KOMATSU REPORT 2013

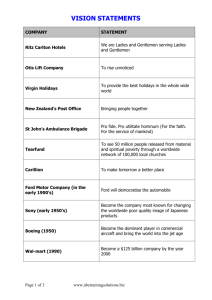

advertisement