American Marketing Association Collegiate Case Competition

advertisement

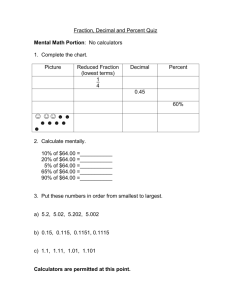

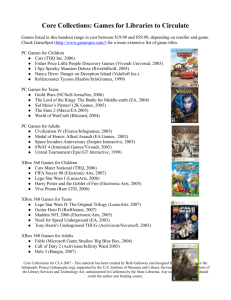

2010-2011 American Marketing Association Collegiate Case Competition Sponsored by Nintendo Co., Ltd. Invitation to AMA Chapters…………………………………………………………. Nintendo Case Challenge……………………………………………………………. The Target Audience………………………………………………………………… Nintendo Products…………………………………………………………………… Evaluative Criteria…………………………………………………………………… 1 1 2 3 6 INVITATION TO AMA CHAPTERS In 2009, 63% of Americans had played a video game at least once in the last 12 months. Nintendo’s strategy in the Americas – the United States, Canada, and Latin America - is to continue expansion of the gaming population. The American Marketing Association’s 2010-2011 Case Challenge is to develop an integrated marketing communications plan for Nintendo’s current line-up of console, portable gaming devices, and software in the United States. Specifically, without creating any new software or hardware devices, identify new or underdeveloped market segments and provide an Integrated Marketing Communications (IMC) plan that will attract current non-gamers in the United States. Nintendo Co., Ltd. welcomes all collegiate chapters to participate in the 2010-2011 American Marketing Association’s Collegiate Case Competition and provide your analysis, interpretation, and suggestions. Please note that by participating in the case competition, all members of your team agree to keep the information in the case confidential. Also, all case submissions become the sole property of the corporate sponsor, Nintendo. NINTENDO CASE CHALLENGE Based in Kyoto, Japan, Nintendo Co., Inc. develops and markets game consoles, portable gaming devices, and software worldwide. Through the years, Nintendo has been responsible for such products as Donkey Kong, Nintendo Entertainment System (NES), Super Mario Bros., Game Boy, Nintendo 64, Nintendo Game Cube, Pokemon, Nintendo DS, and Wii. Established in 1889 in Japan, the company first began selling playing cards. In 1963 the company adopted the Nintendo name and began selling games and toys. Nintendo of America, Inc was established in 1980. Nintendo’s first home video game console was launched in 1982. Nintendo’s basic strategy is to expand the potential gaming market. Your challenge is to create a sales and marketing plan that will reach current non-gamers in the United States. Teams can be as creative as they would like, however, your recommendations should be solely in the area of sales and marketing of currently existing products. Nintendo is not interested in hardware or software development ideas at this time. Case judges will read and evaluate your team’s written case submission with special attention to the following issues: • Research of the potential gaming market in the United States. • Development of an Integrated Marketing Communications plan to support your marketing strategy. • Focus on expanding the gaming population by capturing the attention and imagination of the non-gamer market(s) • Use of $20MM budget during the 6 month period of January 2011 to June 2011. THE TARGET AUDIENCE Gaming companies traditionally have focused on reaching the “hard-core” gaming population with their software and hardware devices. Nintendo sees opportunity differently. Instead of focusing on marketing to the current gaming population, Nintendo seeks to grow their opportunities by bringing non-gamers to the market. Viewing everyone as a potential gamer, Nintendo defines their target market as anyone from 6 years old to 74 years old. In the United States, 37% of the population had not played a video game in the last 12 months. How can Nintendo get this 1/3 of the population interested and playing? Of this 37%, approximately 6% are lapsed gamers – those who once played video games, but no longer do. Note: 82% of non-owners are aware of Wii compared to 65% for Xbox 360 and 71% for Playstation 3 (PS3). 39% of non-owners are aware of DSi, and 57% are aware of Nintendo DS compared to 54% for Playstation Portable (PSP), 14% for PSPgo and 51% for iPodTouch. Nintendo leads in real world Word Of Mouth (WOM), significantly ahead of Sony and Microsoft. Nintendo WOM has continued to rise among parents overall and different parent segments. Nintendo also has continued to outperform Sony and Microsoft for WOM quality, both overall and among most segments. Brand Asset Valuator (BAV) BAV is the largest study of brands, tracking 434 brands across 681,000 respondents in 51 countries. The study reports on measures such as brand health, brand imagery/personality, and loyalty, among others. BAV research of the Nintendo brands found the following information. In terms of Nintendo’s brand essence, Nintendo (parent brand) owns the following attributes: • • Simple Friendly • • • Visionary Innovative Down to earth The majority of consumer groups understands and gives credit to Nintendo' s essence of "making people smile." The overall size of the gaming market is still growing, and new consumers continue to enter the category. Nintendo products are (mostly) the gateway. Competitive products such as iPod/iPhone, Project Natal/Kinect & Sony PS3 Move are potential threats to Nintendo’s brand equity. NINTENDO PRODUCTS As mentioned previously, Nintendo is not interested in new product development for this case. Your recommendations and strategies should revolve around providing sales and marketing communications strategies for current offerings in gaming devices and software. Wii Wii console owners top 29 million units in the United States, 3 million in Canada, and 2 million in Latin America. Wii was developed to capture the imagination. Innovative software for the Wii including product add-ons like Wii Fit has broad appeal. The audience is equally divided 50% male/50% female. In households with a Wii, 2/3 of household members play. This is higher than for any other video game system. About 75% of children in Wii households play Wii. Wii & DSi households tend to have higher incomes when compared to households with other video game systems. (However, households with Apple iPhone/iPod Touch tend to have higher incomes.) In 3-in-4 Wii owning households, Wii is played at least once per week. Wii continues to reach new gaming households as approximately one-in-five Wii-owning households has no other video game systems. Wii is most likely to be in the living room (not true for other consoles). One-fifth of Wii owners are new to gaming—they own no other systems; and many are older female casual gamers. Wii owners are most likely to only purchase video games, and never rent. It is well known in the industry that “Software drives Hardware”. From copy testing results Nintendo knows that the New Super Mario Brothers Wii ad performed very well and had a positive impact on the hardware. One reason it performed so well among adults was that it reminded consumers of the "iconic" Mario games they played when they were younger. DS/DSi The Nintendo DS portable gaming device represents a much larger installed base of users – 40 million in the United States alone. 53% of users of the Nintendo DS are female. The Nintendo DS is more reflective of the general population than some competitive offerings. The 3DS – 3D portable system – was recently announced at the E3 Expo in June 2010. In 4 out of 5 DS/DS Lite/DSi households, the system is played at least once per week. DSi purchases are driven by Nintendo loyalty, DS upgrades, cameras and games. In 30% of DS-owning households, the system is played daily. Software In terms of software, Nintendo offers titles which appeal to traditional and non-traditional gamers. Nintendo’s titles include cooking guides, crossword puzzles, exercise journals, a fashion boutique, and many more. Industry standards dictate that software titles should be marketed to the Traditional Core Gamer, and that most revenues will be realized in the first 3 weeks of the new title’s launch. Nintendo’s expanded audience causes their software titles to have a longer life, often making money for years instead of weeks. In addition to the traditional direct competitors that Nintendo faces, case teams should consider how indirect potential competitors like the Apple iPhone, iPad, and iTouch might move further into this space. Also consider the evolving space of Social Gaming with titles like Mafia Wars and Farmville in Facebook. Two-thirds of gamers have recently accessed a social networking site as social media gaming is growing rapidly. Cumulative Unit Sales on Consolidated Basis Hardware Worldwide Americas Game Boy Advance 81.8 41.6 Nintendo Game Cube 21.7 12.9 Nintendo DS 70.6 22.4 Wii 24.5 10.6 Software Worldwide Americas Game Boy Advance 376.7 216.9 Nintendo Game Cube 208.5 138.4 Nintendo DS 396.6 123.2 Wii 148.4 79.4 Source: Nintendo Annual Report 2008 Units in Millions; As of March 31, 2008 Americas includes U.S., Canada, and Latin America EVALUATIVE CRITERIA AMA case teams should make sales and marketing recommendations for Nintendo in the United States. A complete plan should present research on the potential gaming markets, discuss how to grow Nintendo’s revenue through winning the hearts and share of the nongamer market(s), present a positioning strategy, as well as a complete IMC plan with a $20MM budget during the 6 months from January 2011 – June 2011. The written portion of the case should not exceed 20 pages in length, excluding appendices. In addition to these 20 pages, 20 pages may be included in the appendix. New this year: Your references will not be counted as part of the total 40 pages for the case. ITEM DESCRIPTION POINT VALUE Situation Analysis The situation analysis should demonstrate a thorough understanding of the situation facing Nintendo in the desired market, and should include a SWOT analysis or comparable alternative. 15 Market Research Primary research pertaining to the project. 10 Target Marketing, Objectives & Positioning Strategy Description of the target market(s) for your proposed marketing strategies. Develop a positioning strategy and measurable objectives. 15 Integrated Marketing The plan should be based on the research and Communications Plan situation analysis presented. Timelines and 50 budget should be included in the appendix. Grammar & Proper usage of grammar, punctuation, etc. Punctuation Specific case questions should be addressed to either: Dr. Traci Warrington Salve Regina University traci.warrington@salve.edu Office phone: 401-341-2477 10 Dr. Scott Swanson University of Wisconsin-Eau Claire swansosr@uwec.edu Office phone: 715-836-5127