Cheaper than Value

advertisement

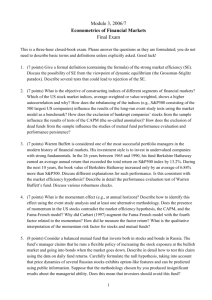

Cheaper than Value* Denis B. Chaves† Research Affiliates, LLC Jason Hsu‡ Research Affiliates, LLC UCLA Anderson Business School Vitali Kalesnik§ Research Affiliates, LLC SDSU Yoseop Shim** Research Affiliates, LLC First Draft: June 14, 2011 Current Draft: September 23, 2011 Abstract Value strategies appear to provide an extra source of return. Academic literature provides two competing theories on what drives the value premium: exposure to risk factors or mispricing of the securities. Existing empirical studies have not conclusively rejected one in support of the other. Using Fama and MacBeth (1973) regressions and extensions of the portfolio tests based on Daniel and Titman (1997), we provide evidence that the book-to-market characteristic largely subsumes the loading on the value factor (HML) as a variable that explains the cross-section of stock returns. We improve the power of these tests by using daily data for estimating factor loadings and by using data from 23 developed countries going back more than 30 years. Given these results, we conclude mispricing is likely a more significant portion of the value premium. There appears to be a free lunch after all. * The authors would like to acknowledge comments and suggestions from Katy Sherrerd. Denis Chaves is a senior researcher in Research & Investment Management at Research Affiliates, LLC, Newport Beach, CA. ‡ Jason Hsu is chief investment officer at Research Affiliates, LLC, Newport Beach, CA, and an adjunct professor of finance at the UCLA Anderson Business School, Los Angeles, CA. § Vitali Kalesnik is a vice president in Research & Investment Management at Research Affiliates, LLC, Newport Beach, CA, and an adjunct professor of finance at SDSU, San Diego, CA. ** Yoseop Shim is a research associate in Research & Investment Management at Research Affiliates, LLC, Newport Beach, CA. † Cheaper Than Value Research Affiliates Electronic copy available at: http://ssrn.com/abstract=1940504 1 1. Introduction Value strategies have been popular with practitioners since the work of Graham and Dodd (1934).1 There is strong consensus among academics and practitioners, supported by empirical evidence, that value investing provides an extra source of return.2 The academic literature proposes two competing theories on the origin of the value premium. These two competing theories are hard to distinguish in empirical tests because they share very similar testable predictions. The main goal of this paper is to find tests that allow us to distinguish between these two theories. The tests we propose are extensions of the existing literature, and are executed on a large sample of countries. The first of the two theories claims that value stocks co-move with some unobserved risk factor. Potentially, they increase portfolio exposure to distress, liquidity, or some rare and hidden (Black Swan) risks and, therefore, offer a return premium. Fama and French (1993) construct a proxy for this risk factor—the HML factor—that can be used to assess a stock’s sensitivity to this yet-to-be-identified source of risk in the economy. Value stocks have high HML loadings and, therefore, are expected to deliver high average returns as risk compensation. The alternate theory, initiated by Lakonishok, Shleifer, and Vishny (1994), argues that value stocks are simply undervalued; investors extrapolate poor past performance and push prices too low relative to fundamentals. According to this theory, value stocks deliver high returns because valuation ratios, like book-to-market (B/M), mean-revert as investors realize and correct the mispricing. The two theories often offer the same testable predictions and, thus, are hard to distinguish. Additionally, HML loadings are correlated with B/M in the cross-section, often reducing the power of econometric tests used to disjoint the two influences. Understanding the source of the value premium has profound implications for the financial industry. For example, investors would likely tie their stock selection rules to reflect the source of the value premium. If the risk-based theory is correct, then value stocks should be selected according to their loadings on the HML factor. On the other hand, if the mispricing theory is correct, then value stocks should be selected according to B/M or other valuation ratios. Perhaps more importantly, investors will view risk differently under the alternative theories. If the risk-based theory is correct, a value-based strategy will expose the portfolio to added risk. Specifically, if the interpretation is that value stocks are exposed to unknown and hidden risks, then value outperformance may be entirely unattractive. If, on the other hand, the mispricing theory is true, then the value outperformance is a free lunch and investors should get as much of it as they can afford. Further, any short-term underperformance by value strategies would point to a buying opportunity in value stocks. Finally, if the mispricing theory is correct, the HML factor would not be the most appropriate portfolio for measuring risk or risk-adjusted performance. Portfolios based on B/M and other characteristics would be better choices for risk and performance attribution models.3 The current view is that the two dominant theories represent conflicting frameworks. We argue, on the other hand, that these two theories can be complementary. Further, we show that the value premium is generated to some extent by risk factor exposure, but mispricing plays a larger and more significant role. This conclusion seems to imply a free lunch for value investors. 1 Value investing is based on buying stocks with high book-to-market ratio, earnings-to-price ratio, dividend yield, and other measures of company fundamental to current price. 2 See Fama and French (1992), among others. 3 See Daniel, Grinblatt, Wermers, and Titman (1997) for an application. Cheaper Than Value Research Affiliates Electronic copy available at: http://ssrn.com/abstract=1940504 2 2. Review of Existing Models The academic literature features two competing theories on the source of the value premium. The first theory is risk-based and can nest neatly within the Intertemporal Capital Asset Pricing Model (ICAPM) framework of Merton (1973), in which the expected return of a stock or portfolio is given by its loadings, , on a series of risk factors and the risk premiums on these factors, : E = ∑ୀଵ ∙ . (1) Under the ICAPM framework, investors are sensitive to undiversifiable shocks to their consumption and their investment opportunity sets. Value stocks (or high fundamental-to-price stocks) are assumed to be correlated with these shocks— making them risk-accentuating to investors—and, therefore, carry a risk premium. Specifically, Fama and French (1993) argue that the value premium arises as a compensation for financial distress risk. They argue that value stocks would underperform during credit or liquidity crises. Working backward, Fama and French use value strategies to construct a factor portfolio that supposedly measures and captures distress risk. They construct a zero-investment (long/short) portfolio of high B/M stocks (value stocks) minus low B/M stocks (growth stocks). This long/short portfolio is commonly referred to as high-minus-low, or HML, and is used as a proxy for distress risk. In Fama and French’s setup, stocks that are sensitive to distress risk exhibit high loadings on the HML factor, ுெ , thus earning a distress risk premium. In other words, value stocks generally exhibit, by construction, high loadings on the HML factor and the value outperformance is interpreted as compensation for being exposed to distress risk. Campbell, Hilscher, and Szilagyi (2008, 2011) challenge this interpretation and show that financially distressed stocks—those with higher probabilities of default—have generally delivered “anomalously low returns” despite having “much higher loadings on the HML factor.” This evidence is damning to the original Fama and French (1993) conjecture that value is distress. We observe that some stocks that have high loading on HML—and, thus, co-move strongly with value stocks—do not earn a value premium but rather produce low returns. More puzzlingly, these stocks have high probability of default and are sensitive to aggregate distress risk. Today, the risk-based literature is significantly less specific about the nature of those risks or their economic interpretation. Various articles propose different risks that may be correlated with value stock returns. However, the academe has not thrown its support behind a particular risk story. The current consensus is that value stocks have exposure to some hidden risks that are rare, hard to measure, and even harder to observe. (Some observers point to the resemblance between those types of risk and Black Swan events.) The second theory is based on Lakonishok, Shleifer, and Vishny (1994), who point out that mispricings might be the source of the value premium. They argue that value stocks are not risky but, in fact, cheap. The value effect, according to this strand of the literature, can be interpreted as driven primarily by mean reversion in prices.4 Expected returns for stocks are, therefore, time-varying and predictable, containing a risk-based premium and an abnormal return driven by mispricing, which can be predicted by valuation ratios like B/M or dividend yield. What the literature seems to be lacking are clear and statistically powerful tests to evaluate one theory versus the other. In this paper we try to fill this void by further developing existing tests in a way that makes them relatively easier to follow and test, and applying them on a large cross-section of countries, which increases their power significantly. 4 See Arnott and Hsu (2008) and Arnott, Hsu, Liu, and Markowitz (2011) for examples. Cheaper Than Value Research Affiliates 3 3. Portfolio Tests This section describes how we use portfolios sorted on factor loadings and characteristics to test the predictions from the risk-based and mispricing theories. As we show below, each theory has different predictions for the expected returns of portfolios with similar HML loadings but different B/M characteristics, or similar B/M characteristics but different HML loadings. Exploring the different predictions allow us to better distinguish between the competing theories. We use the Carhart (1997) four factors as the risk model throughout the paper: HML (value), SMB (small stock), UMD (momentum), and MKT (market): ௧ − ௧ = + ெ் ∙ ௧ெ் − ௧ + ுெ ∙ ௧ுெ + ௌெ ∙ ௧ௌெ + ெ ∙ ௧ெ . (2) We use daily stock returns from the past two months to estimate the regression in Equation (2). This choice allows us to use the international equity sample more efficientlybecause it has a shorter sample period. Note that two months of daily returns contain more observations than three years of monthly returns, which is a common choice in the literature. Moreover, if we suspect that loadings can be highly time-varying, using recent data in the estimation increases the likelihood that the ex ante factor loadings are indeed a good proxy for the ex post factor loadings. All details regarding factor construction and estimation of the factor loadings are located in the Appendix. Daniel and Titman (1997) propose a simple test to identify whether expected returns are a function of the B/M characteristic or the loading on the HML factor. The main challenge with their test is that HML loading and B/M are quite correlated across stocks. Daniel and Titman use traditional portfolio sorts to disentangle these two influences on stock returns. For these types of tests to be statistically powerful, one needs to find a large group of stocks that show strong variation along one dimension but not the other. We extend Daniel and Titman’s test and improve its statistical power by applying the methodology to a significantly larger cross-section sourced from a large number of countries. As highlighted above, we also improve the methodology by using daily data to estimate the loadings on HML and the other factors. Figure 1 illustrates our extended version of the Daniel and Titman approach. We form 25 capitalization-weighted portfolios by sorting stocks along two dimensions: HML loading, ுெ , on the horizontal axis, and B/M on the vertical axis. Each portfolio is numbered according to its position in this 5 × 5 grid. Each row in the grid represents a group of stocks with relatively constant B/M but varying ுெ . Each column represents the opposite: constant ுெ but varying B/M. The focus in this paper is on the return differences between the two extreme portfolios in each row (highest ுெ minus lowest ுெ for each of the five B/M control groups), and in each column (highest B/M minus lowest B/M for each of the five ுெ control groups). Note that the difference portfolios constructed from each row will produce high returns when high- ுெ stocks outperform low- ுெ stocks, but will not be sensitive to the performance of high-B/M stocks versus low-B/M stocks, because each of the five difference portfolios will contain equal positive and negative weights in stocks with similar B/M characteristic. By the same token, the difference portfolios for each column will have sensitivity to the performance of high B/M versus low B/M stocks, but otherwise no sensitivity to the relative performance between high and low ுெ stocks. We construct two test portfolios to help us disentangle the influence of the B/M characteristic and HML loading on stock returns. The return on the first one, /ெ , is an equal-weighted average between the returns of the five difference portfolios in each row , (,ହ) − (,ଵ) : Cheaper Than Value Research Affiliates 4 1 /ெ = (ଵ,ହ) − (ଵ,ଵ) + (ଶ,ହ) − (ଶ,ଵ) + (ଷ,ହ) − (ଷ,ଵ) + (ସ,ହ) − (ସ,ଵ) 5 + (ହ,ହ) − (ହ,ଵ) . (3) We follow Daniel and Titman and call it the B/M characteristic-balanced portfolio, because it holds the B/M characteristic constant and examines the difference in returns between stocks with high ுெ versus stocks with low ுெ exposure. According to the risk-based theory, expected returns increase linearly with exposure to the HML risk factor, , as illustrated by the left graph in Figure 2. This increasing relationship implies that the expected return associated with the characteristic-balanced portfolio, [ /ெ ], is positive, because it has a positive ுெ . Also, according to the risk-based theory, the Carhart 4-factor alpha should be constant—indeed should be zero—as a function of ுெ . Thus, the Carhart alpha of the characteristic-balanced portfolio, /ெ , should be zero. Given these two observations, we present the following testable predictions for the risk-based theory: ுெ R1 (Risk-based 1): E /ெ > 0 and /ெ = 0. The predictions from the mispricing theory are depicted on the right side of Figure 2. The mispricing theory says that expected returns have no relationship with ுெ once we control for B/M; in fact, the HML factor would be an artificial and misguided construct for measuring risk under the mispricing theory. Additionally, because higher ுெ results in higher Carhart risk adjustment, the Carhart alpha would fall with ுெ . These two observations give us the following testable predictions for the mispricing story: M1 (Mispricing 1): E /ெ = 0 and /ெ < 0. The second portfolio is called HML factor loading-balanced portfolio and is defined as 1 ఉ = (ହ,ଵ) − (ଵ,ଵ) + (ହ,ଶ) − (ଵ,ଶ) + (ହ,ଷ) − (ଵ,ଷ) + (ହ,ସ) − (ଵ,ସ) 5 + (ହ,ହ) − (ଵ,ହ) , (4) where (ହ,) − (ଵ,) is the return of the difference portfolio for column j. This portfolio holds ுெ constant and examines the difference in returns between stocks with high B/M versus stocks with low B/M. According to the risk-based theory, after controlling for ுெ , expected returns should bear no relationship with portfolio B/M. This is graphically illustrated in the left graph in Figure 3. The Carhart alpha would also be constant as we vary B/M because both the expected return and the risk adjustments are assumed constant under the risk-based theory. Thus, for the HML factor loading-balanced portfolio, the expected return and the Carhart alpha should both be zero, resulting in the following testable predictions: R2 (Risk-based 2): E ఉ = 0 and ఉ = 0. According to the mispricing theory, expected returns are an increasing function of B/M. This is illustrated in the right graph in Figure 3. When we hold ுெ constant—and, thus, the Carhart risk adjustment is kept constant—the measured Carhart alpha should also be increasing in B/M. These two observations suggest that the HML factor loadingbalanced portfolio should have positive expected return and Carhart alpha: M2 (Mispricing 2): E ఉ > 0 and ఉ > 0. Cheaper Than Value Research Affiliates 5 With the theoretical predictions established, we proceed now to test them on a large sample of countries. We emphasize at this point that the predictions from the two theories are very different and should, therefore, provide us with a powerful framework to check which one finds better support in the data. 4. Empirical Results This section conducts two tests of the risk-based and mispricing theories. The first test uses portfolios sorted on factor loadings and characteristics to test the predictions derived in the previous section. The second test uses Fama–MacBeth regression to address the concern that HML factor loadings and B/M are correlated across stocks. As a preview of our results, the empirical tests provide strong support for the mispricing theory and reject the risk-based theory as the explanation for value stock outperformance. Starting with the predictions from the previous section, Table 1 presents the results for the B/M characteristicbalanced portfolios (Panel A) and the HML factor loading-balanced portfolios (Panel B) for 23 developed countries.5 Individual countries provide interesting evidence, but we focus on the aggregated tests at the bottom of the table because they are statistically more powerful and allow for a more concise discussion around the results. The first set of aggregated test statistics are the arithmetic averages of the sample returns and alphas across the 23 countries.6 The second set of aggregated test statistics are the percentage of countries in the sample with positive (or negative) average returns and alphas. Assuming a binomial distribution for the sign of these variables, one would need to observe at least 70 percent of the sample with the same sign to reject the null hypothesis that the mean of the distribution is zero, at the 5 percent significance level.7 Starting with the results for the B/M characteristic-balanced portfolios, we see that the fraction of positive to negative average returns is 0.57 to 0.43, and only one country shows an average return that is statistically different from zero. Therefore, we cannot reject the hypothesis that the mean of the distribution is zero. The average mean return across the 23 countries is 0.79 percent with a t-statistic of 0.84, which is also indistinguishable from zero. Neither test rejects the hypothesis that expected returns are zero and the tests do not support the alternative claim that E /ெ > 0. In terms of Carhart alpha, we observe that 83 percent of the countries have negative alphas, which is higher than the 70 percent critical value necessary to reject the hypothesis of zero alpha in favor of the negative alpha hypothesis. The average mean alpha is –1.74 percent with a t-statistic of 2.09, which again rejects the zero-alpha hypothesis in favor of the negative-alpha hypothesis.8 Our results appear to support (M1) against (R1). 5 Selected countries include (starting years in parentheses): Australia (1982), Austria (1987), Belgium (1987), Canada (1982), Denmark (1986), Finland (1990), France (1982), Germany (1982), Greece (1989), Hong Kong (1991), Ireland (1985), Italy (1982), Japan (1982), Netherlands (1982), New Zealand (1990), Norway (1987), Portugal (1989), Singapore (1988), Spain (1988), Sweden (1985), Switzerland (1982), United Kingdom (1982), and United States (1927). 6 The standard error for the average return is calculated from the equal-weighted average of the time series of the individual countries. The standard error for the average alpha is calculated using the formula: var ∙ ∑ே ୀଵ = ଵ ଵ ே ேమ ∙ ′ ∙ var() ∙ , where represents a vector of ones, and the covariance matrix of the stacked alphas, var(), is calculated using Hansen’s (1982) Generalized Method of Moments (GMM), as described in the Appendix. Because the U.S. sample is much longer than that of the other countries, we choose to calculate the standard errors for the average expected return and alpha using only the common sample: 1991–2010. 7 We acknowledge that using the binomial distribution to test the frequency of positive (or negative) values is only an approximation, but these results are used mainly to confirm the tests for average expected returns and alphas, for which we have more accurate distributions. 8 Alert readers will wonder why the average alpha is statistically different from zero when only one of the alphas is. The answer is simple: the test portfolios and the factors—and HML in particular—are relatively uncorrelated across different countries (Fama and French, 1998). This property Cheaper Than Value Research Affiliates 6 In our database, we have 84 years of data for the United States, compared with only 30 years for the majority of the other countries (1980–2010). Because the recent 30-year span may not be deemed representative of the true underlying risk–return dynamic, we look to the U.S. results for robustness. The average return in the United States for the B/M characteristic-balanced portfolio is slightly negative (–0.76 percent), but is not statistically different from zero (t-statistic of 0.74). The alpha is –3.17 percent and is significantly different from zero (t-statistic of 3.18). These results provide additional strong support for the mispricing theory (M1) versus the risk-based theory (R1). Our results contradict the evidence presented in Davis, Fama, and French (2000); we attribute this difference in results to our application of daily data to estimate ுெ , which we believe results in more accurate measurement of HML loading. Turning our attention to the results for the HML factor loading-balanced portfolios, we note that the average returns are positive for 100 percent of the countries in our sample. The average mean return is 7.61 percent with a tstatistic of 4.65, which provides strong support for the mispricing theory (M2). The results for Carhart alphas also provide strong support for the mispricing theory, with positive returns in 87 percent of the countries and a statistically significant average alpha of 3.01 percent. These results strongly support the mispricing theory (M2) against the riskbased theory (R2). The results for the United States further support the overall conclusion that M2 is more descriptive of the data than R2. The average return is 7.20 percent with a t-statistic of 3.94. The alpha is also positive at 1.29 percent with a tstatistic of 1.71, which is significant at the 10 percent level, though not at the 5 percent level. The results for portfolios sorted on factor loadings and characteristics strongly favor the mispricing theory over the risk-based theory. Nonetheless, we acknowledge that skeptics could still argue that the double-sorting method only partially controls for the high correlation between B/M and HML loading for stocks. Given the controversy surrounding the source of the value premium, we believe additional evidence is needed to strengthen the claim that mispricing is the more credible explanation. The ordinary least squares (OLS) regression provides a robust way to address the above skepticism. In the regression = + ଵ ∙ ଵ + ଶ ∙ ଶ + , (5) where the resulting coefficients, ଵ and ଶ , explain, by construction, the independent effects of ଵ and ଶ on . In other words, the relationship between ଵ and , given by ଵ , is estimated above and beyond any relationship between ଶ and . The same observation is also true for ଶ . Now consider a joint cross-sectional regression of stocks’ expected returns on their B/M characteristics and HML loadings: = + ுெ ∙ ுெ + /ெ ∙ log(/ ) + . (6) Notice that the loading on the HML factor, ுெ , is now the explanatory variable, and the estimated coefficient—the risk premium—is given by ுெ . Notice also that we model the relationship between expected returns and B/M in logs, a common practice in finance research.9 Regression (6) allows us to do a horse race between the risk-based and the mispricing theories, measuring which one of ுெ or B/M has more explanatory power on expected stock returns in the cross-section, above and beyond the other. significantly increases the statistical power in cross-country tests. Our interpretation of this result is that with longer period of available data more countries would show significant alphas. Moreover, the single significant alpha occurs exactly in the United States, by far our longest sample. 9 See, among others, Fama and French (2008). Cheaper Than Value Research Affiliates 7 The methodology developed by Fama and MacBeth (1973) takes this idea as a starting point and expands it across multiple time periods. Running the regression in Equation (6) for multiple time periods, ுெ ,௧ାଵ = + ுெ + ௧ାଵ ∙ log(/,௧ ) + ,௧ାଵ , ௧ାଵ ∙ ,௧ /ெ (7) we obtain a time-series of the independent relationships between βୌ or log(B/M) and stocks’ returns. Therefore, we / can look at the average values of λୌ ௧ାଵ and δ௧ାଵ over time and make relevant comparisons on their signs, magnitudes, and statistical significances. See the Appendix for details. Table 2 presents results from two specifications of Fama–MacBeth regressions on individual stocks. Similar to Table 1, it also shows aggregated test statistics calculated from the 23 countries. The first regression includes only the factor loadings on the four Carhart factors considered, ெ் ௌெ ுெ ெ ௌெ ,௧ାଵ = + ெ் + ௧ାଵ ∙ ,௧ + ுெ + ெ + ,௧ାଵ , ௧ାଵ ∙ ,௧ ௧ାଵ ∙ ,௧ ௧ାଵ ∙ ,௧ (8) and tells us how differences in loadings on the value factor (HML) explain differences in expected returns. The second, and more interesting, regression includes all four factor loadings plus the three characteristics related to value, size, and momentum: ெ் ௌெ ுெ ெ ௌெ ,௧ାଵ = + ெ் + ௧ାଵ ∙ ,௧ + ுெ + ெ ௧ାଵ ∙ ,௧ ௧ାଵ ∙ ,௧ ௧ାଵ ∙ ,௧ ௌ௭ ெ +௧ାଵ ∙ (−log) + ௧ାଵ ∙ log/,௧ + ௧ାଵ ∙ ,௧ + ,௧ାଵ . /ெ (9) Notice that we also use logs to adjust the size characteristic, and that we invert its sign to obtain a positive relationship ெ ௌ௭ with expected returns. Although we are not interested in the magnitude of ௧ାଵ or ௧ାଵ in this paper, we include them for completeness. Equation (9), when compared with Equation (8), provides us with a framework to evaluate the importance of factor loadings versus characteristics in explaining cross-sectional expected stock returns. In particular, the focus here is on ுெ versus /ெ . Panel A (Table 2) shows that when applying the Fama–MacBeth regression with the specification following Equation (8), 91 percent of the countries have a positive premium for the HML factor, although only 13 percent of them are significantly different from zero. The average HML premium, ுெ , across the 23 countries is 0.17 percent per month with a t-statistic of 2.44. However, when we include the stock characteristics into the Fama–MacBeth regression in Panel B, HML no longer appears to influence expected stock returns. The fraction of positive to negative premiums estimated for the HML factor is 48–52 percent, indicating that there is no support for the hypothesis that ுெ is positive in general, after controlling for the characteristics. The average ுெ across countries is –0.04 percent per month with a t-statistic of 0.27, so we cannot reject the hypothesis that HML premium is equal to zero. The coefficient on log(/), on the other hand, is positive in all but one country (96 percent) and is significantly different from zero in more than half of these cases (57 percent). The average /ெ across countries is 0.33 percent per month with a tstatistic of 5.24. These results imply that the HML factor’s explanatory power over cross-sectional returns is almost completely subsumed when the log(/) characteristic is included in the Fama–MacBeth regression. This corroborates the evidence, which support the mispricing theory for value premium, presented in the previous section.10 10 Miller and Scholes (1972) point out that cross-sectional regressions with estimated factor loadings as explanatory variables suffer from an errorsin-variable problem. Because the factor loadings from the first stage time series regressions are estimated with errors, the second stage risk premiums associated with them are biased toward zero. We recognize that this bias might favor the mispricing theory if one assumes that characteristics—and B/M in particular—are measured more precisely than factor loadings. To alleviate such concerns we note that the value Cheaper Than Value Research Affiliates 8 5. Conclusion In this paper, we utilize distinct econometric tests to distinguish between the two competing theories for the extra source of return from value strategies: the risk-based and the mispricing theories. First, we extend the method of Daniel and Titman (1997). Second, we apply the Fama and MacBeth (1973) method for estimating premiums associated with sources of returns. We add more power to these tests by using daily data to improve the estimates for HML betas and using a large cross-section of countries to improve the power of our test statistics. In both cases, we find strong support for the mispricing theory. Specifically, using both methods we find that when controlling for B/M, HML loading does not explain cross-sectional returns. On the other hand, when controlling for HML loading, B/M still remains an important variable for explaining returns. While we are careful not to outright reject the claim that value premium is compensation for risk, we do conclude that mispricing is responsible for a larger component of the value premium. This conclusion has very important implications for portfolio management and performance attribution. It suggests that value investing is a free lunch; investors would be foolish not to utilize some form of value strategy in their portfolios. It also suggests that traditional factor-based performance attribution, like the Fama–French 3-factor and Carhart 4-factor models, may be misleading and inappropriate. premium estimated in Panel A of Table 2 is statistically significant and becomes indistinguishable from zero only in Panel B, after the characteristics are included in the regression. Moreover, as stressed by Daniel and Titman (1999), the errors-in-variable problem does not affect our conclusions from the previous section, because the factor loadings are never used as second stage explanatory variables. Cheaper Than Value Research Affiliates 9 References Arnott, Robert D., and Jason C. Hsu. 2008. “Noise, CAPM and the Size and Value Effects.” Journal of Investment Management, vol. 6, no. 1 (First Quarter):1-11. Arnott, Robert D., Jason C. Hsu, Jun Liu, and Harry Markowitz. 2011. “Can Noise Create the Size and Value Effects?” Working paper, University of California at San Diego and Research Affiliates. Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. “In Search of Distress Risk.” Journal of Finance, vol. 63, no. 6 (December):2899-2939. Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2011. “Predicting Financial Distress and the Performance of Distressed Stocks.” Journal of Investment Management, vol. 9, no. 2 (Second Quarter):14-34. Carhart, Mark M. 1997. “On Persistence in Mutual Fund Performance.” Journal of Finance, vol. 52, no. 1 (March):57–82. Daniel, Kent, Mark Grinblatt, Russ Wermers, and Sheridan Titman. 1997. “Measuring Mutual Fund Performance with Characteristic-Based Benchmarks.” Journal of Finance, vol. 52, no. 3 (July):1035–1058. Daniel, Kent, and Sheridan Titman. 1997. “Evidence on the Characteristics of Cross Sectional Variation in Stock Returns.” Journal of Finance, vol. 52, no. 1 (March):1–33. Daniel, Kent, Sheridan Titman, and K.C. J. Wei. 2001. “Explaining the Cross-Section of Stock Returns in Japan: Factors or Characteristics?” Journal of Finance, vol. 56, no. 2 (April):743–766. Davis, James L., Eugene F. Fama, and Kenneth R. French. 2000. “Characteristics, Covariances, and Average Returns: 1929–1997.” Journal of Finance, vol. 55, no. 1 (February):389–406. Fama, Eugene F., and Kenneth R. French. 1992. “The Cross-Section of Expected Stock Returns.” Journal of Finance, vol. 47, no. 2 (June):427–465. Fama, Eugene F., and Kenneth R. French. 1993. “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics, vol. 33, no. 1 (February):3–56. Fama, Eugene F., and Kenneth R. French. 1998. “Value Versus Growth: The International Evidence.” Journal of Finance, vol. 53, no. 6 (December):1975–1999. Fama, Eugene F., and Kenneth R. French. 2008. “Dissecting Anomalies.” Journal of Finance, vol. 63, no.4 (August):1653– 1678. Fama, Eugene F., and James D. MacBeth. 1973. “Risk, Return, and Equilibrium: Empirical Tests.” Journal of Political Economy, vol. 81, no. 3 (May/June):607–636. Graham, Benjamin, and David Dodd. 1934. Security Analysis. New York: McGraw-Hill. Hansen, Lars Peter. 1982. “Large Sample Properties of Generalized Method of Moment Estimators.” Econometrica, vol. 50, no. 4 (July):1029–1054. Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1994. “Contrarian Investment, Extrapolation, and Risk.” Journal of Finance, vol. 49, no. 5 (December):1541–1578 Merton, Robert C. 1973. “An Intertemporal Capital Asset Pricing Model.” Econometrica, vol. 41, no. 5 (September):867– 887. Miller, Merton H., and Myron Scholes. 1972. “Rate of Return in Relation to Risk: A Re-Examination of Some Recent Findings.” In Studies in the Theory of Capital Markets, Michael C. Jensen, ed. New York: Praeger Publishers: 47–48. Cheaper Than Value Research Affiliates 10 Appendix I. Data Description For the United States we use daily and monthly stock returns and annual financial data from the Center for Research in Security Prices (CRSP) and Compustat. The sample period is January 1926 to December 2010, and only ordinary common shares (as classified by CRSP) are included in our tests. The book equity data is supplemented by the historical Moody’s Manuals values from Kenneth R. French’s data library as in Davis, Fama, and French (2000), and whenever it is not available in Compustat. We use the one-month U.S. Treasury bill rate from Ibbotson Associates as the risk-free rate. The source for return and accounting data for the other 22 developed countries is Datastream and Worldscope. The sample period starts in January 1980 to November 1994, depending on individual countries, and ends in December 2010. All ADRs (as classified by Worldscope) are excluded. Returns are in U.S. dollars and the risk-free rate is the three-month U.S. Treasury bill rate. One caveat is that Datastream posts daily returns for non-trading days as well. They use the annualized dividend yield and the adjusted price (padded), hence there is usually a value given for holidays such as January 1. Thus, we remove records for a certain day if daily returns are zero for most of the securities within each country. Carhart and Fama–French Four Factors The construction of the factor portfolios primarily follows Fama and French (1993) and Carhart (1997). We sort stocks on size (market capitalization) and the ratio of book equity to market equity (B/M), and form six portfolios (Small Value, Small Neutral, Small Growth, Big Value, Big Neutral, and Big Growth.) B/M is calculated as book equity for the fiscal year ending in calendar year t–1, divided by market equity at the end of December of year t–1. The B/M is used to annually construct the portfolios at the end of June of year t. We exclude negative book equity firms, and leave out companies until they have appeared on Compustat or Worldscope for two years to avoid the survivorship bias in the way those vendors add firms to the data. For the United States we use NYSE median values (size) and 70th and 30th percentiles (B/M) from Ken French’s data library as breakpoints. For international stocks, the breakpoints are the 80th percentile for size, and 70th and 30th percentiles for B/M. We calculate the SMB and HML factors as follows: SMB = 1/3 (Small Value + Small Neutral + Small Growth) - 1/3 (Big Value + Big Neutral + Big Growth) HML = 1/2 (Small Value + Big Value) - 1/2 (Small Growth + Big Growth) The excess return on the market (Mkt–Rf) is the value-weighted return on all stocks including negative BE firms minus the risk-free rate. We also form six value-weighted portfolios based on size and prior two 12-month returns (Small Up, Small Medium, Small Down, Big Up, Big Medium, and Big Down). We use the breakpoints from Ken French’s data library for the United States, and the 80th (size) and 70th/30th (prior return) percentiles for the other countries. To be included in a portfolio for month t (formed at the end of the month t–1), a stock must have a return for the end of month t–13 and t–2. The momentum factor is constructed monthly as follows: Mom = 1/2 (Small High + Big High) - 1/2(Small Low + Big Low) Estimating Factor Sensitivities To estimate the factor loadings for each stock, every month we run an OLS regression on the previous two-month daily returns with the Carhart and Fama–French four-factor model. Stocks should have been traded for at least 22 trading Cheaper Than Value Research Affiliates 11 days within each rolling window. We allow five trading days lag before the end of the month to ensure that this strategy can be implemented in the real world. For instance, at the end of June, we use data from April 26 to June 23 to estimate the factor loadings for the July portfolio. Appendix II. Fama and MacBeth (1973) Regressions We estimate the risk premia of the four factors and stock characteristics by using Fama–Macbeth two-stage regressions. First, we find estimates of the factor loadings of each stock from time series regressions with the Carhart and Fama– French four-factor model as in the portfolio tests. Second, we run monthly cross-sectional regression of returns on risk exposures and/or characteristics. Finally, we estimate the risk premium, λ, of each factor or characteristic as the time series average of the cross-sectional regression estimates: ் 1 λ = λ௧ . (1) ௧ୀଵ The t-statistics of the risk premiums are calculated as follows: λ = λ (λ௧ )⁄√ (2) , where T is the number of months in the period, and (λ௧ ) is the standard deviation of the monthly estimates. Appendix III. GMM Standard Errors For each country we run the following regression: ,௧ = !,௧ ′ ∙ θ + ε,௧ , ′ and !,௧ = 1 mkt ,௧ where θ୧ = α βெ் βௌெ βுெ βெ (2005) we write the GMM moment conditions of each regression as (1) smb,௧ "θ = E!,௧ ∙ ε,௧ = 0. hml,௧ umd,௧ ′. Following Cochrane (2) Solving this equation yields the same result as traditional OLS: θ = E!,௧ ∙ !,௧ ′ E!,௧ ∙ ,௧ . ିଵ (3) Because we want to find the covariance matrix of the parameters across different countries, we stack them together. Our tests in the main text use only the columns and rows relative to the alphas. The notation with multiple countries becomes cumbersome quickly. For this reason, here we solve an example with two countries only. The general case is exactly the same with multiple columns and rows. The moment conditions are "θ = E # where θ = θଵ ′ θଶ ′′. Cheaper Than Value !ଵ,௧ ∙ εଵ,௧ $ = 0, !ଶ,௧ ∙ εଶ,௧ Research Affiliates (4) 12 Hansen (1982) shows that the covariance matrix of θ is given by var(θ) = ் % ିଵ ∙ ∙ % ିଵ . ଵ (5) In this case S is equal to ஶ = & E' ୀିஶ (!ଵ,௧ ∙ εଵ,௧ ) ∙ (!ଵ,௧ି ∙ εଵ,௧ି )′ (!ଶ,௧ ∙ εଶ,௧ ) ∙ (!ଵ,௧ି ∙ εଵ,௧ି )′ (!ଵ,௧ ∙ εଵ,௧ ) ∙ (!ଶ,௧ି ∙ εଶ,௧ି )′ ( (!ଶ,௧ ∙ εଶ,௧ ) ∙ (!ଶ,௧ି ∙ εଶ,௧ି )′ (6) and d is block-diagonal: %= ப() பᇱ = E' !ଵ,௧ ∙ !ଵ,௧ ′ 0 (. 0 !ଶ,௧ ∙ !ଶ,௧ ′ (7) We use no leads or lags in the calculation of because, in our case, the residuals come from monthly returns, which show very little serial correlation. In other words, the formulas above correct only for the more important crosssectional correlation between residuals (and factors) of different countries. To show that the variance formula above is the OLS formula under some simplifying assumptions, consider again the case of one country. Using the usual OLS assumptions that a) the residuals are homoscedastic and uncorrelated over time, and b) the factors and residuals are independent as well as uncorrelated we obtain var) = ் E!ଵ,௧ ∙ !ଵ,௧ ′ ଵ Cheaper Than Value ିଵ ∙ Eଵ,௧ ′ ∙ ଵ,௧ ∙ E!ଵ,௧ ∙ !ଵ,௧ ′ ∙ E!ଵ,௧ ∙ !ଵ,௧ ′ ିଵ Research Affiliates = E!ଵ,௧ ∙ !ଵ,௧ ′ ିଵ ∙ varଵ,௧ . 13 Table 1 – Expected Returns and Alphas for Characteristic-Balanced and Factor Loading-Balanced Portfolios Country Australia Austria Belgium Canada Denmark Finland France Germany Greece Hong Kong Ireland Italy Japan Netherlands New Zealand Norway Portugal Singapore Spain Sweden Switzerland United Kingdom United States % Positive % Pos. Significant % Negative % Neg. Significant Panel A: Characteristic-Balanced Portfolios Ann. Mean Ann. Alpha (%) t-stat (%) t-stat 3.89 1.47 -2.60 -0.97 4.52 1.28 1.03 0.29 -2.47 -0.74 -5.84 -1.79 -2.98 -0.90 -5.80 -1.83 -3.33 -1.13 -5.37 -1.77 2.51 0.54 -0.64 -0.15 -1.73 -0.70 -1.79 -0.80 3.78 1.54 -0.35 -0.15 5.16 1.27 1.48 0.39 9.66 2.31 4.71 1.30 -1.38 -0.27 -3.08 -0.61 -3.25 -1.26 -3.41 -1.36 2.65 1.08 -2.10 -0.99 0.16 0.05 -0.34 -0.12 1.00 0.23 -0.14 -0.03 1.93 0.44 0.12 0.03 -0.55 -0.13 -2.74 -0.65 0.49 0.16 -2.07 -0.74 -1.60 -0.56 -2.39 -0.86 1.80 0.53 -0.02 -0.01 -1.60 -0.68 -3.57 -1.50 0.31 0.16 -1.97 -1.03 -0.76 -0.74 -3.17 -3.18 57 17 4 0 43 83 0 4 0.79 -1.74 (0.84) (-2.09) Average 11 (t-stat) Source: Research Affiliates, LLC. Panel B: Factor Loading-Balanced Portfolios Ann. Mean Ann. Alpha (%) t-stat (%) t-stat 4.23 1.65 -2.40 -1.13 11.11 3.01 5.02 1.59 3.38 1.33 0.63 0.28 9.73 3.45 2.84 1.37 7.12 2.32 5.85 2.29 7.30 1.36 2.24 0.55 10.21 3.82 3.35 1.72 7.96 3.09 4.73 2.50 6.44 1.46 -0.68 -0.21 8.80 2.21 2.25 0.92 9.31 1.92 6.52 1.51 4.04 1.59 1.49 0.75 8.56 3.26 1.59 1.18 3.50 1.35 1.85 0.81 0.68 0.16 2.60 0.63 4.40 1.04 -2.70 -0.77 23.81 2.02 13.26 1.31 7.39 2.31 1.04 0.50 9.41 3.08 7.83 2.92 3.60 0.99 0.87 0.32 9.99 4.72 9.27 4.91 6.87 3.26 0.40 0.28 7.20 3.94 1.29 1.71 100 87 57 17 0 13 0 0 7.61 3.01 (4.65) (4.02) 11 To calculate the standard errors for the average expected return and alpha we used covariance matrices estimated in the longest period where observations for all countries are available: 1991–2010. Cheaper Than Value Research Affiliates 14 Table 2 – Fama–MacBeth Regressions – Risk Premia Estimates. Panel A: Factor Loadings Only Factor Loadings Country Australia Austria Belgium Canada Denmark Finland France Germany Greece Hong Kong Ireland Italy Japan Netherlands New Zealand Norway Portugal Singapore Spain Sweden Switzerland United Kingdom United States Intercept (%) 1.43 (3.72) 0.91 (2.46) 1.07 (3.44) 1.62 (4.47) 0.62 (1.64) 1.31 (3.14) 1.20 (4.19) 0.80 (2.97) 1.42 (2.22) 1.71 (3.96) 0.89 (2.19) 0.59 (1.74) 0.64 (2.10) 1.22 (4.18) 0.78 (1.58) 1.19 (3.26) 1.52 (1.99) 0.51 (1.28) 0.82 (2.74) 1.25 (3.29) 0.99 (3.31) 0.75 (2.58) 1.11 (5.89) % Positive % Pos.Significant % Negative % Neg. Significant Average 1.04 (t-stat) (4.03) Source: Research Affiliates, LLC. Cheaper Than Value Market ࢼࡹࡷࢀ (%) -0.03 (-0.17) -0.20 (-0.59) -0.08 (-0.29) -0.16 (-0.71) 0.12 (0.39) -0.89 (-2.07) 0.09 (0.45) -0.14 (-0.76) -0.41 (-0.87) -0.09 (-0.28) 0.35 (1.16) 0.09 (0.34) 0.04 (0.25) -0.20 (-0.95) -0.03 (-0.05) 0.27 (0.74) -0.93 (-1.32) 0.59 (2.45) -0.32 (-1.06) -0.40 (-1.29) -0.05 (-0.20) 0.10 (0.79) -0.09 (-1.29) Size - ࢼࡿࡹ (%) 0.00 (0.03) 0.22 (1.03) -0.05 (-0.34) 0.02 (0.10) 0.49 (2.47) -0.03 (-0.15) -0.12 (-1.04) -0.02 (-0.23) -0.17 (-0.56) -0.09 (-0.54) -0.22 (-0.77) -0.09 (-0.76) 0.01 (0.07) -0.12 (-1.09) 0.19 (0.76) -0.17 (-0.57) -0.40 (-0.85) 0.08 (0.64) 0.01 (0.05) 0.13 (0.66) -0.11 (-0.83) -0.05 (-0.72) 0.03 (0.92) -0.07 (-0.73) -0.02 (-0.31) Research Affiliates Value - ࢼࡴࡹࡸ (%) 0.13 (1.41) 0.59 (2.61) 0.05 (0.27) 0.06 (0.25) 0.43 (2.08) 0.54 (1.61) 0.19 (1.60) 0.16 (1.69) 0.42 (1.88) 0.32 (1.75) 0.26 (0.75) -0.03 (-0.24) 0.18 (2.22) 0.01 (0.09) 0.22 (0.73) 0.08 (0.27) 0.49 (1.25) 0.08 (0.49) 0.20 (1.23) 0.11 (0.49) -0.18 (-1.57) 0.11 (1.80) 0.04 (0.90) 91 13 9 0 0.17 (2.44) Momentum - ࢼࢁࡹࡰ (%) 0.28 (1.81) 0.70 (2.64) -0.13 (-0.54) 0.50 (2.07) 0.23 (0.98) 0.66 (1.58) 0.00 (0.01) 0.11 (0.73) 0.04 (0.12) -0.08 (-0.41) -0.20 (-0.40) 0.26 (1.32) -0.02 (-0.14) -0.21 (-1.01) 0.85 (2.14) -0.08 (-0.28) -0.69 (-1.06) 0.01 (0.06) 0.19 (0.86) -0.14 (-0.54) -0.02 (-0.14) 0.02 (0.23) 0.02 (0.28) 0.09 (0.73) 15 Panel B: Factor Loadings + Characteristics Factor Loadings Country Intercept (%) Market ࢼࡹࡷࢀ (%) 2.49 (4.87) 0.58 (0.98) 1.65 (2.47) 3.55 (6.15) 1.47 (2.40) 1.67 (2.68) 2.08 (4.80) 1.14 (3.65) 3.06 (2.92) 3.78 (4.91) 1.67 (2.02) 0.80 (1.82) 1.76 (3.05) 1.33 (3.03) 1.65 (2.48) 2.01 (3.16) 2.17 (2.70) 1.12 (1.78) 0.70 (1.37) 1.92 (3.32) 0.93 (2.41) 1.26 (3.56) 3.07 (6.23) 0.09 (0.42) -0.59 (-1.34) 0.08 (0.28) 0.03 (0.14) 0.41 (1.14) -0.48 (-1.04) 0.18 (0.97) -0.22 (-1.31) 0.03 (0.08) 0.34 (1.02) 0.23 (0.54) 0.18 (0.72) 0.30 (1.73) -0.14 (-0.67) 0.12 (0.24) 0.20 (0.54) 0.48 (0.72) 0.62 (2.43) -0.28 (-0.96) -0.33 (-1.12) -0.07 (-0.29) 0.35 (2.74) -0.07 (-1.15) Australia Austria Belgium Canada Denmark Finland France Germany Greece Hong Kong Ireland Italy Japan Netherlands New Zealand Norway Portugal Singapore Spain Sweden Switzerland United Kingdom United States % Positive % Pos. Significant % Negative % Neg. Significant Average 1.79 0.10 (5.95) (0.49) (t-stat) Source: Research Affiliates, LLC. Cheaper Than Value Size ࢼࡿࡹ (%) -0.07 (-0.58) 0.21 (0.64) -0.22 (-1.18) -0.09 (-0.53) 0.39 (1.62) -0.30 (-1.19) -0.26 (-2.34) -0.01 (-0.17) -0.49 (-1.96) -0.36 (-1.90) -0.56 (-1.67) -0.15 (-1.33) -0.12 (-1.85) -0.25 (-2.07) -0.01 (-0.04) -0.19 (-0.59) -1.07 (-2.12) -0.08 (-0.61) 0.07 (0.42) 0.03 (0.15) -0.11 (-0.85) -0.19 (-2.49) -0.03 (-1.45) -0.18 (-2.66) Characteristics Value ࢼࡴࡹࡸ (%) Momentum ࢼࢁࡹࡰ (%) 0.08 (0.86) -0.28 (-0.93) -0.19 (-0.85) 0.02 (0.07) 0.40 (1.62) 0.08 (0.25) -0.01 (-0.07) 0.13 (1.45) 0.02 (0.08) 0.19 (0.94) -0.04 (-0.12) -0.09 (-0.72) 0.09 (1.19) -0.07 (-0.45) 0.45 (1.35) -0.30 (-0.92) -0.56 (-0.91) -0.19 (-1.10) 0.09 (0.56) -0.07 (-0.34) -0.20 (-1.73) 0.06 (1.25) -0.02 (-0.64) 48 0 52 0 -0.04 (-0.27) 0.14 (1.01) 0.29 (1.09) -0.57 (-2.27) 0.37 (1.63) 0.11 (0.41) 0.33 (0.78) -0.15 (-1.07) -0.09 (-0.71) 0.14 (0.44) -0.07 (-0.32) -0.58 (-1.09) 0.01 (0.07) -0.01 (-0.07) -0.51 (-2.61) 0.24 (0.57) -0.49 (-1.35) -0.80 (-1.14) -0.06 (-0.36) -0.01 (-0.05) -0.46 (-1.75) -0.19 (-1.27) -0.09 (-1.02) -0.02 (-0.49) Research Affiliates -0.12 (-1.00) Size log(Size) (%) 0.28 (3.87) -0.09 (-0.96) 0.19 (1.55) 0.51 (6.53) 0.24 (2.23) 0.17 (1.70) 0.19 (3.36) 0.07 (2.04) 0.41 (2.54) 0.50 (4.08) 0.19 (1.39) 0.06 (1.01) 0.17 (2.61) 0.06 (1.10) 0.26 (2.14) 0.22 (1.86) 0.23 (1.19) 0.20 (1.99) 0.01 (0.08) 0.18 (1.93) 0.03 (0.56) 0.16 (3.54) 0.21 (5.54) 0.20 (5.29) Value log(B/M) (%) Momentum UMD (%) 0.36 (2.83) 0.52 (3.32) 0.28 (0.93) 0.06 (0.42) 0.31 (1.23) 0.37 (2.82) 0.47 (5.51) 0.17 (3.05) 0.20 (0.77) 0.33 (2.67) 0.09 (0.50) 0.15 (1.30) 0.36 (4.98) 0.18 (2.00) -0.18 (-0.80) 0.43 (2.20) 1.46 (1.79) 0.52 (2.86) 0.09 (0.87) 0.14 (1.18) 0.21 (3.53) 0.23 (4.10) 0.23 (4.90) 96 57 4 0 0.33 (5.24) 1.10 (4.88) 1.25 (1.11) 2.25 (4.36) 0.83 (4.30) 1.10 (2.85) 0.50 (1.10) 0.82 (3.72) 1.39 (5.79) 0.57 (1.11) 0.66 (2.03) 1.02 (1.60) 1.12 (3.85) -0.19 (-0.80) 1.92 (6.23) 1.49 (2.69) 1.54 (4.38) -0.61 (-0.71) 0.37 (0.74) 1.19 (2.91) 1.30 (3.34) 1.27 (4.17) 0.91 (4.60) 0.58 (3.33) 0.97 (4.78) 16 Figure 1 - Portfolios B/M (5,1) (5,2) (5,3) (5,4) (5,5) (4,1) (4,2) (4,3) (4,4) (4,5) (3,1) (3,2) (3,3) (3,4) (3,5) (2,1) (2,2) (2,3) (2,4) (2,5) (1,1) (1,2) (1,3) (1,4) (1,5) ߚ ுெ Source: Research Affiliates, LLC. Cheaper Than Value Research Affiliates 17 Figure 2 – Predictions from Risk-Based and Mispricing Theories for the Experiment of Holding B/M Constant and Varying *ࡴࡹࡸ . Predictions from the Risk Exposure Theory Predictions from the Mispricing Theory Eሾݎሿ Eሾݎሿ α α ߚ ுெ ߚ ுெ Source: Research Affiliates, LLC. Cheaper Than Value Research Affiliates 18 Figure 3 – Predictions from Risk-Based and Mispricing Theories for the Experiment of Holding *ࡴࡹࡸ Constant and Varying B/M. Predictions from the Risk Exposure Theory Predictions from the Mispricing Theory Eሾݎሿ α Eሾݎሿ α B/M B/M Source: Research Affiliates, LLC. Cheaper Than Value Research Affiliates 19