Return of Organization Exempt From Income Tax C

advertisement

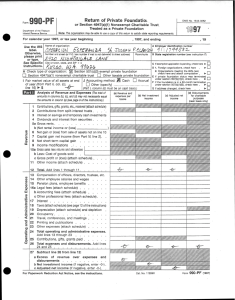

Fcfrm OMB No 1545-0047 9 90 Return of Organization Exempt From Income Tax 2007 Under section 501 (c), 527 , or 4947(aXl) of the Internal Revenue Code (except black lung benefit trust or private foundation) Department of the Treasury Internal Revenue Service(77) A For the 2007 calendar year, or tax year be g innin g B Check if applicable Address change Name change 7/01 , 2007, and ending 6/30 2008 Employer Identification Number C Please use IRS label or print or type. Independent Cosmetic Mfg. & Dist. Inc. 52-1062287 1220 West Northwest Highway Initial return specific Palatine, Termination Instructions. E Telephone number F Accounting method : IL 60067-1803 847-991-4499 Amended return Application pending H (a) Is this a group return for affiliates? H (b) Web site: 01 N/A J Organization ty a K Check here if the organization is not a 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000 A return is not required, but if the organization chooses to file a return, be sure to file a complete return ^ X 501(c) 6 4 (insert no ) 4947( a)(1) or eipts Add lines 6b, 8b, 9b, and 10b to line 12 ^ 780,211. Revenue . Expenses . and Chanoes in Net Assets or Fu a b c d $ noncash 1 1 1 1 $ I M E v d ^N E r It r: n C, r C C CD E P 13 14 Other revenue (from Part VII, line 103) Total revenue . Add lines le, 2, 3, 4, 5, 6c, 7, 8d, 9c, 1Oc, an Program services (from line 44, column (B)) Management and general (from line 44, column (C)) ) 1 e 11 15 Yes X No 2 3 4 5 0. 307 989. 438 , 791. 33 , 414. 6c 7 8d 9c 10e 11 12 17. 78T- 211 . 13 qr NOV 0 I 2008 Cl) t Fundraising (from line 44, column (D)) cr E 16 Payments to affiliates (attach schedule) S 17 Total ex penses . Add lines 16 and 44, column (A) A 18 Excess or (deficit) for the year Subtract line 17 from line 12 N 5 19 Net assets or fund balances at beginning of year (from line 73, column (A)) See Statement 1 Other changes in net assets or fund balances (attach explanation) T T 20 s 21 Net assets or fund balances at end of year Combine lines 18, 19, and 20 TEEA0109L BAA For Privacy Act and Paperwork Reduction Act Notice , see the separate instructions . N No a b c d Program service revenue including government fees and contracts (from Part VII, line 93) Membership dues and assessments Interest on savings and temporary cash investments Dividends and interest from securities Gross rents 6a Less rental expenses 6b c Net rental income or (loss) Subtract line 6b from line 6a 10. 7 Other investment income (describe (A) Securities (B) Other 8a Gross amount from sales of assets other 8a than inventory 8b b Less cost or other basis and sales expenses 8c c Gain or (loss) (attach schedule) d Net gain or (loss) Combine line 8c, columns (A) and (B) 0. 9 Special events and activities (attach schedule) If any amount is from gaming , check here $ of contributions a Gross revenue (not including 9a reported on line lb) 9b b Less direct expenses other than fundraising expenses c Net income or (loss) from special events Subtract line 9b from line 9a 10a 10a Gross sales of inventory, less returns and allowances 10 b b Less cost of goods sold c Gross profit or (loss) from sales of inventory (attach schedule) Subtract line teb from line 10a 11 12 Yes ^ Grou p Exemption Number Check ^ X if the organization is not required to a tta ch Schedu l e B ( Form 990, 990- EZ, or 990- PF) 2 3 4 5 6a b C No ances (Jee me In.crrucnnns. ) Contributions, gifts, grants, and similar amounts receivedContributions to donor advised funds Direct public support (not included on line 1 a) Indirect public support (not included on line la) Government contributions (grants) (not included on line 1 a) e Total (add lines I a through 1d) (cash H (d) Is this a separate return filed by an organization covered by a group ruling? 171 527 Yes If 'Yes,' enter number of affiliates H (C) Are all affiliates included' (if 'No, ' attach a list See instructions check onl y one 1 X Accrual H andl are not applicable to section 527 organizations • Section 501 ( cX3) organizations and 4947(aXl ) nonexempt G rt Cash Other (specify) ^ charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). L Open to Public Inspection ^ The organization may have to use a copy of this return to satisfy state reporting requirements 14 15 16 17 18 711,582. 19 686,847. 20 21 12/27107 68, 629. 30,063. 785, 539. Form 990 (2007) Form 990 (20Q7,). Independent Cosmetic Mfq-.- & Di st . Inc. -1062287 Statement of Functional Expenses All organizations must complete column (A) Columns (B), (C) and (D) are required for section 501 (c)(3) and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others. (See instruct) (B) Program Do not include amounts reported on line (C) Management (A) Total (D) Fundraising services 6b, 8b, 9b, 10b, or 16 of Part I and g eneral Part Il 22a Grants paid from donor advised funds (attach sch) $ (cash non-cash $ ) If this amount includes foreign grants, check here 22b Other grants and allocations (att sch) $ (cash non-cash $ 23 24 22a If this amount includes foreign grants, check here 22b Specific assistance to individuals (attach schedule) 23 Benefits paid to or for members (attach schedule) 24 25a Compensation of current officers, directors, key employees, etc listed in Part V-A b Compensation of former officers, directors, key employees, etc listed in Part V-B c Compensation and other distributions, not included above, to disqualified persons (as defined under section 4958(f)(1)) and persons described in section 4958(c)(3)(B) 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 25a 121, 450. 25b 0. 25c 0. Salaries and wages of employees not included on lines 25a, b, and c 26 154,792. Pension plan contributions not included on lines 25a, b, and c 27 4 , 881. Employee benefits not included on lines 25a - 27 Payroll taxes Professional fundraising fees Accounting fees Legal fees Supplies Telephone Postage and shipping Occupancy Equipment rental and maintenance Printing and publications Travel Conferences, conventions, and meetings Interest Depreciation, depletion, etc (attach schedule) Other expenses not covered above (itemize) 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 38,056. aSee Statement 2 43a ------------------b ------------------c ------------------d ------------------e---- --------------- 5,211. 6, 043. 18,270. 31 , 514. 6 , 857. 29 , 827. 45 , 234. 6 , 664. 242,783. 43b 43c 43d 43e 43f 43 f -- -- --------------g -- - ---------------44 Total functional expenses Add lines 22a through 43g (Or anizations completin columns B) - (D), carry these totals to lines 13q- 15 ) 44 711 , 582. 1 Joint Costs . Check I^H if you are following SOP 98-2 N/A Yes 11 No Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? , ( ii) the amount allocated to Program services If 'Yes,' enter (i) the aggregate amount of these joint costs $ and (iv) the amount allocated $ (iii) the amount allocated to Management and general $ to Fundraising $ BAA TEEA0102L 08/02/07 Form 990 (2007) Form 490 2007 Inde p endent Cosmetic Mfg . & Dist. Inc. Part II I Statement of Program Service Accomplishments (See the instructions.) 52-1062287 Page3 Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization How the public perceives an organization in such cases may be determined by the information presented on its return Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments ___ _ Program Service Expenses What is the organization ' s primary exempt purpose ? ^ _Mem _b_e_r _ e_duc _ _ation_ _and_ se r_viic e m_ _n red for 51 c a nd All organizations must describe their exempt purpose achievements in a clear and concise aner -St-ate- the number of tR (4)io rgan zatioons(and clients served , publications issued , etc Discuss achievements that are not measurable (Section 501(c)(j3) and (4) organ4947(a)(1) trusts, but optional for others ) izations and 4947 (a )( 1 ) nonexem p t charitable trusts must also enter the amount of g rants and allocations to others a See Statement 3 ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------0. [7 Grants and allocations If this amount includes forei g n g rants , check here $ b ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------P. [7 Grants and allocations If this amount includes foreign g rants , check here $ C -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------0. [7 Grants and allocations If this amount includes forei g n g rants , check here $ d -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------If this amount includes foreign g rants, check here Grants and allocations $ e Other program services If this amount includes foreign g rants , check here $ (Grants and allocations f Total of Program Service Expenses (should equal line 44, column (B), Program services) Form 990 (2007) BAA TEEA0103L 12/27/07 Form 990 2007 Indep endent Cosmetic Mf g . & Dist. Inc. Part IV Balance She ets (See the instructions.) Note : 52-1062287 (B) End of year (A) Beginning of year Where required, attached schedules and amounts within the description column should be for end - of-year amounts only 45 Cash - non - interest-bearing 83, 409 . 45 46 Savings and temporary cash investments 94 , 526 . 46 40, 929 . 47c 47a Accounts receivable b Less allowance for doubtful accounts 47a 47b 48a Pledges receivable b Less allowance for doubtful accounts 49 Grants receivable 48a 48b Pa g e 4 92,266. 104, 236. 64,543. 64,543. 48c 49 50 a Receivables from current and former officers, directors , trustees, and key employees ( attach schedule) 50a b Receivables from other disqualified persons (as defined under section 4958 (f)(1)) and persons described in section 4958 (c)(3)(B) (attach schedule) 50b A 51 a Other notes and loans receivable (attach schedule) b Less allowance for doubtful accounts 52 Inventories for sale or use 53 Prepaid expenses and deferred charges 54a Investments - publicly-traded securities b Investments - other securities (attach sch ) 55a Investments - land, buildings , & equipment basis s E s 51a 51 b 51 c 0' 55, 1 b Less accumulated depreciation (attach schedule ) 56 Investments - other (attach schedule) 57a Land, buildings, and equipment basis Cost Cost 55b 57a 56, 533. 57b 49, 849 . Other assets, including program - related investments 59 60 61 Total assets must equal line 74 Add lines 45 through 58 Accounts payable and accrued expenses Grants payable 62 Deferred revenue (describe ^ L A Statement 4 58 9,488 . 57c 137, 800. 58 See Statement 5 Loans from officers , directors, trustees , and key employees (attach schedule) 64a Tax - exempt bond liabilities (attach schedule) b Mortgages and other notes payable ( attach schedule) See Statement 65 Other liabilities (describe 66 Total liabilities . Add lines 60 through 65 20,711. 648,288. 6,684. 129,357. 920, 467. 32,958 . 59 60 61 1,066,085. 16,807. 76,491. 62 162,941. 63 L T s 63 64a 64b 6 Organizations that follow SFAS 117, check here through 69 and lines 73 and 74 A 67 Unrestricted j T 68 Temporarily restricted 69 Permanently restricted Organizations that do not follow SFAS 117, check here ^ N B A A N 70 71 72 73 E 74 124, 171. 65 100,798. 233, 620. 66 280, 546. 686 847. 67 785 539. and complete lines 67 N o F 52 53 54a 54b 55c 56 b Less accumulated depreciation (attach schedu l e) e FMV FMV 10, 055. 544, 260. 68 69 and complete lines 70 through 74 Capital stock , trust principal , or current funds Paid-in or capital surplus , or land , building, and equipment fund Retained earnings, endowment , accumulated income, or other funds Total net assets or fund balances. Add lines 67 through 69 or lines 70 through 72. (Column (A) must equal line 19 and column (B) must equal line 21) Total liab ilities and net assets/fund balances. Add lines 66 and 73 70 71 72 686 920 847. 467 . 73 74 785 , 539. 1,066,085. Form 990 (2007) BAA TEEA0104L 08102/07 Form 990 2007 Indep endent Cosmetic Mf g . & Dist. Inc. 52-1062287 Part 1V-A Reconciliation of Revenue per Audited Financial Statements with Revenue per Return (See the Instructions.) a b c d Total revenue, gains, and other support per audited financial statements Amounts included on line a but not on Part I, line 12 1 Net unrealized gains on investments 2Donated services and use of facilities 3Recoveries of prior year grants a Page 5 815,719. b1 b2 b3 4Other (specify) -----------------------------SeeStm7_ _______ _ ________________ Add lines b1 through b4 Subtract line b from line a Amounts included on Part I, line 12, but not on line a: 1 Investment expenses not included on Part I, line 6b 2Other (specify) ------------------------------ b4 35,508. , b 35,508. c 780,211. _ d e 780,211. d1 d2 Add lines dl and d2 Total revenue Part I, line 12) Add lines c and d e 1-1 Part IV- B. Reconciliation of Ex p enses p er Audited Financial Statements with Ex penses p er Return a b Total expenses and losses per audited financial statements Amounts included on line a but not on Part I, line 17 1 Donated services and use of facilities 2Prior year adjustments reported on Part I, line 20 3Losses reported on Part I, line 20 4Other (specify) ------------------------------ a 717,028. Add lines b1 through b4 b Subtract line b from line a c 5,446. 711,582. d e 711,582. See Stmt 8 ------ - ------- - --- - --- -- - --- - ----- ----c d Amounts included on Part I, line 17. but not on line a: 1 Investment expenses not included on Part I, line 6b 2Other (specify) ------------------------------ b1 b2 b3 b4 5,446. d1 d2 e Add lines dl and d2 Total ex penses (Part I, line 17) Add lines c and d "Part V-A Current Officers , Directors , Trustees , and Key Employees (List each person who was an officer, director, trustee, or kev employee at any time during the year even if they were not compensated) (See the instructions ) (A) Name and address See attached list-all_comp-E ------------- -- --------------------- (B) Title and average hours per week devoted to position (C) Compensation (if not paid, enter -0 -) 118,000. (D) Contributions to employee benefit plans and deferred compensation plans 3,450. (E) Expense account and other allowances 0. 0 ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------BAA TEEA0105L 08102/07 Form 990 (2UU/) Form §90(2007) Inde pend ent Cos me ti c Mfg. & Dist. Inc. Part 'V-A Current Officers , Directors , Trustees , and Key Em p loyees (continued) 52-1062287 Page 6 Yes No x29 ___________ 75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at board meetings b Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated employees l is t e d in S c h e d u l e A , Part I , or h ig hest co m p ensated p rofessional and other independent contractors listed in Schedule A, Part II-A or II-B, related to each other through family or business relationships? If 'Yes,' attach a statement that 75b identifies the individuals and explains the relationship(s) c Do any officers, directors, trustees, or key employees listed in form 990, Part V-A, or highest compensated employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, receive compensation from any other organizations, whether tax exempt or taxable, that are related 75c to the organization' See the instructions for the definition of 'related organization' If 'Yes,' attach a statement that includes the information described in the instructions 75d d Does the or g anization have a written conflict of interest p olicy ? Part V- B X X X Former Officers , Directors , Trustees , and Key Employees That Received Compensation or Other Benefits (If any former officer, director, trustee, or key employee received compensation or other benefits (described below) during the year, list that person below and enter the amount of compensation or other benefits in the appropriate column See the instructions ) (C) Compensation (D) Contributions to (E) Expense ( if not paid, employee benefit account and other (B) Loans and (A) Name and address enter -0- ) Advances plans and deferred allowances compensation plans None -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Part VI Other Information (See the instructions. Yes Did the organization make a change in its activities or methods of conducting activities? If 'Yes,' attach a detailed statement of each change 77 Were any changes made in the organizing or governing documents but not reported to the IRS's If 'Yes,' attach a conformed copy of the changes 78a Did the organization have unrelated business gross income of $ 1,000 or more during the year covered by this return? b If 'Yes,' has it filed a tax return on Form 990 -T for this year' No 76 79 Was there a liquidation, dissolution , termination, or substantial contraction during the year? If ' Yes,' attach a statement 80a Is the organization related (other than by association with a statewide or nationwide organization) through common membership , governing bodies, trustees , officers, etc , to any other exempt or nonexempt organization? b If 'Yes,' enter the name of the organization - N/A -_--_ ------------nonexempt - - - - - - - - - - - - - - - - - - - - - - - - - - - - - and check whether it is 11 exempt or 81 a Enter direct and indirect political expenditures (See line 81 instructions) 81 a 0. b Did the or g anization file Form 1120- POL for this ear' X X 76 77 78a 78b X X 79 X 80a X 1 lb , X Form 990 (2007) BAA TEEA0106L 12127/07 Form 990 2007 Inde p endent Cosmetic Mf g . & Dist . Inc. 52-1062287 Page7 Pa rt VI Other Information (continued) Yes 82 a Did the or g anization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value? b If 'Yes ,' you may indicate the value of these items here Do not include this amount as 82b revenue in Part I or as an expense in Part II (See instructions in Part III ) 83a Did the organization comply with the public inspection requirements for returns and exemption applications? b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? 84a Did the organization solicit any contributions or gifts that were not tax deductible? 82a No X N/A 83a 83b 84a b If 'Yes ,' did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible 85a 501 (c)(4), (5), or (6) Were substantially all dues nondeductible by members? b Did the organization make only in - house lobbying expenditures of $2,000 or less? X X X 84b 85a 85b N A 85 N A - - 85h N A X X If 'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year Dues, assessments , and similar amounts from members Section 162 (e) lobbying and political expenditures Aggregate nondeductible amount of section 6033 (e)(1)(A) dues notices Taxable amount of lobbying and political expenditures (line 85d less 85e) g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f' c d e f 85c 85d 85e 85f In if section 6033( e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? 86 501 (c)(7) organizations Enter a Initiation fees and capital contributions included on line 12 86a b Gross receipts , included on line 12, for public use of club facilities 86b 87 501 (c)(12) organizations Enter a Gross income from members or shareholders 87a b Gross income from other sources (Do not net amounts due or paid to other sources against amounts due or received from them ) 87b 0. 0. 0. 0. N/A N/A N/A N/A 88 a At any time during the year , did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 7701-2 and 301 7701-37 If 'Yes,' complete Part IX 88a b At any time during the year, did the or g anization , directly or indirectly, own a controlled entity within the meaning of 11 88b section 512 (b)(13)' If 'Yes ,' complete Part XI 89a 501 (c)(3) organizations Enter Amount of tax imposed on the organization during the year under N/A N / A , section 4955 ^ section 4911 N/A , section 4912 ^ --------------------- ------ - --b 501(c)(3) and 501 (c)(4) organizations Did the organization engage in any section 4958 excess benefit transaction d uring th e year or d i d i t b ecome aware o f an excess b ene f i t t r ansaction from a p rior y ear' If 'Yes , ' attach a statement 89b explaining each transaction X X N A c Enter Amount of tax imposed on the or g anization managers or disqualified persons during the N/A year under sections 4912 , 4955, and 4958 10. N/A d Enter Amount of tax on line 89c , above, reimbursed by the organization 89e e All organizations At any time during the tax year , was the organization a party to a prohibited tax shelter transaction? 89f f All organizations Did the organization acquire a direct or indirect interest in any applicable insurance contract? X X g For supporting organizations and sponsoring organizations maintaining donor advised funds Did the supporting organization, or a fund maintained by a sponsoring organization, have excess business holdings at any time during 89 gl I X the year' 90a List the states with which a copy of this return is filed ^ None -------------------------------------b Number of emplo yees employed in the pay period that includes March 12, 2007 (See instructions) 190b1 847-991-4499 Telephone number ^ 91 a The books are in care of ^ Ms. Penni Jones 60067 Located at ^ 1220 West Northwest Highway_ Palatine_IL --__-------_ ZIP +4 ^ ---------------------Yes b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a 91 b financial account in a foreign country (such as a bank account , securities account, or other financial account)? If'Yes,' enter the name of the foreign country 0 No X See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts Form 990 (2007) BAA TEEA0107L 09/10/07 Form b90 2007 Indep endent Cosmetic Mf g . & Dist. Inc. Part VI Other Information (continued) 52-1062287 Page 8 Yes No c At any time during the calendar year, did the organization maintain an office outside of the United States? 0 -- - - _ _ _ If 'Yes,' enter the name of the foreign country 92 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1047 - Check here and enter the amount of tax-exem pt interest received or accrued during the tax year Part VII Anal sis of Income - Producin g Activities (See the instructions. Unrelated business income Note : Enter gross amounts unless otherwise Indicated 93 Program service revenue a Advertising b c d e 5111201 N/A N/A 92 E exempt Related or function income (D) Amount (C) Exclusion code 53,003. 55,500. EU Address Fee Event Fees Fees For Service Publications If Medicare/Medicaid payments g Fees & contracts from government agencies 94 Membership dues and assessments 95 Interest on savings & temporary cash invmnts X Excluded by section 512, 513, or 514 (B) Amount (A) Business code 91 c 71 89.462. 103,275. 6,749. 438,791. I 1 Dividends & interest from securities Net rental income or (loss) from real estate a debt-financed property b not debt-financed property 98 Net rental income or (loss) from pers prop 99 Other investment income 96 97 141 1 33,414.1 =^a . Gain or ( loss) from sales of assets other than inventory 100 101 Net income or (loss ) from special events 102 Gross profit or (loss ) from sales of inventory 103 Other revenue a 17. b Misc. C d e 104 Subtotal (add columns ( B), (D), and (E)) 53, 003. - 604,332. 122, 876. 111- 105 Total (add line 104, columns (B), (D), and (E)) Note : Line 105 p lus line le, Part 1, should e qual the amount on line 12, Part 780,211. Part VIII Relationshi p of Activities to the Accom p lishment of Exem pt Pur p oses (See the Instructions. Line No . W Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization ' s exempt purposes (other than by providing funds for such purposes) Part IX Information Reg ardin g Taxa ble Subsidiaries and Disre g arded Entities (See the instructions. (A) (B) (C) (D) (E) Name, address, and EIN of corporation, partnership, or disregarded entity Percentage of ownership interest Nature of activities Total income End-of-year assets N/A Part X % . 0 . with Personal Benefit Contracts (See the instructions. Associated Information Reg ardin g Transfers a Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? b Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? Note : If 'Yes' to (b), file Form 8870 and Form 4720 (see instructions). BAA TEEA0108L 12/27/07 Yes Yes X No X No Form 990 (2007) Form'990 2007 Inde p endent Cosmetic Mf g . & Dist. Inc. 52-1062287 Part XI Information Regarding Transfers To and From Controlled Entities . Complete only if the Page 9 organization Is a controlling organization as defined in section 512(b)(13). Yes 106 Did the reporting organization make any transfers to a controlled entity as defined in section 512 (b)(13) of the Code? If 'Yes,' com p lete the schedule below for each controlled entity (A) a Employer Identification Number ICMAD Purchasing Group, Inc. _ _ _ ---------- -1220 West_Northwest HighwaY_____ Palatine, IL 60067-1803 22-3211153 ------------------------ b (C) (B) Name , address , of each controlled entity Description of transfer No X (D) Amount of transfer Expenses paid by the controlling entit on behalf of the controlled 0. entity. ------------------------------------------------ c ------------------------Totals Yes 107 Did the reporting organization receive any transfers from a controlled entity as defined in section 512 (b)(13) of the Code? If 'Yes,' com p lete the schedule below for each controlled entit y (A) Name , address , of each controlled entity (B) Employer Identification Number a ------------------------------------------------- b ------------------------------------------------- c ----------------------------------------------- (C) Description of transfer No X (D) Amount of transfer Totals Yes 108 Did the organization have a binding written contract in effect on August 17, 2006, covering the interest, rents, royalties, and annuities described in question 107 above? Under penalties of perjurY I d eclare that I have examined this return, including accompanying schedules and statements , and to the best of my kno ledge and belief, it is Cher than officer ) is based on all information of which preparer has any knowledge true, correct d complet Declaration of prepare Please Sign Here ^ Si ^ r tore of officer }?P 0 0 ^.vo J PS , C X^l'_f (=1 I t ^P Date l rP o 43/ r No X Page 1 Federal Statements 2007 52-1062287 Independent Cosmetic Mfg. & Dist. Inc. Statement 1 Form 990, Part I , Line 20 Other Changes in Net Assets or Fund Balances Tota l $ 30 , 063. 30 , 063 . (D) Intercompany Statement 2 Form 990 , Part II, Line 43 Other Expenses (B) (C) Program Management Services & General (A) Total Advertising & Publication EU Address 40,318. 31,023. Insurance Meeting expenses 3,696. 81,645. Miscellaneous Professional & Contract Fees Public Relations 1,603. 48,630. 10,515. Fundraising 6,357. Subscription & Dues 1,408. Utilities 17,588. Young Designer Sponorship Total $ 242,783. 0. $ $ 0. 0. $ Statement 3 Form 990 , Part III, Line a Statement of Program Service Accomplishments Description Grants and Program Service Allocations Expenses Membership-Includes traditional membership functions such as membership tracking and the performance of membership services, such as certificates of free sale No Includes Foreign Grants: Communications & Publications - Publishing of "The Digest", Also, publishing the "Labeling the associations newsletter. Guide", "Guide to European Consmetic Regulations", the "World Showcase" magazine and the on-line publication of the "Call Me First Directory". No Includes Foreign Grants: Education- Includes ICMAD FDA workshops and export seminars No Includes Foreign Grants: Legislation-Includes activities related to keeping members informed of legislative and regulatory matters. No Includes Foreign Grants: $ 0. $ 0. Federal Statements 2007 Page 2 Independent Cosmetic Mfg. & Dist. Inc. 52- 1062287 Statement 4 Form 990 , Part IV , Line 57 Land , Buildings, and Equipment Basis Category Furniture and Fixtures $ Tot a l 56 533. 56 , 533 . $ $ Accum. Book Deprec. Value 49,849. 49 , 8 49. $ $ 6,684. 6 , 684 . $ 129,357. Total $ 129,357. Statement 5 Form 990 , Part IV , Line 58 Other Assets Intercompany Statement 6 Form 990 , Part IV, Line 65 Other Liabilities Accrued Payroll $ 6,689. Total $ 94,109. 100,798. Subsidiary Statement 7 Form 990, Part IV-A, Line b(4) Other Amounts SUB INCOME $ Total $ 35,508. 35,508. $ Total $ 5,446. 5,446. Statement 8 Form 990 , Part IV- B, Line b(4) Other Amounts SUB EXPENSES Statement 9 Form 990, Part VIII Relationship of Activities to the Accomplishment of Exempt Purposes Line 93 Explanation of Activities EU address fee allows members to export to EU fostering intl gr owt h. Events to maintain the organization and certificate fees. Fees for services benefits the members. Publications provide education and sharing of information. 2007 Federal Statements Independent Cosmetic Mfg. & Dist. Inc. Statement 9 (continued) Form 990 , Part VIII Relationship of Activities to the Accomplishment of Exempt Purposes Line 94 Explanation of Activities Dues required to fund organization for benefit of members. Page 3 52-1062287 INDEPENDENT COSMETICS MANUFACTURERS AND DISTRIBUTORS, INC ICI TEL 847-991-4499 1-800-334-2623 FAX 847-991-8161 EMAIL info@icmad org 1220 W Northwest Highway, Palatine, IL 60067-1803 ICMAD OFFICERS AND BOARD OF DIRECTORS 2008-2009 CHAIRMAN - Stanley G. Katz Cosmetic Index 10 Bonnie Drive Northport, NY 11768 Pamela Busiek CBI Laboratories, Inc. 4201 Diplomacy Road Fort Worth, TX 76155 VICE CHAIRMAN - Marva Kalish Marketing Plus Consultants 42-30 Douglaston Parkway Douglaston, NY 11363 Carmen Solo Corcoran The Starfish Group P.O. Box 3102 Lisle, IL 60532 PRESIDENT - David Schieffelin ybf, lic 711 Third Avenue, 11th Fl. New York, NY 10017 Shari Creed Sweet Spot Labs, Inc. 15332 Antioch Street, Suite 418 Pacific Palisades, CA 92072 VICE PRESIDENT - Carl Geffken Carl Geffken Consultants 154 Riverview Drive Guilford, CT 06437 Curran Dandurand Jack Black LLC 2155 Chenault Drive, Ste. 509 Carrollton, TX 75006 VICE PRESIDENT - Pamela Viglielmo The Gramercy House 221 Willow Street Southport , CT 06890 Jeffrey Dorr Madcar Company, Inc. 136 Raynor Avenue Ronkonkoma , NY 1177 SECRETARY - Sharon Blinkoff Venable LLP 1270 Avenue of the Americas, 25th Fl. New York, NY 10020 Ian Ginsberg Bigelow Trading Ltd. 412 Sixth Avenue New York, NY 10011 TREASURER - Howard Baker H. Baker Development 12 Orben Drive, Unit 4 Landing, NJ 07850 Howard Hirsch HDH Holdings 101 Hardscrabble Road Basking Ridge, NJ 07920 DIRECTORS Karen Acker KA Consulting Corp. P.O. Box 800 Nyack , NY 10960 Jane Iredale Iredale Mineral Cosmetics, Ltd. 28 Church Street Gr. Barrington , MA 01230 Paul Aloe Magic of Aloe/Aloe Cosmetics Labs 7300 N. Crescent Blvd. Pennsauken, NJ 08110 Deborah Lippmann Lippmann Enterprises, LLC 55 Vandam Street, Ste. 903 New York , NY 10013 ICI Gun Nowak Face Stockholm Ltd. 324 Joslen Blvd. Hudson, NY 12534 Susan M. Rafaj Susan M. Rafaj Mktg. Serv., Inc. 135 East 55th Street New York, NY 10022 Flori Roberts The Roberts Group, NJ 1241 Gulf of Mexico Drive, #801 Longboat Key, FL 34228 Patricia Schmucker Performance Branding Services 25500 Hawthorne Blvd., #2120 Torrance, CA 90505 David Steinberg Steinberg & Associates 16 Mershon Lane Plainsboro, NJ 08536 Lori Thaler-Cohen Corwood Laboratories, Inc. 55 Arkway Drive Hauppauge, NY 11788 Craig Weiss Consumer Product Testing Co. 70 New Dutch Lane Fairfield, NJ b7004 Herbert L. Wilson Fran Wilson Creative Cosmetics 515 Madison Avenue New York, NY 10022 INDEPENDENT COSMETICS MANUFACTURERS AND DISTRIBUTORS, INC TEL 847-991-4499 1-800-334-2623 FAX 847-991-8161 EMAIL info@icmad org 1220 W Northwest Highway, Palatine, IL 60067-1803 LEGAL COUNSEL Jack R. Bierig Sidley Austin LLP One South Dearborn Street Chicago , IL 60603 ICMAD EXECUTIVE OFFICE Penni Jones , Executive Director 1220 W. Northwest Highway Palatine , IL 60067