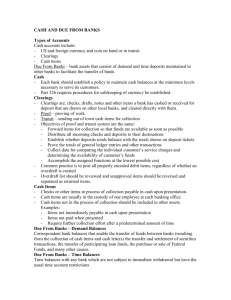

LVTS and the Bank of Canada: A primer

advertisement

Red Square

MONEY CREATION IN A BANKING SYSTEM WITH A SINGLE MONOPOLY BANK

The process of money creation is perhaps the most intriguing aspect of the economic system. It

has given rise to the most extraordinary and extravagant theories. Beyond economists, it has

attracted the attention of all sorts of people, from majors in the army to Chemistry Nobel

Laureates. Still, the process of money creation, as well as the process of money destruction, are

highly simple and can be easily understood by all. Money creation, or rather bank deposit

creation as we will analyse it here, is no alchemy. It relies mainly on three features of the banking

system: the willingness of banks to grant loans, the creditworthiness of borrowers, and the

willingness of borrowers to take on loans.

Yellow Square

The Main Money Creation Channel

To understand how money deposits are being created, it is best to start by imagining that the

banking system is made up of a single bank, that has a total monopoly on the provision of loans

and deposits in the economy, a system that 1982 Nobel Price Laureate John Hicks (1904-1989)

called a monocentric banking system. All financial transactions have to transit through this single

bank. Every economic agent has an account at this bank. Some agents have a negative account, in

which case they have outstanding loans at the bank; other agents have a positive account, in

which case they have deposits at the bank. How do new bank deposits get created? There are

basically two ways in which deposits get created. Let us start with the most obvious one.

Suppose that some individual wishes to purchase some goods or services, but without

having the funds to do so. It may be a student who desires to purchase a new car, or an

entrepreneur who is keen to hire new workers and increase production, having just received

additional orders for his or her product. To go forward with their project, both the student and the

entrepreneur have to borrow from the bank. They have to ask for a bank loan. Will the loan be

granted? The answer is yes, as long as the borrowers are creditworthy – they are worthy of credit.

The word credit comes from the Latin word credere, which means to believe or to trust.

Trustworthy people or organizations can get bank credit.

How can the borrowers demonstrate their creditworthiness? They may show that their

past credit record is impeccable, that they have paid the interest due on their previous loans, and

that they have reimbursed past loans. They may indicate that their current income is high

compared to the interest payments involved with the loan that they are asking for (such ratios are

now generated automatically by bank computer programs, which either flag the customer or tell

the loan officer how much can be lent, and at what rate). They may show proof that the goods

that they are about to produce have already been ordered by some other firm, and promised to be

paid for. They may provide some guarantee – collateral – that the bank can seize in the unlikely

case that they will be unable to pay interest and pay back the amounts due. In the case of a loan to

purchase a house – a mortgage loan – the collateral is the house being purchased. In the case of a

car loan, the collateral is likely to be the car itself. Sometimes the collateral can be financial

assets – stocks, corporate bonds, government securities. If all of this is not enough, someone else

may back the loan, the mother of the student, in which case she is the creditworthy person

prompting the bank to grant the loan.

SIDEBAR

Creditworthiness is at the core of the bank lending system. It can be demonstrated by providing

collateral, or by demonstrating the ability to face the loan obligations.

Collateral is property (car, house, inventories, government securities) that is pledged by the

borrower as guarantee for the repayment of a loan.

So let us suppose that indeed the borrower is creditworthy. What happens next? The

answer to this query is simple. A bank loan gets created ex nihilo – out of nothing – at the stroke

of a pen; or rather, in our modern world, the bank loan gets created by punching a key on the

computer. Simultaneously, as the bank loan gets created, a new bank deposit also gets created.

Let us suppose that on January 2, 2008, a creditworthy borrower is being granted a new

loan of $40,000 (for quite a nice car!). The effects on Bank-a-mythica, who holds a monopoly on

banking services, are shown in Table 3. The bank now has $40,000 more in loans on the asset

side of its balance sheet, but simultaneously, on the liability side, there is an increase of $40,000

in the bank deposits. The minute the loan has been granted, the car purchaser gets credited with a

money deposit of $40,000. This is money that the bank now owes to the car purchaser. This is

why it is on the liability side of the bank. Tables such as this one, which shows changes in

balance sheets rather than the balance sheets themselves, will help us follow the process of

money creation and destruction.

Table 3

Changes in the Balance sheet of Bank-a-mythica, January 2, 2008

Assets

Liabilities and Net Worth

Loans to car purchaser

+$40,000

Deposits of car purchaser

+$40,000

There is nothing more to money creation. Since chequable bank deposits are part of M1, the most

strictly defined money aggregate as we saw on page 234, Table 3 has shown how most money

gets created in the modern world.

{IN RED} For money creation to occur, all we need is the willingness of a bank to lend and a

creditworthy borrower who is willing to borrow. {END Of RED INK}

Box

Lines of credit

The money-creating process can be made even more efficient when banks grant lines of credit

(also called overdrafts) to their customers. As Keynes explained in 1930 in his Treatise on

Money, an overdraft is “an arrangement with the bank that an account may be in debit at any time

up to an amount not exceeding an agreed figure, interest being paid not on the agreed maximum

debit, but on the actual average debit”. There may be a fee for this line of credit.

Take the case of our car purchaser. She may have already negotiated an agreement with the bank,

entitling her to borrow up to a certain maximum amount, say $100,000, depending on her annual

income and her existing net wealth. The bank client can then draw on her line of credit whenever

she wants, up to the indicated limit. For instance, in the present case, assuming a $100,000 line of

credit, she would draw $40,000 to pay for her new car, paying interest on that amount (the

utilized portion of the credit line). The remaining $60,000 would constitute the unused portion of

the line of credit. Because this part of the credit line is not used, no interest is charged on the

remaining $60,000. However, if the car purchaser were to need to borrow some additional

amounts, say $5000 for new kitchen major appliances, she would not need to go back to the bank

loan officer to obtain yet another loan. All she needs to do is draw on an additional $5,000 off the

unused portion of her existing credit line.

Many businesses have these lines of credit. It gives them flexibility in handling payments to

workers and suppliers, because businesses usually sell their ware after they have been produced

and paid for, so that businesses need bank advances. Lines of credit have now been generalized

to individuals, thus also providing them with more flexibility when their expenses, for whatever

reason, run (temporarily!) at a faster pace than their income. {END OF BOX}

What then happens next? Suppose that the car is being purchased the next day, on January 3rd.

The purchaser goes to the car dealer, most likely with a certified cheque in hand, and after having

given the cheque and signed all the papers, she drives off with the car. The car dealer deposits the

cheque, still at Bank-a-mythica, since we assumed that this was the one and only bank of the

country. The balance sheet of Bank-a-mythica will show the changes indicated in Table 4.

Table 4

Changes in the Balance sheet of Bank-a-mythica, January 3, 2008

Assets

Liabilities and Net Worth

Deposits of car purchaser

Deposits of car dealer

-$40,000

+$40,000

By combining Tables 3 and 4, we arrive at Table 5, which summarizes the bank’s overall

transactions for those two days. The car purchaser still owes $40,000 to the bank, but all the

money deposits are now in the account of the car dealer.

Table 5

Changes in the Balance sheet of Bank-a-mythica, January 2-3, 2008

Assets

Loans to car purchaser

Liabilities and Net Worth

+$40,000

Deposits of car dealer

+$40,000

As we pointed out in page 239, all of our balance sheet tables, such as Table 2 or 5, must

balance. In all such tables, which are called T-accounts, the two sides of the ledger must carry

equal total amounts. This balance is required because changes in assets and liabilities must be

equal if the balance sheet is to balance both before and after the transactions.

But Table 5 is unlikely to be the end of the story. Although the car dealer may be quite

happy to be loaded with a $40,000 bank deposit, it is most likely that the car dealer was forced

himself to take a loan when the car was initially brought into the dealership. Indeed, the car

dealer usually holds a large inventory of cars, the cost of which has to be financed by bank loans.

So it is most likely that the car dealer will use the proceeds of his sale to diminish the amount of

his outstanding loans at Bank-a-mythica. Thus, the following change, as shown in Table 6, is

likely to appear on the bank’s balance sheet.

Table 5

Changes in the Balance sheet of Bank-a-mythica, January 4, 2008

Assets

Liabilities and Net Worth

Loans to car dealer

-$40,000

Deposits of car dealer

-$40,000

The car dealer uses his newly acquired deposits to pay back the bank. The money gets destroyed!

When borrowers reimburse their loans, money gets destroyed. At the end of the week, adding

Tables 3, 4, and 5, we obtain Table 6. In the end, despite all the action, there has been no change

in the stock of money deposits. But the composition of the balance sheet of the bank has

changed, with car purchasers owing more funds to the bank, while car dealers owe less.

Table 6

Changes in the Balance sheet of Bank-a-mythica, January 2-5, 2008

Assets

Liabilities and Net Worth

Loans to car purchaser

+$40,000

Loans to car dealer

-$40,000

Total

No change

No change

Yellow Square

A Subsidiary Money Creation Channel

We said in the previous section that there were two main channels of money creation. The first

one is through banks granting new loans. The second channel is tied to changes in the

composition of financial portfolios. Money is not the only financial asset that agents can hold.

People can hold banknotes (about which more will be said later), chequable and non-chequable

bank deposits – these assets being defined as M1 money stock – as well as chequable deposits

from other financial institutions, certificates of deposits, stock market shares, mutual fund shares,

bonds, etc. Money is being created when non-financial economic agents, such as manufacturing

corporations or households, transform some of their non-monetary assets into deposits that are

defined as being money (M1, M1+, M2, M2+, etc.). This can occur either because these nonfinancial agents decide to hold a greater proportion of their financial wealth in the form of

deposits, or when banks wish to hold a bigger proportion of their assets in the form of securities

rather than in the form of outstanding loans. For this kind of money creation to occur, there has

to be a double coincidence of wants: on the one hand, non-financial agents wish to hold more

deposits; and on the other hand, banks wish to hold more assets beyond loans.

Table 7 shows how such a creation of money would occur. The non-financial agent, here Toy

Manufacturer, sells securities (for instance, government bills that it holds) and gets bank deposits

in exchange; Bank-a-mythica purchases the government bills, and credits the sale proceeds to the

deposit account of Toy Manufacturer. We may call this the portfolio-change process. The nonfinancial agent is no richer than it was before – its wealth does not change, only the composition

of its wealth has changed – but note that the size of the balance sheet of the banking system has

now risen by $1000. Both the assets and the liabilities of Bank-a-mythica have risen by $1000.

Table 7

A subsidiary money creation channel: Changes in balance sheet composition

B

Manufacturer

Toy

a

n

k

a

m

y

t

h

i

c

a

Assets

Securities +$1000

Liabilities

Deposits +$1000

Assets

Securities -$1000

Deposits +$1000

Liabilities

No change

Of course the portfolio-change process may operate in reverse gear. Manufacturer Toy

may be unhappy about the interest rate it is getting on its bank deposits at Bank-a-mythica. It may

be want to hold more of its financial assets in the form of securities, which may be slightly less

convenient but which carry a slightly higher rate of return than the interest rate on money

deposits. In this case, Manufacturer Toy may offer to buy securities at a price that will induce

Bank-a-mythica to sell them. Money, therefore, gets destroyed. The deposits of Manufacturer

Toy diminish by $1000, while its holdings of securities rise by $1000, and the size of the balance

sheet of Bank-a-mythica diminishes by $1000.

In the rest of this chapter, we will concern ourselves with the first of these two money

creating channels. From a macroeconomic point of view, the lending channel by which money

gets created is a more interesting one as it generally involves changes in income, sales and

production., which is usually not the case of the portfolio-change process.

Yellow Square

The Limits to Money Creation

One of the most striking feature of the money-creation process, especially through the lending

channel, is that there seems to be no limit to the creation of money. In a sense this is true. The

creation of money is not limited by some scarce resource such as the amount of gold that banks

have accumulated in their vaults. It is sometimes argued that this was the case in the past, and it

may have been, although economic historians argue with each other about that, but it is certainly

not the case in modern banking systems. Nowadays banks are free to lend as much as they want.

This is certainly true of our monopoly bank, but as we shall see in the next section, it is also true

even in the general case, when there are several competing banks.

Take first the case of our monocentric banking system. What could its restrictions on

lending be? The amount that the monopoly bank can lend is only limited by the three crucial

features of the banking system that we identified earlier: the willingness of the bank to grant

loans, the creditworthiness of borrowers, and the willingness of borrowers to take on loans.

As in all economic transactions, both partners to the transaction need to be willing to

engage in the transaction. For a loan to be granted, and for bank deposits to be created as a

consequence of this new loan, both the bank and the borrower have to be willing to go ahead

with this operation. Why would economic agents refuse loans that they are being offered? The

reason is that they may be unwilling to get into debt and pay interest on this debt. They may also

see no reason to spend more, or they may be scared of going bankrupt if they borrow too much or

borrow any more. Thus borrowers, on their own, may willingly put limits on the amounts they

want to borrow. By borrowing too much, they are afraid that they may lose their entire wealth or

a large part thereof. This is sometimes called the borrower’s risk.

Why would a monopoly bank be unwilling to lend? For exactly symmetric reasons. The

bank may fear that some of its clients may be unable to reimburse their loans or make the interest

payments that are due. This is the lender’s risk. If too many of the borrowers of the bank are in

this situation, the bank may become insolvent and may be closed down, as we will explain in a

short time. This is why the bank is on the look for creditworthy customers. Unless the bank is

really pessimistic about future prospects, for instance, fearing an economic recession in the near

future, thus being reluctant to increase the size of its balance sheet, the bank is always looking for

new creditworthy borrowers, or willing to increase the size of loans granted to previous

creditworthy borrowers.

But why is the bank looking for creditworthy borrowers and not just any kind of

borrower? Why does the bank fear customers who do not make their interest payments or

reimburse their loans? First, as pointed out in page 237, banks are in the business of making

profits. Besides service fees, banks make their profits on the difference between: their revenues

– the interest payments that they receive on their assets (on their loans and the securities that they

hold) and their costs – the interest payments that they have to make on their liabilities (essentially

on the deposits that people hold at the bank) plus the costs of operating a bank (the salaries of

clerks and loan officers, rentals, the costs of running the automatic teller machines, etc.). If

borrowers don’t fulfill their interest payment obligations, banks will make losses, not profits.

Bad loans have a second, less obvious, implications. Suppose the bank, by mistake,

makes a loan of $200,000 to a non-creditworthy person, and that this person turns out to be a

crook. Instead of building a prosperous business with the borrowed money, the crook spends it

all in bars, cars, and casinos. At the end of the year, the bank manager wakes up and finds out

about all this. The borrower has defaulted on the loan and has vanished; the collateral that had

been offered to get the loan is worthless. There is no way the loan can be recovered. It has to be

considered as a “bad loan”, and thus must be entirely “written off”. While this is an extreme case,

small businesses regularly go bankrupt (as sometimes do large corporations), because of poor

planning, bad luck, or changing economic conditions. Their banks can only recover a portion of

the loans that they granted. The rest has to be written off.

How will the accountants of the bank take care of this? Table 8 shows how a $200,000

bad loan is written off. Since the loan is now worth nothing, it must be removed from the assets

of the bank on its balance sheet. A minus $200,000 entry will thus need to be recorded into the

changes of the balance sheet. But a T-account must always balance by definition. What other

change must we make for the balance sheet to balance? The answer is to be found in the bank’s

capital. The bank has suffered a $200,000 capital loss, which must be subtracted from the bank’s

own funds.

Table 8

Writing-off a bad loan, Changes in the Balance sheet of Bank-a-mythica

Assets

Liabilities and Net Worth

Assets

Liabilities

Securities

no change

Chequable deposits

no change

Loans outstanding

-$200,000

Total

-$200,000

Net Worth

Bank’s capital

-$200,000

Total

-$200,000

Table 9

Balance sheet of Bank-a-mythica, December 31, 2007, after accounting for bad loan

Assets

Liabilities and Net Worth

Assets

Liabilities

Currency

$100,000

Chequable deposits

$5,000,000

Securities

$1,000,000

Loans outstanding

$4,200,000

Net Worth

Bank’s capital

$300,000

Total

$5,300,000

Total

$5,300,000

The new balance sheet of Bank-a-mythica, once the loan loss has been taken into proper

account, will thus look like Table 9, with Table 9 being the sum of Table 2, before the loss was

recorded, and Table 8, which records the change induced by the loss. In Table 9, compared to

Table 2, Bank-a-mythica has a smaller net worth, but this net worth is still positive, standing at

$300,000. Although Bank-a-mythica is not in as good a shape as it appeared in Table 2, it is still

solvent. In other words, despite the bad loan, the bank’s capital is still positive, as its assets are

still larger than its liabilities. The bank could still face a string of bad loans. Nonetheless, most

likely, the bank would be concerned about the decline in its own funds and would make an effort

to increase its capital (for instance by issuing new shares), or by being more prudent in its future

dealings and in the choice of its borrowers.

Sidebar

A solvent bank is a bank that has positive net worth. The bank’s capital is positive, so that its

assets are larger than its liabilities. An insolvent bank has negative net worth.

Suppose however that more borrowers have defaulted on their loans, for instance because

their businesses did much more poorly than what was predicted in the marketing plan. Suppose

that $900,000 worth of loans turned out to be bad loans that year. $900,000 worth of loans must

thus be subtracted from the asset side of the balance sheet of Bank-a-mythica, as shown in Table

10, and $900,000 must be subtracted from the bank’s capital. But wait! The own funds of the

bank, the bank’s capital, were only $500,000. What happens now? The net worth of the bank

becomes negative, standing at -$400,000. The bank is insolvent. Its liabilities – the deposits of

its customers – are not covered by enough assets (the sum of the securities and loans). The bank

must go under and declare bankruptcy, or its assets and liabilities have to be taken over by some

other bank.

To try to avoid such bank failures, there are minimum requirements that are applied

world-wide regarding the size of bank capital relative to the value of assets (especially the value

of risky loans). These requirements are known as capital adequacy requirements, and their

generalization to banks of many countries has been spearheaded by the Bank for International

Settlements (BIS), an international organization located in Basel, Switzerland.

Table 10

Balance sheet of Bank-a-mythica, December 31, 2007, after accounting for huge bad loans

Assets

Liabilities and Net Worth

Assets

Liabilities

Currency

$100,000

Chequable deposits

$5,000,000

Securities

$1,000,000

Loans outstanding $4,200,000 - $900,000 Net Worth

= $3,500,000

Bank’s capital

= -$400,000

Total

$4,500,000

Total

$500,000 - $900,000

$4,500,000

The lesson to be drawn from this is that Bank-a-mythica faces no limit as to the amount

of loans it can make, and therefore to the amount of money it can create, save for its own fear of

making losses and failing. What limits the creation of money is the number of creditworthy

borrowers and the willingness of these potential borrowers to borrow. If no one is willing to go

into debt, no new loan will be granted and bank deposits will not grow. As the saying goes, you

can bring a horse to water, but you cannot force it to drink!

It should also be clear that monetary relations are based on conventions – on customs.

The definition of a creditworthy borrower will not be the same in all time and space. Someone

classified as a creditworthy person today in Canada may not have been in the past or in some

other country. For instance, criteria to obtain mortgage loans are now much less stringent than

they were in the past. Also, different banks may have different opinions with regard to the

creditworthiness of the same person. Since we are talking about different banks, this is a good

time to consider the limits of money creation when several banks are operating within the

monetary system.

Box

Bank Failures

Thousands of American banks failed during the Great Depression, as they became insolvent

when the value of their assets plummeted with the downfall in economic activity, with other

banks refusing to make transactions with them when insolvency was suspected, and with these

banks often being subjected to bank runs. The surviving banks became overly cautious during the

Great Depression, denying loan demands and recalling loans that had been previously made. This

made the recession even worse, as producers lacked the financial means to produce, thus

reducing production and paid wages. As wages received diminished, household consumption also

fell. In addition, when banks went under, depositors lost the money that they had in these banks,

further reducing consumption and hence economic activity.

In Canada, not a single bank failed during the Great Depression. Still, in Canada as

elsewhere, many bank loans to companies and entrepreneurs must have turned bad, becoming

worthless as these companies and individuals went bankrupt. Most probably, some Canadian

banks, as many other surviving banks in the rest of the world, were insolvent then – a point that

was made by Keynes himself in 1931. But as long as nobody takes notice, or as long as everyone

turns a blind eye, the bank can continue to operate. This shows once more that monetary systems

rely on trust and conventions.

By contrast, as was mentioned earlier and listed in Table 1, in 1985 two Alberta-based

banks failed – the Canadian Commercial Bank and the Northland Bank, causing a bank run on at

least three other small Canadian banks. The big recession of 1981-1982, the slowdown in the oil

and gas sectors, and the concomitant large increase in interest rates are sometimes blamed for

these two failures, as the two Alberta banks were heavily involved in the regional real estate

market in Western Canada. The Estey Commission, which, as noted on page 238 was set up by

the Canadian federal government to investigate the causes of the failures, concluded that bank

management pursued imprudent lending policies and bizarre banking procedures, along with

misleading financial statements. Indeed, the failures of these two Canadian banks show some

similarities with the Savings and Loans (S&L) debacle in the United States, also in the 1980s.

S&L institutions were financial institutions similar to our credit unions or Caisses populaires.

The cause of the failure of S&Ls is well-documented. Besides difficulties caused by a mismatch

between short-term liabilities and short-term assets at a time of rising interest rates, evidence of

fraud and insider abuse, tied in particular to real estate swindles, has been uncovered, leading to

convictions of fraud and racketeering.

Regulation and bank supervision is needed, not only to restrict overly enthusiastic

bankers, but also to create an environment where financial fraud is more difficult, just like

banknotes issued by the Bank of Canada are made in such a way that they are difficult to

reproduce, to avoid counterfeiting. {End of Box}

Red Square

MONEY CREATION IN A BANKING SYSTEM WITH SEVERAL BANKS

We have seen that loans made to individuals or corporations, and hence money creation, depend

on trust. The same is true of the relations between banks. Whenever they engage in transactions

with each other, banks must trust each other, otherwise the banking system would grind to a halt,

or the banks which are not trusted by the other banks would quickly be unable to operate and

their clients would suffer great inconvenience. Well-functioning banking systems have

institutions that allow banks to make their transactions with each other with great confidence. In

Canada, transactions between banks are regulated through the Payment Clearing and Settlement

Act, which was proclaimed in 1996, and through the by-law of the Canadian Payments

Association. The Bank of Canada is a key player in this institutional setup, in particular it

oversees the payment system, but its role will be mainly discussed in the next chapter.

As is the case for individuals, the transactions between banks are closely monitored with

the help of credit ratios. These ratios depend on the amount of collateral that each bank is willing

to provide to the LVTS, and on the amount of bilateral credit limits that participants grant to each

other. The purpose of these controls is to insure that the troubles of one bank will not snowball

into other banks running into trouble – the issue of systemic risk. Collateral and trust, or

creditworthiness, are thus the kingpin of a monetary system.

Sidebar:

There is systemic risk in a payment system when the failure of one bank to meet its obligations

could lead to the failure of other banks to meet their obligations, thus jeopardizing the

functioning of the entire payment system.

Yellow Square

The Canadian Clearing and Settlement System

To understand the functioning of a banking system with multiple banks – a polycentric banking

system as Hicks would call it – let us go back to a situation which is very similar to that of our

initial example. Let us suppose that a Chevrolet car dealer must now pay for an allotment of cars

that was sent to him by the car producing company. Suppose that in order to do so the car dealer

must draw on his line of credit (See the earlier Box, “Lines of Credit”), for an amount of

$400,000, thus increasing the amounts borrowed from his bank, say the Bank of Montreal, by an

amount of $400,000, and ordering his bank to pay this amount to GM Canada. Let us suppose

that GM Canada does business with another bank, say, the Toronto Dominion Bank.

Sidebar

A line of credit is an arrangement with the bank that allows someone to borrow freely up to an

amount not exceeding an agreed figure, interest being paid not on the agreed maximum, but on

the actual average loan.

Because the amount involved is large, the payment will go through an electronic-only

payment system (instead of a paper payment system, such as is the case with ordinary cheques).

In Canada, this electronic-only wire system is called the large-value transfer system (LVTS). It

has been operating since 1999. This is a clearing and settlement system, in which banks and a

few other participants in the LVTS, such as the Fédération des caisses Desjardins and more

importantly the Bank of Canada, clear their payments and settle their accounts. About 90 percent

of the value of bank payments go through the LVTS. From now on, the participants to the LVTS,

save the Bank of Canada, will simply be referred to as “banks”.

SIDEBAR

Clearing is the continuous daily process by which banks exchange and deposit payment items

for their clients, and determine the net amounts owed to each.

Settlement is the end-of-day procedure by which banks use borrowing and deposit facilities at

the Bank of Canada to fulfill their net obligations to all other banks.

Before any large transaction goes through between two banks (before it clears), a

computerized system verifies that the debit position of the paying bank is not too large. Once the

controls within the system are all satisfied, the transaction clears and the payment is irrevocable.

It cannot be reversed. If a bank were to fail by the end of the day, before final settlement, the

collateral pledged by the failing bank or the collateral pledged to the LVTS by the remaining

banks would be enough to cover any amount due by the failing bank. In our car dealer example,

as soon as the $400,000 payment from the Bank of Montreal to the Toronto Dominion bank is

cleared, a $400,000 amount is deposited in the bank account of the car producer, GM Canada,

and that payment is final. It cannot be revoked.

Thus a loan is initially granted by the Bank of Montreal, with deposit money created

therein, but the deposit eventually ends up in an account at the Toronto Dominion Bank. How

will all this be entered in the balance sheets of the two banks at the moment that the transfer to

the account of GM Canada occurs? Let us look at Table 11.

Table 11

The money creation channel with two different banks: Intraday Changes in balance sheets

Bank of Montreal

Assets

Liabilities

Loans to Chevrolet car

dealer +$400,000

Toronto Dominion Bank (TD)

Assets

Liabilities

LVTS balances

Deposits of GM

+$400,000

Canada

+$400,000

LVTS balances

-$400,000

Assets

LVTS

Liabilities and Net Worth

Balances of Toronto Dominion Bank

+$400,000

Balances of Bank of Montreal

-$400,000

The trick to understand what is going on is to remember that all balance sheets must

balance. If the Bank of Montreal has made more loans than it has collected deposits, and if the

Toronto Dominion Bank has collected more deposits than it has made loans, as is the case in our

instance illustrated by Table 11, there has to be some adjustment mechanism that will make the

T-accounts balance.

The Chevrolet car dealer has ordered his bank to transfer $400,000 of his newly acquired

money to the deposit account of GM Canada at the Toronto Dominion Bank. Now, as shown in

the bottom part of Table 11, once the transfer is recorded through the LVTS, the Bank of

Montreal owes this $400,000 amount to the clearing system – it is said to have a negative LVTS

balance or to have a debit LVTS position – while the Toronto Dominion Bank is said to hold a

positive LVTS balance or to have a credit LVTS position. The system owes the Toronto

Dominion Bank $400,000.

SIDEBAR

The LVTS balance of a bank is the multilateral clearing position that the bank has accumulated

within the large-value transfer system in the course of the day. When the bank is in a net credit

position, the balances are positive; when the bank is in a net debit position, the balances are

negative.

Things may change quite rapidly however. During the same day, it may be that GM

Canada has to pay its suppliers, producers of metals or plastics, several of whom may be holding

accounts at the Bank of Montreal. In that event, payments will have to flow from the Toronto

Dominion Bank towards the Bank of Montreal, and the positive LVTS balances of the Toronto

Dominion Bank may get reduced close to zero, or may even become negative. And as further

payment orders come in during the day, there will be further changes to the net position of each

of bank. These changes can be quite large, so that each morning each participant decides how big

a bilateral credit line it grants to each of the other participants, on the basis of their credit

assessment. In addition, a central computer calculates the position of each participant on a

payment-by-payment basis, so that each bank is aware of its overall position and that of every

other bank. The net amount that each participating financial institution is permitted to owe is

subject to bilateral and multilateral limits. Various whistles go off when one bank goes too far in

a negative position. In that case, the bank with the excessive negative position will have to wait

till it receives transfers from the other banks before it can go ahead with the payments ordered by

its depositors .

Box

Gross Flows of Payments and Net Balances in the Large-Value Transfer System

The Canadian LVTS is unique among clearing and settlement systems in the world, and is highly

cost efficient. In other countries, to insure payment finality, large-value payments involve an

immediate transfer of funds on the settlement accounts of banks, on the books of the central

bank. But each clearer must hold central bank deposits that are sufficiently large to cover any

possible outgoing payment. In Canada, settlement only occurs at the end of the day, on a

multilateral basis, but payment finality is guaranteed as soon as the payment is being accepted by

the system and thus clears, thanks to the collateral arrangements mentioned above.

The following numerical example may help to explain how the main Canadian clearing

and settlement system – the LVTS – works. Suppose the following transactions occur between

three banks that participate in the LVTS during the day (the numbers are not unreasonable, given

that on average, in 2006, no less than $166 billion worth of payments did transit through the

LVTS every day – about one ninth of Canada’s annual GDP!)

The Bank of Montreal (BMO) makes payments of $30 billion to depositors of the Toronto

Dominion Bank (TDB).

The Bank of Montreal (BMO) makes payments of $30 billion to depositors of the Canadian

Imperial Bank of Commerce (CIBC).

The Toronto Dominion Bank makes payments of $22 billion to depositors of the Bank of

Montreal.

The Toronto Dominion Bank makes payments of $20 billion to depositors of the Canadian

Imperial Bank of Commerce.

The Canadian Imperial Bank of Commerce makes payments of $40 billion to depositors of

the Bank of Montreal.

The Canadian Imperial Bank of Commerce makes payments of $18 billion to depositors of

the Toronto Dominion Bank.

The following table sums up these transactions and their implications with regards to the

settlement balances of the three banks.

Owed to 6

Owed by

BMO

TD

CIBC

Ó Amounts

owed to

BMO

22

40

62

TD

CIBC

30

30

20

18

48

50

Ó amounts

owed by

(debits)

60

42

58

150

Ó amounts

owed to

(credits)

62

48

50

150

LVTS

balances

+2

+6

-8

0

Although there have been transactions reaching a total gross amount of $150 billion, the net

amounts involved are much smaller, with the Bank of Montreal being left with $2 billion of

positive LVTS balances. In other words, the Bank of Montreal is here in a net credit LVTS

position. The Toronto Dominion Bank has a LVTS positive balance of $6 billion, while the

Canadian Imperial Bank of Commerce holds the difference, a $8 billion negative LVTS

balance (a net debit LVTS position). It would be easy to build other examples where the total

amount of positive balances is even smaller, despite actual daily transactions being of a larger

size. Thus the size of positive LVTS balances is only very indirectly related to the amount of

monetary transactions or the volume of economic activity. It is a random number that

depends on the relative size of incoming and outgoing payments for each LVTS participant.

{END OF BOX}

But suppose now that we have reached the end of the day, and that the situation is that

described by Table 11, with the Bank of Montreal still being in a $400,000 debit LVTS position

(a negative LVTS balance). Can such a situation last? As we will see in the next chapter, in a

sense it could. But there are economic incentives for this situation to be reversed. The banks that

have positive LVTS balances will usually lend them to the banks that have negative balances!

This will occur on a segment of the overnight market – the interbank market – where banks

make loans to each other. In the present case, at the end of the day, the Toronto Dominion Bank

can grant a one-night loan of $400,000 at the overnight rate of interest to the Bank of Montreal.

This generates a LVTS credit (positive) flow of $400,000 for the Bank of Montreal, and a

negative LVTS flow of $400,000 for the Toronto Dominion Bank, as shown in Table 12, thus

allowing both banks to bring their LVTS balances to zero (when Tables 11 and 12 are added).

The end result for the balance sheet of each bank is shown in Table 13.

SIDEBAR

The interbank market is the financial market where banks lend and borrow surplus funds

between themselves for one night.

The overnight market is the financial market where banks and other financial market

participants (investment dealers, pension funds, large corporations, trust companies, the

Government of Canada) lend and borrow surplus funds for one night. The overnight market has

three components, one of which is the interbank market.

Table 12

The Toronto Dominion Bank Grants an Overnight Loan to the Bank of Montreal: Change

in LVTS balances

LVTS

Assets

Liabilities and Net Worth

Balances of Toronto Dominion Bank

-$400,000

Balances of Bank of Montreal

+$400,000

Table 13

The Money Creation Channel with two Different Banks: Overnight Changes in balance

Sheets

Bank of Montreal (BMO)

Toronto Dominion Bank (TD)

Assets

Liabilities

Assets

Liabilities

Loans to Chevrolet car Funds borrowed from Advances made to

Deposits of GM

dealer +$400,000

TD

Bank of Montreal

Canada

+$400,000

+400,000

+$400,000

LVTS balances

LVTS balances

$0

$0

Once again we can draw lessons from this example. First, it is clear that the polycentric

banking system relies on trust and creditworthiness. Banks have to be sufficiently confident in

other banks and in the clearing and settlement system to accept that other LVTS participants run

temporary negative balance positions during the day, and to grant overnight loans to banks that

end the day with a deficit LVTS position. Indeed, as we noted earlier, institutions have been set

up so that transactions can be carried with very little risk. In addition, as long as all banking

institutions are “moving in step”, granting loans and collecting deposits at approximately the

same pace, the situation of a polycentric banking system is not very much different from a

monocentric one, because on average, over a period of weeks, the positive and negative positions

will compensate each other for each bank, although they will not on an hour per hour basis.

When some banks are growing faster than others, with their loans growing faster than

those of other banks, things are more complicated, as these fast-growing banks will show net

debit LVTS positions systematically, unless they find other means to compensate for the

discrepancy between loans and deposits. In the United States, New York City banks

systematically run deficit clearing positions, and so do some banks in Europe. There are basically

two ways through which banks that run systematic clearing deficits avoid borrowing extensively

from other banks. First, they can offer certificates of deposits, at attractive interest rates, that are

purchased by the banks or other financial market institutions that have surplus funds. This is

called liability management. This often involves another segment of the overnight market – the

market for overnight wholesale deposits. Second, once they have granted new loans, they can sell

bunches of loans to banks or financial institutions that are in a surplus position. This is an

instance of securitisation, whereby a loan is transformed into a financial vehicle that can be sold,

just like a security.

SIDEBAR

Liability management is the process through which banks attempt to obtain funds, for instance

by offering certificates of deposits at attractive interest rates, and hence attracting wholesale

deposits.

Securitisation is the process through which illiquid financial assets – assets that cannot be sold

easily, such as mortgages – are transformed into marketable instruments – financial assets that

can easily be sold and purchased.

At this stage it should be clear that, in a modern monetary system such as the Canadian

one, nothing, besides the prudence of bankers and the self-restraint of borrowers, limits the

creation of credit and that of money. This feature of our monetary system, the fact that the

creation of money is essentially endogenous, has advantages. It provides flexibility to the

monetary system: monetary units get easily created when the economy is expanding and there is a

need for additional units of money for production and transaction purposes. However, as for most

things, there is a downside to this flexibility.

In all likelihood, when the economic perspectives are bad, bankers and their customers

will tend to be extra prudent. However, when economic perspectives look good, both bankers

and their clients may become overly enthusiastic. Demand for credit may quickly rise and

bankers are likely to grant new loans at an accelerating pace, attributing creditworthy status to

nearly all income earners. With loans increasing, so will the stock of money. On the basis of

supply and demand analysis, one could then argue that this process ought to lead to rising interest

rates – the cost of loans – and that this would then somewhat restrain the demand for loans and

the growth of the money supply. But what happens is that both the demand for and the supply of

loans increase in tandem, as bankers are just too happy to finance the expenditures that their

customers desire. Hence, with demand and supply growing together, under these circumstances

there is no inherent market force pushing interest rates upwards.

If such a process persists, at some stage the rising demand for credit and money will

outpace the growth of potential output. An inflationary gap will appear, and the inflation rate

will start rising. In addition, as has happened in the past, speculative bubbles may erupt, leading

to fast-rising prices in the stock market or in the real estate market which may further disrupt the

economy. Some outside intervention is necessary.

THE BANK OF CANADA: MONETARY POLICY IMPLEMENTATION

Monetary policy can be conceptually divided into two components: monetary policy strategy

and monetary policy implementation. Monetary policy strategy is closely tied to monetary

macroeconomics. It deals with the macroeconomic goals of the central bank, for instance

achieving a target inflation rate or a given growth rate of economic activity, and how best to

achieve them, especially when goals may be conflicting over the short run. It also deals with the

monetary stance and the transmission mechanism of monetary policy – the decision to change the

value of some monetary variable under the control of the central bank and how this change will

impact the macroeconomic objectives. In other words, monetary policy strategy depends on the

macroeconomic model that lies behind the actions of the central bank.

SIDEBAR: Monetary policy strategy is the decision that the central bank takes about some

monetary variable that constitutes its operational target, for instance a short-term rate of interest

that it can control, with the view of influencing or achieving some macroeconomic outcome or

target, for instance a certain rate of inflation.

Monetary policy implementation is the set of rules, instruments and day-to-day actions

that allow the central bank to implement its operational target.

By contrast monetary policy implementation deals with the day-to-day, or even the hourper-hour, operations of the central bank. We can say that it corresponds to the nitty-gritty aspects

of monetary policy. Monetary policy implementation is made up of two elements – the

operational target and the operational instruments – both of which must be under the control of

the central bank if monetary policy implementation is to be successful. Today, there is a wide

consensus among central bankers that the operational target ought to be a short-term interest rate.

In Canada, this operational target is the overnight interest rate on collateralized transactions.

This is the rate of interest that arises from the overnight market, which we already encountered in

Chapter 12 when discussing the clearing and settlement system of Canadian banking. It is the rate

at which banks and other financial market participants lend and borrow from each other for one

night, using or searching for surplus funds fully secured by acceptable collateral. The operational

target of the Bank of Canada is thus the target overnight interest rate.

SIDEBAR: The overnight interest rate is the interest rate that banks and other financial market

participants pay and receive when they borrow and lend surplus funds from each other for one

day, in particular when banks borrow and lend LVTS balances from one another.

The target overnight interest rate is the operational target of the Bank of Canada; it is

the overnight rate that the central bank would like to see realized.

In what follows we examine the operational framework – the technical instruments that

allow the Bank of Canada to achieve its operational target. In other words, we first deal with

monetary policy implementation. Monetary policy strategy – the choice of the value taken by the

operational target – will be studied once we know how the central bank implements its decisions.

Yellow Square

The Corridor System

How the operational target gets implemented in the Canadian monetary system is a simple story.

Unless there are special circumstances, the Bank of Canada makes an announcement eight times

a year, in the early morning at specific dates, as to what its target overnight interest rate will be

until the next announcement. Et voilà!

The Bank of Canada accompanies its new rate announcement with an explanation of its

decision to decrease, increase or keep constant the target overnight rate (See the Box “Bank of

Canada Press Release”). These justifications have more to do with monetary policy strategy, and

hence they will be dealt with later. In the meantime what must be noted is that the target

overnight rate is accompanied by an operating band, which is made up of two additional interest

rates that stand below and above the target overnight rate. These two rates are respectively the

interest rate on deposits at the central bank and the interest rate on advances made by the

Bank of Canada to the banks that participate in the Large Value Transfer System (the LVTS, as

we called it in Chapter 12). This latter rate is also called the Bank rate. These two interest rates

thus determine the operating band. This band looks like a corridor – a channel or a tunnel – thus

leading this operating framework to be called the corridor system, as shown in Figure 1.

SIDEBAR

The Bank rate is the interest rate charged to banks that still have negative LVTS balances at the

end of the day, and hence that must take advances (borrow funds) for one night from the Bank of

Canada in order to settle with the LVTS.

The interest rate on deposits at the central bank is the rate of interest that banks get on their

deposits at the Bank of Canada as a result of the operation of the LVTS. Banks with positive

LVTS balances must deposit them in their account at the Bank of Canada when settlement occurs

at the end of the day.

The operating band is the zone of overnight rates comprised between the Bank rate and the

interest rate on bank deposits at the central bank.

The corridor system is the operating framework adopted by the Bank of Canada which forces

the overnight interest rate to remain within the operating band and close to the midpoint of the

band, as defined by the target overnight rate.

Figure 1

The Target Overnight Interest Rate with its Operating Band

Figure 1 illustrates the case where the target overnight rate of interest is 4.25 percent. As a

result, the Bank rate is set at 4.50 percent, since the Bank rate is always set at one quarter of one

percent (or 25 basis points, as financial market specialists say) above the target overnight rate.

Symmetrically, the interest rate on deposits at the Bank of Canada is set at 25 basis points below

the target overnight rate. As a result, the operating band is 50 basis points wide.

The Bank of Canada thus acts as a price-fixer with respect to the short-term interest rate.

It constrains the values that the overnight interest rate can take by setting both a floor and a

ceiling to the values that can be taken by the overnight interest rate. The Bank of Canada

promises to take as a deposit, paid at a 4 percent rate, any amount of positive LVTS balances

held by an individual bank; and it promises to grant advances, at a 4.5 percent cost, to any

individual bank that has negative LVTS balances (provided the bank has adequate collateral).

The overnight rate can, in theory, take any value within the operating band, the range of which is

given by the grey area in Figure 1. But it cannot get outside this band. It is constrained within a

corridor. Why is this so? Why does the Bank of Canada have the power to influence so much the

overnight rate? The essential reason for this is that in Canada, as in virtually all countries, all

payments must eventually settle on the books of the central bank, here the Bank of Canada.

{In RED} Recall from Chapter 12 that payments go through two steps: first they are cleared,

then they are settled. The main clearing system is the Large-Value Transfer System (LVTS).

Clearing is the daily process by which banks exchange and deposit payment items for their

clients, and determine the net amounts owed to each. Settlement is the procedure by which banks

use claims on the Bank of Canada to fulfill their net obligations to all other banks at the end of

the day.

The Bank of Canada is the settlement agent of the LVTS. Banks need to settle with the LVTS at

the end of the day, and they must do so on the books of the Bank of Canada. The Bank of Canada

provides settlement accounts to LVTS participants; it provides funds to those that need to cover

their settlement obligations (those that have negative LVTS balances at the end of the day); and it

transfers claims on itself for those banks ending the day with positive LVTS balances. {End of

Red}

Suppose, as was the case in the example of Table 11 in Chapter 12 which we partly

reproduce here as the top of Table 1, that the Bank of Montreal has a net debit LVTS position

(negative LVTS balances) by the end of the day. How much is it willing to pay other banks to

borrow balances from them and bring its LVTS balance position back to zero? Clearly it is not

willing to pay an interest rate higher than 4.50 percent since this is the rate that the Bank of

Canada will charge to banks with negative LVTS balances. If all other banks were offering to

charge more than 4.50 percent to lend LVTS balances, the Bank of Montreal would turn down

these offers and would simply take an advance from the Bank of Canada at the Bank rate of 4.50

percent.

Now, what about the banks that have positive LVTS balances? What is their reasoning?

Suppose, as shown in the top part of Table 1, that the Toronto Dominion Bank has a net credit

LVTS position. What is the minimum interest rate that will induce the TD Bank to lend its

balances to other banks (thus also bringing its LVTS balance position back to zero)? Clearly, it

needs to get paid more than 4.00 percent, since this is the rate that it would get anyway if it were

to leave its LVTS balances as a deposit at the Bank of Canada. If no deal can be struck between

the Bank of Montreal and the Toronto Dominion Bank, then the balance sheet of the Bank of

Canada will be as shown in Table 2. The Toronto Dominion Bank will be granted a claim on the

Bank of Canada – its LVTS balances will be brought down to zero and transformed into an

overnight deposit at the Bank of Canada; as to the Bank of Montreal, it will have to borrow

$400,000 from the Bank of Canada to bring its LVTS balances back to zero.

Table 1

Balance Positions of Banks in the LVTS

Intra-day LVTS, Before Settlement

Assets

Liabilities and Net Worth

Balances of Toronto Dominion Bank

+$400,000

Assets

Balances of Bank of Montreal

-$400,000

End-of-day LVTS, After Settlement

Liabilities and Net Worth

Balances of Toronto Dominion Bank

+$0

Balances of Bank of Montreal

+$0

Table 2

Balance Sheet of Bank of Canada, with no Deal Struck Between Banks

Bank of Canada

Assets

Liabilities and Net Worth

Advance to the Bank of Montreal,

Deposits of Toronto Dominion Bank,

at 4.50 percent

at 4.00 percent

+$400,000

+$400,000

The overnight interest rate, that will arise out of the negotiations between potential

lenders and borrowers of overnight funds will thus have to be somewhere between 4.00 and 4.50

percent. Indeed, unless there are some unusual circumstances, the realized overnight rate will

turn out to be very close to the middle of the operating band, at the target overnight rate – in the

case of Figure 1 it will stand at 4.25 percent, or very close to it, say at 4.23 or 4.24, or perhaps

4.26 percent. There are essentially two reasons for this. First, the banks know that the Bank of

Canada wishes the overnight rate to be around 4.25, and that it will intervene if the actual rate

keeps drifting away from the target rate. Secondly, competition should bring the overnight

interest rate near the middle of the operating band, because at that point the opportunity gain of

the lenders and that of the borrowers are precisely the same, being equal to 25 basis points for

both groups of participants to the overnight market.

Figure 2 shows the evolution of the daily differences between the actual overnight rate

and the target overnight rate since 2006, expressed in basis points. Obviously, except for a few

hiccups, the actual rate is equal, or nearly equal, to the target rate. On average, throughout 2006

for instance, the actual rate was 2 basis points lower than the target rate (the discrepancy was

negative on average).

Figure 2:

The Actual Overnight Interest Rate Versus the Target Overnight Interest Rate in Canada, 20062007

Source: Statistics Canada, series v39079 and v39050

Note: Difference is in basis points (A 100 basis point difference equals an interest rate difference

of 1 percent: 4.30 percent versus 4.25 percent is 5 basis points)

{In RED} The Canadian monetary policy implementation framework is such that the realized

overnight interest rate is always, or nearly always, at the mid-point of the operational band, at the

target overnight rate, or within just a few basis points of the target set by the Bank of Canada.

The operational target of the Bank of Canada – the overnight interest rate – is well under its

control. {END RED INK}

Although several countries in the rest of the world have implemented operating

procedures that are highly similar to those of the Canadian monetary system, few manage to drive

the realized overnight rate towards its target level with as much consistency and precision as the

Bank of Canada does. Why is this? It may be because there are very few participants to the

LVTS, which simplifies things for the Bank of Canada. But the main reason is that the

operational instruments create incentives for each bank to target a zero LVTS balance position,

while the Canadian clearing and settlement system allows the Bank of Canada to know with

perfect certainty its own LVTS position by the end of the day. This is not the case in most of the

other monetary systems in the rest of the world, which explains why most other central banks are

not as successful as the Bank of Canada in achieving their operational target interest rate on a

day-to-day basis. However, these other central banks, such as the Federal Reserve System in the

United States, usually manage to achieve overnight rates (called the federal funds rate in the

United States) which are equal, on average over a monthly basis, to their target. The overnight

interest rate is thus nowadays the operational target of virtually all central banks.

Yellow Square

Government Deposit Shifting

As long as LVTS transactions only involve banks, and not the public sector, whenever a bank is

in a deficit position, i.e., whenever it has negative LVTS balances, there is another bank, or a

group of other banks, that has an identical surplus position, i.e., positive LVTS balances, as

described by Table 1. In other words, under the above condition, the net overall amount of LVTS

balances held by banks – the sum of positive and negative LVTS balances of each bank – is zero

at all times.

Things are entirely different when payment transactions involve the federal government

or the central bank. This will be the case when the federal government pays its employees, when

it collects taxes, when the Bank of Canada purchases or sells foreign currencies on foreign

exchange markets on behalf of government, when it provides banks with currency, or when it

undertakes transactions in government securities with banks or dealers. In all these instances, one

bank may be in a LVTS deficit position without any other bank being in a surplus position; or

one bank may be in a LVTS surplus position, with none of the other banks being in a deficit

position. In this case, the net overall amount of LVTS balances held by banks – the amount of

settlement balances as they are called at the Bank of Canada – will be different from zero.

Sidebar:

Settlement balances are the net aggregate amount of LVTS balances held by banks, that is the

sum of positive and negative LVTS balances of each bank.

Why do monetary transactions involving the federal government or the central bank

disrupt the symmetric behaviour of positive and negative LVTS balances? To examine the

peculiarity of federal government transactions, let us suppose that we are around the end of April,

when taxpayers are sending in their tax returns with their tax payment. Take the example of a

wealthy taxpayer who has to send in an additional $60,000 in federal tax, assuming that it goes

through the LVTS. Table 3 summarizes what happens in the payment system.

Table 3

The Impact of Federal Government Collecting Tax Revenues on Intraday Changes in

Balance Sheets

Bank of Montreal (BMO)

LVTS

Bank of Canada (BofC)

Assets

Liabilities

Assets

Liabilities

Assets

Liabilities

LVTS

Deposits of

Balances of

Deposits of

balances

taxpayer

BMO

Canadian

-$60,000

-$60,000

$-60,000

government

+$60,000

Balances of LVTS

BofC

balances

$+60,000

+$60,000

We assume here that the wealthy taxpayer is a customer of the Bank of Montreal. The

Bank of Canada is the fiscal agent of the Canadian government; in other words the Bank of

Canada handles the payments of the federal government. When the taxpayer orders the Bank of

Montreal to make the $60,000 payment, the account of the federal government at the Bank of

Canada gets credited with $60,000 while the LVTS balances of the Bank of Montreal get

diminished by $60,000. The net aggregate amount of LVTS balances held by banks thus

diminishes. Payments to the federal government thus constitute a drain on settlement balances. If

nothing else occurs, the Bank of Montreal will be looking in vain for a counterparty in its efforts

to borrow funds in the overnight market since no bank has compensatory positive LVTS

balances. This will tend to push the overnight rate above the target overnight rate, towards the

Bank rate, since some banks, here the Bank of Montreal, will be forced to borrow from the Bank

of Canada at the Bank rate. The target overnight rate would not be achieved.

What can the Bank of Canada do to avoid such a situation? The Bank of Canada must

pursue neutralizing operations that will neutralize the impact of government transactions on

settlement balances. In other words, the Bank of Canada will take measures to bring back to zero

the amount of settlement balances. The actions taken to modify settlement balances are described

as settlement-balance management, or in short cash setting.

SIDEBAR:

Cash setting, or settlement-balance management, is the action that the Bank of Canada takes to

bring back the supply of settlement balances to their desired level, usually zero. Cash setting is

usually carried by shifting government deposits between the central bank and banks.

In the present case, the Bank of Canada shifts Canadian government deposits back to the

banks. Suppose that it does so, with $60,000 worth of government deposits being shifted to the

government account at the Bank of Montreal, as shown in Table 4. In reality the deposits are

auctioned off, with the banks offering the highest rate getting the government deposits. Suppose

that in this case, the Bank of Montreal acquires $60,000 worth of LVTS balances when the

auction is completed. Adding Tables 3 and 4, we obtain Table 5, which shows that the system is

back to a situation with a zero amount of settlement balances. The payment flows have been

entirely neutralized.

Table 4

The Impact of a Shift of Government Deposits into Banks on Intraday Changes in Balance

Sheets

Bank of Montreal (BMO)

Assets

Liabilities

LVTS

Deposits of

balances

government

+$60,000

+$60,000

LVTS

Assets

Liabilities

Balances of

BMO

$+60,000

Balances of

BofC

$-60,000

Bank of Canada (BofC)

Assets

Liabilities

Deposits of

Canadian

government

-$60,000

LVTS

balances

-$60,000

Table 5

The Neutralizing Impact of a shift of Government Deposits into Banks Following a Federal

Government Revenue Inflow

Bank of Montreal (BMO)

Assets

Liabilities

LVTS

Deposits of

balances

taxpayer

$0

- $60,000

LVTS

Assets

Deposits of

government

+$60,000

Liabilities

Balances of

BMO

$0

Balances of

BofC

$0

Bank of Canada (BofC)

Assets

Liabilities

Deposits of

Canadian

government

$0

LVTS

balances

$0

The process is quite similar when banks need additional banknotes issued by the Bank of

Canada – so they can feed their automatic teller machines and respond to the demand of their

customers who wish to hold and make use of more banknotes. Withdrawals of banknotes from

the central bank are made as needed by the banks. In other words, whenever the demand for

banknotes rises, more banknotes are being supplied by the Bank of Canada. Banks receive the

banknotes and are debited with negative LVTS balances. These are then neutralized at the end of

the day by shifting the appropriate amount of government deposits from the central bank to the

banks.

We may now examine, more quickly, what happens when the federal government makes

a payment, for instance when it pays for the report of a private-sector economist on the future

competitiveness of the Canadian economy. This time the bank winds up with positive LVTS

balances as a result of the government payment, as shown in Table 6. If the public sector and the

bank of Canada engaged in no further transactions, the Bank of Montreal would be forced to

deposit its LVTS balances at the Bank of Canada, and the actual overnight rate would tend to fall

towards the rate on deposits at the central bank. To stop this, the Bank of Canada must bring the

amount of settlement balances back to zero. Once again, it will do so by shifting the deposits of

the federal government, but this time from its accounts at banks towards its account at the central

bank, as shown in Table 7.2 As a result, as can be seen in Table 8 (which adds Tables 6 and 7),

the federal government payment transaction is neutralized, with the net amount of settlement

balances in the system being brought back to zero. In all likelihood, the actual overnight rate will

be close to the target.

Footnote 2: In reality, the Bank of Canada will auction an amount of government deposits that is

smaller than the amount maturing on that day (and hence returning to the government account at

the Bank of Canada, formally called the Receiver General balances).

Table 6

The Impact of Federal Government Expenditures on Intraday Changes in Balance Sheets

Bank of Montreal (BMO)

Assets

Liabilities

LVTS

Deposits of

LVTS

Assets

Liabilities

Balances of

Bank of Canada (BofC)

Assets

Liabilities

Deposits of

balances

+$60,000

economist

+$60,000

BMO

$+60,000

Balances of

BofC

$-60,000

Canadian

government

-$60,000

LVTS

balances

-$60,000

Table 7

The Impact of Shifting Government Deposits from Banks to the Central Bank on Intraday

Changes in Balance Sheets

Bank of Montreal (BMO)

Assets

Liabilities

LVTS

Deposits of

balances

government

-$60,000

-$60,000

LVTS

Assets

Liabilities

Balances of

BMO

-$60,000

Balances of

BofC

+$60,000

Bank of Canada (BofC)

Assets

Liabilities

Deposits of

Canadian

government

+$60,000

LVTS

balances

+$60,000

Table 8

The Neutralizing impact of a Shift of Government Deposits into the Account at the Central

Bank Following a Federal Government Expenditure Outflow

Bank of Montreal (BMO)

Assets

Liabilities

LVTS

Deposits of

balances

economist

$0

+ $60,000

Deposits of

government

-$60,000

LVTS

Assets

Liabilities

Balances of

BMO

$0

Balances of

BofC

$0

Bank of Canada (BofC)

Assets

Liabilities

Deposits of

Canadian

government

$0

LVTS

balances

$0

{In RED} When the federal government receives a payment (taxes), the banking system as a

whole is put in a negative settlement balance position; when the federal government makes a

payment (expenditures), the banking system as a whole is put in a positive settlement balance

position.

To neutralize the effects of financial payments received by the federal government, the

Bank of Canada shifts government deposits from the central bank to banks; to neutralize the

effects of financial payments made by the federal government, the Bank of Canada shifts

government deposits from banks to the central bank. {END of RED}

The Bank of Canada transfers government deposits twice a day. It does so first in the

early morning, when most of the bank payments through the LVTS are made. It does it again late

in the afternoon, after all bank payments involving the federal government have been made.

When this second adjustment is being carried, the Bank of Canada knows with certainty how

much settlement balances there are in the system. The Bank of Canada is thus able to calculate

the exact amount of government deposits that need to be shifted to achieve a zero amount of net

settlement balances, as occurred in our examples of Tables 5 and 8. Unless there are some

unusual circumstances, the amount of government deposits being auctioned will be such that the

amount of settlement balances is indeed zero by the end of the day. In other words, the Bank of

Canada normally targets a zero amount of settlement balances.

{IN RED} Under normal circumstances, the net amount of settlement balances in the system is

zero at the end of the day. The amounts of positive LVTS balances held by some banks are

exactly equal to the amounts of negative LVTS balances held by the other banks. {END of RED}

Thus, despite the existence of government payment transactions, the situation by the end

of the day is exactly the one that was described in Chapter 12, in Table 11. Thus any bank with a

net debit LVTS position that needs to borrow funds to settle its position is aware that there is at

least one other bank with an offsetting net credit LVTS position, which is a potential lender of

LVTS balances. These banks will meet on the overnight market and the rate of interest on which

they will agree to borrow or lend will be the overnight interest rate. All bank payments involving

a client come to a close at 6:00 pm, with banks being given an additional half hour to interact one

last time on the overnight market, lending their remaining positive balances or borrowing from

other banks when they are in a debit LVTS position. Hence each individual bank is able to bring

its LVTS balances to zero, thus avoiding having to take overnight advances from the central bank

at the Bank rate or avoiding depositing its positive LVTS balances for the night at the Bank of

Canada, as was described in the example of Table 13 of Chapter 12.

It follows that, whatever the size of GDP or the size of daily transactions, under normal

circumstances, bank deposits at the Bank of Canada are zero or very close to zero, while

advances by the Bank of Canada are also zero or next to zero. This can be verified with a look at

Figures 3 and 4, which show the evolution of overnight bank deposits at the central bank and

overnight advances taken by banks at the Bank of Canada. The magnitude of these deposits and

advances, a few dozen million dollars on average with a few spikes in the hundreds of millions,

is dwarfed by the size of daily transactions through the LVTS – more than $165 billions, and the

size of monetary aggregates such as M2 – over $750 billions! These few dozen millions are

peanuts when measured by the scale of the Canadian monetary system, and hence can be

considered as being virtually equal to zero. Actually, to “grease” the wheels of the payment

system, the Bank of Canada purposefully targets an amount of $25 million in positive settlement

balances as of 2007. A banking officer that lets this amount as an overnight deposit at the Bank

of Canada, instead of lending it in the interbank market, foregoes about $175 in interest!

Figure 3:

Bank Deposits at the Bank of Canada

Source: Statistics Canada, series v36629, weekly series

Figure 4:

Bank of Canada Advances to Banks

Source: Statistics Canada, series v36634, weekly series

What would be abnormal or unusual circumstances? A well-known instance occurred

when the World Trade Centre in the financial centre of New York was subjected to two airplane

attacks on September 11, 2001. The Bank of Canada, along with other central banks, made it

clear that it would alleviate any fear of financial disruption by providing the monetary system

with the additional liquidity that was being demanded by the banks and other financial

institutions. For more than a week, the Bank of Canada set settlement balances at levels of

several hundreds of million dollars. This was done with appropriate government deposit shifting

actions. These settlement balances were then gradually brought back to zero. Technical factors

have also forced occasionally the Bank of Canada to set settlement balances at negative levels in

2006 and 2007.

In other words, the Canadian monetary system is such that the overall demand for