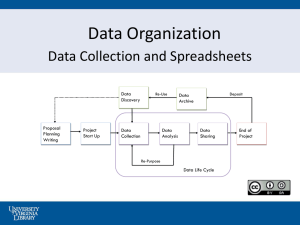

Sarbanes-Oxley: What About all the Spreadsheets?

advertisement