Nintendo Pricing strategy

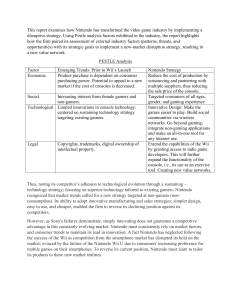

advertisement

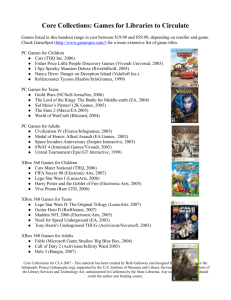

1 Nintendo Pricing strategy Presented by: Angela Ng, Filip Jahoda, Kim Manh Tuan, Sabrina Lee, Zhen-rui Chen 2 About Nintendo World’s biggest video game company Innovator of games hardware and software – has sold over 600 million hardware units and over 4 billion software units Creator of some of the most popular game franchises including Mario, Zelda, Donkey Kong and Pokémon 3 Business Scenario Nintendo is having problems to compete in the video game wars and facing a greatly reduced market share. It is unable to keep up with the powerful hardware and realistic graphics required by the traditional gamer segment. Video game business is growing, but Nintendo’s business is shrinking. Nintendo then chooses a new strategy to broaden the gaming demographic and bring gaming to the masses, through motionsensitive and casual games that are more accessible and fun to play. “Not fighting Sony, but how many people we can get to play games.” - Satoru Iwata Media and many gamers are skeptical that Nintendo can succeed with their ‘gimmicky approach’ 4 New Opportunity: Broadening the Demographic & Casual Gamer Moms / women Including the whole family Attracting the ‘playing gene’ of customer groups who have traditionally not played video games Redefine “who” is a “gamer” Casual game: simpler rules, ease of use, lack of commitment Elderly 5 Positioning Innocent, fun and refreshingly simple! Inclusive play Playing together – group entertainment, family interaction, parties Being active Working against the gamer stereotype to broaden the customer base: NOT violent NOT passive NOT isolated NOT complicated 6 Nintendo’s Product Offering products to different segments including both hardcore gamers and casual gamers Traditional titles: Metroid Prime, Zelda: Twilight Princess, Super Mario Galaxy Casual titles: Wii Fit, Wii Sports, Cooking Mama, Crosswords 7 Key activities Software development: • Develop popular games for the console Hardware development: • Develop consoles and accessories for various games Platform management: • Managing the relationships and development platform with third-party game developers Marketing : • Maintaining contacts with many potential partners and customers (contractors, OEM partners, distributors), media representatives help them to deliver their value proposition to all stakeholders. 8 Non portable games market 9 10 Competitors classification Direct competitors • competitors providing platform for nonportable, non-browser games –> substitutes (more or less) • PSX, Xbox, PC, Apple Indirect competitors • other competitors in the games market • smartphone environment, (tablets), handheld 11 Direct competitors Playstation (PSX) + Xbox • High performance • Backed up by big companies Sony & Microsoft PC (Windows) • Still the highest number of players • characteristic controls mouse + keyboard • high level of piracy Apple - relevant gaming market in development • users typically not focused on gaming 12 Target groups of consumers Gamers • Responsive to all kinds of games Casual players • Responsive to simpler, quick to get into games (action, sports, racing) games, multiplayer preference Non-players (people who are not into gaming) • Responsive to simple, quick to play games, + multiplayer (social aspect), motion control + 13 Tools High Performance • PC Special Features • special controllers and game titles User friendly • xPC Exclusive game titles • Higher demand for exclusive game titles also rises the demand for the game platform (complement). 14 Beginnings Wii hit the market with innovative system of controls and gameplay • • • motion controller and games designed for simple, typically multiplayer gameplay simple access and intuitive use new aspect of entertainment: not playing the game, but playing WITH the game and the controller as with a toy Many users from casual gamer or non-gamer segment 15 Current development Consoles has gone online, C = PC • + access to detailed data about consumers and their behaviour via their online accounts • + direct marketing with shopping right from the couch All platforms now have their motion controllers • Low support on PC 16 Current situation Latest Nintendo release Wii U had insufficient sales even before the new releases from Sony and Microsoft Last month PS4 and Xbox One were released, resulting in serious increase in competition 17 Questions What can Nintendo do in this situation? As a producer of a console and also publisher of a popular exclusive game title, would you agree to release the game on PC? 18 Answers The solution would be to find a way to differentiate our platform again, like it happened before with the motion controller. Other platforms which have lots of strengths has to be as little substitute to ours, as possible Effect • Increased sales • Piracy on PC would lead to large number of illegal copies • Lowering demand for our platform, as we create substitutes this way 19 Nintendo Pricing Strategy The price of a Nintendo Wii ($130) is already a lot cheaper than a Xbox 360 ($300) and a PS3 ($250). This is competition based pricing (where companies use their competitors’ price to judge theirs). => making Wii more competitive. 20 A Loss Leader Strategy A loss leader is a good or service which is advertised and sold below its cost price. Purpose: Bring in (lead) customers in the retail store on the assumption that, once inside the store, the customers will be stimulated to buy full priced items as well. Applied by Nintendo: The cost of manufacturing the touch- screen controller, known as the Wii U GamePad, forces Nintendo to sell the machine at a loss, a trade-off to draw in a large base of consumers who will eventually buy the highmargin Wii U software. 21 Pricing strategy is “Tying” This strategy is to force customers to buy one product in order to use another. Accordingly, buyers pay a relatively low price for the console but then choose a greater or lower price based on how heavily they consume games. Thus, hardcore gamers will purchase more games, resulting in an overall higher price, while lighter gamers will be able to achieve a lower overall price. Additionally, games exclusively made for the Wii U will pressure gamers to purchase the new console. 22 Video Game Pricing Special editions and DLC (Downloadable content) • Get more money from high willingness-to-pay customers without losing sales from low willingness-to-pay customers Games dropping in price • • People just wait if they are only willing to pay less Higher price that early adopters pay is “early adopter tax”. 23 Final Question 24 Thank You! 25 Question for other groups: As a producer of a console and also publisher of a popular exclusive game title, would you agree to release the game on PC ? Contact: In case you need information: Contact: kimmanhtuan295@gmail.com