Business Opportunities in Malaysia

advertisement

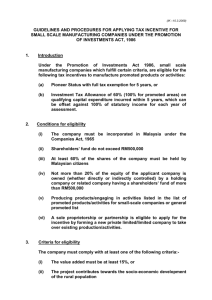

Malaysian Investment Development Authority Business Opportunities in Malaysia National Defence Industrial Association (NDIA) May 27, 2010 www.mida.gov.my 1 Malaysian Investment Development Authority MIDA is the first point of contact for investors who intend to set up projects in the manufacturing and its related services sectors in Malaysia www.mida.gov.my 2 Malaysian Investment Development Authority MIDA’s Global Network Dubai Guangzhou Mumbai www.mida.gov.my 3 Malaysian Investment Development Authority MALAYSIAN ECONOMY 2006 2007 2008 2009 2010f Real GDP (%) 5.9 6.3 4.6 - 1.7 4.5 – 5.5 Inflation (%) 3.6 2.0 5.4 0.6 2.0 – 2.5 Unemployment (%) 3.3 3.2 3.3 3.7 3.6 Trade Surplus (US$ bil) 29.6 29.2 42.6 33.6 11.4 International Reserves (US$ bil) 90.8 101.3 91.4 96.7 95.7* * As at 15 April 2010 (Q1) Source: Central Bank of Malaysia Malaysian Investment Development Authority PROJECTION OF MALAYSIA GDP GROWTH RATE FOR 2010 Agency Forecast GDP (%) Malaysian Government 4.5 – 5.5 World Bank 5.7 Morgan Stanley 7.4 Barclays Bank 7.5 Malaysian Investment Development Authority KEY ECONOMIC INDICES OF MALAYSIA JANUARY – MARCH 2010 Index Jan Feb Mar Inflation Rate (%) 1.3 1.2 1.3 Industrial Production Index (%) 3.8 11.2 15.1 Manufacturing Index 3.5 - 9.7 16.3 Electricity Index (%) 2.1 - 9.6 16.8 Sales Value (USD bill) 12.7 11.8 13.7 Source: Department of Statistics Malaysia 6 Malaysian Investment Development Authority Malaysia’s Economic Strength •Diversified Economy •Healthy trade surplus •Strong inflow of FDI •Strong international reserves •Strong Banking System www.mida.gov.my 7 Malaysian Investment Development Authority Performance of the Manufacturing Sector 8 Malaysian Investment Development Authority TOTAL APPROVED MANUFACTURING PROJECTS (2008 – 2009) Year No. of Projects No. of Employment Proposed Investment (RM billion) Domestic Foreign Total 2008 919 101,173 16.7 46.1 62.8 2009 766 64,330 10.5 22.1 32.6 www.mida.gov.my 9 Malaysian Investment Development Authority FOREIGN INVESTMENT IN APPROVED MANUFACTURING PROJECTS BY MAJOR COUNTRIES JAN – MAR 2010 No of Projects Total Investments (US$ million) Singapore 20 541.3 China 5 140.3 Japan 8 131.0 Taiwan 7 61.5 Germany 3 32.7 United Kingdom 4 17.1 USA 5 14.1 Switzerland 2 6.8 Country 10 FOREIGN INVESTMENT IN IMPLEMENTED MANUFACTURING PROJECTS BY MAJOR COUNTRIES (AS AT 31 DECEMBER 2009) Malaysian Investment Development Authority No of Projects Total Investments (US$ billion) 2,287 17.7 663 13.5 Singapore 2,561 6.5 Germany 324 5.1 1,495 4.7 Netherlands 163 4.0 Rep. of Korea 287 2.6 United Kingdom 372 1.6 Spain 6 1.2 India 95 1.1 Country Japan USA Taiwan Malaysian Investment Development Authority INVESTMENT OPPORTUNITIES Malaysian Investment Development Authority High technology, capital intensive & knowledge driven industries: • Alternative Energy Sources • Biotechnology • Advanced materials • Advanced electronics • Optics and photonics • Petrochemicals • Pharmaceuticals • Medical devices • ICT • Aerospace Industries manufacturing intermediate goods: • Machinery & equipment • Components & parts • Moulds and dies Resourced-based industries: • Food ( Halal Hub ) • Value-added products from oil palm biomass (Particle board, MDF board & Plywood) Malaysian Investment Development Authority INVESTMENT OPPORTUNITIES IN THE SERVICES SECTOR Targeted Services Regional Establishments Business and professional services Logistics ICT services Offshore and outsourcing activities Distributive trade Education and training Construction Health Tourism 14 Malaysian Investment Development Authority REGIONAL ESTABLISHMENTS Opportunities for setting up Regional Operations i.e:- Operational Headquarters (OHQs), International Procurement Centres (IPCs), Regional Distribution Centres (RDCs), Regional Offices and Representative Offices. More then 2,700 regional establishments have set up operations in Malaysia Malaysian Investment Development Authority Investment Policies & Incentives 16 Malaysian Investment Development Authority Equity Policy 100% equity ownership is allowed, irrespective of the level of exports Repatriation of Profits No restriction is imposed on the repatriation of capital, interest profits and dividends to foreign companies investing in Malaysia 17 Malaysian Investment Development Authority Guidelines on Employment of Expatriate Personnel Automatic Approval: Companies No. Of Post Eligible Duration Foreign paid-up capital of Up to 10 posts US$2 million and above (including 5 key posts) • Key post – permanent • Exec. post – 10 years • Non-exec. post – 5 years Foreign paid-up capital of more than US$200,000 Up to 5 posts (including but less than US$2 at least 1 key posts) million • Key post – permanent • Exec. post – 10 years • Non-exec. Post – 5 years Malaysian Investment Development Authority Major Incentives Provided Pioneer Status (PS) Income tax exemption, ranging from 70% to 100% of statutory income - Manufacturing -R&D - Services Investment Tax Allowance (ITA) ITA of 60% to 100% on qualifying capital expenditure for a period of 5 years Reinvestment Allowance (RA) 60% on qualifying capital expenditure for 15 consecutive years commencing from the 1st year the reinvestment is made 19 Malaysian Investment Development Authority Exemption from Import Duty on Raw Materials/Components Exemption from Import duty and Sales Tax on Machinery/Equipment 20 Malaysian Investment Development Authority INCENTIVES FOR THE SERVICES SECTOR Malaysian Investment Development Authority • • • OPERATIONAL HEADQUARTERS (OHQ)/ INTERNATIONAL PROCUREMENT CENTRE (IPC)/ REGIONAL DISTRIBUTION CENTRE (RDC) Full tax exemption for 10 years • • REPRESENTATIVE OFFICE (RE)/ REGIONAL OFFICE (RO) RE or RO status given for a period of 5 years • • • INTEGRATED LOGISTICS SERVICES (ILS)/ INTEGRATED MARKET SUPPORT SERVICES (IMSS)/ INCENTIVES FOR INTEGRATED CENTRAL UTILITY FACILITIES (CUF) Eligible for PS or ITA Malaysian Investment Development Authority Aerospace Industry In Malaysia 23 Malaysian Investment Development Authority Aerospace Industry The aerospace industry comprises the aviation and space sub-sectors The aviation sub-sector encompasses manufacturing of parts & components; maintenance, repair and overhaul (MRO) activities; design & development; and assembly of light aircraft A total of 38 aerospace companies have been approved with various types of incentives. - Of this, 35 companies are in operation Malaysian Investment Development Authority Aerospace Industry – Companies in Operation 23 companies undertaking MRO activities (Malaysia has a full range of MRO capabilities which include modification and remanufacturing of engines & engine components, repair & overhaul of aircraft parts, components and airframe, repair and testing of aircraft instruments and components and provision of line and heavy maintenance to both military and civil aircraft) 12 companies involved in the manufacturing of aircraft parts and components including ground support equipment (Parts and components include aero structures, composite parts, metal parts, machined parts and aircraft avionic components) Malaysian Investment Development Authority Aerospace Industry Malaysia aspires to be global center for aerospace business and a preferred location for business expansion and strategic partnership in the Asia Pacific region To further promote aerospace industry, a comprehensive tax incentive package has been formulated on four (4) main groupings: Design, Manufacturing & Assembly group Operator group Support group Regulatory group Malaysian Investment Development Authority Electronics Industry In Malaysia 27 Malaysian Investment Development Authority EVOLUTION OF ELECTRONICS INDUSTRY 2 Started in 1970’s with 7 companies Consumer : Clarion and Bosch Production Capability Level 1 Components : AMD, HP Intel, Litronix and National Semiconductor Start with a few relatively simple discrete components and semiconductor, parts assembly, SKD 1970 Office & computer equipment (inc. hard disk drive and hard disks) Consumer electronics (analogue) parts to full assembly 1980 Time 1990 Higher value-added products/activities (research, design, wafer fab, ingot growing e.g semiconductor, LED, solar), low volume, high complexity and high mixed products (e.g instrument, medical, aerospace), digital consumers (e.g blu-ray player, HDTV-LED flatscreen, e-book 2010 Malaysian Investment Development Authority Components (EC) Industrial (IE) Motorolla, CSL, Flextronics Electronics Intel, AMD, NEC, Toshiba, Freescale, Spansion, Projects Approved By Sub-sector (USD Billion) Sub-sector 2008 2009 Total EC 1.50 0.88 2.38 IE 1.02 0.11 1.14 CE 0.05 0.11 0.17 Total 2.57 1.10 3.69 Consumer (CE) Sony, Samsung, Panasonic, Sharp, JVC, NEC Malaysian Investment Development Authority Electrical Industry In Malaysia www.mida.gov.my 30 Malaysian Investment Development Authority Industrial Electrical – No. of companies in production – 94 (from 1980 – 2008) – Major products: Switchgears Boards Electric motors – Major players: Malaysian-owned – Malaysia Transformer – TNB Switchgear Foreign-owned/controlled – Nemic Lambda – Hitachi Koki – Panasonic Compressor – Bando Electronics – ABB Manufacturing www.mida.gov.my 31 Malaysian Investment Development Authority Electrical Components – No. of companies in production – 138 (from 1980 – 2008) – Major products: Cables Connectors Batteries Solar cells/wafers – Major players: Malaysian-owned – Mitti Cables – Leader Cables – GP Autobat Foreign-owned/controlled – Fujikura – Sumitomo – Panasonic Manufacturing – Q-Cells – Sunpower – Elektrisola – First Solar www.mida.gov.my 32 Malaysian Investment Development Authority Information Communication Technology (ICT) Industry In Malaysia www.mida.gov.my 33 Malaysian Investment Development Authority …cont’d Computer & computer peripherals and Data Storage Devices Project approved : 223 (from 1980 - 2008) Plants in operation : 196 (from 1980 – 2008) Companies Computers:MNC’s :- Dell, NEC, Qisda Malaysian :- MIMOS Peripherals:Teleplan, Qisda, Affinex Technologies Data storage devices Western Digital, Benchmark Electronics www.mida.gov.my 34 Malaysian Investment Development Authority …cont’d Telecommunications equipment/devices Project approved : 252 (from 1980 - 2008) Plants in operation : 211 Companies Pernec, CSL , Balda Solutions , Finisar, Sanyo PT Optics (photonics, optoelectronics and other optical products) and Optoelectronics Project approved : 17 (from 1980 - 2008) Plants in operation : 15 Companies Finisar Malaysia,Huber & Suhner, OSRAM, Dominant, Nichia Malaysia, PWB Technologies www.mida.gov.my 35 Malaysian Investment Development Authority Focus on new products, applications and technologies :- Wireless telecommunication equipment/devices Mobile application products Broadband equipment and networking products Optics products Multi service and convergent products www.mida.gov.my 36 Malaysian Industrial InvestmentDevelopment DevelopmentAuthority Authority MACHINERY AND EQUIPMENT SECTOR www.mida.gov.my 37 Malaysian Investment Development Authority M&E Cluster Research & Development Support Raw Materials & Components • NCMTT • TPM • Institutions • Universities Heat treatment Surface treatment Casting Forging Mould & die Machining Sub assemblies Fabrication www.mida.gov.my R&D, D&D and Prototyping Sales and Servicing M&E Engineering Supporting Industries • • • • • • • • Modules & Components Manufacturing Associations • MEMA • MMADA • FOMFEIA • FMM-ATIG System Integration Assembly, Testing & Packaging Refurbishment & reconditioning 38 Malaysian Investment Development Authority DEVELOPMENT OBJECTIVES AND STRATEGIES FOR THE M&E INDUSTRY OF MALAYSIA To promote Malaysia as : 1) The regional production hub for the high technology and specialized machinery and equipment 2) The main distribution centre in the region for all types of machinery and equipment 3) The centre for maintenance related services, refurbishment, reconditioning and upgrading of high technology and specialized machinery and equipment Note : To provide total solution for machinery, automation and engineering services www.mida.gov.my 39 Malaysian Industrial InvestmentDevelopment DevelopmentAuthority Authority MALAYSIA’S ENGINEERING SUPPORTING INDUSTRY www.mida.gov.my 40 Malaysian Investment Development Authority Malaysian Engineering Supporting Capabilities Capabilities Sectors Mould & Die Very Strong Strong √ Machining √ Metal Stamping √ √ Surface Engineering √ Heat Treatment √ Forging www.mida.gov.my Basic √ Metal Casting Metal Fabrication Average √ 41 Malaysian Investment Development Authority FACILITIES 42 Malaysian Investment Development Authority FACILITIES TO SUPPORT INDUSTRY • Suitable infrastructures – – – – – Industrial estates Electricity Water Gas Telecommunication • Training – Training institutions – Collaboration with local universities – MIMOS • Manpower – to ensure constant flow of trained workforce CONT. 43 Malaysian Investment Development Authority Training Institutions Technical Training Institutions Courses/programs Public Universities (20) Engineering Courses (Electrical, electronics, mechatronics, chemical etc.) Private Universities /college (37) Engineering Courses (Electrical, electronics, mechatronics, chemical etc.) Industrial Training Institutes (8) Industrial Electronics Polytechnics (27) Certificate/Diploma in Electrical & Electronics Engineering Community College (59) Certificate in Electrical Technology Installation & Service, Diploma in Electrical Technology Penang Skill Development Centre Industrial skill enhancement program (INSEP- partnership with company), Engineering courses (Diploma, Degree, Master – Microelectronics, photonics, Telecommunications GMI (German-Malaysian Institute), JMTI, MFI, BMI, SMI Industrial electronics, Productions Technologies ( Tool & Die, Mould Technology, CNC precision), Resources Development centre – German A-Level preparatory program SHRDC INSEP, Semiconductor chip design + packaging, testing, PCB Analog design,Product design, mould making etc 44 Malaysian Investment Development Authority OUTPUT OF ENGINEERING GRADUATES FROM PUBLIC UNIVERSITIES Year 2008 2009 Forecast 2010 Total Graduates 13,222 13,488 13,759 40,469 Source : Respective Universities 45 Malaysian Investment Development Authority Outsourcing Opportunities 46 Sourcing Capabilities in Malaysia Malaysian Investment Development Authority Engineering Supporting - Mould and Die, Metal Casting, Machining, Metal Stamping, Surface Engineering, Heat Treatment (more than 1,000 companies) - Metal Fabrication (well established) Semiconductor/ electronics components - Silicon wafer, Wafer fab, IC packaging and testing, IC design house, PCB, PCBA, LED, Other passive components (about 380 companies) Plastic components (480 companies) Rubber components (180 companies) In-house design & development Related infrastructure - Design centres - Technical facilities - Specialised colleges - Research institutions www.mida.gov.my 47 Malaysian DevelopmentLocation Authority MalaysiaInvestment : The Preferred for Outsourcing Outsourcing Manufacturing of modules, components & parts Manufacturing related service Individual components/ services Integrated services/ total solution - Product conception to serial production - Manage the entire process including logistics, warehousing, packaging, testing and certification D&D/ R&D Raw material components sourcing Modules/ parts production Sub/ final assembly QC Delivery Outsourcing Supply Chain Management www.mida.gov.my 48 Malaysian Investment Development Authority Why Malaysia ? 49 Malaysian Investment Development Authority ADVANTAGES OF MALAYSIA Consideration Malaysia Incentives Very attractive incentive scheme. • Pioneer Status • Investment Tax Allowance • Reinvestment Allowance Tax savings & low inflation ensure long term competitiveness Income Tax After Incentive Period 25% on Net Income after incentive period Human Resources Skilled labor. CONT. 50 Malaysian Investment Development Authority Malaysia Consideration Facilities : Power Very competitive tariff. Better power quality. Very good power grid infrastructure Facilities : water Abundant supply and very competitive tariff Government Priority industry. Strong support from Government Heavy Engineering Supporting Services Strong Oil & Gas and Chemical Plant Fabrication, Maintenance, Repair, Engineering Services CONT. 51 Malaysian Investment Development Authority Green Energy Resources From hydro, NG, low sulphur coal, bio mass (wood chip & palm waste) Financial Support Grants and supports for High Impact Priority Project Good Implementation Track Record Infineon Wafer Fab(Kedah)-15 months (3 months ahead of schedule) First Solar (Kedah) - 11 months Strategic Location Centre of Asia-most of the new capacities and demand are in Asia. 52 Malaysian Investment Development Authority MALAYSIA’S INTERNATIONAL RANKINGS • 3rd Attractive Location For Outsourcing Destinations – A.T. Kearney Global Services Location Index 2009 • 10th Most Competitive Economy In 2010 – Institute Management of Development • 23rd For Ease Of Doing Business – World Bank’s Doing Business 2010 Report • 24th Most Competitive Economy for 2009 - 2010 – The Global Competitive Report 2009 – 2010 by WEF • 25th Best Country For Business – Forbes Report 2009 • 27th Most Networked Economy – Global Information Technology Report 2009-2010 by WEF Malaysian Investment Development Authority FACILITATION OF INVESTMENT MIDA as a One Stop Agency Processing / Evaluation of applications for: • Manufacturing licence • Tax incentives • Import duty exemptions on raw materials, components and machinery • Expatriate posts/work permits • Regional establishments such as Operational Headquarters, International Procurement Centres, Regional Distribution Centres, Regional and Representative Offices 54 Malaysian Investment Development Authority FACILITATION OF INVESTMENT MIDA as a One Stop Agency to assist investors Representatives Based In MIDA • Immigration Department • Royal Malaysian Customs Liasion Officers outside MIDA • Department of Occupational Safety and Health • Department of Environment • Ministry of Finance • Tenaga Nasional Berhad • Ministry of Human • Telekom Malaysia Berhad • Labour Department Resources • Construction Industry Development Board 55 Malaysian Investment Development Authority CONCLUSION The Malaysian Government is committed to ensuring that Malaysia remains a competitive and business friendly location. Malaysian Investment Development Authority www.mida.gov.my Thank You for your kind attention www.mida.gov.my 57