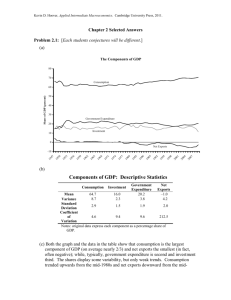

GDP by production approach.mdi - United Nations Statistics Division

advertisement