BMW Industries Limited Annual Report 2013-14

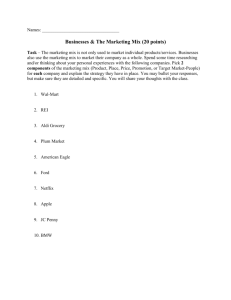

advertisement