ATO Introduction to Tax for Students

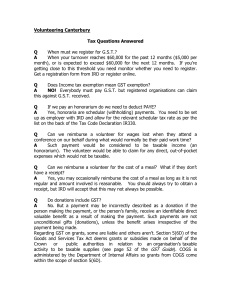

advertisement