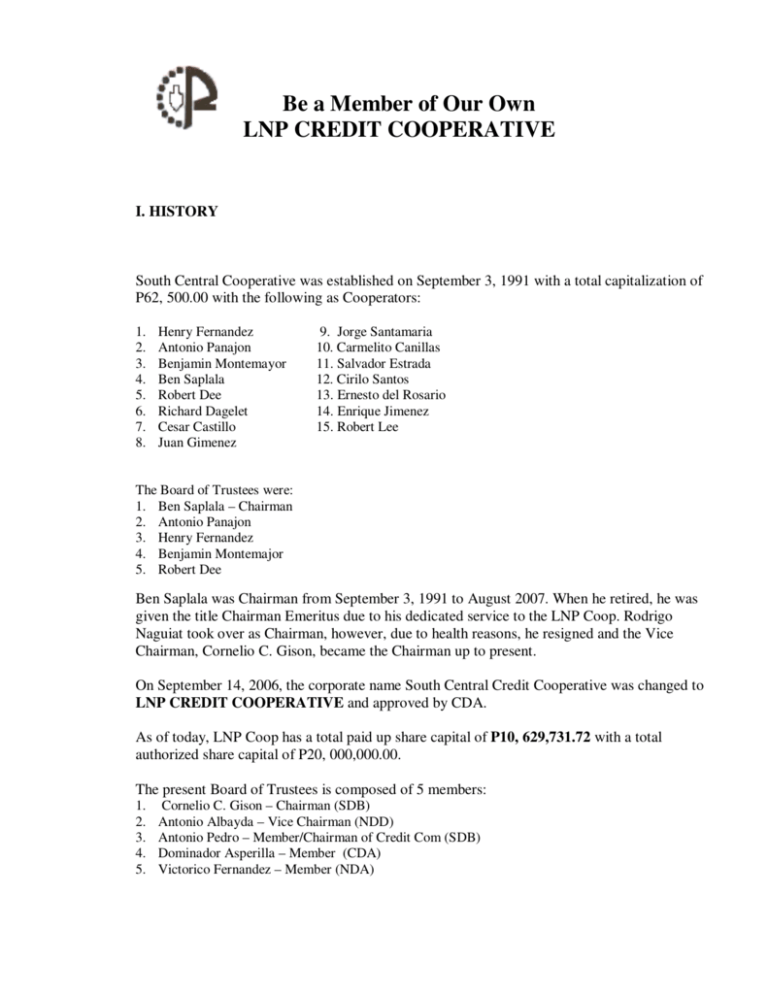

Be a Member of Our Own LNP CREDIT COOPERATIVE

advertisement

Be a Member of Our Own LNP CREDIT COOPERATIVE I. HISTORY South Central Cooperative was established on September 3, 1991 with a total capitalization of P62, 500.00 with the following as Cooperators: 1. 2. 3. 4. 5. 6. 7. 8. Henry Fernandez Antonio Panajon Benjamin Montemayor Ben Saplala Robert Dee Richard Dagelet Cesar Castillo Juan Gimenez 9. Jorge Santamaria 10. Carmelito Canillas 11. Salvador Estrada 12. Cirilo Santos 13. Ernesto del Rosario 14. Enrique Jimenez 15. Robert Lee The Board of Trustees were: 1. Ben Saplala – Chairman 2. Antonio Panajon 3. Henry Fernandez 4. Benjamin Montemajor 5. Robert Dee Ben Saplala was Chairman from September 3, 1991 to August 2007. When he retired, he was given the title Chairman Emeritus due to his dedicated service to the LNP Coop. Rodrigo Naguiat took over as Chairman, however, due to health reasons, he resigned and the Vice Chairman, Cornelio C. Gison, became the Chairman up to present. On September 14, 2006, the corporate name South Central Credit Cooperative was changed to LNP CREDIT COOPERATIVE and approved by CDA. As of today, LNP Coop has a total paid up share capital of P10, 629,731.72 with a total authorized share capital of P20, 000,000.00. The present Board of Trustees is composed of 5 members: 1. 2. 3. 4. 5. Cornelio C. Gison – Chairman (SDB) Antonio Albayda – Vice Chairman (NDD) Antonio Pedro – Member/Chairman of Credit Com (SDB) Dominador Asperilla – Member (CDA) Victorico Fernandez – Member (NDA) II. Highlights A. Financial 1. Paid-Up Share Capital of P10,629,731.72 as of June 30, 2010 There is an increase in Paid-Up Share Capital of P1,214,292.90 against 2008 net of withdrawal. Total Authorized Share Capital of P10 million fully subscribed & paid. Increased to P20 million, approved by Cooperative Development Authority (CDA) last June 24, 2010. 2. Loans Receivable Aging of Loans Receivable as of: June 30, 2010 Amount Current 1-30 days past due 31 days – 12 months Over 12 months % 8,034,254.70 96% 72,282.92 1% 253,972.53 3% 8,360,510.15 100% Dec. 31, 2009 Amount % 8,941,763.32 98.66% 74,706.59 0.82% 46,719.57 0.52% 9,063,189.48 100% Dec.31, 2008 Amount % 7,481,840.14 99% 29,193.75 0% 46,157.98 1% 32,400.00 0% 7,589,591.87 100% 3. Net Surplus Net surplus for the years 2009 and 2008 in the amount of P435,294.40 and P322,798.23 respectively were distributed as follows: 2008 2009 Interest on share capital Patronage refund Reserve fund Education and training fund Optional fund Total P208,941.31 108,823.60 87,058.88 8,705.89 21,764.72 P435,294.40 P154,943.15 80,699.56 64,559.65 6,455.96 16,139.91 P322,798.23 For the 6 months period ending June 30,2010 LNP Coop has undivided net surplus of P301,044.18 as compared to P186,897.45 for the same period of 2009. B. Others 1. Adapted a multi-tiered interest rates. From To Medical 12% 8% Education 12% 10% Business 12% 14% House/Car Repairs 12% 12% Others 12% 12% 2. Reduced the number of directors from 9 to 5 for easier compliance of quorum in board meetings. 3. Approved increase in capitalization from P10 million to P20 million. 4. Expansion of membership in the coop to include all outreaches and partners in mission. III. MEMBERSHIP POLICIES a. Membership in LNP Coop is open to the following: 1. All LNP Members (covenanted/underway) 2. Children of LNP Members 3. Partners in Mission The applicant shall subscribe to at least 10 shares with a total value of P500.00 upon submission of application for membership and P100.00 for one time payment of membership fee. b. Dividends are declared every end of the year which are slightly higher than interest on bank savings account. Interest on share capital depends upon the income of the LNP Coop at the end of the year. Rates of dividends (net of tax) for the last 3 years are follows: Year Rate 2009 1.90% 2008 1.60% 2007 1.70% IV. CREDIT POLICIES a. Only members of the LNP Coop can avail of the loan. The amount that a member can borrow is 2.5x of his fixed deposit. The loan shall be fully secured by his/her fixed deposit which should be at least 40% of the loanable amount and 60% covered by co-makers or acceptable collaterals like a. Vehicles b. Lot/Lot improvements c. Country Club Share b. LNP Coop offers different types of loans with the following interest rates 1. Medical Loan – 8% 2. Educational Loan – 10% 3. Business Loans – 14% 4. House/ Car Repairs – 12% 5. Others – 12% c. Term of loan is 1 to 2 years and covered a MRI (insurance) and secured by issuance of postdated checks. V. Unaudited Financial Statements as of June 30, 2010 LNP CREDIT COOPERATIVE BALANCE SHEET As of June 30, 2010 ASSETS Current Assets Cash in Bank -BPI Madrigal Petty Cash Short-term Investment Loans Receivables Other Receivables Total Current Assets Net Property & Equipment Other Assets TOTAL ASSETS 1,235,257.77 3,000.00 1,850,000.00 8,360,510.15 1,100.00 11,449,867.92 39,051.14 140,000.00 11,628,919.06 LIABILITIES & CAPITAL 28,824.71 153,050.63 181,875.34 Current Liabilities Long Term Liabilities TOTAL LIABILITIES EQUITY Member's Equity Authorized share capital - 400,000 shares @ P50.00 par value Paid-up share capital Statutory Funds Undivided Net Surplus TOTAL LIABILITIES & CAPITAL 10,629,731.72 516,267.82 301,044.18 11,628,919.06 LNP CREDIT COOPERATIVE INCOME STATEMENT For the Six Months Period Ended June 30, 2010 REVENUE Interest income from loans Other Income TOTAL REVENUES 730,834.10 37,686.82 768,520.92 LESS: EXPENSES Salaries & Related Cost Administrative Cost TOTAL EXPENSES NET SURPLUS 293,903.48 173,573.26 467,476.74 301,044.18 Estimated Allocation: (Assuming same percentage is to be used) Reserve Fund 20% Educational & Training Fund 2% Optional Fund 5% Patronage Refund Payable 25% Interest on Share Capital Payable 48% 60,208.84 6,020.88 15,052.21 75,261.05 144,501.21 301,044.18