The economic and social context of property crime in Australia

advertisement

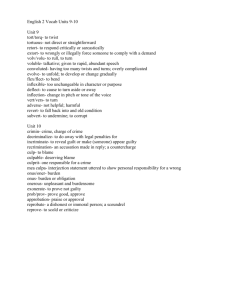

UNEDITED. PAPER AS PRESENTED AT CONFERENCE AUSTRALIAN INSTITUTE OF CRIMINOLOGY Crime in Australia THE FIRST NATIONAL OUTLOOK SYMPOSIUM Canberra, 5 & 6 June 1995 The Economic and Social Context of Property Crime in Australia. ©Don Weatherburn Director NSW Bureau of Crime Statistics and Research Introduction A few years ago, the Bureau published a study linking the number of offenders living in each NSW LGA with various social and economic indicators.1 We found a very high correlation in urban areas between the incidence of unemployment and poverty in an area and the proportion of proven property offenders living in the area.2 The finding reinforced the common-sense view that there is a relationship between poverty and crime. Events over the next couple of years, though, were to prove that the relationship was anything but straightforward. Between 1990 and 1993, the recession drove the unemployment rate in Australia up from 6.1% to 11.3%, leaving nearly a million people in search of work.3 Those who thought the relationship between poverty and crime was simple must have been expecting a crime wave. The two most important income-generating property offences in NSW, though, practically fell through the floor. Between 1991 and 1993, the break, enter and steal rate in NSW fell by 31%.4 Over the same period the recorded rate of car theft fell by 19%.5 This is not the first time crime trends in Australia have behaved in a counterintuitive fashion. In the boom conditions of the 1980’s, real household disposable income and employment growth among low-income earners both rose dramatically.6 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Far from falling, though, over the same period, rates of break, enter and steal and personal robbery in New South Wales nearly doubled.7 Now you could regard these changes as accidental. Sophisticated time series analyses of the relationship between economic factors and crime, though, present the same confusing state of affairs. Sat Mukherjee’s analysis of Australian crime trends between 1900 and 1976 produced evidence that unemployment and property crime rates were positively correlated during some periods and negatively correlated at others.8 Similar results have been found overseas.9 About the only consistent pattern to emerge from the findings is this: Studies which compare the correlation between unemployment and property crime across areas (i.e cross-sectional studies) are more likely to find a significant positive relationship than studies which examine the correlation over time.10 In fact, every cross-sectional study of unemployment and property crime conducted up to 1987 found a significant positive relationship between unemployment and crime. None found a negative relationship. Twenty-five percent of the time series studies conducted up to that year, though, found a significant negative relationship. How do we explain this research puzzle? Well the problem certainly doesn’t stem from a shortage of empirical research on poverty, unemployment and crime. If anything, there’s a glut of it. As so often happens in social science, we seem to have been acting as if empirical research were a substitute for theory instead of its servant. In my view the problem stems from inadequate attention to two things. The first is the way in which economic conditions influence growth in offender populations. The second is the way in which they influence the behaviour of offenders. What I want to do in this paper is offer some thoughts on these two issues. I then want to trace out their implications for future property crime trends in Australia. Australian Institute of Criminology 2 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn I should emphasize at the outset that my comments are directed only at property offences such as break, enter and steal, car theft and robbery. They’re not directed at white-collar offences such as insider trading or corporate fraud. I should also point out that I don’t have time to cite supporting evidence for each of my conjectures. You’ll find all the evidence I could muster in support of my arguments in the printed version of my paper. Let me begin, then, by offering you an overview of my argument. Figure 1 Simplified Property Crime Model INCREASE GROWTH IN POVERTY IN NEGLECT, FAMILY CONFLICT & SEPARATION GROWTH IN PRIVATE CONSUMPTION INCREASED CRIMINAL OPPORTUNITIES & INCENTIVES INCREASE IN OFFENDER POPULATION INCREASE IN INCREASE IN AGGREGATE PROPERTY CRIME RATE OFFENDER "PRODUCTIVITY" AGGREGATE PROPERTY CRIME RATE= OFFENDER POPULATION× OFFENDER “PRODUCTIVITY” The basic thesis is this: Poverty and economic growth both increase property crime rates but in very different ways. Low levels of household income among parents with dependent children produce higher rates of neglect, family conflict and parental separation. Because each of these conditions increases the risk of delinquency, poverty growth tends over time to increase the population of offenders Aggregate property crime rates, though, are shaped not just by the number of offenders but also by their average frequency of offending. Economic growth tends to increase the supply of incentives and opportunities for property crime. Since these opportunities and incentives are mostly exploited by existing offenders, economic growth tends to increase the frequency of offending. Property crime rates will therefore tend to be at their highest when booming economic conditions are combined with chronic social and economic disadvantage. Australian Institute of Criminology 3 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Let me try and put some flesh on this argument now by dealing first with the question of why economic and social disadvantage causes growth in offender populations. Understanding Growth in Offender Populations. Most traditional theories of crime follow commonsense in assuming that adversity increases the crime rate because it increases the motivation to offend.11 If this were really the way in which economic factors affected crime, though, every decrease in household income would lead to an increase in property crime. The fact that this doesn’t happen, counts as hard evidence that individual motivation is not the dominant pathway from economic adversity to crime. In searching for the right pathway it’s instructive to look at the way in which poverty influences parental behaviour. After all, kids aren’t born law-abiding citizens. (Freud was right about this even if he wasn’t about much else). Parents provide the primary means by which values are inculcated. There’s good reason for believing that poverty elevates the risk of child neglect, family conflict and separation.12 We also know that these conditions (neglect, family conflict and separation) increase the risk of juvenile involvement in crime.13 It’s more than likely, then, that economic adversity increases the population of offenders because it increases the risk of neglect, family conflict and separation. If these were the main paths to delinquency, though, it would be hard to explain why so many of those involved in crime emerge from family environments not marked by neglect, family conflict or separation. It would also seem hard to explain why offender populations, and therefore aggregate property crime rates, don’t rise and fall with every passing recession. The answer to the first of these problems lies in the fact that four other secondary processes amplify the drift into delinquency once poverty has begun to exert its effects in a community. Firstly, children who are neglected or abused are widely thought to be at increased risk of becoming neglectful or abusing parents, themselves.14 Secondly, the children of parents with a criminal history are known to be at greater risk themselves of becoming delinquent.15 Australian Institute of Criminology 4 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Thirdly, children whose siblings are delinquent are known to persist longer in crime than children whose siblings are not delinquent.16 Fourthly, children whose peers are delinquent are both more likely to become delinquent and to persist longer in their delinquency.17 The transmission of parental neglect between parents and offspring will elevate the risk of delinquency long after poverty has ceased to be an issue. The modelling and peer group influence of parents, siblings and friends, on the other hand, will boost the population of offenders even where no signs of parental neglect, family conflict and separation exist. You can begin to see, though, why offender populations don’t go up and down with every passing economic storm. Passing changes in household income probably exert no effect on the risk of neglect and therefore exert no real effect on rates of drift into delinquency. Long-term changes in household income do have an effect on rates of neglect but the initial impact of this on offender populations is delayed by the time it takes neglected children to reach their crime-prone years. It’s also delayed by the time it takes modelling and peer group influences in a community, if they exist at all, to reach the stage where they can significantly amplify the effects of an increase in poverty on crime. The thing about differences between areas in average income levels, of course, is that they are usually sustained over long periods of time. They’re also usually substantial. More importantly, the congregation of offenders in poor areas provides peer support and encouragement to those whose stake in conformity has been weakened by poor school performance. The shortage of adequate recreational facilities, high residential mobility and poor transport services typically found in low-income areas probably compound these effects. Understanding Change in Offending Frequency. Let me turn now to the question of how economic growth influences the frequency of offending. In dealing with this issue I hope to give you some explanation for why aggregate property crime rates don’t rise and fall with the number of offenders. It’s worth pointing out first that the potential impact of changes to offending frequency on aggregate property crime rates is much underestimated. Australian Institute of Criminology 5 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Much of the time, property offenders are not that active. Pia Salmelainen in the Bureau,18 for example, found that break, enter and steal offenders were committing break and enter offences at a median rate of only one every three weeks in the six months prior to their most recent arrest.19 Frequent offenders, though, were committing more than ten break, enter and steal offences per week. In other words the offending rates of high frequency offenders were more than thirty times higher than the median offending rate for this type of offence.20 Now there are good theoretical reasons for expecting the frequency of most forms of property crime to rise and fall with the level of private consumption. Recidivist property offenders are known to explore the available opportunities for crime.21 The dominant forms of property crime in Australia involve the theft of goods for resale. Second-hand dealers and pawnbrokers are more likely to turn a blind eye to the offer of stolen goods when demand for second-hand goods is rising than when it’s falling. The same is true of those involved in selling stolen goods through pubs, clubs, garage sales and classified ADs. A growth in private consumption, then, ought to fuel an increase in the frequency of offences involving the resale of stolen goods. Property offenders, though, probably benefit in other ways from private consumption growth. During periods of private consumption growth, the cash turnover of service stations, fast food outlets and service providers, such as taxis, increases significantly. The number of cash-carrying individuals wandering the streets at night also increases. These are all prime targets for robbery offenders. ........ How well do these theoretical arguments fit the empirical facts? Unfortunately no empirical studies to date have looked at the impact of consumption growth on offending frequency. Three studies, however, have looked at the relationship between economic growth and aggregate property crime rates. Australian Institute of Criminology 6 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn The results of these studies are mixed. Two of them, carried out, respectively, in Sweden22 and Australia,23 found a strong positive relationship between private consumption levels and property crime rates, at least during the post-war period. The other, carried out by the Home Office in England, found a negative relationship.24 The Home Office result is a puzzling one and difficult to reconcile with what we know about the behaviour of those involved in property crime. If current property crime trends in New South Wales are anything to go by, the relationship between consumption growth and offending frequency would seem more likely to be positive than negative. We’ve just come out of a recession during which, as I mentioned earlier, rates of many property offences declined substantially. Private consumption growth is now on the way up and so too are rates of break, enter and steal and car theft.25 This pattern is consistent with the pattern Sat Mukherjee observed in Australia over the period from 1900 to 1976, even if it falls well short of establishing a direct connection between private consumption growth and offending frequency. The Implications for Future Property Crime Trends in Australia. What does all this portend, then, for the future direction of property crime in Australia? It’s difficult to offer any unqualified prognosis. Too much depends upon factors, such as the pace and pattern of technological innovation, whose future behaviour is impossible to predict. Too much also depends upon the strength of the relationship between poverty, neglect and offender population growth and on the way in which private consumption growth influences offending frequency. At the same time, forced to speculate, I would tend to view any increase in the level of poverty among families with dependent children with apprehension, particularly if we are in for a long period of growth in the level of private consumption. Australia at the moment appears to be experiencing both. Between December 1992 and December 1994, private final consumption expenditure in Australia rose by 6.4% in real terms.26 Australian Institute of Criminology 7 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Between 1981-82 and 1989-90 the percentage of family units falling below the Henderson poverty line rose by about 60%.27 This growth in inequality is not concentrated solely among the elderly or those income units whose potential contribution to crime is negligible. It is to be found among the very family units whose children are at particular risk of involvement in crime. Peter Saunders’ research shows, for example, that the proportion of single-parent families living in poverty, after adjusting for housing costs, rose from about 38% in 1981-82 to 54.% in 1989-90.28 There are also other worrying economic trends on the horizon. Bob Gregory and Boyd Hunter at the ANU recently charted a significant fall between 1976 and 1991 in average household income among the bottom 70% of urban census collection districts in terms of SES.29 The fall was greatest in districts at the lowest end of the socioeconomic scale. These are the very districts which past Bureau research has shown have the highest concentrations of proven property offenders.30 Some commentators would argue that the Henderson poverty line is a relative poverty line, that is, a line is set relative to average incomes across the population as a whole. Peter Saunders’ data do show an 13% increase in average real household disposable income per capita over the decade from 1979 to 1989, despite the growth in inequality.31 It could be argued, then, that there’s no real reason why a Hendersonian-style growth in poverty should be regarded as criminogenic. There are two counterpoints to this argument. Firstly, most cross-sectional studies actually show a stronger association between income inequality and offending rates than absolute income and offending rates.32 The second is that Bob Gregory and Boyd Hunter’s findings point to either a fall in household income among low-income earners or to a progressive concentration of low-income earners in certain areas.33 To my mind both of these outcomes spell potential trouble. A drop in household income among the poor will increase the rate of neglect, family conflict and separation, thereby increasing the rate of initiation into property crime. Australian Institute of Criminology 8 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn A progressive concentration of low-income earners in certain areas will achieve the same result by intensifying the influence of delinquent peers and also by placing added social strains on those with low incomes. There are some grounds for concern, then, about the impact of current social and economic trends on property crime in Australia. At the same time there isn’t enough hard evidence on causes to justify anyone sounding a note of general alarm about the future impact of Federal Government economic policies on rates of property crime in Australia. The fact is we don’t yet know how the economic trends observed by Peter Saunders, Bob Gregory and Boyd Hunter have come about. Nor can we be absolutely certain of their social effects. The philosopher Wittgenstein, faced with similar epistemic uncertainty, once said: “Whereof one cannot speak, thereof one should keep silent.” This is not a principle I would apply to reasoned discussion. But it is a principle I would like to see applied more often in politics. What we need to sort out this situation is more careful research and theory. We don’t need a law and order crisis manufactured for political ends. 1 Disadvantage and Crime in New South Wales. Devery, C. NSW Bureau of Crime Statistics and Research. 1991. 2 ibid, p. 37. 3 Reserve Bank of Australia. Bulletin. September, 1992, p. S.59. September, 1993. S60. 4 Crime and Safety Australia. April 1993. Australian Bureau of Statistics. Catalogue No. 4509.0. p.16. 5 NSW Recorded Crime Statistics. NSW Bureau of Crime Statistics and Research. 1993. p.22-24. 6 Saunders, P. Economic Adjustment and Distributional Change: Income Inequality in Australia in the Eighties. Social Policy Research Centre. Report 47. November 1993. p.11. 7 NSW Police Service. Crime Statistics. 1988-1989. p. 123. 8 Mukherjee, S. Crime Trends in Twentieth Century Australia. 1981. Australian Institute of Criminology. Allen and Unwin. p. 107-135. 9 Chiricos, T., Rates of Crime and Unemployment: An Analysis of the Aggregate Research Evidence. Social Problems. 1987, 34, 2, p.187-212. 10 ibid, p. 208-212. Note that this pattern is not found when studies examining violent crime are included in the comparison of time series and cross-sectional studies. 11 This is not to say that most traditional theories of crime speak the same language in their treatment of the economics-crime relationship. Sociological theories tend to see economic adversity as corrosive of an individual’s stake in conformity or attachment to dominant social values (c.f. Toby, J. Social Disorganization and Stake in Conformity: Complementary Factors in the Predatory Behaviour of Hoodlums. Journal of Criminal Law, Criminology and Police Science. 1957, 48, p. 12-17). Economists typically construe economic adversity as a set of factors which reduce the “opportunity costs” of involvement in crime (c.f. Becker, G. Crime and Punishment. An Economic Approach. Journal of Political Economy. 1968. 76(2). p. 169-217). 12 Skurry, H. Family Poverty and Child Abuse in Sydney. Australian Journal of Marriage and Family. 1990. 11. (2). p. 94-99. D. Baumrind. The Social Context of Child Maltreatment. Family Australian Institute of Criminology 9 Crime in Australian National Symposium – Canberra, 5 & 6 June 1995 D.Weatherburn Relations. 1994, 43, 360-368. Gelles, R. International Perspectives on Child Abuse and Neglect. Child Abuse and Neglect. 1992. 7. 375-386. Pelton, L. Child Abuse and Neglect: The Myth of Classlessness. 1978. American Journal of Orthopsychiatry, 607-617. 13 Loeber, R., and Stouthamer-Loeber, M. Family Factors as Correlates and Predictors of Juvenile Conduct Problems and Delinquency. In Crime and Justice. An Annual Review of Research. Tonry, M. and Morris, N. (eds.). The University of Chicago Press. 1986. Volume, 7. p. 51-55. 14 Egeland, B. Breaking the Cycle of Abuse: Implications for Prediction and Intervention. 1988. In K Browne, C. Davies and P. Stratton (eds.). Early Prediction and Prevention of Child Abuse. New York. Wiley. p. 77-92. 15 Loeber and Stouthamer-Loeber, op. cit. p. 71. 16 Blumstein, A., Farrington, D., and Moitra, S. Delinquency Careers: Innocents, Desisters and Persisters. In Crime and Justice. An Annual Review of Research. Tonry, M., and Morris, N. (eds). 1985. Volume 6. p. 196. 17 Huizinga, D., Esbensen, F., and Weither, A. Are there Multiple Paths to Delinquency? The Journal of Criminal Law and Criminology. 1991. 82. (1). p.100. 18 Salmelainen, P. The Correlates of Offending Frequency: A Study of Juvenile Theft Offenders in Detention. NSW Bureau of Crime Statistics and Research. 1995. 19 ibid, p. 24-25. 20 ibid. 21 Tarling, R. Analyzing Offending. Data Models and Interpretations. London. HMSO. 1993. p. 48-50. 22 T. Norstrom. Theft Criminality and Economic Growth. Social Science Research. 1988. 17. p. 48-65. 23 Mukherjee. op. cit. p. 128-129. 24 Field, S. Trends in Crime and Their Interpretation: A Study of Recorded Crime in Post-War England and Wales. Home Office Research Study No. 19. 1990. 25 NSW Crime and Safety Survey. 1994. Australian Bureau of Statistics. Catalogue No. 4501.1 26 National Income, Expenditure and Product. Australian National Accounts. Australian Bureau of Statistics. December Quarter, 1994. Catalogue No. 5206.4. p. 47. 27 Saunders, P. op. cit. p. 31. 28 ibid. 29 Gregory, R., and Hunter, B. The Macro Economy and the Growth of Ghettos and Urban Poverty in Australia. Address to the National Press Club. Centre for Economic Policy Research. Australian National University. Discussion Paper 325. April, 1995. p. 6. 30 Devery, C. op. cit. p. 45. 31 Saunders, op. cit. p. 15. 32 Belknap, J. The Economics-Crime Link. Criminal Justice Abstracts. 1989. March. p. 140-157. 33 Gregory and Hunter, op. cit., p. 5. Australian Institute of Criminology 10