Key Strategic Issues in Online Apparel Retailing

advertisement

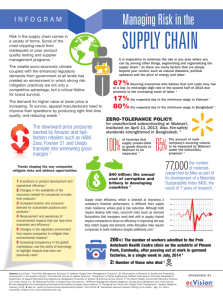

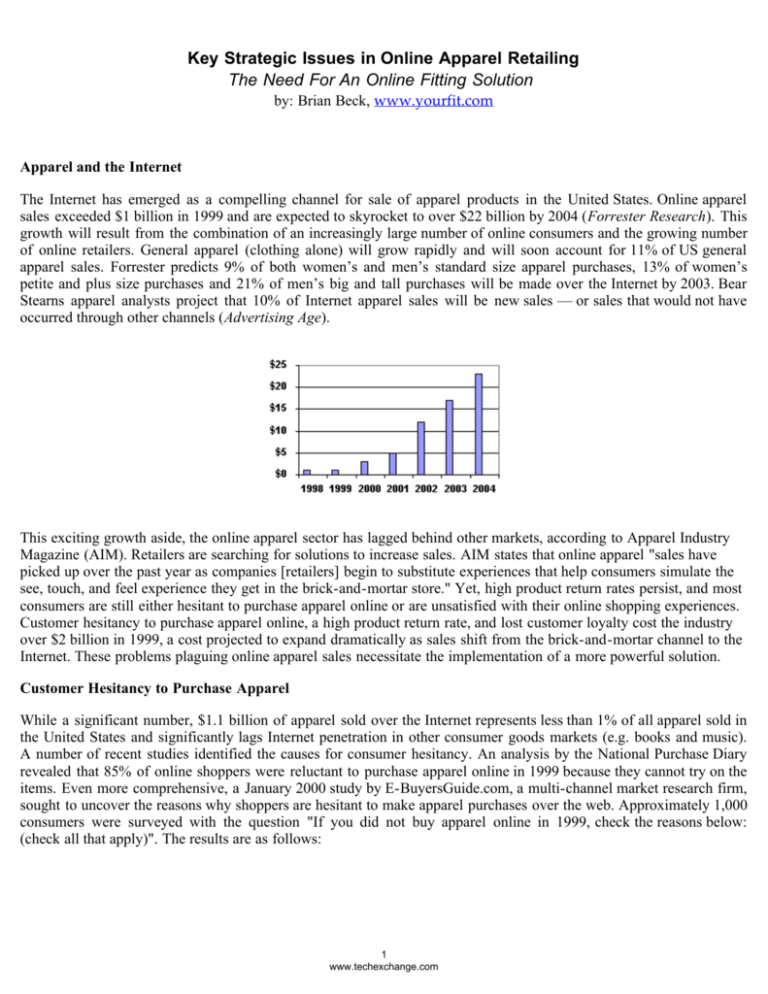

Key Strategic Issues in Online Apparel Retailing The Need For An Online Fitting Solution by: Brian Beck, www.yourfit.com Apparel and the Internet The Internet has emerged as a compelling channel for sale of apparel products in the United States. Online apparel sales exceeded $1 billion in 1999 and are expected to skyrocket to over $22 billion by 2004 (Forrester Research). This growth will result from the combination of an increasingly large number of online consumers and the growing number of online retailers. General apparel (clothing alone) will grow rapidly and will soon account for 11% of US general apparel sales. Forrester predicts 9% of both women’s and men’s standard size apparel purchases, 13% of women’s petite and plus size purchases and 21% of men’s big and tall purchases will be made over the Internet by 2003. Bear Stearns apparel analysts project that 10% of Internet apparel sales will be new sales — or sales that would not have occurred through other channels (Advertising Age). This exciting growth aside, the online apparel sector has lagged behind other markets, according to Apparel Industry Magazine (AIM). Retailers are searching for solutions to increase sales. AIM states that online apparel "sales have picked up over the past year as companies [retailers] begin to substitute experiences that help consumers simulate the see, touch, and feel experience they get in the brick-and-mortar store." Yet, high product return rates persist, and most consumers are still either hesitant to purchase apparel online or are unsatisfied with their online shopping experiences. Customer hesitancy to purchase apparel online, a high product return rate, and lost customer loyalty cost the industry over $2 billion in 1999, a cost projected to expand dramatically as sales shift from the brick-and-mortar channel to the Internet. These problems plaguing online apparel sales necessitate the implementation of a more powerful solution. Customer Hesitancy to Purchase Apparel While a significant number, $1.1 billion of apparel sold over the Internet represents less than 1% of all apparel sold in the United States and significantly lags Internet penetration in other consumer goods markets (e.g. books and music). A number of recent studies identified the causes for consumer hesitancy. An analysis by the National Purchase Diary revealed that 85% of online shoppers were reluctant to purchase apparel online in 1999 because they cannot try on the items. Even more comprehensive, a January 2000 study by E-BuyersGuide.com, a multi-channel market research firm, sought to uncover the reasons why shoppers are hesitant to make apparel purchases over the web. Approximately 1,000 consumers were surveyed with the question "If you did not buy apparel online in 1999, check the reasons below: (check all that apply)". The results are as follows: 1 www.techexchange.com These factors resulted in over $3.3 billion in lost revenue to the online apparel industry in 1999 in the US alone. Of particular note is the consumer’s overwhelming concern with fit and correct sizing (28% of respondents), concerns with having to return garments (18% of respondents), the inability to fully evaluate garment (quality, details, etc.) (20%), and the lack of or difficulty in obtaining of the right information and difficulty in using site (6%). 72% of online shoppers (almost 30 million consumers) did not purchase apparel online in 1999 due to these reasons, resulting in $2.4 billion (72% of $3.3 billion) in lost revenue to the online apparel industry in 1999. In addition to consumer hesitancy, the average purchase size for online apparel stands at only $101 (Internet Retailer Magazine). Studies have shown that the introduction of interactive technologies leads to an increase in the average purchase size, sometimes by as much as four times the industry average (Stores Magazine). Online Return Problem Consumers send back an estimated 30% of product online apparel purchasesorders, amounting to a $6 billion annual problem for apparel e-tailers by 2004 in the US alone (Forrester Research, Research Boston, yourfit.com research). On average, return costs stood at 21% of gross sales in 1999 for online apparel sellers and are projected to evolve to 27% in 2004 as an increasing number of e-tailers pay for all shipping to and from the consumer to ensure consumer loyalty (Bain & Company). Return costs are enumerated as follows and vary by type of apparel and retailer. Customer service costs. Shipping costs - labor and materials. Pick//pack and shipping costs - labor and materials. Disposal of written-off item and markdown on item re-sale. Lost customer loyalty. Potential lost revenues and margin on the initial sale. In 1999, return costs to the online apparel industry exceeded $240 million in the US alone. The largest single reason for garment return is poor fit, in some cases responsible for 75% of returns (leading apparel e-tailer). Lost loyalty Lost customer loyalty is projected to cost the online apparel industry over $800 million, based on 1999 transactions alone. This number will continue to grow as increasing numbers of apparel purchases are completed over the Internet. According to a recent study by iMarketing News, 62% of consumers that describe their experience as unsatisfactory will not purchase from a site again. 18% of online apparel shoppers are dissatisfied, translating to 11% of total online shoppers that will never return to purchase from the e-tailer. When applied to the average lifetime value of an apparel customer (four years) and the total number of online shoppers, the losses from 1999 alone are staggering, as demonstrated in the table below. 2 www.techexchange.com Today’s Evaluation Tools Consumers that purchase apparel online today base their purchase and size-selection decisions mostly on 2D photos of garments and sizing charts. Recognizing the insufficiency of this customer experience, e-tailers have begun to implement improved functionalities on their sites. Recently introduced capabilities allow the customer to view items together, such as a blouse and a skirt, enabling the mix and match of color/texture combinations, and zoom technology, to give the customer a feel for garment details. A few e-tailers offer 360 degree viewing, enabling complete rotation of the apparel item. Even with these improvements in product presentation, a number of things can go wrong when the consumer pulls the apparel item out of the box. The most common problems include poor fit, bad drape, or unpleasant feel while wearing the item, or surprise as to the color of the garment. Customer dissatisfaction in any of these areas drives returns, a costly occurrence for e-tailers, and creates lost customer loyalty, an even more costly proposition. The Next Generation in Online Apparel Merchandising Industry attempts to solve the online product evaluation and fitting conundrum have met with limited success, as evidenced by the high percentage of Internet shoppers who are unsatisfied with their online shopping experience, the high amount of lost revenue, and high product return rates. Today’s online apparel merchandising tools have not succeeded in created an online setting in which consumers feel completely comfortable shopping. The need for a comprehensive solution to the online product evaluation and fitting problem is apparent. A virtual dressing room, in which consumers can not only view apparel products, but see them on their bodies, addresses many of the concerns that consumers have about shopping for apparel online: Hesitancy to purchase based on fit and return concerns. Need to return items based on poor fit. Dissatisfaction with purchases and resulting lost customer loyalty. With a virtual dressing room solution, consumers will view completely accurate models of themselves wearing clothing in multiple colors and sizes and read about how the garments will fit. This next generation of fitting software will even provide a recommendation as to which size fits the consumer’s body best. Shoppers will be empowered to finally gain a true understanding of the fit of the garment before they buy it, solving the problems enumerated above: Reduce consumers’ hesitancy to purchase apparel online by allowing them to try it on. Decrease product returns by guaranteeing fit through visual evaluation, size recommendation, and fit description. Ensure long-term loyalty by reducing dissatisfaction with purchases and building a virtual closet of past purchases. The time is ripe for a robust solution enabling apparel retailers to match the remarkable growth of commodity products selling over the Internet. With a fully functional virtual dressing room, the apparel industry will be set to explode beyond the $22 billion in sales already projected for 2004 (Forrester Research). September 2000 3 www.techexchange.com