Campbell and Mankiw (1990) Hall Hall Hall

advertisement

28 : 2 (2000), 127

148

>

?

@

O

A

P

B

C

D

Q

R

\

E

F

G

H

I

J

K

L

M

S

T

U

V

W

X

Y

Z

]

^

_

Campbell and Mankiw (1990)

Hall

/

0

d

e

f

~

=

~

*

=

f

'

h

5

*

(

)

$

)

-

i

y

n

o

5

#

(

)

*

%

`

'

(

)

*

+

*

1

"

%

2

3

4

5

6

7

^

*

;

<

=

`

2

E

F

G

/

J

K

L

∗

1

2

3

g

h

M

J

4

(

K

3

)

i

g

0

L

5

M

j

N

*

8

9

∗

b

5

:

!

;

<

"

=

#

>

$

?

%

@

&

'

[

l

m

n

o

p

-

k

q

r

s

5

t

u

*

y

n

o

q

r

s

5

g

s

*

(

)

g

h

*

c

d

*

%

!

"

(

)

-

k

q

r

s

5

t

u

*

7

*

8

9

5

:

-

0

+

$

s

I

+

6

O

y

*

H

7

a

k

v

*

u

-

6

`

P

7

Q

j

8

d

e

f

g

h

i

j

k

l

:

~

¤

¥

j

k

¦

§

:

¨

©

ª

«

¦

§

k

½

¾

¿

~

¤

À

Á

Â

Ã

°

c

d

Ä

Å

5

(

:

>

)

6

-

*

?

5

;

@

*

A

B

8

/

C

D

v

7

*

+

,

-

.

]

^

_

`

2

c

w

x

y

z

{

|

}

+

,

s

1

2

3

+

,

+

,

$

%

!

"

(

v

%

&

g

h

;

v

w

x

.

y

/

0

,

*

+

,

*

8

9

5

:

Hall

?

)

*

^

9

\

(

:

-

v

;

v

8

c

9

*

Hall

,

1

N

m

¬

u

9

5

n

­

Æ

j

®

s

-

:

k

o

;

p

m

R

q

1

r

j

2

k

3

o

R

c

d

t

u

v

w

l

x

y

z

{

|

o

}

°

±

²

¥

=

´

µ

¶

·

¸

¹

º

»

¼

s

NSC862451H035T¯

=

h

Ç

È

É

Ê

Ë

Ì

°

Í

Î

c

y

d

n

Ï

Ð

R

o

Ñ

Ò

q

s

r

s

128

:

1

U

U

V

W

X

Y

Z

[

\

p

q

r

X

s

W

t

u

v

]

^

`

Z

Y

[

Z

\

[

_

\

_

or Permanent Income Theory)

`

}

e

a

b

<

28 : 2 (2000)

=

S

T

`

a

b

c

d

e

f

g

h

i

j

[

\

_

k

k

w

x

y

z

{

|

}

]

~

x

s

W

}

e

a

e

n

r

m

¡

b

`

^

}

a

b

e

~

x

§

s

¨

©

}

e

ª

«

¤

z

{

|

}

v

`

¬

­

®

d

µ

¶

·

¸

­

¹

¡

¢

º

»

À

Á

e

­

l

Ç

È

É

U

U

Í

Õ

Ö

×

Ø

r

r

á

â

e

ã

ä

å

Ï

e

¡

¢

f

g

ë

ì

`

]

æ

í

¼

V

î

e

æ

¡

¢

e

ª

¾

ß

V

î

`

ó

ô

õ

Ê

Ü

a

b

ÿ

ß

á

ë

W

r

Å

a

b

ÿ

Â

(1981)

Å

Æ

Ã

j

Ä

Å

Æ

Ð

¼

Ñ

Ò

Hall

Ó

`

æ

Ô

­

ç

Ü

Õ

Õ

Ö

Ö

f

g

]

ö

÷

d

W

`

^

e

a

b

l

±

²

³

´

`

¼

½

¾

~

x

e

¿

y

Ê

Ë

l

Ì

Í

e

Î

Ï

f

g

r

Ù

e

Ú

Û

`

Ê

Ü

Ý

}

a

b

·

Þ

ß

à

e

s

ê

r

Î

ò

]

Ö

ï

`

ß

s

ë

W

e

ø

Ü

_

ç

e

¥

¦

}

é

l

ð

ñ

ß

V

î

ù

e

ú

`

û

æ

r

ú

ü

Û

ý

d

j

r

Hall

}

©

^

e

¨

l

l

(Life Cycle

e

Õ

¤

e

°

æ

æ

o

¯

e

n

£

è

e

m

`

PIH

è

`

¢

Hall

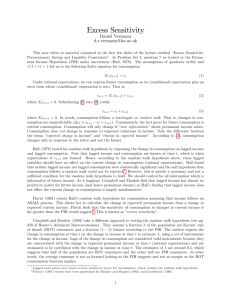

(excess sensitivity)

á

¡

Hall (1978)

(random walk)

PIH

Hall (1978)

l

`

Flavin

PIH

þ

^

à

(liquidity constraint)

(credit constraint)

Flavin

(1985), Hayashi (1987) Zeldes (1989) ]

(myopia)

Flavin (1985, 1991) Shea (1995) ]

Campbell and Mankiw (1989, 1990, 1991)

Hall

1

(RuleofThumb)

¨

]

¼

`

ß

õ

b

e

U

U

ÿ

l

^

d

Ý

%

]

j

®

ê

7

8

9

Å

e

!

ç

<

4

ß

õ

ö

e

a

b

ß

=

>

e

@

A

e

~

x

`

ß

B

l

õ

ö

e

a

b

`

@

A

Ý

Õ

@

E

F

V

G

H

a

b

§

#

$

K

A

e

U

U

R

S

á

l

e

}

e

ÿ

a

Y

b

*

a

e

Ü

¿

`

,

Y

&

ú

e

Ó

'

-

~

.

T

e

U

V

¹

Õ

@

E

T

"

j

ç

#

ß

3

$

ß

Ý

l

&

Ø

a

j

x

¨

ö

ú

a

d

r

e

a

b

j

#

$

[

%

~

x

r

(

Ý

)

'

ã

¨

`

-

/

j

0

1

d

[

4

ú

`

^

3

ü

5

6

j

æ

¨

:

;

^

3

ü

j

æ

¨

¨

Õ

?

`

!

"

e

a

b

j

#

$

C

¨

Õ

?

ò

!

D

Õ

?

æ

­

`

l

õ

ö

e

ü

b

õ

Deaton (1991)

Jappelli and Pagano (1989, 1994)

E

!

b

e

r

`

r

a

(imperfect)

Ý

e

Ã

+

2

_

ê

e

ê

b

ö

®

I

Õ

§

J

à

`

L

a

b

§

Ý

}

×

l

£

e

M

¢

^

N

O

`

!

"

Ð

¼

P

Q

`

Ê

Ü

Z

3

ü

[

e

\

]

è

W

e

X

Y

r

Ô

¨

Õ

W

Ö

×

X

Ø

!

Y

"

#

e

$

ô

^

2 Flavin (1991)

(asset shocks)

¿

Ã

j

<

Þ

ß

a

b

4

ú

ä

å

¨

}

e

G

Õ

Ö

&

_

r

e

%

'

(

`

)

a

*

n

+

`

,

æ

-

­

.

b

ç ç

/

Z

3

W

0

1

ü

2

3

c

1

¼

k

h

Õ

?

i

t

u

a

b

à

¨

e

ä

å

`

Ê

Ü

k

k

l

e

a

b

`

!

"

p

¡

ß

Ð

¼

Õ

?

i

j

m

n

!

"

e

(smoothing)

t

b

W

á

j

æ

]

ä

å

`

u

]

à

v

w

î

/

j

ÿ

­

l

~

q

`

d

l

^

ù

Ë

ß

l

õ

ö

e

a

b

j

#

$

e

a

b

`

q

j

î

Ó

X

[

\

Z

Ì

v

r

æ

­

T

G

H

è

V

G

H

e

V

î

`

Ê

d

l

^

°

Ý

e

a

b

e

3

ü

v

t

e

~

x

U

U

y

a

b

r

}

ß

|

)

e

`

j

§

¨

¨

æ

©

r

ú

¡

¢

ë

ì

Ê

Ü

`

~

x

`

G

ª

«

e

¡

¬

Õ

Ö

r

­

®

§

¯

°

c

d

¨

-

`

®

¤

³

ó

e

l

`

t

u

a

b

e

c

¶

-

j

a

b

e

Ý

&

-

·

V

ý

©

}

e

\

`

º

r

«

À

·

I

K

Î

Å

|

Æ

j

-

`

j

Ä

à

e

`

y

Ë

Ì

b

ß

á

e

Ü

¾

ð

½

¾

e

a

b

j

æ

U

U

@

|

d

º

`

I

a

s

`

ÿ

e

ß

á

e

a

b

à

¨

ê

r

Y

`

^

3

ü

5

6

j

à

ä

å

`

x

y

q

z

{

l

j

r

@

|

r

m

`

@

|

e

º

@

j

`

`

à

¼

è

.

`

@

|

Ù

Ð

¼

¬

E

`

§

·

PIH

e

a

b

e

3

ü

`

d

[

%

a

b

r

@

|

§

Ð

¼

e

a

b

h

Õ

Ö

)

"

ª

¾

t

v

3

ü

e

ô

^

à

_

e

¾

~

x

'

¡

¢

f

g

D

¡

a

¢

£

ð

W

ñ

½

ÿ

e

É

¼

e

·

¤

e

ë

W

`

¨

à

Ð

Á

e

Â

b

Õ

Ö

W

%

¢

¦

¤

Ð

§

~

¼

¨

x

è

`

Z

¤

¥

`

¦

¤

d

e

Õ

Ö

`

Ê

Ñ

Ò

e

¼

y

½

¾

Ä

à

·

I

K

­

-

X

K

×

e

÷

ý

l

a

©

£

b

e

}

¢

ô

e

ß

`

ú

±

¡

²

ë

ì

e

ä

å

r

!

"

Ê

Ü

Î

p

¡

ß

¸

]

e

¹

&

`

`

ú

À

@

`

1980

¡

¾

Ã

V

ã

¿

e

á

Ä

¨

ä

å

¦

y

Ç

È

e

e

Í

Î

Ï

Ò

e

Y

Z

Õ

Ö

r

Ð

Ñ

`

e

a

b

j

Ä

à

¨

ê

r

V

î

e

Ò

d

Ê

r

`

¨

d

l

^

3

u

ð

`

a

b

e

r

×

t

`

±

½

¾

`

l

£

Ð

¡

²

ë

!

"

ò

Ê

Ü

¼

ì

¹

º

³

ó

Campbell and Mankiw

»

30%

Jappelli and Pagano (1989, 1994)

Chyi and Huang (1997)

PIH

Huang (1999)

Shea (1995)

¨

PIH

Campbell and Mankiw (1990, 1991)

`

`

¨

(Euler Equation)

v

¥

;

(1996)

:

`

s

r

e

Campbell (1987)

(1996)

µ

a

.

§

¼

}

è

½

Ý

Hall (1978)

(1989)

Hall (1978)

b

ã

Chan and Hu (1997)

·

¨

y

´

ê

g

L

r

`

`

PIH

$

Ö

¢

Õ

¨

b

e

a

r

y

u

ß

`

à

t

q

O

`

129

9

N

o

8

e

n

¼

7

f

m

6

e

c

à

5

d

H

ç ç

4

º

Ý

}

g

¼

É

Ê

e

a

e

½

á

l

e

130

:

r

^

¼

y

h

.

a

b

×

§

§

º

@

¡

¢

ð

¡

¬

e

ë

ì

,

V

Ú

Ó

d

l

½

¢

.

Z

U

ÿ

@

ã

ä

r

#

$

ì

ô

`

í

|

±

©

î

g

Hall

M ax Et

ú

f

e

e

O

¾

`

`

e

ß

à

X

28 : 2 (2000)

=

l

e

`

Ö

ë

W

2

U

<

Hall (1978)

`

[

ü

Ø

§

Û

"

\

¡

ñ

e

÷

ø

}

ù

ñ

Ð

Á

rt

`

t

ð

σ(> 0)

[

r

ñ

v

©

î

j

â

a

b

H

e

V

À

`

í

ñ

a

b

¯

°

e

¢

£

¿

l

ñ

(3)

`

ñ

a

X

s

¨

©

}

e

b

Et−1 Ctα = Et−1 (

U

î

Ó

)

d

à

|

w

t

Ô

§

`

@

§

&

Õ

`

Ö

§

Ù

¡

¢

e

ë

ì

`

¯

Î

l

§

/

@

|

z

{

²

á

â

~

x

s

W

¨

a

b

è

é

ê

i

A

ë

¼

Ü

Z

Þ

Hall (1978)

d

Ì

Ý

v

`

å

l

æ

ç

(1)

j = 0, . . . , ∞

U

(2)

j = 0, . . . , ∞

U

U

r

·

j=0

ç

`

H

(3)

ç

j

æ

Ó

t

Ö

ò

ó

}

e

¡

Á

`

Et

ë

U (Ct )

(1)

(Constant Relative RiskAversion CRRA)

Å

Æ

∞

Ct ï At ï Yt `

`

Å

S ( 1 +1 σ )j U (Ct+j )

At+j ≥ 0, U

v

Ä

r

At+j+1 = (1 + rt+j )(At+j + Yt+j − Ct+j )U

ñ

j

r

3

PIH

e

¼

e

}

Õ

ñ

(3)

Ã

e

÷

?

`

l

ø

ú

`

í

}

V

e

Å

ñ

a

ç

¼

b

s

û

ï

#

-

¡

$

`

ñ

Ö

ª

Õ

?

ï

h

¡

ñ

c

¶

t

}

ß

e

ô

õ

ö

ü

¾

a

ÿ

ý

þ

ÿ

ñ

æ

Ct1−α

, α > 0r

U (Ct ) =

(1 − α)

Õ

Æ

e

?

`

f

`

}

í

Õ

Ð

'

õ

`

¶

[

¤

(2)

¦

c

¶

r

X

Õ

·

E

T

G

V

à

¼

`

þ

1 + rt )C α

1 + σ t−1

ª

À

`

(4)

ñ

(4)

ç

s

a

b

X

Ö

t

}

è

Ö

t −1

}

a

b

e

}

Ô

Õ

Ö

×

Ø

!

"

¯

°

j

¡

ñ

Ð

¢

£

ð

W

ñ

Ä

#

$

Á

%

&

'

rt

h

Ó

(

)

*

+

ò

,

ó

-

.

ç ç

σ

Á

/

0

¾

1

e

2

3

r

(

4

5

6

y

K

7

8

4

ÿ

131

9

-

ö

ñ

ç

s

þ

(5)

Et−1 ct − ct−1 = a + bEt−1 rt

ct

ñ

v

-

D

r

­

U

U

error)

`

r

á

ÿ

æ

"

ut

h

ª

`

Î

e

a

rt

^

"

vt

e

t

ð

1]

`

b[≡

`

æ

­

ñ

v

©

}

s

¨

b

Ö

ñ

t

α

}

æ

Â

¨

1 ) ln(1 + α)]

α[≡ −(

`

α

rt ≈ ln(1 + rt )r

`

¡

}

a

b

Ä

þ

¬

h

[

¡

ñ

Ð

©

Á

}

e

[

©

¦

Ø

©

Ø

`

À

x

(forecast

`

ct = Et−1 ct + ut

rt = Et−1 rt + vt

(

(5)

εt = ut − bvt `

(6)

∆ct = a + brt + εt

Ë

%

¢

e

#

ó

$

=

Hall

¡

¢

º

»

a

r

b

æ

j

é

εt

²

j

³

´

µ

¶

`

V

`

w

x

t −1

à

}

"

j

!

(6)

y

"

ô

õ

ñ

e

Û

ä

å

l

(6)

`

þ

Et−1 (∆ct − a − brt ) = 0

(6')

(1982)

Ê

a, b`

U

U

a

b

c2t `

(6')

Wirjanto (1995) ]

(Generalized Method of Moment GMM)

Hall PIH

Campbell and Mankiw (1989, 1990, 1991)

'

·

l

d

á

l

e

Ì

l

Í

ñ

`

e

ß

½

õ

ö

%

|

ü

ý

`

j

¾

%

¢

e

j

Ä

Å

×

l

Æ

£

`

±

v

ß

l

(

e

a

b

j

#

$

!

"

e

[

%

`

(

a

b

e

c

¶

2

Y

c

¶

3

ü

#

$

Hall

e

~

x

1

(

e

c

¶

Hansen

¼

)

&

-

Z

Ì

ß

v

(

c1t

Ý

}

`

r

e

Ý

2

ª

[

\

}

a

b

λr

B

l

(

e

a

b

c

¶

e

3

ü

Y

132

(1 − λ)r

ð

:

ç

s

yt

á

ÿ

-

Î

e

<

Y

c

∆c2t = (1 − λ)(a + brt + εt )

∆ct = ∆c1t + ∆c2t `

æ

28 : 2 (2000)

=

¶

`

(

v

∆c1t = λ∆yt `

æ

e

a

b

Å

)

Á

t

Y

a

b

e

Å

)

Á

­

(7)

∆ct = k + θrt + λ∆yt + εt

ñ

k = (1 − λ)a, θ = (1 − λ)br

v

(7)

ñ

Ä

æ

yt = Et−1 yt + et `

∆ŷt = Et−1 (∆yt )`

(8)

∆ct = k + θrt + λ∆ŷt + εt

εt = εt − λ∆et r

ñ

v

U

U

J

ä

å

£

Hall

PIH

*

+

;

l

e

a

b

r

#

$

^

{

q

`

Ê

Ò

k

¹

e

¡

¢

f

g

`

!

"

Ê

e

±

s

`

Ó

:

;

^

3

ü

ô

ç

U

U

[

ô

V

a

î

`

¸

.

i

j

`

À

±

i

j

0

÷

_

ÿ

Â

e

U

`

ú

X

ß

X

]

Ó

2

3

¼

`

æ

­

a

b

è

©

}

¸

]

e

a

n

¨

4

r

ú

@

|

§

d

B

l

^

Ã

a

b

U

U

º

è

@

o

-

X

e

`

à

à

V

î

e

`

@

|

d

V

G

H

]

8

¾

Ð

Á

Á

a

ÿ

ô

^

Ó

¢

f

r

U

2

:

`

Ó

;

e

L

ß

`

¬

Ø

­

Ó

`

Ð

E

W

Á

Ø

T

e

a

E

Ó

`

æ

e

)

Å

e

¬

[

ô

,

!

"

·

Þ

ß

×

l

_

?

z

e

ú

l

`

/

j

æ

a

b

e

Å

r

b

±

a

b

è

e

a

b

`

¬

­

`

a

b

³

©

}

e

i

j

ú

¨

e

U

À

`

a

b

1

}

i

¦

e

a

n

¨

:

`

ú

è

©

Ò

t

u

¨

¿

]

¼

N

À

O

®

d

l

Ø

Ù

e

(imperfect loan market)

6

Î

E

G

ô

T

H

_

V

U

`

Ð

¼

e

9

§

Õ

Ö

:

Å

v

;

U

¾

e

a

b

G

H

V

à

Ó

<

h

¬

Y

=

-

e

å

l

ü

¾

3

ü

§

r

e

N

O

5

¤

r

ý

õ

V

ÿ

Â

`

¬

7

Ð

Á

§

ô

7

?

z

r

m

`

(

"

Ê

Ü

Ð

õ

Ð

õ

Á

a

ÿ

`

"

/

ª

^

¡

H

U

h

V

G

H

U

`

±

-

Y

j

λ1

h

G

H

U

3

¿

ÿ

}

"

%

]

V

V

[

Á

T

_

,

·

&

λ

(interest spread)

'

j

X

r

)

g

`

,

`

6

·

j

­

Ü

¬

`

Campbell and Mankiw (1989, 1990, 1991)

/

e

V

õ

¨

¨

Shea (1995)

Á

j

j

Ð

V

Hayashi (1987)

`

`

"

:

e

λ

λ

Ã

þ

E

¬

T

e

E

U

r

æ

T

ú

­

G

ä

Campbell and Mankiw

å

e

λ

>

Å

Ô

λ2 r

±

v

=

3

ü

à

D

Õ

Ö

×

Ø

!

"

#

X

¬

$

%

&

'

(

)

*

+

,

-

.

U

À

ç ç

/

0

1

2

3

4

7

8

133

5

6

9

¶

@

A

a

b

e

B

l

õ

ö

λ1

ç

r

­

l

3

ü

Ë

Ì

Ë

v

^

õ

ö

`

ß

l

õ

ö

e

a

b

`

¼

e

a

b

r

Ý

¬

E

T

V

G

H

Ó

`

ß

¬

B

í

a

b

`

ú

ß

y

\

e

Ð

Á

¬

B

`

4

ú

q

a

b

3

!

"

e

c

¶

C

@

`

õ

ö

e

à

¼

e

j

X

Ý

v

/

ß

å

l

3

ü

e

a

b

`

!

"

e

G

H

V

à

Ó

<

ä

å

`

V

W

j

¬

E

T

j

ï

G

H

]

V

G

H

U

`

!

"

e

¼

÷

V

à

!

"

`

j

!

"

e

a

b

/

j

V

K

e

#

$

!

"

e

@

A

ú

a

b

`

õ

ö

e

/

j

a

b

r

ú

B

l

õ

ö

e

a

b

E

F

G

H

r

g

¬

V

B

`

!

"

1

I

c

¶

H

õ

a

b

o

`

l

õ

ö

e

j

à

¼

e

a

b

λ1

0

1

e

/

j

v

õ

ö

a

b

3

ü

e

¦

Y

r

Ý

¬

E

T

G

H

E

T

Ó

`

æ

a

b

¬

÷

J

I

w

`

?

#

$

c

¶

@

A

a

b

e

a

b

`

·

'

æ

!

"

e

¼

à

ê

`

K

L

j

æ

!

"

e

λ2

0

1

e

M

j

õ

ö

e

3

ü

r

U

U

(

y

-

_

ñ

ç

N

O

P

`

"

§

Q

Å

À

Í

þ

s

E

T

V

G

H

?

`

æ

­

#

`

$

c

Campbell and Mankiw

∆ct = k + θrt + λ1 D∆ŷt + λ2 (1 − D)∆ŷt + εt

st

Ö

t

}

e

Ð

õ

;

Ó

-

Í

(

v

`

?

]

Õ

Ö

O

r

Ë

|

b

ø

(

λ2

ô

λ1

,

`

^

ú

À

ô

@

e

Ó

"

ô

È

W

y

ä

b

λ2

T

|

$

ÿ

ð

#

a

e

λ1

`

st

r

λ2 `

Á

`

Õ

Ö

@

j

ë

:

;

ì

R

l

(1 − D)

|

e

D

`

§

)

W

À

Ö

b

O

U

`

Õ

e

(9)

æ

e

S

$

ç

¨

?

§

Â

λ1

=

e

÷

λ1

Õ

Ö

ã

s

`

ç

s

[

\

Z

Ì

V

ß

å

l

ü

¾

3

ü

e

a

b

λ2

a

b

ÿ

ß

h

å

a

b

.

`

G

H

j

æ

"

§

ç

¾

¼

à

¾

`

¾

e

`

Z

3

ü

3

ü

e

a

b

j

æ

¼

`

®

ê

!

"

1

I

Ý

}

e

a

b

o

r

á

e

Ü

`

î

Ó

,

W

å

a

b

e

à

¼

`

y

ß

r

ý

ì

"

b

W

á

e

Ü

ß

l

ü

¾

3

ü

e

a

b

`

æ

±

ê

r

ý

ì

á

e

Ü

`

G

H

j

æ

ß

l

ü

¾

3

ê

r

Ý

U

U

ÿ

Å

)

¾

Å

)

Á

±

0

Hall

W

`

"

`

ë

í

:

X

λ1 >

ü

e

a

0

λ2 =

ú

b

ú

`

æ

§

0

±

ß

PIH

Campbell and Deaton (1989)

;

e

Å

Æ

`

(λ1 − λ2 )

e

λ2

(

AR(1)

^

`

²

a

­

¶

Å

æ

c

ö

·

r

e

Æ

}

Å

j

©

ÿ

V

b

Á

a

§

a

b

st

W

e

"

l

b

"

X

h

!

`

ç

`

Ó

æ

λ1 = λ2 = 0

`

V

λ1 = λ2 >

-

r

e

ª

134

:

<

28 : 2 (2000)

=

(10)

∆yt+1 = γ∆yt + ξt

ñ

v

`

}

í

0<γ<1

ξt

`

©

Ø

þ

"

Ð

(10)

¼

ñ

ö

t

Å

}

Å

)

Á

(11)

§

ñ

æ

(8)

¤

ñ

(8)

`

ñ

Ä

Å

(8')

∆ct = k + θrt + ψ∆yt−1 + εt

ψ = γλr

ñ

v

ÿ

a

G

«

`

b

e

(

ä

[

å

ß

(11)

§

l

ã

ñ

æ

e

e

j

l

`

}

(9)

¤

ñ

X

Y

!

"

`

(9)

`

e

¡

¢

t

u

v

ú

^

Ê

Ü

è

ñ

Ä

Å

þ

`

@

´

|

è

­

(1996)

µ

ï

e

ª

¾

V

Ê

Ü

Ý

}

Z

ú

*

r

î

∆ct = k + θrt + ψ1 D∆yt−1 + ψ2 (1 − D)∆yt−1 + εt

ψi = γλi `

Å

)

Á

e

r

"

y

m

Ñ

§

λi

1

3

ë

`

v

¨

Ê

Ü

ê

è

b

W

Þ

ß

^

_

ð

r

U

U

e

¬

E

T

`

X

e

K

ß

ä

å

å

ë

ì

Á

k

γ

ú

ô

`

[

¾

\

"

0.95

AR(1)

(9')

ñ

`

y

ñ

ψi

]

Á

e

ª

`

"

e

+

,

ê

+

,

-

r

À

2

e

+

,

ë

ì

`

"

ψi

e

ë

ì

ô

`

ú

¨

Ë

b

c

ä

]

(9')

ô

l

ß

`

æ

K

­

"

e

4

Campbell and Mankiw (1989, 1990, 1991)

§

?

à

¼

e

a

b

¿

Ã

t

a

r

e

u

Ä

Å

∆ct = k + θrt + ψ(1 + δt)∆yt−1 + εt

t

ñ

v

æ

e

K

æ

­

ÿ

a

b

ç

Ó

`

s

e

`

W

ä

(8)

`

δ

j

b

c

¨

K

ä

å

ë

ì

à

¼

a

b

e

3

ü

§

d

d

]

`

í

1

`

[

r

a

î

e

`

E

ò

Ä

Å

δ

å

`

@

|

e

©

(11)

∆ŷt = Et−1 (∆yt ) = γ∆yt−1

(

e

Ë

e

½

¬

e

δt

T

X

è

r

t

³

¬

E

T

§

_

a

0

e

n

K

Ô

Õ

Ö

×

Ø

!

"

#

$

%

&

'

(

)

*

+

,

-

.

ç ç

/

0

1

2

3

4

5

6

7

8

135

9

∆ct = k + θrt + ψ1 (1 + δt)D∆yt−1 + ψ2 (1 − D)∆yt−1 + εt

δt

ñ

v

·

Þ

ß

d

Ü

X

¬

e

a

b

à

e

ä

¨

`

ú

Ä

¨

!

"

e

a

b

J

_

Ü

ë

ì

r

E

T

_

Ü

G

H

U

À

`

j

æ

X

U

À

1

ß

?

å

r

ú

"

Ø

#

@

V

J

æ

¬

E

T

¨

e

Ä

r

æ

­

E

T

ï

V

G

H

U

À

δt

r

á

â

f

g

a

n

j

k

l

m

1

`

3

3.1

(9)

ß

f

X

¬

g

h

`

i

n

U

U

)

¼

e

Õ

Ö

è

a

b

ë

¼

û

-

e

ª

õ

o

q

e

|

%

`

ô

p

í

m

÷

'

a

b

¹

f

g

ÿ

r

d

@

|

q

u

e

V

r

b

È

`

a

b

e

I

Õ

V

J

s

b

X

'

`

ú

À

g

ß

l

õ

ö

e

3

ü

J

s

X

e

t

}

r

4

ú

`

'

h

~

¨

e

a

b

è

a

b

e

¨

ñ

V

î

`

l

|

%

X

ÿ

a

b

¹

¡

¢

f

g

&

`

w

x

J

ª

¾

l

e

¾

h

`

·

V

J

m

Ñ

§

a

b

e

Õ

Ö

k

x

e

%

¢

2

r

¼

û

-

e

ª

¾

/

î

1985)

X

ï

s

e

W

`

a

ý

þ

1

¼

X

~

b

Ó

!

e

±

ë

e

a

b

r

(

"

@

|

\

n

®

e

O

¿

a

b

Û

b

¹

¡

¢

t

u

r

L

@

|

e

)

\

b

ï

Ò

V

z

?

ï

¡

ñ

Ð

Á

h

Ð

õ

Á

Ö

Ô

r

U

U

'

h

~

*

'

a

b

c

d

j

X

.

´

è

µ

î

j

§

a

b

h

Õ

Ö

j

d

Õ

Ö

`

y

h

½

~

¾

Õ

¨

Ö

j

e

ð

ñ

e

§

Õ

Ö

Û

§

a

b

V

|

Bernanke (1984,

ý

Ó

h

'

`

§

"

e

t

u

ÿ

m

÷

'

h

~

¨

e

a

b

g

r

×

`

"

ò

ÿ

m

÷

Y

a

a

b

`

'

h

~

¨

a

Õ

a

c

Y

=

Õ

r

Õ

j

ß

Ö

Y

d

V

t

Y

j

1961

d

`

ú

12

Å

e

r

Ö

l

1995

Y

Ò ¡ v

−−−−−−−−−−−−

e

¡

ñ

¡

r

@

f

g

D

r

ß

n

¦

Y

e

ð

h

£

a

b

e

Û

Ã

r

m

÷

=

Õ

Ö

j

K

r Õ `

−−−−−−−−−−−−−−−−−−−−−−−−

1961

r

Í

Ò ¡ v

−−−−−−−−−−−

d

¦

Y

Ô

d

r

Ö

c

Z

y

e

Ö

b

Ö

{

ï

Ë

`

Õ

ü

z

&

y

ï

|

D

`

x

¼

@

D

h

s

w

k

`

ï

ï

n

­

`

v

k

a

æ

r

§

b

Ý

1

Ö

a

e

Ã

Ë

(1991=100)

(1996)

1965

`

5

ð

u

e

²

`

t

PIH

¸

B

¬

õ

Ö

l

x

1964

Ö

Ô

j

¼

Ý

136

U

U

:

GDP

c

Ý

¶

Û

c

X

¶

1

Ò ¡ v

−−−−−−−−−−−−

e

æ

s

¨

}

}

Ð

Á

y

h

E

¡

a

b

¨

}

¬

Ð

Á

e

æ

s

¨

-

?

m

j

X

-

â

Ð

Á

`

ú

K

U

U

¡

æ

­

`

X

)

e

á

ü

ý

`

´

è

µ

ñ

)

v

`

"

V

Ó

m

÷

¼

¡

e

¡

ñ

Ð

Á

r

À

í

¼

`

V

Ó

ä

å

)

-

e

ô

¬

E

T

.

ß

¤

¦

¨

e

ñ

"

î

Ó

í

¼

¦

¥

Ð

Á

÷

-

¿

U

U

e

a

b

h

Ý

v

`

"

V

ý

î

e

Õ

Ö

r

Ë

¦

"

Ä

í

Å

)

Á

ß

¼

U

­

Z

-

Ð

<

¬

Õ

Ö

r

ß

n

Ð

Á

e

(1991=100)

¿

E

r

æ

@

|

y

Ò

V

z

?

`

"

y

Ö

l

Ø

­

Ã

E

T

¼

>

¬

Ð

Á

`

t

ð

Û

¡

`

¡

ñ

Ð

Á

j

y

­

×

}

Ð

Á

j

â

Ò

V

z

e

w

Á

r

Ð

õ

Á

j

E

E

T

Ð

Á

j

m

j

X

-

Å

v

}

Ð

Á

Õ

Ö

K

· I `

−−−−−−−−−−−−−−−−−−

¬

Ã

E

T

[

\

\

l

`

X

[

\

j

W

v

`

Ð

Á

(1996)

e

:

;

¼

Á

`

¡

W

v

¡

¢

\

Ò

r

E

Ã

Ð

Á

ò

1

£

¿

¡

ñ

Ð

Á

§

ä

å

)

ë

ì

r

L

X

@

|

e

e

Y

a

b

'

h

~

e

a

b

`

ò

t

ð

|

ç

)

ë

ì

v

`

"

Ê

Ü

V

î

¡

ñ

Ð

Á

e

^

`

ú

À

ò

ä

å

@

|

e

ë

W

r

j

æ

e

ê

Ë

¤

¦

·

I

e

¨

`

X

)

Ó

Ý

Û

b

)

e

K

¨

-

`

ú

¦

¥

Ð

Á

j

è

¡

Ð

Á

e

m

h

Õ

Ö

p

Þ

ß

[

á

§

¨

e

;

ª

`

æ

­

X

¡

¢

t

u

`

m

Ñ

¼

a

b

h

ë

ì

`

ª

¨

-

4

e

r

Campbell and Mankiw (1990, 1991)

§

§

¨

¨

æ

Davidson et al. (1978)

8

e

¨

-

`

X

b

)

e

á

W

v

Í

_

Ü

e

j

V

ª

e

«

`

±

õ

Á

e

ô

^

`

b

c

°

Ü

V

W

"

¼

!

"

]

^

­

®

e

}

³

Ï

'

x

j

V

´

Ï

_

Ü

G

H

U

]

e

ð

ñ

t

Ð

õ

Á

and Prescott (1997)

9

1

Hodrick and Prescott

r

`

X

©

"

§

v

È

÷

`

r

ÿ

ô

^

~

æ

V

z

¨

Å

e

m

÷

Ð

Ý

­

®

)

r

#

$

¬

E

V

H

U

N

î

Ý

5

r

Á

e

`

u

]

Ë

D

[

k

l

e

­

®

¼

E

T

V

G

H

z

ß

Á

ô

r

æ

­

¼

k

l

­

®

q

`

õ

Á

-

Í

`

ú

Í

d

«

T

Ð

r

}

E

Ä

`

»

¯

¨

º

ð

SP

0

e

-

`

Z

ô

õ

`

«

d

Ð

s

}

¶

ÿ

²

ã

o

-

ú

¨

^

·

±

ó

`

ÿ

4

1

y

J

`

©

(

n

;

r

ð

m

¬

e

}

¨

)

^

Í

)

§

ô

-

e

å

∆4 yt−6 = yt−6 − yt−10 `

n

ä

ÿ

10

ð

]

j

V

T

¹

a

Y

m

d

a

µ

V

e

b

Á

·

Ý

∆4 ct = ct − ct−4

a

l

¨

Á

õ

d

Z

)

Å

Ð

¾

¨

ð

Ê

§

`

ð

y

^

e

`

r

"

¹

a

b

ô

¸

¨

ý

­

h

É

e

ü

¸

y

e

Á

æ

Ã

©

)

O

Ð

á

e

Å

Ã

î

r

Ë

Ê

V

¿

n

­

-

m

æ

¨

ú

Ã

s

1

Ö

6

æ

¿

Õ

¿

e

O

28 : 2 (2000)

=

Ò ¡ r

−−−−−−−−−−−−

7

ß

-

^

r

©

Ý

1

Í

"

e

HP

Ð

v

õ

v

í

Hodrick

¼

)

}

ÿ

·

m

n

º

»

ç

s

¼

Á

ô

a

ÿ

º

»

e

3

`

Ô

Õ

Ö

×

Ø

!

"

#

$

%

"

3.2

j

ô

ê

Ì

Í

Î

É

d

Ð

õ

Á

Á

e

)

¾

a

*

+

¿

ÿ

,

À

ô

^

-

.

Á

Â

Ã

Ê

Ë

ç ç

/

0

Ä

Å

1

2

Æ

3

Ç

4

5

6

7

8

137

9

È

r

Ï

U

ß

à

"

ÿ

Å

)

)

Á

e

l

K

a

n

-

[

b

Ð

e

R

ª

c

³

ó

\

K

a

n

R

Á

±

²

e

v

ö

Å

r

U

U

X

¡

e

(8)

(

½

N

U

γ

ò

V

t

u

v

ñ

y

h

@

·

V

è

v

`

εt

ß

-

÷

)

r

Ý

l

e

)

l

^

ü

r

y

|

t

:

¾

;

[

`

ç

l

ò

¶

ã

÷

°

¦

y

b

)

`

ç

ô

,

`

ú

À

½

1

v

ρ

LM

a

ñ

l

·

c

Ý

a

M

)

r

Ë

J

ð

y

c

Õ

ð

r

ú

¯

^

m

¼

Å

b

]

)

Á

c

GMM

Ð

¡

GMM

e

1

³

ó

Ó

V

r

`

æ

L

R

¾

Ð

`

ξt

[

s

`

X

ú

Õ

­

©

ª

}

Z

e

Í

m

a

5%

(10)

ã

`

y

é

°

Ô

t

¢

±

j

Ý

v

l

ê

¨

e

)

ñ

Ö

«

×

¼

X

ð

¼

Ú

e

.

Ú

¡

¨

.

)

`

`

ð

¢

-

¨

`

f

-

g

h

`

Å

"

¯

#

`

`

æ

a

n

Ó

y

O

%

r

ô

$

Ø

\

Ê

&

`

¼

j

p

'

X

(

-

Ñ

Ò

ñ

e

þ

Hall

ß

)

Ø

ρ=0

À

`

Å

l

(8')

+

%

ξt

)

ñ

e

e

ð

l

^

a

GMM

j

*

j

Å

χ2

e

(10)

d

OLS

GMM

1

)

n

Ý

γ =1

ª

l

÷

(GMM)

Campbell and Mankiw (1989, 1990, 1991)

(9') (9)

y

`

γ

À

j

"

AR(1)

e

J

}

ú

ñ

­

`

(6)

r

`

`

1

AR(1)

¢

PIH

'

1j

¼

&

,

-

e

.

138

:

1

Ù

Ú

Û

Ü

Ý

<

Þ

28 : 2 (2000)

=

AR(1)

ß

à

á

â

ã

ä

å

∆yt = γ∆yt−1 + ξt

γ

χ2

ρ

æ

ç

è

í

î ï

ì

ñ

0

1

L

M

/

Y

/

%

]

]

A

^

l

D

E

e

h

4

%

P

ø

4

(1978)

N

χ

"

#

ÿ

ô

õ

}

I

8

0

_

X

£

#

d

D

E

`

TU

e

a

b

o

p

d

g

z

8

M

/

p

4

%

6

M

D

s

*

8

]

v

u

5

\

§

4

¨

|

4

ª

«

@

^

½

X

£

¤

¥

@

´

Ä

e

*

¢

Õ

4

K

t

3

È

É

A

À

8

ρ

"

ô

÷

ø

ÿ

ξt

ÿ

!

ù

4

¢

4

)

*

I

q

r

`

a

b

c

º

¿

À

Á

4

Â

Ã

2

8

X

£

¤

¥

£

Í

6

Î

£

Ï

¯

0

Ö

h

}

0

6

)

*

q

Zt

N

I

q

*

PIH

6

²

³

0

{

b

(

I

Å

Æ

Ø

Ù

Ú

8

´

®

F

¢

6

(1)

4

¬

0

¡

#

e

m

n

g

8

^

#

s

*

4

*

t

t

4

J

s

*

#

|

}

ψ1 − ψ2 > 0

}

2 3

Breusch

A

|

­

E

J

s

H

%

χ2

k

@

®

¯

°

6

|

}

u

4

y

µ

¶

·

4

B

¸

v

¹

q

8

|

}

©

º

8

s

*

¢

»

£

¯

¼

­

w

x

y

,

z

4

\

Ç

Ã

2

LM

A

Ì

8

I

s

Q

2

¯

8

|

}

4

Q

Ð

q

|

Ü

PIH

}

v

I

4

8

«

%

j

2

%

b

%

@

i

=

¯

X

#

@

8

#

b

LM

4

Hansen

8

/

%

h

8

v

M

Û

{

D

K

6

w

4

×

z

g

J

´

,

p

@

l

I

I

∆4 yt−i

NB

k

o

H

#

¥

W

4

j

G

¤

e

%

ª

Ë

£

E

{

Ê

X

#

,

h

i

%

6

@

Ò

#

u

½

Ñ

b

¦

F

>

g

¡

­

Ð

8

K

F

6

4

E

V

H

M

χ2

6

f

y

@

L

0

t

8

4

#

D

U

D

x

e

l

w

∆4 rt−6 , · · · , ∆4 rt−9 4

∆4 yt−i @

k

v

C

4

NU

4

j

8

B

T

E

Ä

¯

[

t

s

N

Z

*

N

©

S

D

i

A

R

s

4

u

^

#

@

LM

%

4

?

d

g

εt

0

=

b

5%

Hall PIH

Campbell and Mankiw (1990, 1991)

»

ø

>

#

n

N

8

A

*

K

¾

ÿ

!

;

b

m

?

6

ì

(1 − D)

±

u

ì

ó

,

=

'

u

Hall (1978)

Et−1 (∆ct − a − brt ) = 0

(6')

Wirjanto (1995)

GMM

a

2

]

ò

p

∆4 yt−i

e

%

@

s

<

NW

4

6

/

t

E

v

E(εt Zt )

8

*

%

L

x

)

ñ

+

TB

(6)

,

6

*

;

0

h

y

üì ý ì þ

)

:

c

#

x

(

9

b

w

8

4

Q

#

L

û

I

∆4 yt−i

p

∆4 yt−i

#

\

N

8

ρ

8

¥

rt

7

4

K

ú

û

'

t

J

ù

54.70

0.061]

54.45

0.063]

&

*

~

%

s

}

6

r

|

¤

4

'

b

6

∆4 yt−i 4

4

ø

LM

0.023

(0.086)

0.005

(0.086)

H0 ï γ = 1 ÿ ÷

Breusch (1978) ∆4 yt−i

h

5%

rt

5

g

0

÷

0.002

0.969]

0.001

0.975]

∆4 yt−6 , · · · , ∆4 yt−9 4 ∆4 ct−6 , · · · , ∆4 ct−9 4

F

q

ö

LM LM ÷

%

f

0

Zt

e

[

õ

2

$

P

2 3

χ2 (p − q)

εt

O

Z

I

ô

4

D

ó

/

0.954*

(0.026)

0.970*

(0.020)

ë

ë

3

N

TW

'

t

ò

r t−5 , · · · , r t−9

'

|

2

ì

ù

*ï

%

ê

ê

ð

ì

/

é

~

ρ4

Ó

Ý

à

'

Ô

`

á

H

a

)

*

'

\

§

@

´

â

4

ã

=

Þ

4

ß

o

&

ä

º

@

Ô

Õ

Ö

×

Ø

!

"

#

$

%

&

'

(

)

*

+

2 PIH

Ù

Ú

å

,

-

.

æ

à

ç ç

á

/

0

â

ç

1

ã

2

ä

3

4

5

6

7

8

139

9

å

Et−1 (∆ct − a − bγt ) = 0

è

é

ê

a

ë

TB

UB

TU

NW

ï

ì

ì

ì

í

î

ø

ý

ï

ð

ï

ì

ì

ì

ñ

ñ

*

ò

ò

ô

ï

õ

ó

ó

ô

ñ

ô

Ù

ì

ï

NU

TW

NW

î ï

ô

'

ó

þ

ý

ø

ø

&

ò

ý

ù

ú

û

(

ì

õ ìö ì÷

ô

÷

NW

û

ü

)

ï

ý

*

þ

+

ø

NU

ý

ø

ù

ñ

,

ú

ò

!

(0.102)

−0.021

(0.089)

−0.003

(0.103)

−0.012

(0.096)

0.016

(0.100)

0.003

(0.097)

2

ψ

H

19.4

0.150]

20.2

0.123]

14.5

0.412]

15.7

0.332]

15.4

0.352]

17.4

0.238]

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ì

ï

ú

ò

ì

ì

û

ó

ù

ü

ô

ú

ò

ÿ

ÿ

ø

ô

à

á

ç

â

ì

û

ü

ó

ý

÷

ò

ô

ø

÷

ó

þ

ø

ô

÷

ÿ

õ

ø

ö

ý

P

ø

θ

−0.108

(0.126)

−0.069

(0.096)

0.031

(0.123)

0.017

(0.106)

0.000

(0.107)

−0.029

(0.099)

ψ

0.375*

(0.170)

0.177

(0.155)

0.677*

(0.145)

0.554*

(0.172)

0.663*

(0.141)

0.472*

(0.149)

ã

ä

å

(8)

δ

0.003

(0.002)

0.004

(0.002)

−0.003

(0.003)

−0.002

(0.003)

0.001

(0.002)

0.002

(0.002)

H

÷

TW

(8')

0.567*

(0.116)

0.435*

(0.097)

0.667*

(0.152)

0.523*

(0.147)

0.678*

(0.126)

0.532*

(0.121)

ì

ì

ü

LM

78.2*

0.000]

70.8*

0.000]

78.5*

0.000]

71.0*

0.000]

78.0*

0.000]

69.9*

0.000]

ì

ì

ù

û

ó

"

H

38.0*

0.001]

33.1*

0.005]

32.8*

0.005]

25.5*

0.044]

37.2*

0.001]

30.8*

0.009]

ì

NB

ý

ï

Ú

θ

TU

ì

3 Campbell and Mankiw

−0.023

NB

ñ

ô

÷

÷

TB

ó

ì

ì

ì

%

ì

ì

ì

ö

5%

$

ì

ÿ

ì

ì

ì

ì

ò

õ

ì

ì

ì

TB

þ

ð

TU

0.807*

(0.051)

0.765*

(0.056)

0.828*

(0.048)

0.792*

(0.053)

0.814*

(0.050)

0.775*

(0.054)

ì

ì

TW

ρ

0.060

(0.117)

−0.013

(0.105)

0.139

(0.123)

0.122

(0.104)

0.085

(0.104)

0.086

(0.091)

ì

ì

NU

î

b

0.066*

(0.005)

0.061*

(0.004)

0.034

(0.026)

0.034

(0.022)

0.054*

(0.013)

0.050*

(0.011)

16.9

0.21]

15.4

0.282]

12.0

0.527]

13.9

0.380]

15.4

0.281]

16.8

0.219]

140

:

Ù

è

é

ê

θ

ë

4

Ú

ψ1

<

=

28 : 2 (2000)

ψ2

â

ã

ä

δ

å

χ2

H

TB

−0.105

0.635* 0.388*

(0.131) (0.120)

9.08* 12.1

0.003] 0.792]

NB

−0.060

(0.078)

0.535* 0.240*

(0.121) (0.101)

8.88* 10.9

0.003] 0.861]

TU

0.028

(0.062)

0.630* 0.583*

(0.132) (0.111)

0.10

17.9

0.754] 0.392]

NU

0.041

(0.064)

0.424* 0.412*

(0.123) (0.108)

0.01

18.9

0.934] 0.335]

(9') TW

−0.031

0.766* 0.503*

(0.128) (0.125)

4.19* 15.3

0.041] 0.577]

NW

−0.016

TB

−0.119

0.582* 0.338*

4.37*

(0.130) (0.116)

0.037]

0.647* 0.328* −0.000 0.59

(0.390) (0.128) (0.004) 0.444]

NB

−0.082

(0.086)

ì

ì

ì

ì

(0.069)

(0.069)

(0.096)

ì

ì

ì

ì

ì

ì

15.7

0.547]

15.3

0.506]

ì

ì

(0.083)

0.375 0.251* 0.002 0.09

13.8

(0.389) (0.108) (0.005) 0.771] 0.611]

TU

0.062

(0.116)

0.743* 0.549* −0.002 0.17

18.6

(0.350) (0.170) (0.006) 0.679] 0.289]

NU

0.032

(0.093)

0.353 0.421* 0.001 0.03

19.0

(0.306) (0.137) (0.005) 0.863] 0.270]

ì

ì

ì

ì

ì

ì

(9) TW

−0.106

0.416 0.546* 0.001 0.13

16.7

(0.346) (0.126) (0.002) 0.720] 0.404]

NW

−0.102

0.117 0.388* 0.002 0.57

13.6

(0.332) (0.113) (0.002) 0.451] 0.627]

(0.108)

2

(0.096)

ì

ì

Ô

Õ

3

Ö

×

ì

ì

)

+

,

$

-

.

!

=

>

?

-

7

J

O

P

Q

R

s

t

u

d

ê

H

/

$

ψ

$

]

7

'

£

¤

^

!

=

!

"

#

ì

ì

f

g

h

v

δ

i

g

h

.

]

·

a

Â

£

ψ1

!

,

i

$

@

$

%

&

(8')

(

)

*

-

3

$

4

5

A

B

C

D

E

,

F

G

H

ê

S

"

#

$

%

&

x

y

z

{

$

!

-

]

/

0

(8)

T

c

d

H

|

!

.

$

/

0

K

?

Y

(

)

è

6

7

8

9

$

L

[

J

j

#

$

H

δt

\

]

k

l

{

_

m

3

v

^

ê

è

é

Hansen

M

!

ê

J

<

"

#

N

`

a

b

$

o

I

p

$

q

r

!

"

#

$

%

&

c

ψ

!

{

:

;

:

n

141

9

*

;

8

:

$

7

$

0

6

9

'

5

8

&

4

7

i

~

3

6

Z

.

2

%

$

9

!

Campbell and Mankiw

!

@

>

e

f

g

h

.

i

J

j

k

l

m

n

o

s

x

y

z

{

¡

#

$

¢

¥

9

L

¦

¥

9

d

§

¨

©

c

ª

.

q

«

x

y

z

{

´

µ

$

n

®

¯

°

q

«

x

y

z

{

~

k

l

¶

o

$

s

t

u

G

v

i

x

j

!

k

H

"

l

δt

R

Å

m

Æ

n

o

$

ê

#

$

¢

$

Ç

:

¾

F

È

$

{

$

;

Ò

]

/

0

O

¾

Î

Ó

a

$

:

]

7

@

Õ

%

&

Ö

×

e

f

g

h

.

'

£

F

%

&

¥

G

Ø

¥

!

=

ì

ì

ä

ê

ê

^

è

é

ê

&

F

G

ê

ë

ß

à

'

»

÷

~

]

¾

å

z

-

7

@

V

W

ó

ô

õ

ö

À

ß

à

á

â

è

é

ê

ë

:

.

(9')

Þ

%

ê

"

$

#

/

å

z

ß

à

á

ë

$

%

&

ç

7

@

4

5

á

â

$

ì

ê

è

é

K

{

%

&

(1983)

Ó

:

û

(9')

$

)

L

$

F

~

Ó

!

¦

ê

G

ë

·

&

²

%

³

&

e

Campbell

s

!

"

#

¹

º

$

'

»

¼

e

z

¿

H

/

0

~

δ

+

,

x

y

ψ1

/

0

~

Á

`

a

b

$

!

¹

º

$

£

Ë

Ì

Í

¾

Î

>

?

*

!

p

J

Ê

%

j

!

&

k

Ú

$

K

l

­

]

â

m

®

ß

!

!

f

"

ð

g

#

ñ

h

I

n

/

o

s

à

$

á

]

-

ψ1

(9)

!

δ

Ï

+

δt

Ô

q

«

x

y

z

{

$

s

x

y

z

{

¡

#

$

¢

:

"

â

#

\

6

7

8

/

)

ò

S

0

$

!

.

ψ1

{

ψ1 > ψ2

e

¸

%

G

(9)

²

w

Ù

F

±

i

J

:

v

$

&

ψ1 > ψ2 4

!

i

w

y

#

G

δ

Ñ

"

u

É

Ð

!

t

(9')

$

(9')

s

Ã

§

$

ú

0

1

­

$

$

h

{

#

X

g

¬

J

"

J

W

f

0

!

"

L

I

V

e

}

δ

U

/

ψ =

2

ç ç

!

1

PIH

.

0

Ä

ù

,

(8)

!

ø

+

/

!

'

w

À

ë

#

i

and Mankiw

½

ê

J

"

5%

(8')

4

!

Hall

$

(8)

G

Ø

"

\

Û

F

)

G

í

9

Ø

¥

$

ê

x

y

>

?

Ü

Ý

!

"

#

ã

H

æ

ç

è

é

x

y

Å

:

$

*

Ï

%

$

%

&

q

¿

H

í

/

î

ï

V

W

ó

ô

g

h

D

H

õ

ö

$

'

£

q

$

ü

ý

!

þ

ÿ

ê

ó

(9')

z

ß

à

á

â

æ

ê

ë

ß

á

â

$

¢

é

&

x

y

z

{

j

%

&

#

$

Û

{

%

&

´

µ

V

W

x

y

z

{

è

é

ê

ë

ê

¬

"

#

$

\

G

À

ß

¸

"

³

è

å

(9')

TW NW

$

!

¸

142

:

à

á

â

ì

ì

H

x

y

ñ

>

!

^

â

è

é

ψ1

?

ψ2

Hansen J

<

<

28 : 2 (2000)

=

ψ1

,

!

!

!

=

d

ç

/

0

6

GMM

4 TW

n

/

0

5%

ψ2

ψ1 − ψ2 >

0

8

1

¾

9

2

%

&

H

î

ï

Ì

­

®

$

]

í

x

y

\

#

ï

$

ê

ë

$

:

;

H

*

'

ê

ë

:

(

ê

ë

ì

ì

Ã

æ

ç

è

é

)

£

À

¯

­

®

ê

c

d

ç

"

è

é

$

@

>

x

:

7

/

GMM

ψ1 − ψ2 > 0

ψ2

¨

Î

?

¬

;

n

»

Ã

2

3

$

ê

F

G

À

¯

R

­

®

ê

.

¾

G

ç

è

é

x

y

!

$

ì

s

2

§

$

]

.

í

x

¢

:

\

7

M

D

ì

ì

a

b

$

â

ß

à

ß

à

,

ç

]

è

B

C

â

á

E

c

é

F

G

¡

#

:

.

%

&

ß

^

Ó

a

I

'

V

W

x

y

w

ê

ë

¡

#

'

K

$

L

I

ê

ë

á

â

å

z

á

â

M

;

É

U

X

9

+

¨

¾

Î

7

@

4

5

:

;

n

a

ê

¬

!

ì

0

#

'

´

1

n

!

"

#

¹

º

$

%

&

c

d

5

x

y

w

¹

"

'

4

ë

y

æ

ç

è

é

x

%

&

x

y

w

#

ï

ª

T

9

:

á

â

>

$

á

â

+

,

!

/

0

$

ê

L

0

$

t

u

G

v

i

8

.

í

x

y

j

¹

"

$

á

â

;

<

¡

#

¾

ê

3

?

'

;

<

@

~

{

Å

:

.

$

%

&

c

d

F

G

À

ß

à

á

â

+

,

-

{

#

ï

¡

#

Y

Z

[

T

Hall (1978)

8

.

ë

TW

ç

¡

(9')

θ

#

*

Ú

ê

î

ï

)

+

,

$

-

¬

0

H

6

d

j

\

*

©

$

E

=

x

y

Æ

$

Ù

Ú

x

y

!

$

!

"

#

$

H

Ä

Å

ê

H

+

ê

¯

°

A

ë

>

d

Æ

J

^

$

s

x

y

:

D

î

'

ë

$

V

W

ê

ë

H

>

d

Æ

J

£

¾

;

<

¡

#

$

J

'

ß

à

á

â

j

N

O

$

¢

:

P

F

x

y

À

Q

R

z

:

S

ð

`

1

é

P-

0

è

¸

/

NW

Deaton and Paxson (1994)

Ê

¹

5%

.

2

χ

"

3

0

L

]

$

y

ψ2

$

ê

$

$

/

é

`

#

è

!

v

"

y

ê

W

$

x

é

V

#

í

è

\

"

x

\

[

ψ1

,

$

Z

ï

?

S

#

>

*

X

\

$

ë

=

$

$

!

(earning shocks)

i

<

/

$

v

J

I

Y

0

?

Hansen

Í

H

/

>

£

4

U

ç

$

ç

y

I

t

&

¬

Í

G

%

ê

£

$

{

¬

,

{

Ó

z

$

NW

&

w

!

%

w

y

³

E

$

y

x

é

D

!

x

è

/

í

W

"

â

é

V

¹

è

Ý

0

^

C

u

¾

»

G

{

s

Ò

³

F

Ó

$

,

#

ê

$

w

E

b

ç

GMM

P

æ

$

y

/

D

χ2

¼

x

C

'

ψ1

8

#

"

$

7

"

"

²

¹

©

6

a

a

'

*

*

&

!

!

-

%

ê