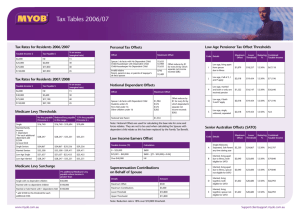

Tax Offsets – 2011/12

advertisement

Tax Offsets – 2011/12 Dependant and Housekeeper Tax Offsets A taxpayer is entitled to a dependant or housekeeper tax offset if they are a resident for tax purposes and their dependant is also a resident. The maximum amount of Dependant Tax Offsets are reduced by $1 for every $4 by which the dependant’s 'adjusted taxable income' (ATI) exceeds $282. 2011/12 Description Max Offset $ Max ATI1 $ 2,355 9,702 2,736 11,226 1,919 7,958 2,299 9,478 376 1,785 282 1,409 376 1,785 2,355 9,702 864 3,737 1,726 7,185 1,607 N/A 1,919 N/A 2,299 N/A Dependant Tax Offsets: Spouse/De facto (no dependent child/student)2,3 2,4 Spouse/De facto (with dependent child/student) 2 Child-housekeeper (no dependent child/student) 2,4 Child-housekeeper (with dependent child/student) First child under 21 (not being a student)5 5 Each other child under 21 (not being a student) Student 5 Invalid spouse/carer spouse 6 Invalid Relative Parent or Parent-in-law Sole Parent 7 Housekeeper Tax Offsets: No dependent child/student2 With dependent child/student 1 2 3 4 5 6 7 2,4 The dependent spouse tax offset can only be claimed by individuals whose ATI is $150,000 or less and for other dependant tax offsets, the offset can generally only be claimed where the combined ATI of the taxpayer and their spouse is $150,000 or less. A taxpayer's ATI includes their: – taxable income; – adjusted fringe benefits total; – tax-free pensions or benefits; – target foreign income; – reportable superannuation contributions; – total net investment losses; Less Deductible child maintenance expenditure (child support paid). The dependent spouse/de facto, child-housekeeper (no dependent child/student), child-housekeeper (with dependent child/ student) and housekeeper tax offsets cannot generally be claimed in respect of a period where there is also an entitlement to claim Family Tax Benefit (FTB) Part B at the full care rate. However, where FTB Part B is not available at the full care rate (e.g., where the taxpayer's former spouse has shared care, a partial tax offset may be available. When claiming a partial spouse/de facto tax offset, the spouse/de facto (no dependent child/student) tax offset amount must be used. The tax offset for Dependent Spouses/De Factos, with no dependent child/student, who were born on or after 1 July 1971 has been removed. This means that the Dependent Spouse/De Facto tax offset cannot be claimed in 2011/12 in respect of a spouse/de facto born on or after 1 July 1971. The spouse/de facto, child-housekeeper and housekeeper (with dependent child/student) higher tax offsets have been withdrawn and are only notionally retained for calculating the Zone and Overseas Forces tax offsets. The child under 21 and student offsets have been abolished. However, they have been retained on a notional basis for the purpose of determining whether a taxpayer is entitled to other tax offsets and the higher level of spouse/de facto and child-housekeeper tax offsets. Broadly, from 1 July 2011, a person who maintains a dependent spouse who is an invalid, permanently unable to work or providing care may be entitled to claim an 'invalid spouse' or 'carer spouse' tax offset, regardless of the age of the dependent spouse. The sole parent rebate was replaced by Family Tax Benefit Part B. However, it is notionally retained for calculating the Zone and Overseas Forces tax offsets and for determining entitlement to the Medicare Levy Family income threshold. Medical Expenses Tax Offset Description Offset1, 2 Medical expenses 20% of every $1 over $2,060 1 The threshold is indexed annually in line with CPI. 2 The medical expense tax offset will be means tested from 1 July 2012. Low Income Tax Offset Resident individuals (including trustees assessed under S.98 ITAA 1936 in respect of presently entitled resident beneficiaries) are entitled to the Low-income tax offset1, 2. The maximum offset of $1,500 is reduced by four cents for every dollar of taxable income over $30,000. The offset is not automatically indexed. Taxable Income $ 0 – 30,000 30,001 – 67,499 67,500+ 1 2 Tax Offset $1,500 $1,500 – [(Taxable Income – $30,000) x 4%] Nil From 1 July 2011 (i.e., 2012 and later income years), minors who are not classified as an 'excepted person' are no longer eligible to apply the low-income tax offset to reduce tax payable on their unearned (i.e., Division 6AA) income. The low income tax offset will be reduced to $445 from 1 July 2012 and to $300 from 1 July 2015. Private Health Insurance Tax Offset A resident taxpayer who has paid premiums to a registered health fund for the appropriate health insurance is eligible for a tax offset, a direct payment or reduced health insurance premiums. If direct payments or reduced premiums are taken, the offset cannot be claimed. Any excess portion of the offset is refundable to the taxpayer. The amount of the offset is determined by the age of the oldest person covered by the policy, and is calculated as follows: Income Year Offset $ 2011/12 u Policy covers persons aged under 65 u Policy covers one or more persons, the oldest of whom is aged 65 to 69 Policy covers one or more persons, the oldest of whom is aged 70 or over u 1 30% x Premiums Paid1 35% x Premiums Paid1 40% x Premiums Paid1 Where the taxpayer had a policy before 1 January 1999 and was eligible to claim an amount under the Private health insurance incentive scheme (PHIIS), the amount of the tax offset is the greater of the amount worked out in the table above and the 'incentive amount' under the PHIIS. From 1 July 2012, the private health insurance offset and the Medicare levy surcharge will be income tested against three income tier thresholds. Mature Age Worker Tax Offset The non-refundable Mature Age Workers Tax Offset was introduced to encourage taxpayers to remain in the workforce. Resident taxpayers must be aged 55 or more at the end of the income year and have received net income from working1. Net Income from Working $ 1 Tax Offset Up to $10,000 5% $10,001 to $53,000 $500 $53,001 to $62,999 $500 – [5% of the excess over $53,000] $63,000+ Nil As announced in the 2012/13 Federal Budget, the Mature Age Workers Tax Offset will be phased out from 1 July 2012 for taxpayers born on or after 1 July 1957. Senior Australians Tax Offset The Senior Australians Tax Offset (SATO) is available to a taxpayer who during the year: ♦ is eligible for a pension, allowance or benefit under the Veterans' Entitlements Act 1986 and has reached pension age under that Act; or ♦ is qualified for an age pension under the Social Security Act 1991; and ♦ was not in prison at least one day during the income year; and ♦ has taxable income under the 'Cut-out Threshold' from the table below. The 2011/12 maximum offset and threshold amounts for SATO are as follows1: Family Situation2 Maximum Offset $ Shade-out Cut-out Threshold2 Threshold3 $ $ Single, separated or widowed 2,230 30,685 48,525 Each member of a couple (married or de facto)4 1,602 26,680 39,496 Each member of a couple (married or de facto) separated due to illness or because one was in a nursing home4 2,040 29,600 45,920 1 2 3 4 From 1 July 2012, the Pensioner Tax Offset (PTO) will no longer be available. Instead, individuals who were previously eligible for the PTO will generally be eligible for SATO which will be renamed the "Seniors and Pensioners Tax Offset". For a taxpayer who is a member of a couple, eligibility is established by halving the combined 'rebate' income of the taxpayer and their spouse and comparing this amount against the relevant Cut-out Threshold – if this figure reaches the Cut-out Threshold, then neither person is eligible for SATO. If this figure is below the Cut-out Threshold, then the amount of each person’s SATO depends on their own rebate income and their eligibility for any unused portion of their spouse’s SATO or Pensioner Tax Offset. An individual's 'rebate' income for a year of income is the sum of the individual's: (a) taxable income for the year; (b) reportable superannuation contributions for the year; (c) total net investment loss for the year; and (d) the individual's adjusted fringe benefits total for the income year. The maximum offset reduces by 12.5 cents for every dollar of rebate income over the Shade-out Threshold and reduces to nil for rebate income levels at or above the Cut-out Threshold. The transfer of any unused portion of a spouse’s Pensioner or Senior Australians Tax Offset may occur if both the taxpayer and their spouse are eligible for either SATO or the Pensioner Tax Offset, the spouse’s tax offset entitlement exceeds their tax payable, and tax payable by the taxpayer exceeds their tax offset entitlement. For the purposes of calculating the transfer amount, if the spouse is eligible for SATO, their rebate income includes any trust income assessed to the trustee under S.98 of the ITAA 1936. If the spouse is eligible for the Pensioner Tax Offset, their rebate income includes any exempt pension income. Pensioner Tax Offset A taxpayer who is not eligible for the Senior Australians Tax Offset (SATO) is entitled to the Pensioner Tax Offset (PTO) if they receive an assessable Commonwealth pension, payment or allowance and has rebate income under the relevant Cut-out Threshold (which was not available at the time of printing). Such payments and pensions include: Age Pension, Age Service Pension, Bereavement Allowance, Carer Payment, Disability Support Pension (only if reached age pension age), Income Support Supplement, Invalidity Service Pension (only if reached age pension age), Parenting Payment (single), Partner Service Pension, Widow B Pension or Wife Pension. An individual's 'rebate' income for a year of income is the sum of the individual's: (a) taxable income for the year; (b) reportable superannuation contributions for the year; (c) total net investment loss for the year; and (d) the individual's adjusted fringe benefits total for the income year. From 1 July 2012, the Pensioner Tax Offset is no longer available (refer footnote 1 on previous page). Zone Tax Offset Taxpayers who live in remote areas of Australia may be entitled to a Zone Tax Offset depending on the amount of time spent in the relevant zones. Generally speaking, taxpayers qualify as residents of a zone where they reside in the zone (not necessarily continuously) for 183 days or more. Remote areas do not include offshore rigs. To find out whether a location is currently in a zone or special area, refer to the 'Australian Zone List', which can be searched at the Tax Professionals section of the ATO website at www.ato.gov.au and search for Australian zone list. The zone rebate levels are set out below: Description1 Maximum Offset2 $ Special Area in Zone A $1,173 + 50% of the relevant rebate amount Special Area in Zone B $1,173 + 50% of the relevant rebate amount Zone A $338 + 50% of the relevant rebate amount Zone B $57 + 20% of the relevant rebate amount 1 2 Areas specified in Zone A are more remote than those in Zone B. The Zone A offset applies to a taxpayer who is a resident of Zone A during the year of income but has not resided or actually been in the special area of either zone (these areas are particularly isolated) during any part of the year. The Zone B offset applies to a taxpayer who is a resident of Zone B during the year of income but has not resided or actually been in Zone A, or the special area of either zone during any part of the year. Where a taxpayer does not fall into any of the previous categories but resided in a zone area for some of the year, the Commissioner can determine a reasonable amount of tax offset to allow in the circumstances. The 'relevant rebate amount' means the sum of the tax offsets to which the taxpayer is notionally entitled to, or would notionally be entitled to (e.g., a dependant, sole parent or housekeeper offset), if tax offsets were still allowable for dependent children and students. Note that the phasing-out of the dependant spouse tax offset does not affect a taxpayers entitlement to a notional spouse/child component of the Zone Tax Offset.