Econ 500 - Microeconomic Analysis and Policy

advertisement

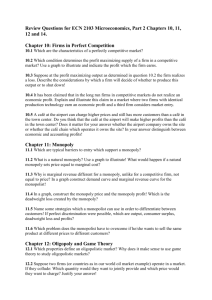

ECON 500 ECON 500 –Microeconomic Theory Econ 500 - Microeconomic Analysis and Policy Monopoly ECON 500 Monopoly A monopoly is a single firm that serves an entire market and faces the market demand curve for its output. Unlike the perfectly competitive firm’s output decision (which has no effect on market price), the monopoly’s output decision will, in fact, determine the good’s price. Furthermore, due to barriers to entry, other firms find it impossible or unprofitable to enter the market a monopoly operates in. Therefore, monopoly markets and markets characterized by perfect competition are polar opposite cases. ECON 500 Barriers to Entry The reason a monopoly exists is that other firms find it unprofitable or impossible to enter the market. Barriers to entry are therefore the source of all monopoly power. If other firms could enter a market then the firm would, by definition, no longer be a monopoly. There are two general types of barriers to entry: Technical Barriers to Entry Legal Barriers to Entry ECON 500 Barriers to Entry There are two general types of barriers to entry: Technical Barriers to Entry: Economies of Scale Proprietary Technology Ownership of unique resources Legal Barriers to Entry: Intellectual Property Rights Government Designation Firms may also expand productive resources to create barriers to entry. ECON 500 Monopoly Output Choice ECON 500 Monopoly Output Choice Monopoly Markup ECON 500 Monopoly Output Choice Two General Conclusions: A monopoly will choose to operate only in regions where the market demand curve is elastic, eQ,P < -1 The firm’s “markup” over marginal cost depends inversely on the elasticity of market demand ECON 500 Monopoly and Supply There is no unique relationship between price and quantity supplied in the case of a monopoly. Monopoly has no supply curve. ECON 500 Monopoly and Profit ECON 500 Monopoly and Welfare ECON 500 Measuring Monopoly Power Lerner Index of Monopoly Power: Measure of monopoly power calculated as excess of price over marginal cost as a fraction of price. 𝐿 = (𝑃 − MC)⁄𝑃 = −1⁄𝐸𝑑 ECON 500 Measuring Monopoly Power Capturing Consumer Surplus CAPTURING CONSUMER SURPLUS If a firm can charge only one price for all its customers, that price will be P* and the quantity produced will be Q*. Ideally, the firm would like to charge a higher price to consumers willing to pay more than P*, thereby capturing some of the consumer surplus under region A of the demand curve. The firm would also like to sell to consumers willing to pay prices lower than P*, but only if doing so does not entail lowering the price to other consumers. In that way, the firm could also capture some of the surplus under region B of the demand curve. ● price discrimination Practice of charging different prices to different consumers for similar goods. Price Discrimination First-Degree Price Discrimination ● reservation price for a good. Maximum price that a customer is willing to pay ● first degree price discrimination reservation price. Practice of charging each customer her ADDITIONAL PROFIT FROM PERFECT FIRST-DEGREE PRICE DISCRIMINATION Because the firm charges each consumer her reservation price, it is profitable to expand output to Q**. When only a single price, P*, is charged, the firm’s variable profit is the area between the marginal revenue and marginal cost curves. With perfect price discrimination, this profit expands to the area between the demand curve and the marginal cost curve. Second-Degree Price Discrimination ● second-degree price discrimination Practice of charging different prices per unit for different quantities of the same good or service. ● block pricing Practice of charging different prices for different quantities or “blocks” of a good. SECOND-DEGREE PRICE DISCRIMINATION Different prices are charged for different quantities, or “blocks,” of the same good. Here, there are three blocks, with corresponding prices P1, P2, and P3. There are also economies of scale, and average and marginal costs are declining. Second-degree price discrimination can then make consumers better off by expanding output and lowering cost. Third-Degree Price Discrimination ● third-degree price discrimination Practice of dividing consumers into two or more groups with separate demand curves and charging different prices to each group. CREATING CONSUMER GROUPS If third-degree price discrimination is feasible, how should the firm decide what price to charge each group of consumers? 1. We know that however much is produced, total output should be divided between the groups of customers so that marginal revenues for each group are equal. 2. We know that total output must be such that the marginal revenue for each group of consumers is equal to the marginal cost of production. Let P1 be the price charged to the first group of consumers, P2 the price charged to the second group, and C(QT) the total cost of producing output QT = Q1 + Q2. Total profit is then 𝜋 = 𝑃1 𝑄1 + 𝑃2 𝑄2 − 𝐶 𝑄𝑇 ∆𝜋 ∆ 𝑃1 𝑄1 ∆𝐶 = − =0 ∆𝑄1 ∆𝑄1 ∆𝑄1 MR1 = MC MR 2 = MC MR1 = MR 2 = MC • (11.1) DETERMINING RELATIVE PRICES 𝑀𝑅 = 𝑃 1 + 1 𝐸𝑑 𝑃1 1 + 1 𝐸2 = 𝑃2 1 + 1 𝐸1 (11.2) THIRD-DEGREE PRICE DISCRIMINATION Consumers are divided into two groups, with separate demand curves for each group. The optimal prices and quantities are such that the marginal revenue from each group is the same and equal to marginal cost. Here group 1, with demand curve D1, is charged P1, and group 2, with the more elastic demand curve D2, is charged the lower price P2. Marginal cost depends on the total quantity produced QT. Note that Q1 and Q2 are chosen so that MR1 = MR2 = MC. NO SALES TO SMALLER MARKETS Even if third-degree price discrimination is feasible, it may not pay to sell to both groups of consumers if marginal cost is rising. Here the first group of consumers, with demand D1, are not willing to pay much for the product. It is unprofitable to sell to them because the price would have to be too low to compensate for the resulting increase in marginal cost. Intertemporal Price Discrimination and Peak-Load Pricing ● intertemporal price discrimination Spending money in socially unproductive efforts to acquire, maintain, or exercise monopoly. ● peak-load pricing Spending money in socially unproductive efforts to acquire, maintain, or exercise monopoly. Intertemporal Price Discrimination INTERTEMPORAL PRICE DISCRIMINATION Consumers are divided into groups by changing the price over time. Initially, the price is high. The firm captures surplus from consumers who have a high demand for the good and who are unwilling to wait to buy it. Later the price is reduced to appeal to the mass market. Peak-Load Pricing PEAK-LOAD PRICING Demands for some goods and services increase sharply during particular times of the day or year. Charging a higher price P1 during the peak periods is more profitable for the firm than charging a single price at all times. It is also more efficient because marginal cost is higher during peak periods. The Two-Part Tariff ● two-part tariff Form of pricing in which consumers are charged both an entry and a usage fee. SINGLE CONSUMER TWO-PART TARIFF WITH A SINGLE CONSUMER The consumer has demand curve D. The firm maximizes profit by setting usage fee P equal to marginal cost and entry fee T* equal to the entire surplus of the consumer. TWO CONSUMERS TWO-PART TARIFF WITH TWO CONSUMERS The profit-maximizing usage fee P* will exceed marginal cost. The entry fee T* is equal to the surplus of the consumer with the smaller demand. The resulting profit is 2T* + (P* − MC)(Q1 + Q2). Note that this profit is larger than twice the area of triangle ABC. ECON 500 Regulation of Monopoly Price Regulation ECON 500 Regulation of Monopoly Price Regulation ECON 500 Regulation of Monopoly Price Regulation – Natural Monopoly Dilemma ECON 500 ECON 500 ECON 500 –Microeconomic Theory Econ 500 - Microeconomic Analysis and Policy Imperfect Competition ECON 500 ECON 500 Bertrand Competition Two identical firms, producing identical products at a constant marginal cost (and constant average cost) c. The firms choose prices p1 and p2 simultaneously in a single period of competition. Since firms’ products are perfect substitutes, all sales go to the firm with the lowest price. Sales are split evenly if p1= p2. The only pure-strategy (Nash) equilibrium of the Bertrand game is p1 = p2 = c ECON 500 Cournot Competition Two identical firms, producing identical products at a constant marginal cost (and constant average cost) c. The firms choose prices q1 and q2 simultaneously in a single period of competition. The pure strategy (Nash) equilibrium of the Cournot game is a set of quantities where each firm correctly assumes how much its competitor will produce and sets its own production level accordingly. After this simple change in strategic variable, equilibrium price will be above marginal cost and firms will earn positive profit in the Nash equilibrium of the Cournot game. The Cournot Model ● Cournot model Oligopoly model in which firms produce a homogeneous good, each firm treats the output of its competitors as fixed, and all firms decide simultaneously how much to produce. FIRM 1’S OUTPUT DECISION Firm 1’s profit-maximizing output depends on how much it thinks that Firm 2 will produce. If it thinks Firm 2 will produce nothing, its demand curve, labeled D1(0), is the market demand curve. The corresponding marginal revenue curve, labeled MR1(0), intersects Firm 1’s marginal cost curve MC1 at an output of 50 units. If Firm 1 thinks that Firm 2 will produce 50 units, its demand curve, D1(50), is shifted to the left by this amount. Profit maximization now implies an output of 25 units. Finally, if Firm 1 thinks that Firm 2 will produce 75 units, Firm 1 will produce only 12.5 units. 5 75 REACTION CURVES ● reaction curve Relationship between a firm’s profit-maximizing output and the amount it thinks its competitor will produce. REACTION CURVES AND COURNOT EQUILIBRIUM Firm 1’s reaction curve shows how much it will produce as a function of how much it thinks Firm 2 will produce. (The xs at Q2 = 0, 50, and 75 correspond to the examples shown in Figure 12.3.) Firm 2’s reaction curve shows its output as a function of how much it thinks Firm 1 will produce. In Cournot equilibrium, each firm correctly assumes the amount that its competitor will produce and thereby maximizes its own profits. Therefore, neither firm will move from this equilibrium. COURNOT EQUILIBRIUM ● Cournot equilibrium Equilibrium in the Cournot model in which each firm correctly assumes how much its competitor will produce and sets its own production level accordingly. Cournot equilibrium is an example of a Nash equilibrium (and thus it is sometimes called a Cournot-Nash equilibrium). In a Nash equilibrium, each firm is doing the best it can given what its competitors are doing. As a result, no firm would individually want to change its behavior. In the Cournot equilibrium, each firm is producing an amount that maximizes its profit given what its competitor is producing, so neither would want to change its output. The Linear Demand Curve—An Example Two identical firms face the following market demand curve 𝑃 = 30 − 𝑄 Also, MC1 = MC2 = 0 Total revenue for firm 1: then 𝑅1 = 𝑃𝑄1 = 𝑎 − 𝑄 𝑄1 = 𝑎𝑄1 − 𝑄12 − 𝑄2 𝑄1 MR1 = ∆𝑅1 ∆𝑄1 = 30 − 2𝑄1 − 𝑄2 Setting MR1 = 0 (the firm’s marginal cost) and solving for Q1, we find 1 𝑄 = 15 − 𝑄 Firm 1’s reaction curve: 1 2 2 By the same calculation, Firm 2’s reaction curve: Cournot equilibrium: (12.1) 1 𝑄2 = 15 − 𝑄2 2 (12.2) 𝑄1 = 𝑄2 = 10 Total quantity produced: 𝑄 = 𝑄1 + 𝑄2 = 20 If the two firms collude, then the total profit-maximizing quantity is: Total revenue for the two firms: R = PQ = (30 –Q)Q = 30Q – Q2, then MR1 = ∆R/∆Q = 30 – 2Q Setting MR = 0 (the firm’s marginal cost) we find that total profit is maximized at Q = 15. Then, Q1 + Q2 = 15 is the collusion curve. If the firms agree to share profits equally, each will produce half of the total output: 𝑄1 = 𝑄2 = 7.5 DUOPOLY EXAMPLE The demand curve is P = 30 − Q, and both firms have zero marginal cost. In Cournot equilibrium, each firm produces 10. The collusion curve shows combinations of Q1 and Q2 that maximize total profits. If the firms collude and share profits equally, each will produce 7.5. Also shown is the competitive equilibrium, in which price equals marginal cost and profit is zero. ECON 500 Cournot Competition – General Model n firms, indexed by i = 1,…,n each of which is producing qi with the cost function Ci(qi) where the total industry output is Q = q1 + q2 + … + qn and where the inverse demand revealing the market price is P(Q) with P’(Q) < 0 A representative firm i maximizes it’s profit πi = P(Q) qi - Ci(qi) where the first order condition with respect to it’s own quantity is P(Q) qi + P’(Q) qi – Ci’(qi) = 0 This first order condition must hold for all firms i = 1,…,n and this system of equations can be solved for the Cournot-Nash equilibrium quantity qi* by imposing symmetry. ECON 500 Natural Spring Duopoly Inverse demand: P(Q) = a – Q where Q = ∑ Cost functions Ci(qi) = cqi Bertrand Equilibrium: P* = c; total output = Q* = a – c *i = 0; total profit for all firms = * = 0 ECON 500 Natural Spring Duopoly Inverse demand: P(Q) = a – Q where Q = ∑ Cost functions Ci(qi) = cqi Cournot Equilibrium: 1 = P(Q)q1 – cq1 = (a – q1 – q2 – c)q1 2 = P(Q)q2 – cq2 = (a – q1 – q2 – c)q2 a – 2q1 – q2 – c = 0 ↔ q1 = a – q1 – 2q2 – c = 0 ↔ q2 = q1* = q2* = (a – c)/3 total output = Q* = (2/3)(a – c) P* = (a + 2c)/3; 1* = 2* = (1/9)(a – c)2 * = (2/9)(a – c)2 ECON 500 Natural Spring Duopoly Inverse demand: P(Q) = a – Q where Q = ∑ Cost functions Ci(qi) = cqi Cartel Equilibrium: 1 + 2 = (a – q1 – q2 – c)q1 + (a – q1 – q2 – c)q2 a – 2q1 – 2q2 – c = 0 q1* = q2* = (a – c)/4 total output = Q* = (a – c)/2 P* = (a + c)/2; 1* = 2* = (a – c)2/8 * = (a – c)2/4 ECON 500 Natural Spring Duopoly ECON 500 Number of Firms and Range of Outcomes: n = perfect competition n = 1 perfect cartel / monopoly πi = P(Q)qi – cqi = (a – qi – Q-i - c)qi where ∂πi /∂qi = a – 2qi – Q-i – c = 0 Q-i = Q - qi qi = imposing symmetry Q-i* = Q* - qi* = n qi* - qi* = (n-1) qi* qi* = (a-c) / (n+1) Q* = P* = (a-c) a+ * = n ( c ) ECON 500 Prices or Quantities Cournot model admits more realistic market structure outcomes as n varies. However, firms tend to set prices rather than quantities Allowing for capacity constraints in price competition establishes an isomorphism between price and quantity competition. First stage: choose capacities q1, q2 Second stage: price competition p1, p2 p1 = p2 < p or p1 = p2 > p can not be a Nash Eq. p1 = p2 = p is the only Nash Eq. in the pricing stage. Having observed the outcome of the second stage, capacity choices are made in a Cournot fashion in the fisrt stage. ECON 500 Price Competition with Product Differentiation Suppose n firms simultaneously choose prices p1, p2,…, pn of their differentiated goods. Firm i’s demand is where, ai is the product specific attributes that enable differentiation. Firm i’s profit function is with the first order condition These FOCs can be solved simultaneously to yield the Nash Equilibrium prices. ECON 500 Price Competition with Product Differentiation ECON 500 Other Sources of Price Dispersion Even if the physical characteristics of the goods they sell are identical, competitors may have some ability to charge prices above marginal cost and earn positive profits if their location choices (quality, variety, transportation, etc. dimension) lead to spatial differentiation. Any positive search cost s incurred by the consumer that demand a single unit with identical gross surplus v to learn the prices of a number n of firms avoids the Bertrand Paradox and allows firms to arrive at a Nash Eq. where all firms charge the monopoly price v. Firms choices of where to locate in an attribute space in which consumers are distributed according to some density function with an increasing cost of buying at a location different than theirs also avoids Bertrand Paradox and allows for price (>MC) dispersion. ECON 500 Hotelling’s Beach Two firms locate at points a and b on the line of length L. Consumers are uniformly distributed along the same line and have quadratic costs of traveling to their firm of choice t(x-a)2 A consumer at x will be indifferent between the two firms if pA + t(x – a)2 = pB + t(b – x)2 b a pB p A x 2 2t (b a) ECON 500 Hotelling’s Beach The two firms’ demands are: Nash Equilibrium prices then become: ECON 500 Tacit Collusion Do firms have to endure the Bertrand paradox (marginal cost pricing and zero profits) in each period of a repeated game or can they instead achieve more profitable outcomes through tacit collusion? In order for collusion to be sustainable collusive profit should exceed one time deviation profit ECON 500 Tacit Collusion Do firms have to endure the Bertrand paradox (marginal cost pricing and zero profits) in each period of a repeated game or can they instead achieve more profitable outcomes through tacit collusion? Suppose Q = 5000 – 100P MC=AC=10 PB = 10 PC = 30 PM = 30-ε Πi = 0 ΠC = 20000 ΠM = 40000 Collusion can be sustained if δ >1/2 ↔ r <1 ECON 500 Tacit Collusion Do firms have to endure the Bertrand paradox (marginal cost pricing and zero profits) in each period of a repeated game or can they instead achieve more profitable outcomes through tacit collusion? Suppose Q = 5000 – 100P MC=AC=10 PB = 10 PC = 30 PM = 30-ε Πi = 0 ΠC = 20000 ΠM = 40000 With n firms collusion can be sustained if δ >1-(1/n) ↔ n <12