financial report - K+S Aktiengesellschaft

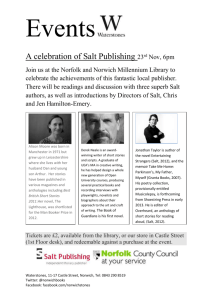

advertisement