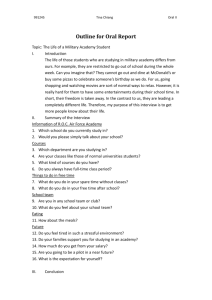

Anesu Daka CA (SA)

advertisement