Financial Risk Manager (FRM®)

advertisement

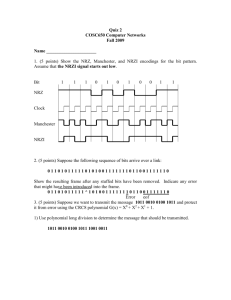

Financial Risk ® Manager (FRM ) The global benchmark qualification for professional risk managers. May 2010 examination FRM Part I training courses ® FRM Parts 1 and 11 will be administered twice annually on May 22nd and November 20th. Part I of the new programme will cover core areas of financial risk management, such as quantitative analysis, financial markets and products and essential risk modeling. Part II will cover specific topics on the practical implementation and execution of approaches to measuring and managing risks and also includes a new section covering current issues in financial markets. BPP will be offering Part I training courses for the May and November 2010 examinations. The course programme will be broken down into three phases over a six day period, all of which you can guarantee will be taught be one of our experienced tutors who hold the FRM designation. The classroom courses will be held at our Liverpool Street training centre, in the heart of the City offering flexibility for the many risk professionals operating in London. Visit us online or call us today to find out more about the FRM programme and how it can benefit you. Why should you study for the FRM® examination? Choose BPP to train for the FRM® examination You will be trained by Europe’s leading professional education company, with a proven track record of helping candidates achieve a wide range of qualifications. Personal service – we will support you from initial enquiry through to passing the exam. Dedicated, experienced tutors – all our tutors have passed the exams they teach towards. State of the art facilities – you will be taught at one of our hi-tech training centres. We use study materials from the world’s leading supplier, Kaplan Schweser. The FRM® Part I syllabus The FRM Part I examination syllabus is broken down into four key areas of risk management. The pie chart shows the weightings for each key area. For more detailed syllabus information, including the topics covered in each of these areas, please visit www.garp.com to download the 2010 FRM study guide. Global recognition You will be recognised across the globe as a leader in financial risk management. Foundations of Risk Management 20% Improved career prospects Many organisations seek FRM holders for senior risk jobs. Holistic view of risk You will gain an appreciation of the role risk management plays right across the organisation. Join an elite group You will be one of over 17,000 FRM holders spread across 90 countries globally. 2 Quantitative Analysis Valuation and Risk Models 20% 30% Financial Markets and Products 30% All study materials are supplied to you by BPP Learning Media, whose aim is to provide comprehensive, easy to read and exam focused materials of the highest quality for our delegates. Classroom study Our unique phased approach has been put together to meet the needs of our delegates. We use practice questions on each course to maximise the effectiveness of your studies, monitor your progress and ensure that you stay focused for the exam. The classroom course is 6 days in total, split into 3 phases with 2 days classroom tuition on each phase. Phase 1 Foundations of Risk Management and Quantitative Analysis. Phase 2 Financial Markets and Products. Phase 3 Valuation and Risk Models. How will BPP support you? No matter what your study requirements, BPP will provide everything you need to supplement your study for the FRM® examination. We have teamed up with Kaplan Schweser, the world’s trusted leader in FRM exam preparation, to provide study material that will complement the syllabus. In conjunction with Kaplan Schweser study materials, BPP will provide support with our own experienced tutors and additional study tools. Tutor Support Kaplan SchweserProTM Question Bank Our tutors know what it takes to succeed and therefore are the best people to guide you through the FRM exam. Contactable via email, they are always on hand to answer queries or pass on study and exam tips. This online practice question bank contains hundreds of questions, allowing you to retain risk management concepts. PowerPointTM Course Slides Our course slides will help you keep track of key areas covered in class. These allow you to concentrate in class and annotate key areas. Exam Approved Calculator You will receive the exam approved Texas Instruments BAII Plus Professional calculator free of charge with your study pack. We will also provide a user-friendly calculator guide to ensure you use it in the most efficient way. Kaplan Schweser Study Notes These study notes will keep you focused on the critical concepts with a clearly written, easy-to-understand format that will guide you through the assigned FRM® readings. Kaplan Schweser QuickSheetTM Kaplan Schweser Practice Exams Two, full length practice exams offer you the additional practice needed to master the syllabus. Kaplan Schweser Final Review Guidebook This book will guide you through the key concepts, bringing the syllabus together as you revise for the examination. Kaplan Schweser Final Review Examination This challenging practice examination will fully test your knowledge and readiness for the exam day. Study Rooms You can use our study rooms during weekdays and evenings for quiet and comfortable study. To guarantee your place you must book a room by calling 020 7786 5908 or email receptionfinancialservices@bpp.com Maximise your study time while reviewing the crucial concepts with this well-organised, reference sheet. All tuition and courses are supplied by BPP Professional Education All study materials are supplied by BPP Learning Media 3 GARP ® Membership Founded in 1996, GARP® is a not-for-profit independent association with close to 100,000 members worldwide, making it one of world’s largest financial industry associations. When you enrol on the FRM examination, you will be provided with one year of GARP membership. To find out more about the benefits you will get as a GARP member or to join online, visit www.garp.com What our delegates say about FRM ... Course structure “The topic areas were well balanced in light of the exam.” Course tutor “The syllabus was excellent and so was the course and the teaching.” Course material “The course and the slides were extremely helpful in “clearing the way” and not feeling overwhelmed by each subject.” Tutors top tips for revision and passing exams 1.You should plan and organise your studies away from distractions and take regular breaks so your mind stays fresh. Customer services “Very good facilities; I found the administration staff extremely helpful and I received all my material in plenty of time.” 2.We say active revision is better than passive revision, test your memory by giving yourself quizzes and using the review exercises. 3.You must learn the factual details from the study text as well as the major concepts. 4.We believe practice makes perfect – attempt the questions in the question bank, build momentum by completing the practice exams and identify areas that need further study. 5.We want you to succeed, so contact us for advice and guidance. What’s your next step? GARP requires you to pass Part 11 within four years, otherwise you will need to re-enroll in the FRM exam programme and start all over again. To book or for further information please contact us at: 4 FS Course Booking Team BPP Professional Education 1st Floor Aldine House 142–144 Uxbridge Road Shepherds Bush London W12 8AA FRM® Handbook, 5th Edition When you register for the FRM exam, you will be asked whether you would like to purchase the FRM Handbook by Philippe Jorion. This handbook contains coverage of key FRM examination topics, as well as past exam questions. As such, it can be used to complement your Schweser study materials. Note that the FRM Handbook should not be used in place of your Schweser study materials as it does not cover all the readings in the 2010 FRM study guide. Tel: +44 (0)20 8746 4178 Fax: +44 (0)20 7374 4008 financialservices@bpp.com www.bppfinancialservices.com FRMBR201005