Insurance companies as employers (<1MB)

advertisement

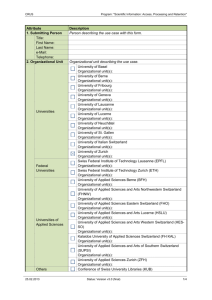

26 Insurance companies as employers Source of income for 49 000 families in Switzerland Swiss private insurance companies employ around 129 000 employees across the world, 49 000 of them in Switzerland. The industry trains 1 800 apprentices and offers a wide range of further training opportunities. The insurance industry shows the highest productivity (value added per employee) of any sector in Switzerland. With its 129 000 employees, 49 000 of them in Switzerland, private insurance is one of the most important employers in the country. The sector also trains around 1 800 apprentices every year. If all those families whose living depends indirectly on the insurance industry were added, these figures would be at least doubled. Insurance industry workers are highly trained and have a great deal of purchasing power. Insurers offer interesting professions Almost one in five employees in an insurance company works in field sales. Since the new supervisory legislation came into force in 2006, registration has been mandatory for insurance intermediaries who are not tied. Account managers working on behalf of one insurance company may register on an optional basis. In 2008, 382 intermediaries working for insurance com­ panies gained the right to use the legally protected title of ­Insurance Intermediary VBV. In addition, the spectrum of professions offered by Swiss insurance companies is enormous. It ranges from telephonist to loss expert, art historian and stock exchange trader to lawyer and from translator to director’s personal assistant, programmer and web designer to mathematician and engineer. ASA SVV Nothing works without insurance An industry that champions education The Insurance Industry Vocational Training Association (VBV), as a centre of competence for vocational and cross-company education and training, delivers in­ novative services to insurance companies’ employees. In addition, it also provides tailored teaching and learning media. Due to the complexity of the insurance business and the constantly growing and changing needs of the stakeholders, a sufficient number of specialists with top qualifications is essential. This requires ongoing adaptation of the industry’s education and training provision. The VBV has addressed this in the past few years and introduced a new training concept with the Insurance Management School HFV. In addition, there is a revised federal certificate in insurance. Investing in knowledge In the past year, 511 candidates have taken up inservice training formulated according to a new concept. Some of them are aiming for the federal certificate in insurance. That means they are headed in the near future for a career as, for example, a risk advisor, loss inspector, management consultant or corporate portfolio analyst. Others want to gain the diploma awarded by the Insurance Management School and become qualified insurance managers. After that, positions as product manager, sales manager, general agent or account manager will be open to them. These two training programmes have been newly created and represent a total investment of CHF 6.6 million francs. 27 High status of education and training Insurance companies attach great importance to the field of education and training, which enjoys high priority as an element of strategic management. Traditionally, insurers have also been committed to training apprentices, a commitment they take very seriously. To ensure that they can continue to offer young people competitive occupational training in the future, they are championing the innovative further development of education and training. Training is rising rapidly in importance in the deregulated and client-orientated market. The Swiss insurance industry will address its tasks in this field aggressively and respond to the changes. In other words, it will continue to invest in knowledge. The Insurance Industry Vocational Training Association Insurance Industry Vocational Training Association: www.vbv.ch Registration for the insurance intermediary course: www.education-at-insurance.ch Registration for the VBV insurance intermediary examination: www.intermediary-at-insurance.ch Registration for the advanced vocational training course culminating in the Federal Certificate of Insurance: www.education-at-insurance.ch Registration for the HFV diploma: www.akad.ch Employees in the private insurance sector At 1 January 2007 Total employed 2008 2009 125 184 126 005 129 227 In Switzerland 47 184 47 505 49 236 Abroad 78 000 78 500 79 991 Women 19 814 19 316 20 718 Men 27 370 28 189 28 518 Full-time employees 38 069 38 875 39 518 Part-time employees 9 115 8 630 9 718 39 251 39 549 40 097 7 933 7 956 9 139 Female trainees 983 958 986 Male trainees 812 780 787 Total trainees 1 795 1 738 1 773 Breakdown of those employed in Switzerland Administration Sales force Source: Swiss Insurance Association ASA SVV Nothing works without insurance 28 ASA SVV Nothing works without insurance 29 Incomes for 49 000 families Swiss private insurance companies have around 129 000 employees across the world, 49 000 of them in Switzerland. In addition, they are important clients and safeguard jobs in many different industries. They train around 1 800 apprentices every year and attach major importance to training and education. ASA SVV Nothing works without insurance 30 “Swiss insurers not only represent an important economic factor, they also embody fundamental values like trust, security and reliability. This reputation also makes a de­ cisive contribution to Switzerland’s good image abroad.” Ernst Tanner, CEO and Chairman of the Board of Directors Lindt & Sprüngli, Kilchberg ZH ASA SVV Nothing works without insurance