Burger King Holdings Inc - Restaurant Brands International

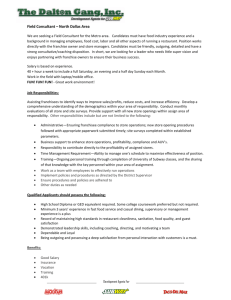

advertisement