bank rakyat annual report 2013

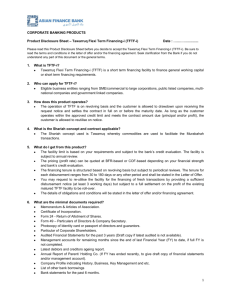

advertisement