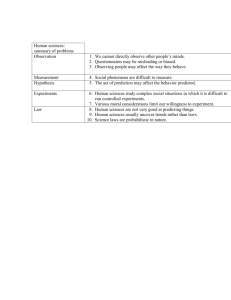

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

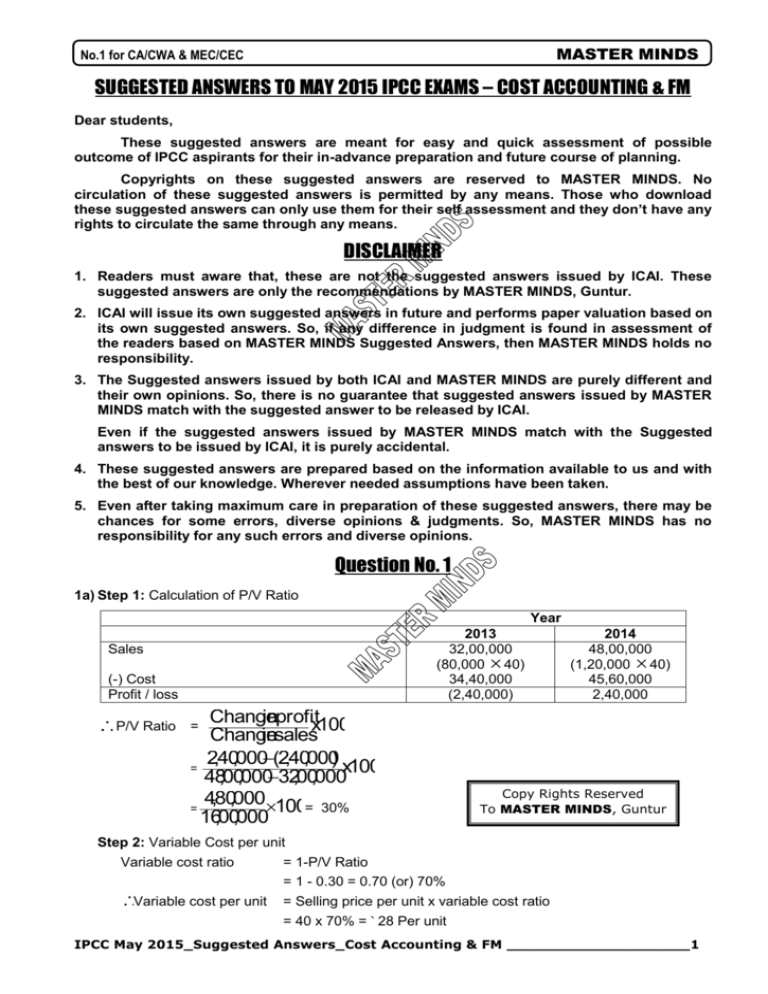

SUGGESTED ANSWERS TO MAY 2015 IPCC EXAMS – COST ACCOUNTING & FM

Dear students,

These suggested answers are meant for easy and quick assessment of possible

outcome of IPCC aspirants for their in-advance preparation and future course of planning.

Copyrights on these suggested answers are reserved to MASTER MINDS. No

circulation of these suggested answers is permitted by any means. Those who download

these suggested answers can only use them for their self assessment and they don’t have any

rights to circulate the same through any means.

DISCLAIMER

1. Readers must aware that, these are not the suggested answers issued by ICAI. These

suggested answers are only the recommendations by MASTER MINDS, Guntur.

2. ICAI will issue its own suggested answers in future and performs paper valuation based on

its own suggested answers. So, if any difference in judgment is found in assessment of

the readers based on MASTER MINDS Suggested Answers, then MASTER MINDS holds no

responsibility.

3. The Suggested answers issued by both ICAI and MASTER MINDS are purely different and

their own opinions. So, there is no guarantee that suggested answers issued by MASTER

MINDS match with the suggested answer to be released by ICAI.

Even if the suggested answers issued by MASTER MINDS match with the Suggested

answers to be issued by ICAI, it is purely accidental.

4. These suggested answers are prepared based on the information available to us and with

the best of our knowledge. Wherever needed assumptions have been taken.

5. Even after taking maximum care in preparation of these suggested answers, there may be

chances for some errors, diverse opinions & judgments. So, MASTER MINDS has no

responsibility for any such errors and diverse opinions.

Question No. 1

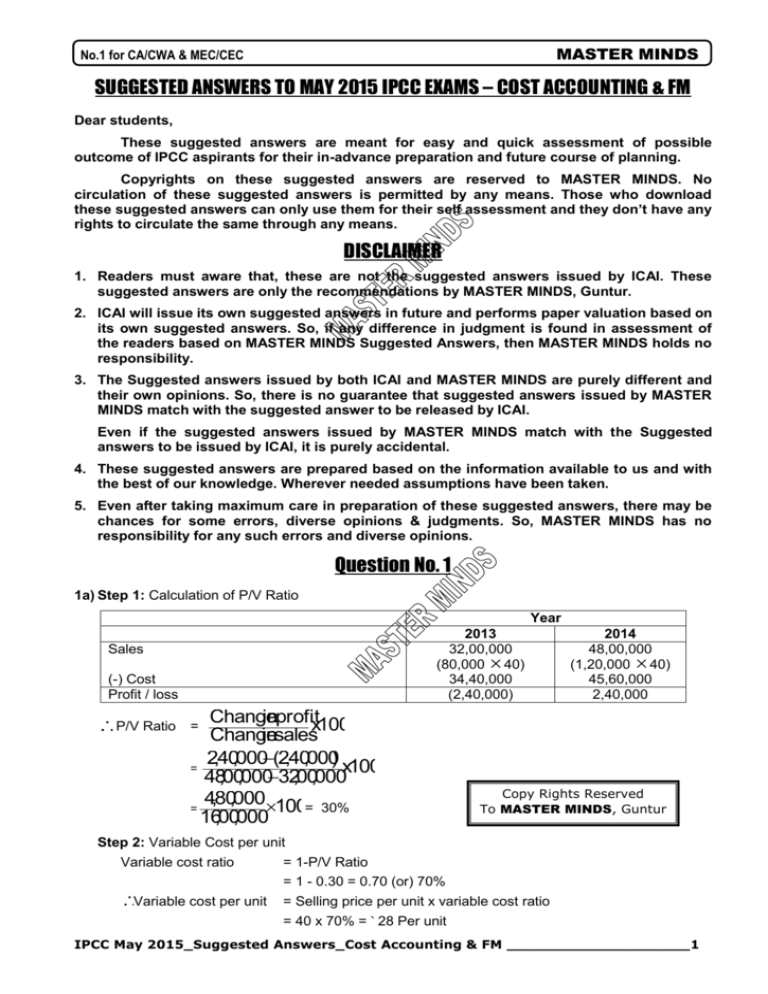

1a) Step 1: Calculation of P/V Ratio

Year

2013

32,00,000

(80,000 40)

34,40,000

(2,40,000)

Sales

(-) Cost

Profit / loss

P/V Ratio

Change

inprofitx100

Change

insales

2,40,000(2,40,000) x100

=

48,00,00032,00,000

4,80,000100= 30%

=

16,00,000

2014

48,00,000

(1,20,000 40)

45,60,000

2,40,000

=

Copy Rights Reserved

To MASTER MINDS, Guntur

Step 2: Variable Cost per unit

Variable cost ratio

Variable cost per unit

= 1-P/V Ratio

= 1 - 0.30 = 0.70 (or) 70%

= Selling price per unit x variable cost ratio

= 40 x 70% = ` 28 Per unit

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________1

Ph: 98851 25025/26

www.mastermindsindia.com

Step 3: Break even point (in units)

B.E.P(inunits)

Fixed

cost

Contributi

onperunit

Fixed cost (Based on 2014) = Contribution – Profit

= Sales x P/V Ratio – Profit

= 48,00,000 x 30% - 2,40,000

= `12,00,000

Contribution per unit = S.P.P.U – V.C.P.U

= 40-28 = 12 per unit

B.E.P(inunits) 12,00,000= 1,00,000 units

12

Step 4: Profit of the firm operates at 25% of the capacity

Sales at 15% Capacitor = 2,00,000 x 25% x 40

= `60,00,000

Copy Rights Reserved

To MASTER MINDS, Guntur

Profit = Sales x P/V Ratio – Fixed cost

= 60,00,000 x 30% - 12,00,000

= `6,00,000

1b)

i)

Production Budget ( month wise ) for the first quarter of the year 2015-16 :Particulars

Product Xml

Current month sales

+Closing stock

(25% of next month)

- opening stock

Production for the month

Product Yml

Month sales

+closing stock

(25% of next month)

-opening stock

April

May

June

8000

2500

(10000X254%)

10500

10,000

3000

(12000X25%)

(2500)

10500

12000

4000

(10000X25%)

(3000)

10500

6000

2000

(8000X25%)

8000

8000

2250

(9000X25%)

(2000)

8250

9000

3500

(14000X25%)

(2250)

10250

ii) Production cost budget (for first quarter) of the year 2015-16:Particulars

total production for the quantity

(units)

Direct material per unit

Direct labour per unit

Direct man. Exp. Per unit

Total cost per unit

Total production cost

Xml

34000

(10500+10500+13000)

220

130

2

(

400000

)

200000

352

1,19,68,000

(34000X352)

Yml

26500

(8000+8250+10250)

280

120

3.33

500000

150000

403.33

1,06,88,333

(26500X403.3333)

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________2

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Note:

1) Direct manufacturing expenses given is assumed as for to be budgeted production i.e

2,00,000 & 1,50,000. for Xml & Yml given in the problem.

2) There are no opening stock of finishing goods at the beginning of the year 2015-16.

1c) Evaluation of credit policy relating to the new customer

Particulars

Amount (`)

2,40,000

1,92,000

48,000

24,000

24,000

7,200

16,800

9,600

7,200

Incremental sales

(-) Cost of sales @ 80%

Profit before adjustment of Bad debts & tax

(-) Bad debts

PBT

(-) tax @ 30%

PAT

(-) Opportunity cost of Investment in Debtors (W.N)

Incremental Net Benefit

Since the incremental Net Benefit is positive i.e. ` 7,200, it is advisable for the firm to establish

new business connection with the new customer.

W.N 1:

It is assumed that investment in debtors is valued at cost of sales

Investment in debtors = 2,40,000 x

1.50x 80%

12

Copy Rights Reserved

To MASTER MINDS, Guntur

= `24,000

Opportunity cost of investment in debtors

= investment in debtors value x desired rate of return

= `24,000 x 40%

= `9,600

1d) Calculation of degree of operating leverage for all the firms:

Particulars

A)Change in revenue

B) change in operating income

Degree of operating leverage

inoperating

income(B)

(DOL)= change

Change

inrevenue

(A)

Firm ( in % )

Q

R

25

23

32

36

P

27

25

25 =0.9259

27

32=1.28

25

S

21

40

36=1.5652 40=1.9047

23

21

Calculation of degree of combined leverage for all the firms : Particulars

A)Change in Revenue

B) change in earnings per share

Degree of combined leverage ( DOC) =

change

inearnings

pershare

(B)

Change

inSales(A)

P

27

30

30=1.11

27

Firm (in %)

Q

R

25

23

24

21

24=0.96

25

21=0.91

23

S

21

23

23=1.095

21

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________3

Ph: 98851 25025/26

www.mastermindsindia.com

Question No. 2

2a)

Difference

ofOverhead

attwolevel

Difference

inProduction

units

2,10,0001,80,000 15

=

10,000units8,000units

a) Variable Overhead rate per unit

=

b) Fixed Overhead

= ` 1,80,000 − (8,000 units × ` 15) = ` 60,000

c) Standard hours per unit of production

=

d) Standard Variable Overhead Rate per hour

e) Standard Fixed Overhead Rate per hour

f)

Std.Overhead

Absorption

Rate

Std.Rateperhour

20=5 hours

=

4

VariableOv

erheadper

unit= 15 =3

=

5hours

Std.hour

perunit

=`4- `3=`1

= ` 2,95,000 – ` 62,500

Actual Variable Overhead

= ` 2,32,500

g) Actual Variable Overhead Rate per Hour

=

2,32,500

74,000hour

s

= 3.1419

h) Budgeted hours

= 12,000 units × 5 hours

= 60,000 hours

i)

Standard Hours for Actual Production

= 15,560 units × 5 hours

= 77,800 hours

i)

Variable Overhead Efficiency and Expenditure Variance:

Variable Overhead Efficiency Variance

= Std. Rate per hour (Std. Hours – Actual Hours)

= ` 3 (77,800 hours − 74,000 hours)

= ` 11,400 (F)

Variable Overhead Expenditure Variance

= Actual Hours (Std. Rate - Actual Rate)

= 74,000 hours (` 3 - ` 3.1419)

= ` 10,500 (A)

ii) Fixed Overhead Efficiency and Capacity Variance:

Fixed Overhead Efficiency Variance = Std. Rate per Hour (Std. Hours-Actual Hours)

= ` 1(77,800 hours -74,000 hours)

= ` 3,800 (F)

Fixed Overheads Capacity Variance = Std. Rate per Hour (Actual Hours -Budgeted Hours)

= ` 1(74,000 hours – 60,000 hours)

= ` 74,000 − ` 60,000

= ` 14,000 (F)

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________4

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

2b)

a) Calculation of Operating Expenses for the year ended 31st March, 2015.

(`)

3,75,000

3,75,000

7,50,000

60,000

8,10,000

60,00,000

Net Profit [@ 6.25% of Sales]

Add: Income Tax (@ 50%)

Profit Before Tax (PBT)

Add: Debenture Interest

Profit before interest and tax (PBIT)

Sales

Less: Cost of goods sold

PBIT

18,00,000

8,10,000

Operating Expenses

b)

26,10,000

33,90,000

Balance Sheet as on 31st March, 2015

`

Liabilities

Share Capital

Reserve and Surplus

15% Debentures

Sundry Creditors

10,50,000

4,50,000

4,00,000

2,00,000

`

Assets

Fixed Assets

Current Assets:

Stock

Debtors

Cash

21,00,000

17,00,000

1,50,000

2,00,000

50,000

21,00,000

Working Notes:

i)

Share Capital and Reserves

The return on net worth is 25%. Therefore, the profit after tax of ` 3,75,000 should be

equivalent to 25% of the net worth.

NetworthX 25 = ` 3,75,000

100

X100= ` 15,00,000

Networth = 3,75,000

25

The ratio of share capital to reserves is 7:3

ShareCapital= 15,00,000X 7 = `10,50,000

10

Reserves

= 15

,00,000X 3 = `4,50,000

10

ii) Debentures

Interest on Debentures @ 15% = ` 60,000

∴ Debentures =

60,000

X100` 4,00,000

15

Copy Rights Reserved

To MASTER MINDS, Guntur

iii) Current Assets

Current Ratio

=2

Sundry Creditors = ` 2,00,000

∴ Current Assets = 2 Current Liabilities = 2× 2,00,000 = ` 4,00,000

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________5

Ph: 98851 25025/26

www.mastermindsindia.com

iv) Fixed Assets

`

Liabilities

Share capital

Reserves

Debentures

Sundry Creditors

10,50,000

4,50,000

4,00,000

2,00,000

21,00,000

4,00,000

17,00,000

Less: Current Assets

Fixed Assets

v) Composition of Current Assets

Inventory Turnover = 12

Copy Rights Reserved

CostofGoods

sold12

To

MASTER

MINDS, Guntur

Closing

Stock

Closing

Stock

`18,00,000

Closing

Stock

` 1,50,000

12

Composition

Stock

Sundry debtors

Cash (balancing figure)

Total Current Assets

(` )

1,50,000

2,00,000

50,000

4,00,000

Question No. 3

3a) Calculation of no.of kms to be travelled & no.of passengers kms for year:Total Kms travelled in a year

= 30 kms X 10 trips X 2 journes X 25 dats X 12 months

= 1,80,000 kms

No.of passengers kms per year = 1,80,000 kms X 32 passengers X 70% capacity

= 40,32,000 passengers kms.

Operating cost statement for year particulars :-

A)

B)

C)

Particulars

Standing charger:

Insurance

Garage Rent

Road tax

Depreciation

A)Total standing charger

Maintenance charger:

Repairs (4800 X 4)

Tyres & tuber (3600 X 4)

Total (B)

Running charger:

180000

5km

180000

km

Oil & sundries 22dr X

100

km

Diesel 13m X

Sadry of operating stuff 7200 X 12

Total ( C )

Total cost A,B & C

Amount

15,600

9,600

5,000

68,000

98,200

19,200

14,400

33,600

4,68,000

39,600

86,400

5,94,000

`7,25,800

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________6

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Passenger tax 725800 X

Inof.t 725800 X

25

53

22

53

301275.47

342358.49

Total taking

13,69,434

Total

cost

Total

passengers

km

1027075

.47

=

4032000

Cost per passenger km

=

= 0.2547 Rs per km

One way fare per passenger =

Copy Rights Reserved

To MASTER MINDS, Guntur

1369434

30kms

4032000

= `10.189 per one way.

3b) Given Information

Annual cash inflows = `60,000

Useful life

= 4 years

Internal rate of return = 15%

Profitability index

= 1.064

Salvage value

=0

i)

Calculation of cost of the project:

IRR is the rate at which present value of cash inflows is equal to the present value of cash

outflows

At IRR

Present value of cash Inflows = Present value of cash outflows

Annual cash Inflows x PVAF[r, n] = Present value of cash outflows

`60,000 x PVAF[15%, 4] = Present value of cash outflows

Present value of cash outflows

= `60,000 x 2.855

= `1,71,300

Cost of the project

= `1,71,300

ii) Calculation of payback period

Payback period

InitialInvestment

Annual

CashInflows

1,71,300

=`

60,000

=

Copy Rights Reserved

To MASTER MINDS, Guntur

= 2.855 years

(or)

2 years 10 months 8 days

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________7

Ph: 98851 25025/26

www.mastermindsindia.com

iii) Calculation of cost of capital

Profitability index means it is the ratio of sum of the discounted cash inflows to the sum of the

discounted cash outflows.

Sumof thediscounted

cashinflows

Sumof thediscounted

cashoutflows

Sumof thediscounted

cashinflows

1,71,300

Profitability Index =

1.064 =

Sum of the discounted cash Inflows

= `1,71,300 x 1.064

= `1,82,263

Cash Inflows x PVAF[r, n] = `1,82,263

`60,000 x PVAF[r, 4] = `1,82,263

PVAF[r, 4] = ` 1,82,263

60,000

Copy Rights Reserved

To MASTER MINDS, Guntur

= 3.03772

Trace the PVAF[r, 4] of 3.03772 in PVAF table against 4 years, the cost of capital would be

12%

Cost of capital = 12%

iv) Calculation of Net Present Value

= Present value of cash inflows – present value of cash outflows

Net Present Value

= `1,82,263 - `1,71,300

= `10,963

Question No. 4

4a)

Statement showing allocation of Joint Cost

Particulars

No. of units Produced

Selling Price Per unit (`)

Sales Value (`)

Less: Estimated Profit (B1 -20% & B2 -30%)

Cost of Sales

Less: Estimated Selling Expenses (B1 -15% & B2 -15%)

Cost of Production

Less: Cost after separation

Joint Cost allocated

B1

B2

1,800

3,000

40

30

72,000

90,000

(14,400)

(27,000)

57,600

63,000

(10,800)

(13,500)

46,800

49,500

(35,000)

(24,000)

11,800

25,500

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________8

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Statement of Profitability

Particulars

M1 (`)

Sales Value (A)

B1 (`)

4,00,000

(4,000 × `100)

72,000

90,000

1,75,100

(2,12,400 -11,800 25,500)

11,800

25,500

-

35,000

24,000

80,000

10,800

13,500

(B)

2,55,100

57,600

63,000

(A –B)

1,44,900

14,400

27,000

Less:- Joint Cost

- Cost after separation

- Selling Expenses

(M1- 20%, B1-15% & B2-15%)

Profit

B2 (`)

Overall Profit = `1,44,900 + `14,400 + ` 27,000 = ` 1,86,300

4b) Given Information:

Additional finance required for meeting investment plans

= ` 30 lakhs

Retained earnings available for investment purposes

= ` 600,000

Debt – equity ratio = 30 : 70

Statement of showing pattern of raising additional finance:

Additional finance required = ` 30 lac.

Debt. = ` 30 lacs

30

100

= `9,00,000

Equity

Copy Rights Reserved

To MASTER MINDS, Guntur

70

= ` 30 lacs

100

= ` 21,00,000

Debt. - ` 900,000

11% of Debt. - ` 300,000

14% of Debt. - ` 600,000

Equity - ` 21,00,000

Retained earnings - ` 600,000

fresh issue of equity share capital

(21,00,000 – 600,000) - ` 15,00,000

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________9

Ph: 98851 25025/26

i)

www.mastermindsindia.com

After tax cost of 11% debt. ( kd) =

I

I(1t)

NP

= Interest

= ` 300,000 * 11%

Copy Rights Reserved

To MASTER MINDS, Guntur

= ` 33,000

t

= tax Rate

= 30%

NP = Net proceeds

= ` 300,000

Kd =

33000

(10.30) * 100

300

,000

= 7.70%

After tax cost of 14% Debt. ( kd ) =

I

I(1t)

NP

= Interest

= 600,000 * 14%

= ` 84,000

NP = Net proceeds

= ` 600,000

Kd =

84000

(10.30) * 100

600

,000

= 9.80%

Calculation of post tax average cost of additional debt.:Sources

11 % Debt.

14% Debt.

Amount (`)

300,000

600,000

Proportion

0.3333

0.6667

900,000

Cost of capital

7.70

9.80

Post tax average cost of

additional Debt. (Kd)

Prop * C/c

2.57

6.53

9.10

ii) Calculation of cost of retained earnings and cost of equity:

Cost of retained earnings ( kr) = Cost of existing equity ( Ke) ( I – tp)

Cost of existing equity (Ke) =

DPS

1 +g

MP0

DPS1 = EXPECTED Dividend per share at the end of the first year

= DPS0 ( I + g)

DPS0 = EPS * Dividend payout ratio

= ` 15 * 70%

=` 10.50

DPS1 = 10.50 ( 1 + 0.10 )

Copy Rights Reserved

To MASTER MINDS, Guntur

= 11.55

MP0

= current market price per share

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________10

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

= ` 90

g

= growth rate

= 10%

Ke =

11.55+ 10%

90

Copy Rights Reserved

To MASTER MINDS, Guntur

= 12.833 + 10

= 22.833%

Cost of reserves ( Kr ) = Ke (1 – tp)

= 22.833 (1-0.20)

= 18.2664

DPS

1 +g

NP

Cost of new equity ( Kne) =

DPS1 = expected Dividend per share at the end of the first year

= `10.50 ( 1+ 0.10 )

= 11.55

NP

= Net proceeds

= `90 ( Assumed to be issued at current market price)

g

= growth rate

= 10%

Cost of new equity ( Kne) =

11.55+ 10%

90

= 22.833

iii) Calculated of overall weighted average ( after tax ) cost of additional finance :-

Sources

New equity share

capital

Retained earnings

Debt

Amount

(in lakhs )

Proportion

Cost of

capital

Proportion Cost

of capital

15

0.50

22.833

11.4165

6

9

30

0.20

0.30

18.2664

9.10

3.65328

2.73

Ko = 17.80%

Overall cost of additional finance ( K0 )= 17.80% (Approximately)

Question No. 5

5a) Sunk costs: Historical costs incurred in the past are known as sunk costs. They play no role in

decision making in the current period.

Opportunity costs: This cost refers to the value of sacrifice made or benefit of opportunity

foregone in accepting an alternative course of action.

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________11

Ph: 98851 25025/26

www.mastermindsindia.com

5b) Meaning: If during the period of execution of a contract, the prices of materials, or labour etc.,

rise beyond a certain limit, the contract price will be increased by an agreed amount. Inclusion of

such a clause in a contract deed is called an “Escalation Clause”.

Accounting Treatment:

a) The amount of reimbursement due should be determined by reference to the Escalation

Clause.

b) The amount due from the Contractee should be recorded by means of the following journal

Entry:

Date

Contractee’s A/c

To Contract A/c

Dr

XXX

XXX

5c) Sale and Lease back:

a) Under this type of lease, the owner of an asset sells the asset to a party (the buyer), who in turn

leases back the same asset to the owner in consideration of a lease rentals.

b) Under this arrangement, the asset is not physically exchanged but it all happens in records only.

c) The main advantage of this method is that the lessee can satisfy himself completely regarding

the quality of an asset and after possession of the asset convert the sale into a lease

agreement.

Under this transaction, the seller assumes the role of lessee and the buyer assumes the role of a

lessor. The seller gets the agreed selling price and the buyer gets the lease rentals.

5d) Miller- Orr Cash Management Model Or stochastic model:

a) When the demand for cash is stochastic and not known in advance this method is used.

b) In this model control limits are set for cash balances. These limits may consist of as upper

limit, the return point; and the lower limit.

c) When the cash balance reaches the upper limit, an investment is made in marketable

securities by an amount equal to the amount, which is in excess of return point.

d) When the cash balance touches the lower limit, some investments are sold so that the cash

balance reaches the return point.

e) During the period when cash balance stays between high and low limits no transactions

between cash and marketable securities are made.

Question No. 6

6a) Effective Machine hour for four-week period

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________12

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

= Total working hours – unproductive set-up time

= {(48 hours × 4 weeks) – {(4 hours × 4 weeks)}

Copy Rights Reserved

To MASTER MINDS, Guntur

= (192 – 16) hours ) =176 hours.

i) Computation of cost of running one machine for a four week period

(`)

(A)

Standing charges (per annum)

Rent

Heat and light

Forman’s salary

Standing charges (per annum)

Total expenses for one machine for four week

period

5,400.00

9,720.00

12,960.00

28,080.00

(`)

720.00

28,000

3machines

x13fourweekperiod

Wages (48 hours × 4 weeks × ` 20 × 3

operators) ÷ 3 machines)

(B)

3,840.00

Bonus (176 hours × ` 20 × 3 operators) ÷ 3

machines)× 10%

Total standing charges

Machine Expenses

Depreciation =

4,912.00

Repairs and maintenance (`60 × 4 weeks)

Consumable stores (` 75 × 4 weeks)

Power (176 hours × 20 units ×` 0 .80)

Total machine expenses

Total expenses (A) + (B)

240.00

300.00

2,816.00

3,756.00

8,668.00

352.00

400.00

52,000x10%x

1

13fourweekperiod

(C)

ii) Machine hour rate = `

8,668 = `49.25

176hours

Copy Rights Reserved

To MASTER MINDS, Guntur

6b)

i)

Calculation of operating cycle period:

Particulars

Raw material storage period

Work in progress conversion period

Finished goods storage period

Debt collection period

Gross operating cycle period

(-) Creditor’s payment period

Net operating cycle period

ii) Number of operating cycles in a year

Period [in days]

50

18

22

45

135

55

80 days

=

360days

Netoperating

Cycle

Period

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________13

Ph: 98851 25025/26

www.mastermindsindia.com

=

360days

80

= 4.50 cycles

iii) Calculation of Amount of working capital required for the company on cash cost basis

Annual operating cost

= `21,00,000

(-) Depreciation

= ` 2,10,000

Annual cash operating cost

= `18,90,000

Amount of working capital required for the company on cash cost basis

=

=

Annual

cashoperating

cost

No. of operating

Cycles

ina year

18,90,000

4.50

= `4,20,000

Copy Rights Reserved

To MASTER MINDS, Guntur

iv) As per the given information it is clear that the company is planning to discontinue sales on

credit and deliver products based on prepayments. So there is no debt collection period after

the new decision. Consequently net operating cycle period will be reduced and hence working

capital requirement will be reduced substantially.

Revised Net operating cycle period = 80 days – 45 days

= 35 days

New working capital requirement because of the new decision = 18,90,000 x

35days

360days

= ` 1,83,750

Calculation of reduction in working capital requirement

Working capital required for the company before the new decision = ` 4,20,000

(-) New working capital requirement because of the new decision = ` 1,83,750

Reduction in working capital requirement

= ` 2,36,250

Question No. 7

7a) Cost Centers: It is defined as a location, person or an item of equipment for which cost may be

ascertained and used for the purpose of Cost Control. Cost Centers are of two types - Personal

and Impersonal.

A personal cost center consists of a person or group of persons and an Impersonal cost center

consists of a location or an item of equipment.

In a manufacturing concern there are two main types of Cost Centers as indicated below:

a) Production Cost Center: It is a cost centre where raw material is handled for conversion into

finished product. Here both direct and indirect expenses are incurred. Machine shops, welding

shops and assembly shops are examples of Production Cost Centers.

b) Service Cost Center: It is a cost centre which serves as an ancillary unit to a production cost

centre. Power house, gas production shop, material service centers, plant maintenance

centers are examples of service cost centers.

7b) Integrated Accounts is the name given to a system of accounting, whereby cost and financial

accounts are kept in the same set of books.

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________14

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

a) There will be no separate sets of books for Costing and Financial records.

b) An integrated account provides full information required for Costing as well as for Financial

Accounts.

c) For Costing it provides information useful for ascertaining the Cost of each product, job,

process, operation of any other identifiable activity and for carrying necessary analysis.

d) Integrated accounts provides relevant information which is necessary for preparing profit and

loss account and the balance sheet as per the requirement of law and also helps in exercising

effective control over the liabilities and assets of its business.

Advantages: The main advantages of Integrated Accounts are:

a) No need for Reconciliation: The question of reconciling costing profit and financial profit

does not arise, as there is only one figure of profit.

b) Less effort: Due to use of one set of books, there is a significant extent of saving in efforts

c) Less Time consuming: No delay is caused in obtaining information as it is provided from

books of original entry.

d) Economical process: It is economical also as it is based on the concept of “Centralisation of

Accounting function”.

7c) Factoring & Bill discounting.

a) Factoring is called as “Invoice Factoring’ whereas Bills discounting is known as ‘Invoice

discounting’.

b) In factoring, the parties are known as the Client, Factor and Debtor whereas in bills

discounting, they are known as Drawer, Drawee and Payee.

c) Factoring is a sort of management of book debts whereas bills discounting is a sort of

borrowing from commercial banks.

d) For factoring there is no specific Act, whereas in case of bills discounting, the Negotiable

Instruments Act is applicable.

7d)

Profit Maximisation

Does not consider the effect of future cash

flows, dividend decisions, EPS, etc.

A firm with profit maximisation objective

may refrain from payment of dividend to its

shareholders.

Ignores time pattern of returns.

Focus on short – term.

Does not consider the effect of uncertainty / risk.

Comparatively easy to determine the

relationship between financial decisions and

profits.

Wealth Maximisation

Recognises the effect of all future cash

flows, dividends, EPS, etc.

A firm with wealth maximisation objective

may pay regular dividends to its

shareholders.

Recognises the time pattern of returns.

Focus on medium / long-term.

Recognises the risk – return relationship.

Does not offer any clear or specific

relationship between financial decisions and

share market prices.

7e) Present value

1. Present value is the current value of a future amount. It can also be defined as the amount

invested today at a given rate over specified period to equal the future amount.

2. Present value (PV), is the amount of money that represents the sum of Principal and Interest if

such amount (say Rs.P) is required to be invested now at a certain rate compounded over

number of time periods at a specified rate for each time period.

3. From the formula of amount under Compound Interest, we known that

An P(1R)n

IPCC May 2015_Suggested Answers_Cost Accounting & FM ____________________15

Ph: 98851 25025/26

www.mastermindsindia.com

4. Transporting the above formula and solving for P, we have P = Present Value =

An

(1R)n

(Present value Tables are available for different values of “R” and “n”).

Perpetuity

1. Meaning: Perpetuity is a stream of payments or a type of annuity that starts payments on a

fixed date and such payments continue forever, i.e. perpetually.

2. Thus, perpetuity is a constant stream of identical cash flows with no end.

3. Examples: (a) Dividend on Irredeemable Preference Share Capital, (b) Interest on Irredeemable

Debt / Bonds, (c) Scholarships paid perpetually from an Endowment funds, etc.

4. Operation: In a Fund involving perpetual annual cash flows, an Initial Fund (Principal) is

established first, and the payments will flow from the Fund indefinitely. This means that these

periodic payments are effectively the annual interest payments.

5. Value:

a) Value of perpetuity is calculated as its Expected Income Stream ÷ Discount Factor or

Market Rate of interest. Thus, it reflects the expected present value of all payments (to be

received perpetually).

b) The value of perpetuity is finite because receipts that are anticipated far in the future have

extremely low PV. Since the principal is never repaid, there is no present value for the

principal.

Note: Since perpetuity is a type of annuity which is unending, its sum of Future Value can’t be

calculated.

6. Formula:

PV of constant Perpetuity =

Where,

C

R

C = Cash Flow i.e. Interest, Dividend, etc. per period.

R = Interest Rate per Payment Period.

PV of a Growing Perpetuity =

Where,

C

RG

C = Cashflow i.e. Interest, Dividend, etc. for the first period.

R = Interest rate per payment period, G = Rate of growth in cash flows

Note: A stream of Cash Flows at a constant rate forever is known as growing perpetuity.

THE END

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC May 2015_ Suggested Answers_ Cost Accounting & FM ___________________16