103 104 106 107 109 92 94 95 96 98 81 83 84 86 87 70 72 73 75 76 60 61 62 64 65 49 51 52 53 54 41 42 43 44 46 33 34 35 36 37 25 26 27 28 29 2180 2200 2220 2240 2260 2200 2220 2240 2260 2280 132 133 135 136 137 121 122 124 125 127 110 111 113 114 116 99 101 102 103 105 88 90 91 93 94 78 79 80 82 83 67 68 70 71 72 56 57 59 60 61 47 48 49 50 51 38 39 40 42 43 30 31 32 33 34 2280 2300 2320 2340 2360 2300 2320 2340 2360 2380 139 140 142 143 144 128 129 131 132 134 117 119 120 121 123 106 108 109 111 112 95 97 98 100 101 85 86 87 89 90 74 75 77 78 79 63 64 66 67 69 52 53 55 56 58 44 45 46 47 48 35 37 38 39 40 2380 3256 7.05 PERCENT (.0705) OF THE EXCESS OVER $2,380 PLUS (round total to the nearest whole dollar) 145 134 123 113 102 91 80 69 58 49 40 207 196 185 174 164 153 142 131 120 9.85 PERCENT (.0985) OF THE EXCESS OVER $6,048 PLUS (round total to the nearest whole dollar) 109 98 426 317 305 Revised Jan. 1, 2015 If the employee’s wages are 7.85 PERCENT (.0785) OF THE EXCESS OVER $3,256 PLUS (round total to the nearest whole dollar) 3256 6048 6048 and over 414 402 390 378 366 354 342 329 23 Revised Jan. 1, 2015 Married employees paid every two weeks 24 If the employee’s wages are Number of withholding allowances at least but less than The amount to withhold (in whole dollars) 0 340 360 380 400 340 360 380 400 420 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 420 440 460 480 500 440 460 480 500 520 5 6 7 9 10 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 520 540 560 580 600 540 560 580 600 620 11 12 13 14 15 2 3 5 6 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 620 640 660 680 700 640 660 680 700 720 16 17 18 19 20 8 9 10 11 12 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 720 740 760 780 800 740 760 780 800 820 21 22 23 25 26 13 14 15 16 17 5 6 7 8 9 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 820 840 860 880 900 840 860 880 900 920 27 28 29 30 31 18 20 21 22 23 10 11 12 13 15 2 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 920 940 960 980 1000 940 960 980 1000 1020 32 33 34 35 36 24 25 26 27 28 16 17 18 19 20 7 8 10 11 12 0 0 1 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1020 1040 1060 1080 1100 1040 1060 1080 1100 1120 37 38 40 41 42 29 30 31 32 33 21 22 23 24 25 13 14 15 16 17 4 6 7 8 9 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1120 1140 1160 1180 1200 1140 1160 1180 1200 1220 43 44 45 46 47 35 36 37 38 39 26 27 28 30 31 18 19 20 21 22 10 11 12 13 14 2 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1220 1240 1260 1280 1300 1240 1260 1280 1300 1320 48 49 50 51 52 40 41 42 43 44 32 33 34 35 36 23 24 26 27 28 15 16 17 18 19 7 8 9 10 11 0 0 1 2 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1320 1340 1360 1380 1400 1340 1360 1380 1400 1420 53 55 56 57 58 45 46 47 48 50 37 38 39 40 41 29 30 31 32 33 21 22 23 24 25 12 13 14 16 17 4 5 6 7 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1420 1440 1460 1480 1500 1440 1460 1480 1500 1520 59 60 61 62 63 51 52 53 54 55 42 43 44 46 47 34 35 36 37 38 26 27 28 29 30 18 19 20 21 22 9 10 12 13 14 1 2 3 4 5 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 2 3 4 5 6 7 8 9 10 or more Married employees paid every two weeks Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 10 at least but less than 1520 1540 1560 1580 1600 1540 1560 1580 1600 1620 64 65 66 67 68 56 57 58 59 60 48 49 50 51 52 39 41 42 43 44 31 32 33 34 36 23 24 25 26 27 15 16 17 18 19 7 8 9 10 11 0 0 0 2 3 0 0 0 0 0 0 0 0 0 0 1620 1640 1660 1680 1700 1640 1660 1680 1700 1720 70 71 72 73 74 61 62 63 64 66 53 54 55 56 57 45 46 47 48 49 37 38 39 40 41 28 29 30 32 33 20 21 22 23 24 12 13 14 15 16 4 5 6 7 8 0 0 0 0 0 0 0 0 0 0 1720 1740 1760 1780 1800 1740 1760 1780 1800 1820 75 76 78 79 80 67 68 69 70 71 58 59 61 62 63 50 51 52 53 54 42 43 44 45 46 34 35 36 37 38 25 27 28 29 30 17 18 19 20 22 9 10 11 12 13 1 2 3 4 5 0 0 0 0 0 1820 1840 1860 1880 1900 1840 1860 1880 1900 1920 82 83 85 86 87 72 73 74 75 77 64 65 66 67 68 56 57 58 59 60 47 48 49 50 52 39 40 41 42 43 31 32 33 34 35 23 24 25 26 27 14 15 17 18 19 6 7 8 9 10 0 0 0 1 2 1920 1940 1960 1980 2000 1940 1960 1980 2000 2020 89 90 92 93 94 78 79 81 82 84 69 70 71 72 73 61 62 63 64 65 53 54 55 56 57 44 45 47 48 49 36 37 38 39 40 28 29 30 31 32 20 21 22 23 24 11 13 14 15 16 3 4 5 6 8 2020 2040 2060 2080 2100 2040 2060 2080 2100 2120 96 97 99 100 101 85 86 88 89 91 74 76 77 78 80 66 67 68 69 70 58 59 60 61 62 50 51 52 53 54 42 43 44 45 46 33 34 35 37 38 25 26 27 28 29 17 18 19 20 21 9 10 11 12 13 2120 2140 2160 2180 2200 2140 2160 2180 2200 2220 103 104 106 107 109 92 93 95 96 98 81 83 84 85 87 72 73 74 75 76 63 64 65 67 68 55 56 57 58 59 47 48 49 50 51 39 40 41 42 43 30 31 33 34 35 22 23 24 25 26 14 15 16 17 18 2220 2240 2260 2280 2300 2240 2260 2280 2300 2320 110 111 113 114 116 99 100 102 103 105 88 90 91 92 94 77 79 80 82 83 69 70 71 72 73 60 62 63 64 65 52 53 54 55 57 44 45 46 47 48 36 37 38 39 40 28 29 30 31 32 19 20 21 23 24 2320 2340 2360 2340 2360 2380 117 118 120 106 108 109 95 97 98 84 86 87 74 75 76 66 67 68 58 59 60 49 50 51 41 42 43 33 34 35 25 26 27 2380 5932 121 The amount to withhold (in whole dollars) or more Revised Jan. 1, 2015 If the employee’s wages are 7.05 PERCENT (.0705) OF THE EXCESS OVER $2,380 PLUS (round total to the nearest whole dollar) 5932 10264 10264 and over 36 27 7.85 PERCENT (.0785) OF THE EXCESS OVER $5,932 PLUS (round total to the nearest whole dollar) 371 360 349 338 328 317 306 295 284 110 99 88 77 68 60 52 44 273 262 9.85 PERCENT (.0985) OF THE EXCESS OVER $10,264 PLUS (round total to the nearest whole dollar) 711 699 687 675 663 651 639 626 614 602 590 25 Revised Jan. 1, 2015 Single employees paid twice a month 26 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 100 120 140 160 100 120 140 160 180 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 180 200 220 240 260 200 220 240 260 280 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 280 300 320 340 360 300 320 340 360 380 10 11 13 14 15 1 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 380 400 420 440 460 400 420 440 460 480 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 480 500 520 540 560 500 520 540 560 580 21 22 23 24 25 12 13 14 15 16 3 4 5 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 580 600 620 640 660 600 620 640 660 680 26 28 29 30 31 18 19 20 21 22 9 10 11 12 13 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 680 700 720 740 760 700 720 740 760 780 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 780 800 820 840 860 800 820 840 860 880 37 38 39 40 41 28 29 30 31 33 19 20 21 23 24 10 11 13 14 15 1 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 880 900 920 940 960 900 920 940 960 980 42 44 45 46 47 34 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 980 1000 1020 1040 1060 1000 1020 1040 1060 1080 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 3 4 5 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1080 1100 1120 1140 1160 1100 1120 1140 1160 1180 53 54 55 57 58 44 45 46 47 49 35 36 37 39 40 26 28 29 30 31 18 19 20 21 22 9 10 11 12 13 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1180 1200 1220 1240 1260 1200 1220 1240 1260 1280 59 61 62 64 65 50 51 52 53 54 41 42 43 44 45 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Single employees paid twice a month Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 10 at least but less than 1280 1300 1320 1340 1360 1300 1320 1340 1360 1380 66 68 69 71 72 55 56 58 59 60 46 47 48 49 50 37 38 39 40 41 28 29 30 31 33 19 20 21 23 24 10 11 13 14 15 1 3 4 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1380 1400 1420 1440 1460 1400 1420 1440 1460 1480 73 75 76 78 79 62 63 65 66 67 51 52 54 55 56 42 44 45 46 47 34 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 1480 1500 1520 1540 1560 1500 1520 1540 1560 1580 81 82 83 85 86 69 70 72 73 74 57 58 60 61 63 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 3 4 5 6 8 0 0 0 0 0 0 0 0 0 0 1580 1600 1620 1640 1660 1600 1620 1640 1660 1680 88 89 90 92 93 76 77 79 80 81 64 65 67 68 70 53 54 55 57 58 44 45 46 47 49 35 36 37 39 40 26 28 29 30 31 18 19 20 21 22 9 10 11 12 13 0 1 2 3 4 0 0 0 0 0 1680 1700 1720 1740 1760 1700 1720 1740 1760 1780 95 96 97 99 100 83 84 86 87 89 71 73 74 75 77 59 61 62 64 65 50 51 52 53 54 41 42 43 44 45 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 1780 1800 1820 1840 1860 1800 1820 1840 1860 1880 102 103 105 106 107 90 91 93 94 96 78 80 81 82 84 66 68 69 71 72 55 56 58 59 60 46 47 48 49 50 37 38 39 40 41 28 29 30 31 33 19 20 21 23 24 10 11 13 14 15 1 3 4 5 6 1880 1900 1920 1940 1960 1900 1920 1940 1960 1980 109 110 112 113 114 97 98 100 101 103 85 87 88 89 91 73 75 76 78 79 62 63 65 66 67 51 52 54 55 56 42 44 45 46 47 34 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 1980 2000 2020 2040 2060 2000 2020 2040 2060 2080 116 117 119 120 121 104 105 107 108 110 92 94 95 97 98 81 82 83 85 86 69 70 72 73 74 57 58 60 61 63 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 2080 2100 2120 2140 2160 2100 2120 2140 2160 2180 123 124 126 127 128 111 112 114 115 117 99 101 102 104 105 88 89 90 92 93 76 77 79 80 81 64 65 67 68 70 53 54 55 57 58 44 45 46 47 49 35 36 37 39 40 26 28 29 30 31 18 19 20 21 22 2180 2200 2220 2240 2260 2200 2220 2240 2260 2280 130 131 133 134 136 118 120 121 122 124 106 108 109 111 112 95 96 97 99 100 83 84 86 87 89 71 73 74 75 77 59 61 62 64 65 50 51 52 53 54 41 42 43 44 45 32 33 34 35 36 23 24 25 26 27 2280 2300 2320 2340 2360 2300 2320 2340 2360 2380 137 138 140 141 143 125 127 128 129 131 113 115 116 118 119 102 103 105 106 107 90 91 93 94 96 78 80 81 82 84 66 68 69 71 72 55 56 58 59 60 46 47 48 49 50 37 38 39 40 41 28 29 30 31 33 2380 3528 7.05 PERCENT (.0705) OF THE EXCESS OVER $2,380 PLUS (round total to the nearest whole dollar) 143 132 120 108 96 85 73 61 51 42 33 6552 7.85 PERCENT (.0785) OF THE EXCESS OVER $3,528 PLUS (round total to the nearest whole dollar) 224 212 201 189 177 165 154 142 130 118 107 6552 and over 9.85 PERCENT (.0985) OF THE EXCESS OVER $6,552 PLUS (round total to the nearest whole dollar) 462 449 435 422 409 396 383 370 357 344 331 3528 The amount to withhold (in whole dollars) or more Revised Jan. 1, 2015 If the employee’s wages are 27 Revised Jan. 1, 2015 Married employees paid twice a month 28 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 360 380 400 420 360 380 400 420 440 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 440 460 480 500 520 460 480 500 520 540 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 540 560 580 600 620 560 580 600 620 640 10 11 12 13 15 1 2 3 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 640 660 680 700 720 660 680 700 720 740 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 740 760 780 800 820 760 780 800 820 840 21 22 23 24 25 12 13 14 15 16 3 4 5 6 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 840 860 880 900 920 860 880 900 920 940 26 27 28 30 31 17 18 20 21 22 8 10 11 12 13 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 940 960 980 1000 1020 960 980 1000 1020 1040 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1040 1060 1080 1100 1120 1060 1080 1100 1120 1140 37 38 39 40 41 28 29 30 31 32 19 20 21 22 23 10 11 12 13 15 1 2 3 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1140 1160 1180 1200 1220 1160 1180 1200 1220 1240 42 43 44 46 47 33 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1240 1260 1280 1300 1320 1260 1280 1300 1320 1340 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 3 4 5 6 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1340 1360 1380 1400 1420 1360 1380 1400 1420 1440 53 54 55 56 57 44 45 46 47 48 35 36 37 38 40 26 27 28 30 31 17 18 20 21 22 8 10 11 12 13 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Married employees paid twice a month Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 10 at least but less than 1440 1460 1480 1500 1520 1460 1480 1500 1520 1540 58 59 61 62 63 49 51 52 53 54 41 42 43 44 45 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1540 1560 1580 1600 1620 1560 1580 1600 1620 1640 64 65 66 67 68 55 56 57 58 59 46 47 48 49 50 37 38 39 40 41 28 29 30 31 32 19 20 21 22 23 10 11 12 13 15 1 2 3 5 6 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1640 1660 1680 1700 1720 1660 1680 1700 1720 1740 69 70 71 72 73 60 61 62 63 64 51 52 53 54 56 42 43 44 46 47 33 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 1740 1760 1780 1800 1820 1760 1780 1800 1820 1840 74 76 77 78 79 66 67 68 69 70 57 58 59 60 61 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 3 4 5 6 7 0 0 0 0 0 0 0 0 0 0 1840 1860 1880 1900 1920 1860 1880 1900 1920 1940 80 81 82 83 85 71 72 73 74 75 62 63 64 65 66 53 54 55 56 57 44 45 46 47 48 35 36 37 38 40 26 27 28 30 31 17 18 20 21 22 8 10 11 12 13 0 1 2 3 4 0 0 0 0 0 1940 1960 1980 2000 2020 1960 1980 2000 2020 2040 86 88 89 90 92 76 77 78 79 81 67 68 69 71 72 58 59 61 62 63 49 51 52 53 54 41 42 43 44 45 32 33 34 35 36 23 24 25 26 27 14 15 16 17 18 5 6 7 8 9 0 0 0 0 0 2040 2060 2080 2100 2120 2060 2080 2100 2120 2140 93 95 96 98 99 82 83 84 86 87 73 74 75 76 77 64 65 66 67 68 55 56 57 58 59 46 47 48 49 50 37 38 39 40 41 28 29 30 31 32 19 20 21 22 23 10 11 12 13 15 1 2 3 5 6 2140 2160 2180 2200 2220 2160 2180 2200 2220 2240 100 102 103 105 106 89 90 91 93 94 78 79 80 81 82 69 70 71 72 73 60 61 62 63 64 51 52 53 54 56 42 43 44 46 47 33 35 36 37 38 25 26 27 28 29 16 17 18 19 20 7 8 9 10 11 2240 2260 2280 2300 2320 2260 2280 2300 2320 2340 107 109 110 112 113 96 97 98 100 101 84 85 87 88 90 74 76 77 78 79 66 67 68 69 70 57 58 59 60 61 48 49 50 51 52 39 40 41 42 43 30 31 32 33 34 21 22 23 24 25 12 13 14 15 16 2340 2360 2360 2380 114 116 103 104 91 92 80 81 71 72 62 63 53 54 44 45 35 36 26 27 17 18 28 19 296 284 652 639 The amount to withhold (in whole dollars) or more Revised Jan. 1, 2015 If the employee’s wages are 7.05 PERCENT (.0705) OF THE EXCESS OVER $2,380 PLUS (round total to the nearest whole dollar) 2380 6426 117 105 93 81 72 64 55 46 37 7.85 PERCENT (.0785) OF THE EXCESS OVER $6,426 PLUS (round total to the nearest whole dollar) 6426 11119 402 390 378 367 355 343 331 320 308 9.85 PERCENT (.0985) OF THE EXCESS OVER $11,119 PLUS (round total to the nearest whole dollar) 11119 and over 770 757 744 731 718 705 692 679 666 29 Revised Jan. 1, 2015 Single employees paid once a month 30 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 200 220 240 260 200 220 240 260 280 0 1 2 3 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 280 300 320 340 360 300 320 340 360 380 5 6 7 8 10 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 380 400 420 440 460 400 420 440 460 480 11 12 13 14 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 480 500 520 540 560 500 520 540 560 580 16 17 18 19 20 0 0 0 1 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 580 600 640 680 720 600 640 680 720 760 21 23 25 27 29 3 5 7 9 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 760 800 840 880 920 800 840 880 920 960 31 34 36 38 40 14 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 960 1000 1040 1080 1120 1000 1040 1080 1120 1160 42 44 46 49 51 24 26 29 31 33 7 9 11 13 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1160 1200 1240 1280 1320 1200 1240 1280 1320 1360 53 55 57 59 61 35 37 39 41 44 17 19 21 24 26 0 2 4 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1360 1400 1440 1480 1520 1400 1440 1480 1520 1560 64 66 68 70 72 46 48 50 52 54 28 30 32 34 36 10 12 14 16 19 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1560 1600 1640 1680 1720 1600 1640 1680 1720 1760 74 76 79 81 83 56 59 61 63 65 39 41 43 45 47 21 23 25 27 29 3 5 7 9 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1760 1800 1840 1880 1920 1800 1840 1880 1920 1960 85 87 89 91 94 67 69 71 74 76 49 51 54 56 58 31 34 36 38 40 14 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1960 2000 2040 2080 2120 2000 2040 2080 2120 2160 96 98 100 102 104 78 80 82 84 86 60 62 64 66 69 42 44 46 49 51 24 26 29 31 33 7 9 11 13 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2160 2200 2240 2280 2320 2200 2240 2280 2320 2360 106 109 111 113 116 89 91 93 95 97 71 73 75 77 79 53 55 57 59 61 35 37 39 41 44 17 19 21 24 26 0 2 4 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Single employees paid once a month at least but less than Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 The amount to withhold (in whole dollars) 10 or more 2360 2400 2440 2480 2520 2400 2440 2480 2520 2560 119 122 124 127 130 99 101 104 106 108 81 84 86 88 90 64 66 68 70 72 46 48 50 52 54 28 30 32 34 36 10 12 14 16 19 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2560 2600 2640 2680 2720 2600 2640 2680 2720 2760 133 136 139 141 144 110 112 115 118 121 92 94 96 99 101 74 76 79 81 83 56 59 61 63 65 39 41 43 45 47 21 23 25 27 29 3 5 7 9 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2760 2800 2840 2880 2920 2800 2840 2880 2920 2960 147 150 153 155 158 123 126 129 132 135 103 105 107 109 111 85 87 89 91 94 67 69 71 74 76 49 51 54 56 58 31 34 36 38 40 14 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 2960 3000 3040 3080 3120 3000 3040 3080 3120 3160 161 164 167 170 172 138 140 143 146 149 114 117 120 123 125 96 98 100 102 104 78 80 82 84 86 60 62 64 66 69 42 44 46 49 51 24 26 29 31 33 7 9 11 13 15 0 0 0 0 0 0 0 0 0 0 3160 3200 3240 3280 3320 3200 3240 3280 3320 3360 175 178 181 184 186 152 154 157 160 163 128 131 134 137 139 106 109 111 113 116 89 91 93 95 97 71 73 75 77 79 53 55 57 59 61 35 37 39 41 44 17 19 21 24 26 0 2 4 6 8 0 0 0 0 0 3360 3400 3440 3480 3520 3400 3440 3480 3520 3560 189 192 195 198 201 166 169 171 174 177 142 145 148 151 154 119 122 124 127 130 99 101 104 106 108 81 84 86 88 90 64 66 68 70 72 46 48 50 52 54 28 30 32 34 36 10 12 14 16 19 0 0 0 0 1 3560 3600 3640 3680 3720 3600 3640 3680 3720 3760 203 206 209 212 215 180 183 186 188 191 156 159 162 165 168 133 136 139 141 144 110 112 115 118 121 92 94 96 99 101 74 76 79 81 83 56 59 61 63 65 39 41 43 45 47 21 23 25 27 29 3 5 7 9 12 3760 3800 3840 3880 3920 3800 3840 3880 3920 3960 217 220 223 226 229 194 197 200 202 205 170 173 176 179 182 147 150 153 155 158 123 126 129 132 135 103 105 107 109 111 85 87 89 91 94 67 69 71 74 76 49 51 54 56 58 31 34 36 38 40 14 16 18 20 22 3960 4000 4040 4080 4120 4000 4040 4080 4120 4160 232 234 237 240 243 208 211 214 217 219 185 187 190 193 196 161 164 167 170 172 138 140 143 146 149 114 117 120 123 125 96 98 100 102 104 78 80 82 84 86 60 62 64 66 69 42 44 46 49 51 24 26 29 31 33 4160 4200 4240 4280 4320 4200 4240 4280 4320 4360 246 248 251 254 257 222 225 228 231 233 199 201 204 207 210 175 178 181 184 186 152 154 157 160 163 128 131 134 137 139 106 109 111 113 116 89 91 93 95 97 71 73 75 77 79 53 55 57 59 61 35 37 39 41 44 4360 4400 4440 4480 4520 4560 4400 4440 4480 4520 4560 4600 260 263 265 268 271 274 236 239 242 245 248 250 213 216 218 221 224 227 189 192 195 198 201 203 166 169 171 174 177 180 142 145 148 151 154 156 119 122 124 127 130 133 99 101 104 106 108 110 81 84 86 88 90 92 64 66 68 70 72 74 46 48 50 52 54 56 4600 7055 275 7055 13104 13104 and over 7.05 PERCENT (.0705) OF THE EXCESS OVER $4,600 PLUS (round total to the nearest whole dollar) 252 228 205 181 158 134 111 93 75 58 7.85 PERCENT (.0785) OF THE EXCESS OVER $7,055 PLUS (round total to the nearest whole dollar) 448 425 401 378 354 331 307 284 260 9.85 PERCENT (.0985) OF THE EXCESS OVER $13,104 PLUS (round total to the nearest whole dollar) 237 213 923 688 662 897 871 845 819 792 766 740 714 Revised Jan. 1, 2015 If the employee’s wages are 31 Revised Jan. 1, 2015 Married employees paid once a month 32 If the employee’s wages are Number of withholding allowances at least The amount to withhold (in whole dollars) but less than 0 1 2 3 4 5 6 7 8 9 10 or more 0 720 760 800 840 720 760 800 840 880 0 1 3 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 880 920 960 1000 1040 920 960 1000 1040 1080 10 12 14 16 18 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1080 1120 1160 1200 1240 1120 1160 1200 1240 1280 21 23 25 27 29 3 5 7 9 11 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1280 1320 1360 1400 1440 1320 1360 1400 1440 1480 31 33 35 38 40 13 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1480 1520 1560 1600 1640 1520 1560 1600 1640 1680 42 44 46 48 50 24 26 28 30 33 6 8 11 13 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1680 1720 1760 1800 1840 1720 1760 1800 1840 1880 53 55 57 59 61 35 37 39 41 43 17 19 21 23 26 0 1 3 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1880 1920 1960 2000 2040 1920 1960 2000 2040 2080 63 65 68 70 72 45 48 50 52 54 28 30 32 34 36 10 12 14 16 18 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2080 2120 2160 2200 2240 2120 2160 2200 2240 2280 74 76 78 80 83 56 58 60 63 65 38 40 43 45 47 21 23 25 27 29 3 5 7 9 11 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2280 2320 2360 2400 2440 2320 2360 2400 2440 2480 85 87 89 91 93 67 69 71 73 75 49 51 53 55 58 31 33 35 38 40 13 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2480 2520 2560 2600 2640 2520 2560 2600 2640 2680 95 98 100 102 104 78 80 82 84 86 60 62 64 66 68 42 44 46 48 50 24 26 28 30 33 6 8 11 13 15 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2680 2720 2760 2800 2840 2720 2760 2800 2840 2880 106 108 110 113 115 88 90 93 95 97 70 73 75 77 79 53 55 57 59 61 35 37 39 41 43 17 19 21 23 26 0 1 3 6 8 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Married employees paid once a month Number of withholding allowances 0 1 2 3 4 5 6 7 8 9 10 at least but less than 2880 2920 2960 3000 3040 2920 2960 3000 3040 3080 117 119 121 123 125 99 101 103 105 108 81 83 85 88 90 63 65 68 70 72 45 48 50 52 54 28 30 32 34 36 10 12 14 16 18 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3080 3120 3160 3200 3240 3120 3160 3200 3240 3280 128 130 132 134 136 110 112 114 116 118 92 94 96 98 100 74 76 78 80 83 56 58 60 63 65 38 40 43 45 47 21 23 25 27 29 3 5 7 9 11 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3280 3320 3360 3400 3440 3320 3360 3400 3440 3480 138 140 142 145 147 120 123 125 127 129 103 105 107 109 111 85 87 89 91 93 67 69 71 73 75 49 51 53 55 58 31 33 35 38 40 13 16 18 20 22 0 0 0 2 4 0 0 0 0 0 0 0 0 0 0 3480 3520 3560 3600 3640 3520 3560 3600 3640 3680 149 151 153 155 157 131 133 135 137 140 113 115 118 120 122 95 98 100 102 104 78 80 82 84 86 60 62 64 66 68 42 44 46 48 50 24 26 28 30 33 6 8 11 13 15 0 0 0 0 0 0 0 0 0 0 3680 3720 3760 3800 3840 3720 3760 3800 3840 3880 160 162 164 167 170 142 144 146 148 150 124 126 128 130 133 106 108 110 113 115 88 90 93 95 97 70 73 75 77 79 53 55 57 59 61 35 37 39 41 43 17 19 21 23 26 0 1 3 6 8 0 0 0 0 0 3880 3920 3960 4000 4040 3920 3960 4000 4040 4080 173 175 178 181 184 152 155 157 159 161 135 137 139 141 143 117 119 121 123 125 99 101 103 105 108 81 83 85 88 90 63 65 68 70 72 45 48 50 52 54 28 30 32 34 36 10 12 14 16 18 0 0 0 0 1 4080 4120 4160 4200 4240 4120 4160 4200 4240 4280 187 189 192 195 198 163 166 169 172 174 145 147 150 152 154 128 130 132 134 136 110 112 114 116 118 92 94 96 98 100 74 76 78 80 83 56 58 60 63 65 38 40 43 45 47 21 23 25 27 29 3 5 7 9 11 4280 4320 4360 4400 4440 4320 4360 4400 4440 4480 201 204 206 209 212 177 180 183 186 188 156 158 160 162 165 138 140 142 145 147 120 123 125 127 129 103 105 107 109 111 85 87 89 91 93 67 69 71 73 75 49 51 53 55 58 31 33 35 38 40 13 16 18 20 22 4480 4520 4560 4520 4560 4600 215 218 220 191 194 197 168 171 173 149 151 153 131 133 135 113 115 118 95 98 100 78 80 82 60 62 64 42 44 46 24 26 28 4600 12852 222 47 29 592 569 1305 1279 The amount to withhold (in whole dollars) or more Revised Jan. 1, 2015 If the employee’s wages are 7.05 PERCENT (.0705) OF THE EXCESS OVER $4,600 PLUS (round total to the nearest whole dollar) 198 175 154 136 119 101 83 65 7.85 PERCENT (.0785) OF THE EXCESS OVER $12,852 PLUS (round total to the nearest whole dollar) 12852 22238 804 780 757 733 710 686 663 639 616 9.85 PERCENT (.0985) OF THE EXCESS OVER $22,238 PLUS (round total to the nearest whole dollar) 22238 and over 1540 1514 1488 1462 1436 1410 1383 1357 1331 33 Computer Formula If you use a computer to determine how much to withhold, use the formula below to set up your program. This formula supersedes any formulas before Jan. 1, 2015. If you use a computer to determine withholding, you must program it for this new formula. Step 1 Determine the employee’s total wages for one payroll period. Step 2 Multiply the total wages from step 1 by the number of payroll periods you have in a year. The result is the employee’s annual wage. Multiply step 1 by: • 360 if you pay by the day • 52 if you pay by the week • 26 if you pay every two weeks • 24 if you pay twice a month • 12 if you pay once a month Step 3 Multiply the number of the employee’s withholding allowances by $4,000. Step 4 Subtract the result in step 3 from the result in step 2. Step 5 Use the result from step 4 and the chart below to figure an amount for step 5. Step 6 Divide the result in step 5 by the number of payroll periods that you used in step 2. You may round the amount to the nearest dollar. The result is the amount of Minnesota income tax to withhold from the employee’s wages. Chart for step 5 If the employee is single and the result from step 4 is: More than But not more than $2,300 27,370 84,660 157,250 $27,370 84,660 157,250 Subtract this amount from the result in step 4 Multiply result by Add 2,300 27,370 84,660 157,250 5.35% 7.05% 7.85% 9.85% 1,341.25 5,380.20 11,078.52 Subtract this amount from the result in step 4 Multiply result by Add 8,600 45,250 154,220 266,860 5.35% 7.05% 7.85% 9.85% 1,960.78 9,643.17 18,485.41 If the employee is married and the result from step 4 is: 34 More than But not more than $8,600 45,250 154,220 266,860 $45,250 154,220 266,860 www.revenue.state.mn.us