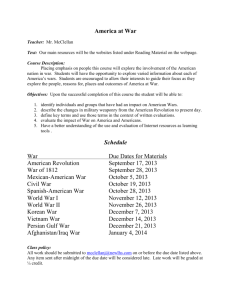

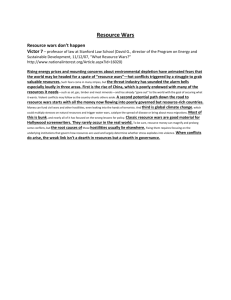

Does Conflict Disrupt Growth? Evidence of the Relationship

advertisement