Consideration Sets and Competitive Marketing

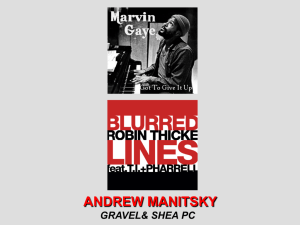

advertisement