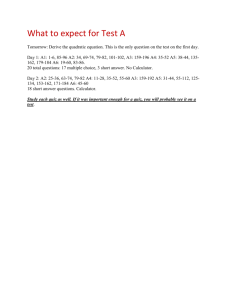

EYK 15-2 PV Tutorial Using Calculator (Sharp EL-738)

advertisement

EYK 15-2 PV Tutorial Using Calculator (Sharp EL-738) TABLE OF CONTENTS Calculator Configuration and Abbreviations Exercise 1: Calculating FV (Lump Sum) Exercise 2: Calculating Interest Rate (Lump Sum) Exercise 3: Calculating Investment Period (Lump Sum) Exercise 4: Calculating PV (Lump Sum) Exercise 5: Calculating Monthly Payments I (Annuity) Exercise 6: Calculating Monthly Payments II (Annuity) Exercise 7: Calculating FV (Annuity) Exercise 8: Calculating PV (Annuity) Exercise 9: Calculating Interest (Annuity) Exercise 10: Calculating Investment Period (Annuity) Exercise 11: Calculating NPV (Unequal Payments) Exercise 12: Using NPV Key to Calculate PV (Unequal Payments) 1 2 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) CALCULATOR CONFIGURATION AND ABBREVIATIONS Abbreviations on the calculator 2nd shift key COMP compute N number of periods I/Y interest per period PV present value FV future value PMT payment 2nd F MODE clear all 2nd F BGN/END payments at beginning of the period or at the end MODE NORMAL 0 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 1: CALCULATING FV (LUMP SUM) If you invest $1,000,000 for 10 years at a stated annual rate of 6% with interest earned monthly, what is the future value? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. The $1,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 1000000, /, PV 4. Key in: 6 12 I/Y 5. Key in: 10 12 N 6. Key in: COMP, FV The final result appearing on your calculator screen should be: 1,819,396.73. This means that the $1,000,000, invested at 6% (or 0.5% compounded monthly) for 10 years will have a total future value of $1,819,396.73 ($1,000,000 original investment plus $819,396.73 of interest). Note: Steps 3, 4, 5 could be done in a different order. EXERCISE 2: CALCULATING INTEREST RATE (LUMP SUM) If you invest $1,000,000 for 10 years with interest earned monthly, what interest rate is necessary to achieve a future value of $1,938,621? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. The $1,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 1000000, /, PV 4. Key in: 10 12 N 5. Key in: 1938621, FV 6. Key in: COMP, I/Y 7. The final result appearing on your calculator screen should be: 0.55 (or 0.55% per month 12 months 6.64% per year). This means that the $1,000,000, invested at 0.55% compounded monthly for 10 years, will have a total future value of $1,938,621 (or $1,000,000 original investment plus $938,621 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. 3 4 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 3: CALCULATING INVESTMENT PERIOD (LUMP SUM) If you are able to invest $5,000,000 and earn interest of 10% per year, in how many years will the investment have a future value of $12,500,000? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. The $5,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 5000000, /, PV 4. Key in: 10, I/Y 5. Key in: 12500000, FV 6. Key in: COMP, N 7. The final result appearing on your calculator screen should be: 9.61. This means that the $5,000,000, invested at 10% per year for 9.61 years, will have a total future value of $12,500,000 (or $5,000,000 original investment plus $7,500,000 of interest). Note: Steps 3, 4, 5 could be done in a different order. EXERCISE 4: CALCULATING PV (LUMP SUM) You want to have $150,000 in 15 years to pay for your child’s post-secondary education. Assuming interest is earned annually at a rate of 4.5%, how much do you have to invest today? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. The $150,000 is a positive value because it is a cash INFLOW in 15 years; remember that outflows are negative and inflows are positive. 3. Key in: 150000, FV 4. Key in: 15, N 5. Key in: 4.5, I/Y 6. Key in: COMP, PV 7. The final result appearing on your calculator screen should be: 77,508.07 (the negative indicates that this is a cash outflow). This means that the $77,508.07, invested at 4.5% for 15 years, will have a total future value of $150,000 (or $77,508.07 original investment plus $72,491.93 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 5: CALCULATING MONTHLY PAYMENTS I (ANNUITY) You want to have $80,000 in 20 years to pay for your child’s post-secondary education. Assuming interest is earned monthly at an annual stated rate of 7.25%, what will the monthly payments be? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. $80,000 is interest as a positive value because it is a cash INFLOW in 20 years; remember that outflows are negative and inflows are positive. 3. Key in: 80000, FV 4. Key in: 20 12 N 5. Key in: 7.25 12 I/Y 6. Key in: COMP, PMT 7. The final result appearing on your calculator screen should be: 148.97 (the negative indicates that this is a cash outflow). This means that the monthly payments of $148.97, invested at an annual rate of 7.25% for 20 years, will have a total future value of $80,000 (or $148.97 12 20 $35,752.19 actual investment plus $44,247.81 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. 5 6 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 6: CALCULATING MONTHLY PAYMENTS II (ANNUITY) You have purchased a home and are applying for a $250,000 mortgage. The stated annual interest rate is 4.8%. What will the monthly payments be if you choose to pay the house off in: a. 15 years? b. 20 years? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. $250,000 is left as a positive value because you are receiving it from the bank—cash INFLOW—and will be making monthly payments to repay the bank. 3. Key in: 250000, PV 4. Key in: 4.8 12 I/Y 5. Key in: 15 12 N 6. Key in: COMP, PMT 7. Solving part (a), the result appearing on your calculator screen should be: 1,951.04 (to solve part (b), go directly from Step 6 to Step 8 without entering anything else into your calculator). NOTE: Steps 3, 4, 5 could be done in a different order. 8. Key in: 20 12 N 9. Key in: COMP, PMT 10. Solving part (b), the result appearing on your calculator screen should be: 1,622.39. Explanation of results: Part (a) vs. Part (b) This means that the monthly payments for 15 years will be $1,951.04. This means that the monthly payments for 20 years will be $1,622.39. ($1,951.04 15 years 12 months/year $351,187.20 $250,000 principal $101,187.20 in interest) ($1,622.39 20 years 12 months/year $389,373.60 $250,000 principal $139,373.60 in interest) Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 7: CALCULATING FV (ANNUITY) You are starting a retirement savings plan and can afford to invest $500 at the end of each month for the next 25 years. What is the future value of this investment stream assuming a stated annual interest rate of: a. 5%? b. 8%? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. 500 is interest as a negative value because it is cash OUTFLOW each month. 3. Key in: 500, /, PMT 4. Key in: 25 12 N 5. Key in: 5 12 I/Y 6. Key in: COMP, FV 7. Solving part (a), the result appearing on your calculator screen should be: 297,754.85 (this is a positive value indicating that this is a cash inflow; if you had entered the 500 PMT as a positive, the $297,754.85 would have shown as a negative value . . . try it!!!). 8. Key in: 8 12 I/Y 9. Key in: COMP, FV 10. Solving for part (b), the final result appearing on your calculator screen should be: 475,513.20. Explanation of results: Part (a) vs. Part (b) The answer to part (a) means that the monthly payments of $500, invested at an annual rate of 5% for 25 years, will have a total future value of $297,745.85. The answer to part (b) means that the monthly payments of $500, invested at an annual rate of 8% for 25 years, will have a total future value of $475,513.20. ($500 12 25 $150,000.00 actual investment plus $147,745.85 of interest) ($500 12 25 $150,000 actual investment plus $325,513.20 of interest) 7 8 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 8: CALCULATING PV (ANNUITY) You want to have $2,000,000 in 22 years for your retirement. Assuming a stated annual interest rate of 7%, how much do you have to invest monthly (interest is earned monthly)? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. Key in: 2000000, FV 3. Key in: 22 12 N 4. Key in: 7 12 I/Y 5. Key in: COMP, PMT 6. The final result appearing on your calculator screen should be: 3,201.82. The negative indicates that this is a cash outflow OR payment to be made each month for 22 years to achieve a future value of $2,000,000. NOTE: Steps 2, 3, 4 could be done in a different order. EXERCISE 9: CALCULATING INTEREST (ANNUITY) You want to have $55,000 in 10 years to pay for a new car. You have committed to saving $300 per month. What stated annual interest rate will allow you to meet your goal? (Assume interest is earned monthly.) 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. Key in: 55000, FV 3. Key in: 10 12 N 4. Key in: 300, /, PMT 5. Key in: COMP, I/Y 6. The final result appearing on your calculator screen should be: 0.67 (or 0.67% 12 8.04% per year). NOTE: Steps 2, 3, 4 could be done in a different order. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 10: CALCULATING INVESTMENT PERIOD (ANNUITY) You estimate that you will need $25,000 to take your family on a memorable vacation. Assume a stated annual interest rate of 6% and monthly contributions of $700 to a savings account. How many months will it take to achieve your goal? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data (2nd F, MODE) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. Key in: 25000, FV 3. Key in: 700, /, PMT 4. Key in: 6 12 I/Y 5. Key in: COMP, N 6. The final result appearing on your calculator screen should be: 32.94 (or 32.94 months 12 2.75 years). NOTE: Steps 2, 3, 4 could be done in a different order. 9 10 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 11: CALCULATING NPV (UNEQUAL PAYMENTS) You are purchasing a machine at a cost of $10,000 and an additional $1,500 for installation costs. You estimate the net revenues generated by the machine in years 1 through 5 will be $6,000, $14,000, $15,000, $17,000, and $18,000 respectively. After the fifth year, you will sell the machine for $2,000. What is the net present value, assuming a profit objective of 20% per year? 1. Make sure your calculator is – set to normal mode (Normal 0) – cleared of any data and memory (2nd F, MODE) and (2nd F, ALPHA, , ) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. Key in: /, 10000, , /, 1500, , ENT (this is the initial investment, a cash outflow, at time ‘0’) 3. Key in: 6000, ENT (this is the cash inflow for Year 1, assumed to be at the end of the year. Notice that this is left as a positive value because it is a cash inflow. You must be extremely careful to distinguish between cash inflows and outflows.) 4. Key in: 14000, ENT (Year 2 cash inflow) 5. Key in 15000, ENT (Year 3 cash inflow) 6. Key in 17000, ENT (Year 4 cash inflow) 7. Key in: 18000 2000 ENT (the cash inflows in the fifth year are the revenues plus the sale proceeds of the machine) 8. Key in: 2nd F, CFi, 20, ENT 9. Key in: ↓, COMP (to calculate the NPV) 10. The final result appearing on your calculator screen should be: 28,138.63 (the positive nature of this value indicates that the investor’s desired return of 20% will be achieved by this investment). NOTE: Steps 2 through 7 MUST be done in sequence. The calculator assumes that the first ENT value entered is at time ‘0’, the second ENT value entered is for Year 1, the third ENT value entered is for Year 2, etc. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (Sharp EL-738) EXERCISE 12: USING NPV KEY TO CALCULATE PV (UNEQUAL PAYMENTS) You are planning to provide customers a new service with anticipated net revenues each year for the next four years of $8,000, $15,000, $25,000, and $40,000 respectively. No initial investment is required because the service can be provided using existing unused capacity. Assume a stated annual interest rate of 8%. What is the present value of this stream of cash flows? 1. Make sure your calculator is – set to normal mode – cleared of any data and memory (2nd F, MODE) and (2nd F, ALPHA, , ) – set to 2 decimals (2nd F, SET UP, 0, 0, 2) 2. Key in: 0, ENT (this is the initial investment, at time ‘0’) 3. Key in: 8000, ENT (this is the cash inflow for Year 1, assumed to be at the end of the year. Notice that this is left as a positive value because it is a cash inflow. You must be extremely careful to distinguish between cash inflows and outflows.) 4. Key in: 15000, ENT (Year 2 cash inflow) 5. Key in: 25000, ENT (Year 3 cash inflow) 6. Key in: 40000, ENT (Year 4 cash inflow) 7. Key in: 2nd F, CFi, 8, ENT 8. Key in: ▼, COMP 9. The final result appearing on your calculator screen should be: 69,514.49 (the present value of this stream of unequal cash inflows). NOTE: Unlike Exercises 1–10, steps 3 through 8 MUST be done in sequence. The calculator assumes that the first CFi value entered is at time ‘0’, the second CFi value entered is for Year 1, the third CFi value entered is for Year 2, etc. 11 EYK 15-2 PV Tutorial Using Calculator (TI BA II Plus) TABLE OF CONTENTS Calculator Configuration and Abbreviations 12 Exercise 1: Calculating FV (Lump Sum) Exercise 2: Calculating Interest Rate (Lump Sum) Exercise 3: Calculating Investment Period (Lump Sum) Exercise 4: Calculating PV (Lump Sum) Exercise 5: Calculating Monthly Payments I (Annuity) Exercise 6: Calculating Monthly Payments II (Annuity) Exercise 7: Calculating FV (Annuity) Exercise 8: Calculating PV (Annuity) Exercise 9: Calculating Interest (Annuity) Exercise 10: Calculating Investment Period (Annuity) Exercise 11: Calculating NPV (Unequal Payments) Exercise 12: Using NPV Key to Calculate PV (Unequal Payments) Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) CALCULATOR CONFIGURATION AND ABBREVIATIONS Abbreviations on the calculator 2nd shift key COMP compute N number of periods I/Y interest per period PV present value FV future value PMT payment CE/C clear all 13 14 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 1: CALCULATING FV (LUMP SUM) If you invest $1,000,000 for 10 years at a stated annual rate of 6% with interest earned monthly, what is the future value? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. The $1,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 1000000, /, PV 4. Key in: 6 12 I/Y 5. Key in: 10 12 N 6. Key in: CPT, FV The final result appearing on your calculator screen should be: 1,819,396.73. This means that the $1,000,000, invested at 6% (or 0.50% compounded monthly) for 10 years, will have a total future value of $1,819,396.73 ($1,000,000 original investment plus $819,396.73 of interest). Note: Steps 3, 4, 5 could be done in a different order. EXERCISE 2: CALCULATING INTEREST RATE (LUMP SUM) If you invest $1,000,000 for 10 years with interest earned monthly, what interest rate is necessary to achieve a future value of $1,938,621? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. The $1,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 1000000, /, PV 4. Key in: 10 12 N 5. Key in: 1938621, FV 6. Key in: CPT, I/Y 7. The final result appearing on your calculator screen should be: 0.55 (or 0.55% per month 12 months 6.64% per year). This means that the $1,000,000, invested at 0.55% compounded monthly for 10 years, will have a total future value of $1,938,621 (or $1,000,000 original investment plus $938,621 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 3: CALCULATING INVESTMENT PERIOD (LUMP SUM) If you are able to invest $5,000,000 and earn interest of 10% per year, in how many years will the investment have a future value of $12,500,000? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. The $5,000,000 is an investment or cash flowing OUT as opposed to cash flowing IN. Hence the need to make it a negative value; cash flowing IN would not require the / keystroke. 3. Key in: 5000000, /, PV 4. Key in: 10, I/Y 5. Key in: 12500000, FV 6. Key in: CPT, N 7. The final result appearing on your calculator screen should be: 9.61. This means that the $5,000,000, invested at 10% per year for 9.61 years, will have a total future value of $12,500,000 (or $5,000,000 original investment plus $7,500,000 of interest). Note: Steps 3, 4, 5 could be done in a different order. EXERCISE 4: CALCULATING PV (LUMP SUM) You want to have $150,000 in 15 years to pay for your child’s post-secondary education. Assuming interest is earned annually at a rate of 4.5%, how much do you have to invest today? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. The $150,000 is a positive value because it is a cash INFLOW in 15 years; remember that outflows are negative and inflows are positive. 3. Key in: 150000, FV 4. Key in: 15, N 5. Key in: 4.5, I/Y 6. Key in: CPT, PV 7. The final result appearing on your calculator screen should be: 77,508.07 (the negative indicates that this is a cash outflow). This means that the $77,508.07, invested at 4.5% for 15 years, will have a total future value of $150,000 (or $77,508.07 original investment plus $72,491.93 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. 15 16 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 5: CALCULATING MONTHLY PAYMENTS I (ANNUITY) You want to have $80,000 in 20 years to pay for your child’s post-secondary education. Assuming interest is earned monthly at an annual stated rate of 7.25%, what will the monthly payments be? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. $80,000 is interest as a positive value because it is a cash INFLOW in 20 years; remember that outflows are negative and inflows are positive. 3. Key in: 80000, FV 4. Key in: 20 12 N 5. Key in: 7.25 12 I/Y 6. Key in: CPT, PMT 7. The final result appearing on your calculator screen should be: 148.97 (the negative indicates that this is a cash outflow). This means that the monthly payments of $148.97, invested at an annual rate of 7.25% for 20 years, will have a total future value of $80,000 (or $148.97 12 20 $35,752.19 actual investment plus $44,247.81 of interest). NOTE: Steps 3, 4, 5 could be done in a different order. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 6: CALCULATING MONTHLY PAYMENTS II (ANNUITY) You have purchased a home and are applying for a $250,000 mortgage. The stated annual interest rate is 4.8%. What will the monthly payments be if you choose to pay the house off in: a. 15 years? b. 20 years? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. $250,000 is left as a positive value because you are receiving it from the bank—cash INFLOW—and will be making monthly payments to repay the bank. 3. Key in: 250000, PV 4. Key in: 4.8 12 I/Y 5. Key in: 15 12 N 6. Key in: CPT, PMT 7. Solving part (a), the result appearing on your calculator screen should be: 1,951.04 (to solve part (b), go directly from Step 6 to Step 8 without entering anything else into your calculator). NOTE: Steps 3, 4, 5 could be done in a different order. 8. Key in: 20 12 N 9. Key in: CPT, PMT 10. Solving part (b), the result appearing on your calculator screen should be: 1,622.39. Explanation of results: Part (a) vs. Part (b) This means that the monthly payments for 15 years will be $1,951.04. This means that the monthly payments for 20 years will be $1,622.39. ($1,951.04 15 years 12 months/year $351,187.20 $250,000 principal $101,187.20 in interest) ($1,622.39 20 years 12 months/year $389,373.60 $250,000 principal $139,373.60 in interest) 17 18 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 7: CALCULATING FV (ANNUITY) You are starting a retirement savings plan and can afford to invest $500 at the end of each month for the next 25 years. What is the future value of this investment stream assuming a stated annual interest rate of: a. 5%? b. 8%? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. 500 is interest as a negative value because it is cash OUTFLOW each month. 3. Key in: 500, /, PMT 4. Key in: 25 12 N 5. Key in: 5 12 I/Y 6. Key in: CPT, FV 7. Solving part (a), the result appearing on your calculator screen should be: 297,754.85 (this is a positive value indicating that this is a cash inflow; if you had entered the 500 PMT as a positive, the $297,754.85 would have shown as a negative value . . . try it!!!). 8. Key in: 8 12 I/Y 9. Key in: CPT, FV 10. Solving for part (b), the final result appearing on your calculator screen should be: 475,513.20. Explanation of results: Part (a) vs. Part (b) The answer to part (a) means that the monthly payments of $500, invested at an annual rate of 5% for 25 years, will have a total future value of $297,745.85. The answer to part (b) means that the monthly payments of $500, invested at an annual rate of 8% for 25 years will have a total future value of $475,513.20. ($500 12 25 $150,000.00 actual investment plus $147,745.85 of interest) ($500 12 25 $150,000 actual investment plus $325,513.20 of interest) Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 8: CALCULATING PV (ANNUITY) You want to have $2,000,000 in 22 years for your retirement. Assuming a stated annual interest rate of 7%, how much do you have to invest monthly (interest is earned monthly)? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. Key in: 2000000, FV 3. Key in: 22 12 N 4. Key in: 7 12 I/Y 5. Key in: CPT, PMT 6. The final result appearing on your calculator screen should be: 3,201.82. The negative indicates that this is a cash outflow OR payment to be made each month for 22 years to achieve a future value of $2,000,000. NOTE: Steps 2, 3, 4 could be done in a different order. EXERCISE 9: CALCULATING INTEREST (ANNUITY) You want to have $55,000 in 10 years to pay for a new car. You have committed to saving $300 per month. What stated annual interest rate will allow you to meet your goal? (Assume interest is earned monthly.) 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. Key in: 55000, FV 3. Key in: 10 12 N 4. Key in: 300, /, PMT 5. Key in: CPT, I/Y 6. The final result appearing on your calculator screen should be: 0.67 (or 0.67% 12 8.04% per year). NOTE: Steps 2, 3, 4 could be done in a different order. 19 20 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 10: CALCULATING INVESTMENT PERIOD (ANNUITY) You estimate that you will need $25,000 to take your family on a memorable vacation. Assume a stated annual interest rate of 6% and monthly contributions of $700 to a savings account. How many months will it take to achieve your goal? 1. Make sure your calculator is – cleared of any data (2nd FV) – set to 2 decimals (2nd., 2, ENTER) 2. Key in: 25000, FV 3. Key in: 700, /, PMT 4. Key in: 6 12 I/Y 5. Key in: CPT, N 6. The final result appearing on your calculator screen should be: 32.94 (or 32.94 months 12 2.75 years). NOTE: Steps 2, 3, 4 could be done in a different order. Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 11: CALCULATING NPV (UNEQUAL PAYMENTS) You are purchasing a machine at a cost of $10,000 and an additional $1,500 for installation costs. You estimate the net revenues generated by the machine in years 1 through 5 will be $6,000, $14,000, $15,000, $17,000, and $18,000 respectively. After the fifth year, you will sell the machine for $2,000. What is the net present value, assuming a profit objective of 20% per year? 1. Make sure your calculator is – cleared of any data and memory (2nd FV) and (CF, 2nd, CE/C) – set to 2 decimals (2nd., 2, ENTER) 2. Key in: CF, 10000, /, , 1500, /, , ENTER (this is the initial investment, a cash outflow, at time ‘0’) 3. Key in: ↓, 6000, ENTER (this is the cash inflow for Year 1, assumed to be at the end of the year. Notice that this is left as a positive value because it is a cash inflow. You must be extremely careful to distinguish between cash inflows and outflows.) 4. Key in: ↓, ↓, 14000, ENTER (Year 2 cash inflow) 5. Key in ↓, ↓, 15000, ENTER (Year 3 cash inflow) 6. Key in ↓, ↓, 17000, ENTER (Year 4 cash inflow) 7. Key in: ↓, ↓, 18000 2000 ENTER (the cash inflows in the fifth year are the revenues plus the sale proceeds of the machine) 8. Key in: NPV, 20, ENTER, ↓, CPT 9. The final result appearing on your calculator screen should be: 28,138.63 (the positive nature of this value indicates that the investor’s desired return of 20% will be achieved by this investment). NOTE: Steps 2 through 7 MUST be done in sequence. The calculator assumes that the first ENT value entered is at time ‘0’, the second ENT value entered is for Year 1, the third ENT value entered is for Year 2, etc. 21 22 Extend Your Knowledge 15-2 PV Tutorial Using Calculator (TI BA II Plus) EXERCISE 12: USING NPV KEY TO CALCULATE PV (UNEQUAL PAYMENTS) You are planning to provide customers a new service with anticipated net revenues each year for the next four years of $8,000, $15,000, $25,000, and $40,000 respectively. No initial investment is required because the service can be provided using existing unused capacity. Assume a stated annual interest rate of 8%. What is the present value of this stream of cash flows? 1. Make sure your calculator is – cleared of any data and memory (2nd FV) and (CF, 2nd, CE/C) – set to 2 decimals (2nd., 2, ENTER) 2. Key in: CF, 0, ENTER (this is the initial investment, at time ‘0’) 3. Key in: ↓, 8000, ENTER (this is the cash inflow for Year 1, assumed to be at the end of the year. Notice that this is left as a positive value because it is a cash inflow. You must be extremely careful to distinguish between cash inflows and outflows.) 4. Key in: ↓, ↓, 15000, ENTER (Year 2 cash inflow) 5. Key in: ↓, ↓, 25000, ENTER (Year 3 cash inflow) 6. Key in: ↓, ↓, 40000, ENTER (Year 4 cash inflow) 7. Key in: NPV, 20, ENTER, ↓, CPT 8. The final result appearing on your calculator screen should be: 69,514.49 (the present value of this stream of unequal cash inflows). NOTE: Unlike Exercises 1–10, steps 3 through 7 MUST be done in sequence. The calculator assumes that the first CFi value entered is at time ‘0’, the second CFi value entered is for Year 1, the third CFi value entered is for Year 2, etc.