D R I T S A K I , C H A I D O

advertisement

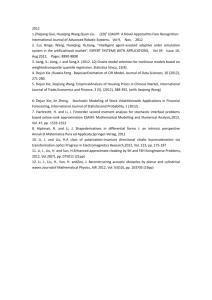

D R I T S A K I , C H A I D O Tel: +30 6976 918 870, +30 24610 68184 Email: dritsaki@teiwm.gr PERSONAL DETAILS Name Surname Father’s name Mother’s name Date of birth Place of birth Employment address Current post Subject area : Chaido : Dritsaki : Nikolaos : Evanthia : 26.11.1980 : Thessalonica, Greece : Technological Educational Institute (TEI) of Western Macedonia, Koila, Kozani 50100, Greece : Associate Professor at the Department of Accounting and Finance, Faculty of Management and Economics (Government Gazette of the Hellenic Republic No 1817/30.12.2014) : Econometric Applications EDUCATION 2003 – 2005 University of Macedonia, Greece, Dept of Applied Informatics PhD PhD thesis title: “The Relation between Tax System Structures and EconomicFinancial Indices: an Empirical Approach on the European Union”. Grade: Excellent. 2002 – 2003 University of Southampton, UK, School of Management MSc International Banking and Financial Studies Recognised by the Hellenic NARIC Dissertation title: “Financial, Credit and Economic Development using Granger causality: The case of Greece”. 1998 – 2002 Aristotle University of Thessalonica, Greece, Dept of Economics Degree mark: 7.80 out of 10, grade: Very Good 1995 – 1998 6th General Lyceum of Calamaria, Thessalonica, Greece Certificate of Secondary Education (CSE) mark: 19.5 out of 20, grade: Excellent. TEACHING EXPERIENCE 2014 – today Technological Educational Institute (TEI) of Western Macedonia, Greece Associate Professor (Dept of Accounting and Finance) • Modules taught include “Microeconomics” (2nd semester), “Econometrics I” (4th semester), “Econometrics II” (5th semester), Financial Econometrics (7th semester). 2010 – 2014 Technological Educational Institute (TEI) of Western Macedonia, Greece Assistant Professor (Dept of Financial Applications) • Modules taught include “Microeconomics” (1st semester) at the Dept of Financial Applications and Accounting, “Macroeconomics” (2nd semester) at the Dept of Financial Applications and Accounting, “Financial Mathematics” (1st semester), “Business Economics” (2nd semester), “Investment Analysis” (5th semester), “Forecasting Methods” (5th semester), “Quantitative Methods ΙΙ” (6th semester), “Quantitative Methods” (Erasmus programme). 2009 – 2010 University of Macedonia, Greece Adjunct Lecturer (Dept of Marketing and Operations Management) Module taught: “Finance for Business Administration” (1st semester). 2009 – 2010 University of Macedonia, Greece Adjunct Lecturer (Dept of Technology Management) Module taught: “Managerial Economics & Business Decision-Making” (5th semester). 2009 – 2010 Technological Educational Institute (TEI) of Thessalonica, Greece Fully qualified Teaching Fellow Module taught: “Microeconomics” (2nd semester) at the Dept of Tourist Enterprises. 2009 – 2010 TEI of Larisa, Greece Fully qualified Teaching Fellow Module taught: “Business Funding” (3rd semester) at the Dept of Tourist Enterprises. 2008 – 2009 University of Macedonia, Greece Adjunct Lecturer (Dept of Marketing and Operations Management) Module taught: “Economics for Business Administration” (1st semester). 2008 – 2009 University of Macedonia, Greece Adjunct Lecturer (Dept of Technology Management) Module taught: “Managerial Economics & Business Decision-Making” (5th semester). 2008 – 2009 TEI of Thessalonica, Greece Fully qualified Teaching Fellow Modules taught: 2 “Macroeconomics” (1st semester) at the Dept of Tourist Enterprises. “Microeconomics” (2nd semester) at the Dept of Tourist Enterprises. “Principles of Economics II” (1st semester) at the Dept of Marketing. 2008 – 2009 TEI of Larisa, Greece Fully qualified Teaching Fellow (Dept of Tourist Enterprises) Module taught: “Business Funding” (3rd semester). 2007 – 2008 University of Macedonia, Greece Adjunct Lecturer (Dept of Marketing & Operations Management) Module taught: “Economics for Business Administration” (1st and 2nd semester). 2007 – 2008 University of Macedonia, Greece Adjunct Lecturer (Dept of Technology Management) Module taught: “Managerial Economics & Business Decision-Making” (5th semester). 2007 – 2008 TEI of Kavala, Greece Fully qualified Teaching Fellow Modules taught: “Financial Mathematics (2nd semester) at the Dept of Accountancy. “The Stock Exchange – Technical Analysis” (5th semester) at the Dept of Information Management. “Economics” (1st semester) at the Dept of Information Management. Supervised students’ final dissertations. 2006 – 2007 University of Macedonia, Greece Adjunct Lecturer (Dept of Technology Management) Module taught: “Managerial Economics & Business Decision-Making” (5th semester). 2006 – 2007 TEI of Serrai, Greece Teaching Fellow (Dept of Accounting) Module taught: “Financial Statements Analysis” (5th semester). Supervised students’ final dissertations. 2006 – 2007 TEI of Kavala, Greece Teaching Fellow (Dept of Accountancy) Modules taught: “Banking and Finance” (4th semester). “Stock Exchange and Stock Market Analysis” (7th semester). Supervised students’ final dissertations. 2005 – 2006 ΤEI of Serrai, Greece Teaching Fellow (Dept of Accounting) “Financial Statements Analysis” (5th semester). 2005 – 2006 TEI of Kavala, Greece Teaching Fellow (Dept of Accountancy) Modules taught: 3 “Accounting for Business Organisations” (3rd semester). “Banking and Finance” (4th semester). “Stock Exchange and Stock Market Analysis” (7th semester). Supervised students’ final dissertations. 2004 – 2005 TEI of Kavala, Greece Teaching Fellow and Laboratory Assistant (Dept of Accountancy) Modules taught: “Accounting for Business Organisations” (3rd semester). “Banking and Finance” (4th semester). Supervised students’ final dissertations. 2003 – 2004 Vlazaki, Antonia Foreign Languages Centre, Neoi Epibatai, Thessalonica, Greece EFL teacher Taught English as a Foreign Language. WORK EXPERIENCE 2008 TEI of Kavala, Greece Reader Research of the Kavala Chamber entitled “Delving into, and Recording, the Qualitative Characteristics of the Unemployed and of Enterprises”, which was part of the “Career Advising and Employment Creation” project. 2007 – 2008 University of Macedonia, Greece Software developer Supported the Computing Studies in the Dept of Applied Informatics University of Macedonia (of Economic and Social Sciences). 2006 – 2007 Malliares and Sons plc., Thessalonica, Greece Assistant accountant 2005 TEI of Thessalonica, Greece Administrative Co-ordinator Participated in the Tempus CD JEP 31084-03 project, entitled “Enhancing Academic Cooperation in the Mediterranean -Development of Postgraduate Curriculum for Hospitality and Tourism Studies” sponsored by the Dept of Tourist Enterprises. 2004 – 2005 University of Macedonia, Thessalonica, Greece Software developer Supported the Computing Studies in the Dept of Applied Informatics University of Macedonia (of Economic and Social Sciences). Maintained the Master’s Degree Programmes (MDPs) web site, realised and maintained its applications with a view to supporting the educational work of the MDPs; in co-operation with MDP instructors, I was 4 responsible for regularly updating the website with educational material for modules of Economics/Finance. 2003 – 2004 University of Macedonia, Greece Software Developer Operational Programme for Education and Initial Vocational Training II Developed a model website for the Econometrics module Workshop/seminar support; introduced assessment sessions for the Accounting module while it was being administered; designed and constructed an electronic database of accounting data. 2003 – 2004 TEI of Thessalonica Administrative Co-ordinator Participated in the Tempus CD JEP 17121-2002 project, sponsored by the Dept of Tourism Enterprises. ADMINISTRATIVE DUTIES 1. 2. 3. 4. 5. 6. Prepared and marked papers of the matriculation examinations for “Microeconomics” in academic years 2010/2011, 2011/2012, 2012/2013, and 2013/2014. Been the chairperson of the 3-member committee for the internal evaluation of the Department of Financial Applications, Department of Management and Economics, University of Western Macedonia in academic years 2010/2011, 2011/2012, and 2012/2013. Standing in the 3-member committee for reshaping the curriculum of the abovementioned Department. Author/Editor of the implementation study of the system evaluating the Dept of Financial Applications. Member of the committee of the scheme for the internal system evaluation of the Dept of Financial Applications Academic co-ordinator for the Erasmus+ Programme in the Dept of Accounting and Finance SUPERVISING UNDER-GRADUATE AND POST-GRADUATE DISSERTATIONS (ERASMUS) (Alexander Technological Educational Institute of Thessalonica, Greece, Erasmus Mundus ECW for Georgia, Armenia and Azerbaijan) Under-graduate students 1. 2. 3. 4. Grigori Avanesyan “Supply and Demand” (Microeconomics) Grigori Avanesyan “Inflation and Unemployment: The case of Armenia” (Macroeconomics) Otar Antia and Mariam Meparishvili “Is Tax Policy Coordination Necessary for the EU Countries?” (Macroeconomics) Mariam Meparishvili “Productivity Growth in the Business Sector” (Microeconomics) 5 5. Mariam Papoyan and Armenuhi Budaghyan “Credit Market Development and Economic Growth: The case of Armenia” (Macroeconomics) Post-graduate students 1. 1. Aytan Mammadova “Is Azerbaijan vulnerable to Dutch Disease?” MONOGRAPHS 1.1 Dritsaki, C. (2005). “The Relation between Tax System Structures and EconomicFinancial Indices: an Empirical Approach on the European Union” (in Greek), Doctoral thesis, Dept of Applied Informatics, University of Macedonia, Greece. 1.2 Dritsaki C. (2003). “Financial, Credit and Economic Development using Granger Causality: The case of Greece”, Dissertation, International Banking and Financial Studies, University of Southampton, UK. 2. SCIENTIFIC ARTICLES 2.1. SCIENTIFIC ARTICLES IN JOURNALS 2.1.1 Dritsaki C. (2014). “The dynamic relationship between stock volatility and trading volume from the Athens stock exchange”, International Journal of Empirical Finance,Vol.3, No.3, pp.152-165. (Scopus, Impact Factor). 2.1.2. Dritsaki C., Dritsaki M. (2014). “CO2 emissions, energy consumption, financial development and economic growth: A multivariate cointegration and causality analysis for Greece”. World Applied Science Journal, Vol.32, No.2, pp.309-321. (Scopus, Impact Factor). 2.1.3. Dritsaki C., Dritsaki M. (2014). “Causal relationship between energy consumption, economic growth and CO2 emissions: A dynamic panel data approach”, International Journal of Energy Economics and Policy, Vol.4, No.2, pp.125-136. (Scopus, Impact Factor). 2.1.4. Dritsaki C., Dritsaki M. (2013). "Hysteresis in unemployment: an empirical research for three member states of the European Union”, Theoretical and Applied Economics, Vol. XX, No. 4(581), pp. 35-46. (Impact Factor). 2.1.5. Dritsaki C., Dritsaki M. (2013). "Philips Curve Inflation and Unemployment: An empirical research for Greece”, International Journal of Computational Economics and Econometrics, (EconLit). 2.1.6. Dritsaki, M., & Dritsaki, C. (2013). "The Bound Testing Approach for Cointegration and Causality between Financial Development, Trade Openness and Economic Growth in Bulgaria", The IUP Journal of Applied Economics, Vol.12, No.1, pp.1-18. (Impact Factor). 6 2.1.7. Dritsaki, C., & Dritsaki, M. (2012). "Exports and FDI: A Granger causality analysis in a heterogeneous panel", Economics Bulletin, Vol.32, No.4, pp.3128-3139. (Impact Factor). 2.1.8. Dritsaki, C. (2012). "Finance Development and Economic Growth: A Theoretical Perspective", Archives of Economic History, Vol.14, No.2, (EconLit). 2.1.9. Dritsaki, M., & Dritsaki C. (2012). "A panel data approach to the demand for money in Bulgaria and Romania", Applied Economics Letters, Vol.19. No.8. pp. 705-710. (Impact Factor). 2.1.10. Dritsaki, C. (2011). "The Random Walk Hypothesis and Correlation in the Visegrad Countries Emerging Stock Markets", Romanian Economic Journal, Vol.14, No.40, pp.25–56. (Impact Factor). 2.1.11. Dritsaki, C., & Dritsaki, M. (2010). "Government Expenditure and National Income: Causality Tests for Twelve New Members of E.E", Romanian Economic Journal, Vol.13, No.38, pp.67–89. (Impact Factor). 2.1.12. Dritsaki, C. (2009). “Real Wages as Determinant of Labour Productivity in Tourism”, Tourism and Hospitality Management, Vol.15, No.1, pp.101–105. (EconLit). 2.1.13. Dritsaki, C. (2009). “The Life cycle of Agro tourist enterprises”, Tourismos: An International Multidisciplinary Journal of Tourism, Vol.4, No.2, pp.149-154. (Scopus). 2.1.14. Dritsaki, C., & Dritsakis, N. (2009). “Okun’s Coefficient for four Mediterranean member countries of EU: An empirical study”, International Journal of Business and Management, Vol.4, No.5, pp. 18–26. (Google Scholar). 2.1.15. Dritsaki C. (2009). “Bulgaria–Romania: A nexus between European Union and Black Sea Region”, Journal of World Economic Review. Vol.4, No.1, pp.1–5. (JEL). 2.1.16. Dritsaki, C. (2009). "Tax Structures and Trade: An empirical research for Greece", International Journal of Management Research and Technology”, Vol.3, No.1, pp. 213–220. (JEL). 2.1.17. Dritsaki, C., & Kepouros, A. (2007). “Human capital and economic development: an empirical research on Greece using co-integration analysis” (in Greek). Spoudai, Vol.57, No.2, pp.106–118. (EconLit). 2.1.18. Dritsaki, C., & Karasavvoglou, A. (2007). “An Empirical Investigation of Bulgaria for Productivity and Inflation”, International Review of Applied Economic Research, Vol.2, No.1, pp.79-87. (JEL). 2.1.19. Anastassiou, T., & Dritsaki C. (2005). "Tax Revenues and Economic Growth: An Empirical Investigation for Greece Using Causality Analysis", Journal of Social Sciences, Vol.1, No.2, pp.99-105. (ISI Web of Science). 7 2.1.20. Dritsaki, C., & Dritsaki – Bargiota, M. (2005). "The causal relationship between stock, credit market and economic development: An empirical evidence for Greece", Economic Change and Restructuring, Special Issue, pp.113–127. Springer. (Impact Factor). 2.1.21. Dritsaki, C., & Gialetaki, K.(2005). "Taxes and Economic Indicators: An Empirical Investigation for Greece", Spoudai, Vol.55, No.3, pp.34–54. (EconLit). 2.1.22. Dritsaki, C., & Adamopoulos, A. (2005). "A causal relationship and macroeconomic activity: Empirical results from European Union", American Journal of Applied Sciences, Vol.2, No.2, pp.504–507. (Scopus, ISI Web of Science). 2.1.23. Dritsaki, C., Vazakides, A., & Adamopoulos, A. (2004). "Exports, investments and economic growth: An empirical investigation of the three Baltic countries", Baltic Journal of Economics, Vol.4, No.2, pp.72-79. (Impact Factor). 2.1.24. Dritsaki, M., Dritsaki, C., & Adamopoulos, A. (2004). "A causal relationship between trade, foreign direct investment and economic growth for Greece", American Journal of Applied Sciences, Vol.1, No.3, pp.230-235. (Scopus, ISI Web of Science). 2.2. SCIENTIFIC ARTICLES REVIEWERS 2.2.1. Dritsaki. C, and Stiakakis. E (2014). “Foreign direct investment, exports and economic growth in Croatia: A time series analysis” ICOAE, Chania, Greece, 3-5 July 2014, Procedia Economics and Finance, Vol.14, pp.181-190. (Elsevier). 2.2.2. Dritsaki C., (2013). “Causal Nexus Between Economic Growth, Export and Government Debt: The case of Greece” ICOAE, Istanbul, Turkey, 28-30 June 2013, Procedia Economics and Finance, (Elsevier). 2.2.3. Dritsaki C., & Dritsaki, M. (2012). “Inflation, Unemployment and the NAIRU in Greece”, ICOAE, Uppsala, Sweden, 28-30 June 2012, Procedia Economics and Finance, Vol.1, pp.118-127. (Elsevier). 2.2.4. Dritsaki C., & Dritsaki. M. (2011). “The stability of money demand: Evidence from Turkey”, Eurasia Business and Economics Society, Istanbul, Turkey 1-3 June 2011, και δηµοσιεύθηκε στo The IUP Journal of Bank Management, Vol.XI, No.4, pp.728, 2012 (Impact Factor). 2.2.5. Dritsaki, C. (2010). “The Weak Form Efficiency and Correlation of Stock Markets in Eastern Europe: An Empirical research for four new member states of European Union”, 2nd International Conference, “The Economies of Balkan and Eastern Europe Countries in the Changed World”, Kavala, 7–9 May. 2.2.6. Dritsaki C., Dritsaki. M. (2009). “The Deficit of Balance on Current Account: An Empirical Investigation for Greece” International Conference on Applied Economics, 2009, Kastoria, 27–30 May 2009. Published in the Journal of European Economy, Vol.9, No.5, pp.132–145, 2010 (EconLit). PRESENTED IN CONFERENCES WITH 8 2.2.7. Dritsaki, C. (2007). "Black economy in Cyprus: An empirical research” (in Greek). Presented at the 20th Pan-Hellenic Conference on Statistics (published in the proceedings of the Conference). Nicosia, 10-15 April. 2.2.8. Dritsaki, C, (2006). "Romania a linkage between European Union and the Black Sea Region: An empirical research of productivity and inflation".(Approved and presented at the International Conference, entitled: “Innovations, Entrepreneurship and Competitiveness in the Balkan and Black Sea countries”). Kavala 3-5 November. 2.2.9. Dritsaki, C. (2006). "Company taxation and private investment: an empirical research for Greece using cointegration analysis” (in Greek). Presented at the 19th Pan-Hellenic Conference on Statistics and published in the proceedings of the Conference, pp.205-212, Castoria 26-29 April. 2.2.10. Dritsaki, C., Vazakides, A. (2005). "Tax Categories and Economic Growth: An empirical research for Greece” (in Greek). Presented at the 18th Pan-Hellenic Conference on Statistics and published in the proceedings of the Conference, pp.99108, Rhodes, 4-7 May. 2.2.11. Dritsaki- Bargiota M., Dritsaki C. (2004). "Macroeconomic Determinants of Stock Price Movements: An Empirical Investigation of the Greek Stock Market", 11th Annual Conference of the Multinational Finance Society, Istanbul, Turkey 3-8 July. 2.2.12. Dritsaki, M., & Dritsaki, C. (2004). "Correlation of the New York and Athens Stock Exchanges” (in Greek). Presented at the 17th Pan-Hellenic Conference on Statistics and published in the proceedings of the Conference, pp.159-166, Leucas, 14-18 April. 2.3. ARTICLES IN YEARBOOKS 2.3.1. Dritsaki, C., Dritsaki, M., Adamopoulos A. (2006). "Inflation and Productivity: an empirical research for Greece using the causality analysis” (in Greek). University of Macedonia Scientific Yearbook, Volume in honour of Maria Delivany, pp.119-132. 3. BOOKS – NOTES – CHAPTERS IN BOOKS 3.1. Dritsaki, C., & Dritsaki, M. (2013). “An Introduction to Econometrics employing EViews”, Athens: Cleidarithmos publications, p.387. 3.2. Dritsaki C. (2009). "Tax Structures and Trade: An empirical research for Greece", Chapter on book “Contemporary Issues in Management”, Serials Publications, New Delhi, Year of Publication, 2010, Editors: Dr. C. Samudhra Rajakumar, Dr. K. Tamizh Jyothi and R. Rajinikanth. 3.3. Dritsaki, C. (2007). “The use of General Mathematics in the Economy”, pp.171, Dept of Accounting, Technological Educational Institute of Kavala. 9 4. CITATIONS • Dritsaki.M., Dritsaki C. (2004). "Macroeconomic determinants of stock price movements: An empirical investigation of the Greek stock market", Selected paper, 11th Annual Conference of Multinational Finance Society, Istanbul, Turkey, 2004. 1) Francisco Lopez Herrera, (2004). "Prima de riesgo del mercado mexicano de capitales y la dinamica de factores de Riesgo con base en variables conomicas clave", Memoria del IX Foro de Investigacion: Congreso Internacional de Contaduria, Administracion e Informatica. Octobre 27-29, 2004. 2) Cumhur Erdem, Cem Kaan Arslan, and Meziyet Sema Erdem, (2005). "Effects of macroeconomic variables on Istanbul stock exchange indexes» Applied Financial Economics, Vol. 15, No.14, pp. 987–994. 3) Francisco Lopez Herrera (2006). "Riesgo sistematico en el mercado mexicano de capitales : un caso de segmentacion parcial ". No 219, mayo-agosto, 2006, Universidad Nacional Autonoma de Mexico. 4) Francisco Lopez Herrera and Edgar Ortiz (2006). "NAFTA capital markets mild segmentation: dynamic multifactor asset pricing models", 13th Global Finance Conference, April 26th to 28th, 2006 Rio de Janeiro, Brazil. 5) Serra Eren Sarioglou (2006). "Degiskenlik modelleri ve imkb hisse senetleri piyasasinda degiskenlik modellerinin kesitsel olarak irdelenmesi”, Doktora Tezi, Bogazici Universitesi Sosyal Bilimler Enstitusu, Istanbul 2006. 6) Muhittin Zugul and Cumhur Dahin (2009). “An application to examine the relationship between IMKB 100 INDEX and some macroeconomic variables”, Akademik Bakis, sayi 16, Nisan, 2009. 7) Azemi Bin Mohd Noh (2009). “The impact of macroeconomic variables on firm’s performance: Evidence from Malaysian GLC”, Master of Business Administration, University of Malaysia. 8) Francisco Lopez Herrera and Edgar Ortiz (2011). "Dynamic multibeta macroeconomic asset pricing model at NAFTA stock markets”, International Journal of Economics and Finance, Vol. 3, No. 1, pp. 55–68. 9) Sayilgan, G., and Suslu, C. (2011). “The effect of macroeconomic factors on stock returns: A study of Turkey and emerging markets”, BDDK Bankac l k ve Finansal Piyasalar, Vol.5, No.1, pp. 73-96. 10) Hugida, L. (2011). “Analisis faktor-faktor yang mempengaruhi volatilitas harga saham (studi pada perusahaan yang terdaftar dalam indeks LQ 45 periode 2006-2009)”, Thesis submitted for the degree of Doctor of Philosophy, Fakultas Ekonomi Universitas Diponegoro, Semarang. 11) Siti Noorahayusolah, Kosnandi (2011). “The impact of macroeconomic forces on stock returns in Malaysia”. Masters thesis, Universiti Utara Malaysia. 12) Shehnila Soomro, Niaz Ahmed Bhutto and Ghulam Abbas (2012). “Stock market cycles generation of non financial companies in Pakistan” Asian Journal of Business and Management Sciences, Vol. 1, No. 57, pp. 57-64. 13) Fauziah, Naimatul (2013). “Analisis pengaruh volume perdagangan, inflasi, dividend yield dan dividend payout ratio terhadap volatilitas harga saham perusahaan yang terdaftar di LQ45”, Doctor of Philosophy, Fakultas Ekonomi Dan Bisnis Universitas Islam Negeri Syarif Hidaytullah, Jakarta. 14) Vardhan, Harsh (2014). “Industry response to trade liberalization: quantitative analysis of stock market”, Doctor of Philosophy Dept. of Management Studies, University of Delhi. 15) Arif Hussain, Gohar Zaman and Qadir Bukhsh Baloch (2014). “The causal relationship of interest rate and stock prices: Empirical evidence from Pakistani markets” City 10 University research Journal, Vol.4, No.2, pp.147-155. 16) Sibel Karina Arnes (2015). “Impact of macroeconomic indicators on stock market performance: The case of the Istanbul stock exchange” Master’s Thesis, MSc. Finance & Strategic Management, Copenhagen Business School. • Dritsaki M., Dritsaki C, and A. Adamopoulos (2004). "A causal relationship between trade, foreign direct investment and economic growth in Greece", American Journal of Applied Sciences, Vol. 1, No.3, pp. 230–235. (Scopus, ISI Web of Science). 17) Pokou Koffi (2005). “Investissements directs etrangers et croissance economique en cote d’ivoire” Cellule d’ analyse de Politiques Economiques du CIRES, Decembre 2005, E. No 130. 18) Frank S.T. Hsiao and Mei-Chu W. Hsiao (2006). “FDI, exports, and growth in east and southeast Asia evidence from time – series and panel data causality Analysis”, Journal of Asian Economics, Vol.17, No.6, pp.1082–1106. 19) ∆εδελούδης Κωνσταντίνος, (2006). "Οικονοµική µεγέθυνση και ανάπτυξη του κατασκευαστικού κλάδου: Ένα οικονοµετρικό υπόδειγµα της συνάρτησης παραγωγής του κλάδου των κατασκευών", ∆ιδακτορική ∆ιατριβή, Τµήµα Πολιτικών Μηχανικών της Πολυτεχνικής Σχολής του Α.Π.Θ. 20) Amin Karimu (2006). “Foreign direct investment and economic growth: A causality analysis for the case of Chana”, D-Level Thesis, Economics, Hogskolan Dalarna, Borlange. 21) Papadogonas, Th, Voulgaris, F. and G. Agiomirgianakis (2007). "Determinants of export behavior in the Greek manufacturing sector", Operational Research, An International Journal, Vol.7, Νο.1, pp.121-135. 22) Ahmed Torch and Jihad Mohammed (2007). “The economic investment the foreign court usher on the growth influenced: Applied study on Jordan.”, Magazine of the Flags Economic and Administrative, Vol.23, No.1, pp.1–31. 23) Bitzenis, A. Marangos J, and A. Andronikidis (2007). “The interaction of international trade and foreign direct investment (FDI) under decisive institutional reforms in Bulgaria”, International Journal Trade and Globat Markets, Vol.1, No.1, pp.69–88. 24) Oscar Eddy Kiiza (2007). “The causal relationship between foreign direct investment and economic growth: The case study of Uganda”, MSc Thesis, Cranfield University, School of Management, 2007. 25) Zakia Mishal, and Ziad Abulaida (2007). “The impact of foreign direct investment on economic growth: The case of Jordan”, Journal of Economic and Administrative Sciences, Vol.23 No.1, pp.1-31. 26) Yongkul Won, Frank S. T. Hsiao, and Doo Yong Yang (2008). “FDI inflows, exports and economic growth in first and second generation ANIEs: Panel data causality analyses”, Book, Korea Institute for International Economic Policy, Published by KIEP 2008. 27) Yongkul Won (2008). “FDI inflows, exports and economic growth in major ASEAN countries time series and panel causality analyses”, Southeast Asia research, Vol.18, No.2, pp. 173-209. 28) Siti Hajar Samsu, Alias Mat Derus, Ai-Yee Ooi and Mohd Fahmi Ghazali (2008). “Causal links between foreign direct investment and exports: Evidence from Malasia”, International Journal of Business and Management, Vol.3, No.12, pp.177-183. 29) Joao Bento (2008). “The dynamic interactions between trade, foreign direct investment and economic growth: Evidence from Portugal”, Book, Perspectives on Intergration and Globalisation. 30) Yongkul Won, Frank S. T. Hsiao, and Doo Yong Yang (2008). “Panel causality analyses FDI – exports - economic growth nexus in first and second generation ANIEs:”, The Journal of the Korean Economy, Vol.9, No.2, pp.257–267. 11 31) Derek Gibbs and Patrick McCaskie (2008). “The trade debt and finance nexus: An assessment of Barbados”, Research and Policy Working Papers, Vol.1, pp.8-31. 32) Pham Thi Hong Hanh, and Tran Thi Anh-Dao (2009). “Panel causal relationship between FDI and exports: Evidence from a sector level analysis of Vietnam”, Working Paper, CARE-EA 2260, University of Rouen. 33) Matiur Rahman (2009). “Contributions of exports, FDI and expatriates remittances to real GDP of Bangladesh, India, Pakistan and Sri Lanka” Southwestern Economic Review, pp. 141–154. McNeese State Univesity. 34) Bhissum Nowbutsing (2009). “FDI, domestic investment and economic growth: A theoretical framework” Working Paper, University of Technology Mauritius. 35) Kundan Pokhrel Majagaiya (2009). “A time series analysis of foreign direct investment and economic growth: Case study of Nepal”, Working Paper, Donghua University, Shanghai, China. 36) Suzanne Michelle Jones, Michelle Menke, Bryan Lowenberg, James Long and Gbemi Abudu (2009). “ A definition of FDI and economic growth” ,Conference, The FDI and Economic Growth Report prepared for the Jordan Investment Board, Amman, Jordan 2009. 37) Erkan Ilgόn (2009). “Deutsche direktinvestitionen in der Turkei und deren beitrag zum wirtschaftswachstum”, Inaugural-Dissertation zur Erlangung des akademischen Grades eines Doktors der Wirtschafts-und Sozialwissenschaften (Dr. rer. pol.) der Universitδt Siegen. 38) Maria, E. de Boyrie (2009). “Structural changes, causality, and foreign direct investments: Evidence from the Asian crises of 1997”, Global Economy Journal, Vol.9, No.4. Article 2. 39) Prakoso, Andrian Tony (2009). “Analisis hubungan perdagangan internasional dan FDI terhadap pertumbuhan ekonomi Indonesia”, MSc thesis, UNSPECIFIED, Universitas Indonesia. 40) Abu Nurudeen, Obida Wafure Gobna and Abdullahi Usman (2010). “On the causal links between foreign direct investment and economic growth in Nigeria, 1970-2008: An Application of Granger Causlity and Co-Integration Techniques”, Romanian Statistical Review, nr. 3 / 2010. 41) Jaime Martinez-Martin (2010). “On the dynamics of exports and FDI: The spanish internationalization process” Research Institute of Applied Economics, Working Paper. 42) G.Jayachandran and A. Seilan (2010). “A causal relationship between trade, foreign direct investment and economic growth for India” International Research Journal of Finance and Economics, Vol.42, pp.74–88. 43) Piort Misztal (2010). “Foreign direct investments as a factor for economic growth in Romania” Review of Economic and Business Studies, Vol.3, No.1, pp.39–53. 44) Nguyen Tu Anh (2010). “Deeper integration and navigating volatility”, Working Paper. Central Institute for Economic Management, Department for Macroeconomic Management, CIEM, 68 Phan Dinh Phung Hanoi. 45) Muhammad Shahzad Iqbal, Faiz Muhammad Shaikh, and Amir Hussain Shar (2010). “Causality relationship between foreign direct investment, trade and economic growth in Pakistan” Asian Social Science, Vol.6, No.9, pp.82–89. 46) Nguyen Tu Anh and Nguyen Thu Thuy (2010). “Is Vietnam economic paradigm sustainable for catch up”, Working Paper, Central Institute for Economic Management, CIEM, 68 Phan Dinh Phung Hanoi. 47) Hassen Guenichi (2010). “Cointegration, structural changes and the relationship between trade and economic growth in Tunisia” The International Journal of Business and Management Research, Vol.1, No.1, pp.36–56. 48) Muhammad Shahzad Iqbal., Imamuddin Khoso Amir., Hussain Shar and Faiz Muhammad Shaikh (2010). “Analysis of regional trade block and agricultural productivity: 12 impact of SAFTA (South Asian free trade agreement) on economic growth of Pakistan by using CGE model, Asian Social Science, Vol.6, No.12, pp.160–166. 49) Bruno Manuel de Almeida Casqueira (2010). “The foreign direct investment and the Portuguese trade and specialization pattern in goods and services in the recent years (19952009)", MSc in International Economic Consulting, Aarhus School of Business, University of Aarhus. 50) Zuzana Gallova, Daniel Stavarek (2010). “Modelovanie kauzálních väzieb medzi priamymi zahraničnými investíciami, exportoma ekonomickým rastom v Chorvátsku”, Ekonomická revue – Central European Review of Economic, Vol.13, pp.179–184. 51) Rajender, S. Godara, Manoj, K. Siwach, and Ranjan, K. Aneja (2010). “Foreign direct investment and economic growth in India: An Empirical Analysis” International Journal of Research in Commerce and Management, Vol.1, No.10, pp.49-51. 52) Timo Mitze (2010). “Global cointegration in the analysis of the German regional growth-trade-FDI nexus”, Working Paper, Published RWI Essen and Ruhr-University Bochum, Germany. 53) Faiz Muhammad Shaikh (2010). “Causality relationship between foreign direct investment, trade and economic growth in Pakistan” International Conference on Applied Economics – ICOAE, pp.717-722. 54) Lucyna Kornecki and Vedapuri Raghavan (2011). “Inward FDI stock and growth in central and eastern Europe”, The International Trade Journal, Vol.5, No.5, pp.539-557. 55) Shahbaz, Muhammad and Rahman, Mizanur (2011). “Impact of economic growth and financial development on exports: Cointegration and causality analysis in Pakistan”, MPRA Paper No.28563. 56) Alireza Kazerooni, and Majid Feshari (2011). “Causality relationship between FDI, export and GDP: The case study of MENA countries”, Working Paper. 57) Olga Nosova (2011). “Foreing direct investment and spillover effects in eastern Europe” EAEPE research area: I. Structural and Institutional Change in Eastern Europe, Kharkov National University of Internal Affairs. 58) Mani Nandwani (2011). “A study of export performance of India in world trade and causal relationship between trade foreign direct investment and economic growth in India”, MSc Thesis, Northern Integrated Institute of Learning Management, Centre for Management Studies, New Delhi, India. 59) Fadli Fizari Abu Hassan Asari, Norazidah Shamsudin, Rhaudhah Anis Hamid Abd Kadir, Nurul Syuhada Baharuddin, Salwani Affandi and Kamaruzaman Jusoff (2011). “Impact of export and gross domestic product towards foreign direct investment inflows in Malaysia”, World Applied Sciences Journal, Vol.12, pp.27-33. 60) Karahasan, Burhan Can (2011). “Causal links between trade and economic growth Evidence from Turkey and European Union countries”, MPRA Paper No.29809. 61) Mehdi Behname (2011). “The relationship between growth, foreign direct investment and trade in MENA countries: A causality test”, Society of Interdisciplinary Business Research (SIBR) 2011 Conference on Interdisciplinary Business Research. 62) Ikhtiar A. G., Asif. A. S, Khalid H. S, Tahira A, and Faiz M. S.(2011). “Relationship between foreign direct investment, trade and economic growth in Pakistan by using CGEmodel”, Asian Journal of Business and Management Sciences, Vol.1, No.4, pp.134 – 140. 63) Muhammad Irfan Javaid Attari, Yasir Kamal, and Sumayya Nasim Attaria (2011). “The causal link between foreign direct investment (FDI) and economic growth in Pakistan economy”, The Journal of Commerce, Vol.3, No.4, pp.61-68. 64) Georgantopoulos, A. G, and Tsamis. A. D. (2011). “The triangular causal links between economic development, FDI and exports: Evidence from Turkey”, Middle Eastern Finance and Economics, Vol.15, pp.66-75. 13 65) Ikhtiar A. G., Khalid H. S, Asif. A. S, and Faiz M. S. (2011). “Globalization economic development and trade growth in Pakistan”, Asian Journal of Business and Management Sciences, Vol.1, No.4, pp.141–146. 66) Sarbapriya Ray (2011). “Exploring cointegration and causality between foreign trade and economic growth: Econometric evidence from India”, International Journal of Contemporary Business Studies, Vol.2, No.10 pp.53-69. 67) Reza Ahmadi and Mojtaba Ghanbarzadeh (2011). “FDI, exports and economic growth: Evidence from Mena region”, Middle-East Journal of Scientific Research, Vol.10, No.2, pp. 174-182. 68) Eman Selim (2011). “Economic growth, FDI, and income inequality: The case of Egypt”, Working Paper, Tanta University – Egypt. 69) Öğr. Gör. Mustafa METE (2011). “The role of trade policies on economic growth in Turkey (1990-2010)”, International Symposium, Regional and Global Dynamics: Economic and Political Issues of Turkey and Its Near Abroad (28-29 April 2011), Izmir University, Izmir, Turkey. 70) Shahul Hameed (2011). “Study on trade foreign direct investment economic growth for India”, Analysis in Trade, FDI and Economic Growth, Working Paper. 71) Jeffery Dennis Patterson (2011). “The eastward expansion of the European Union: Is foreign direct investment being diverted from the EU periphery?” MSc Thesis, University of Delaware, USA. 72) Mahmoud M. Sabra (2011). “The strategic choice of the multinational firms and the relationship between exports and FDI, application on bivariate probit model, and dynamic gravity model in the Mediterranean area”, Doctor of Philosophy, Laboratoire d’ economie appliqueé au developpenent-lead, Universite du Sud Toulon-Varrsite du. 73) Benoit Kafando (2011). “Investissement direct etranger et croissance economique au burkina faso”, Master en économie, Economie et Finance, Université Ouaga. 74) Syed Imran Ali Meerzal (2012). “Causal links between trade, foreign direct investment and economic growth for Bangladesh”, Working Paper, Department of Economics, South Dakota State University. 75) Narayan Sethi and Sanhita Sucharita (2012). “Effect of FDI on economic growth in Bangladesh and India: An empirical investigation”, Working Paper, Department of Humanities and Social Sciences, National Institute of Technology (NIT), Rourkela, India. 76) Egwaikhide Christian Imoudu (2012). “The impact of foreign direct investment on Nigeria’s economic growth; 1980-2009: Evidence from the Johansen’s cointegration approach”, International Journal of Business and Social Science, Vol.3, No.6, pp.122-134. 77) Timo Mitze (2012). “Within and between panel cointegration in the German regional output–trade–FDI nexus”, Empirical Modelling in Regional Science, Vol.657, No.2, pp.191215. 78) Shanta Parajuli (2012). “Examining the relationship between the exchange rate, foreign direct investment and trade” Doctor of Philosophy, Department of Agricultural Economics and Agribusiness, Louisiana State University. 79) Mounir Belloumi (2012). “The relationship between trade, FDI and economic growth in Tunisia: An application of autoregressive distributed lag model” Working Paper. 80) Timo Mitze (2012). “Measuring regional spillovers in long-and short run models of total factor productivily trade and FDI”, International Regional Science Review, pp.1-24. 81) Bishnu Kumar Adhikary (2012). “Impact of foreign direct investment trade openness, domestic demand and exchange rate on export performance in Bangladesh: A VEC approach”, Economics Research International, Vol.2012, Article ID 463856, 10 pages, doi:10.1155/ 2012/463856. 14 82) Misztal, Piotr (2012). “Bezpośrednie inwestycje zagraniczne jako czynnik wzrostu gospodarczego w Polsce”, Finanse : czasopismo Komitetu Nauk o Finansach PAN, Vol.5, No.1, pp. 9-34. 83) Farhat Rashid Sami Ullah and Bedi-uz-Zaman (2012). “Effects of exports instability on economic growth in SAARC region countries”, Pakistan Journal Commercian Sociance Science, Vol.6, No.1, pp.97-120. 84) Arshad, Muhammad (2012). “Impact of foreign direct investment on trade and economic growth of Pakistan: A co-integration analysis” International Journal Economic Research, Vol.3, No.4, pp.42-75. 85) Zuzana Gallová (2012). “A causal relationship between foreign direct investment, economic growth and export for Central and Eastern Europe” Proceedings of 30th International Conference Mathematical Methods in Economics, pp.201-206. 86) Iason Koufodontis, Andreas Alexopoulos, Eleni Gaki (2012). “European regional policy and development in Greece: Do statistics justify the investments?”, ERSA conference. 87) Mohammad Mafizur Rahman, Muhammad Shahbaz and Abdul Farooq (2012). “ Financial development, international trade and economic growth in Australia: New evidence from multivariate framework analysis”, MPRA Paper No.42023. 88) William Akoto (2012). “On the nature of the causal relationship between foreign direct investment, GDP and exports in South Africa”, Journal of International Development, DOI: 10.1002/jid.2892. 89) Mehmet ERYİĞİT (2012). “The long run relationship between foreign direct investments, exports, and gross domestic product: panel data implications” Theoretical and Applied Economics, Vol.XIX, No.10, pp.71-84. 90) Ismet Gocera, Sahin Bulut, and M. Metin Dam (2012). “Effects of foreign direct investments on export performance of Turkey: An econometric analysis”, Business Research and Economics Journal, Vol.3, No.2, pp.21-40. 91) Muhammad, Shahbaz; Saleheen , Khan and Mohammad , and Iqbal Tahir (2013). “The dynamic link between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis”, Energy Economics,. Vol.40, pp.8-21. 92) Silvia Domeneghetti (2013). “Three essays on the egyptian economy” Dottorato di Ricerca in Economia, Dipartimento di Economia, Università di Verona. 93) M. Azeem Naseer (2013). “A causal relationship between trade, FDI, exchange rates and economic growth of Pakistan”, African Journal of Business Management, Vol.7, No.21, pp.2020-2025. 94) Moses Joseph Shawa, and Yao Shen (2013). “Causality relationship between foreign direct investment, GDP growth and export for Tanzania” International Journal of Economics and Finance, Vol.5, No.9, pp.13-19. 95) Muhammad Ayaz, Muhammad Umair Yousuf, Muhammad Asghar (2013). “Exports performance under the role of foreign direct investment in Pakistan: An ARDL Approach”, International Journal of Economic Practices and Theories, Vol.3, No.3, pp.192-202. 96) Farshid Pourshahabi, Ehsan Salimi Soderjani, and Davood Mahmoudinia (2013). “Panel causality relationship among FDI and trade (evidence from 16 advanced Europe countries)”, Iranian Economic Review, Vol.17, No.1, pp.115-133. 97) Ding Chen (2013). “Based on VAR model of China import and export, FDI impact on GDP” Money China, Vol.24. 98) Marcelo Villena (2013). “Estudio de medición del impacto de la inversión extranjera directa en la economía Chilena”, Book, SCL Econometrics, S.A. Economia Aplicada, Regulacion & Estrategia, Santiago, Chile. 15 99) Mika’ilu Abubakar., Saidu Tanko (2013). “Foreign trade, foreign direct investment and economic growth: Cointegration evidence for Nigeria”, Developing Country Studies, Vol.3, No.14, pp.1-10. 100) Faridul Islam and Muhammad Shahbaz and Mohammad Mafizur Rahman (2013). “ Trade openness, financial development energy use and economic growth in Australia: Evidence on long run relation with structural breaks”, MPRA Paper No.52546. 101) Tran Thi Anh Dao, Dinh Thi Thanh Binh (2013). “FDI and growth in Vietnam: A critical survey”, Journal of Economics and Development, Vol.15, No.3, pp.91-116. 102) Pauna, B (2013). “Empirical models of investment impact on the economy: VAR models”, Romanian National Institute for Economic Research, pp.101-124. 103) Muhammad Shahbaz and Mazur Rahman Mohammad (2014). “The dynamics of exports, financial development and economic growth in Pakistan: New Extensions from cointegration and causality analysis”, MPRA Paper No.53225. 104) Taqadus Bashir, Ayesha Mansha, Rizwana Zulfiqar, Rabia Riaz (2014). “Impact of FDI on economic growth: A comparison of south Asian states and China”, European Scientific Journal, Vol.10, No.1, pp.446-469. 105) Jaydeep Mukherjee, Debashis Chakraborty and Tanaya Sinha (2014). “The causal linkage between FDI and current account balance in India: An econometric study in the presence of endogenous structural breaks”. India Studies in Business and Economics, Vol.1, No.1, pp.479-498. 106) Muhammad Shahbaz, Mohammad Mafizur Rahman, (2014). "Exports, financial development and economic growth in Pakistan", International Journal of Development Issues, Vol.13, No.2. 107) Zuzana Szkorupova (2014). “A causal relationship between foreign direct investment, trade and economic growth”, Scientific Papers of the University of Pardubice, Faculty of Economics and Administration, Vol.XXI, No.30, pp.139-149. 108) Halil Altintaş, and Oğuzhan Türker (2014). “The dynamics of export and import functions in Turkey: Cointegration and multivariate Granger causality analysis”, International Journal of Asian Social Science, Vol.4, No.5, pp. 676-689. 109) Anthony Adu-Asare Idun, Anthony Q.Q. Aboagye, (2014). "Bank competition, financial innovations and economic growth in Ghana", African Journal of Economic and Management Studies, Vol.5, No.1, pp.30-51. 110) Ahmed Abdulrahman Khder Aga (2014). "The impact of foreign direct investment on economic growth: A case study of Turkey 1980–2012", International Journal of Economics and Finance; Vol.6, No.7, pp.71-84. 111) Ahmed Mohammed Khater Arabi (2014). “Foreign direct investment, openness and economic growth: Empirical evidence from Sudan (1972-2011)”, Journal of American Science, Vol.10, No.9, pp.30-35. 112) Pritish Kumar Sahu (2014). “The influence of Malaysian FTAs on trade and investment, with special reference to Malaysia-India FTA.”, IUP Journal of Applied Economics, Vol.13, No.2. 113) Murugesan, B (2014). “The causal relationship between FDI and economic growth in India”, Asia Pacific Journal of Marketing & Management Review,Vol.3, No.7, pp.42-47. 114) Fahad Saif Harhara (2014). “Foreign direct investment and technology transfer: The case of the UAE”, PhD thesis, Brunel Business School, Brunel University. 115) Anindita Chakraborty (2014). “Effect of trade openness and foreign direct investment on economic growth: Evidence from development economies of Asia”, Indian Journal of Accounting, Vol. XLVI, No.1, pp.8-18. 116) Moses Joseph Shawa, and Grafoute AmoroYaoshen (2014). “The causal link between foreign direct investment, GDP growth, domestic investment and export for Kenya: The new evidence”, Journal of Economics and Sustainable Development, Vol.5, No.16, pp.107-114. 16 117) Mihaela Simionescu (2014). “The relationship between trade and foreign direct investment in G7 countries a panel data approach”, Journal of Economics and Development Studies,Vol.2, No.2, pp.447-454. 118) Mitze, T (2014). “Measuring regional spillovers in long and short-run models of total factor productivity, trade, and FDI”, International Regional Science Review, Vol.37, No.3, pp.365-388. 119) Ahmed Mohammed Khater Arabi (2014). “The causal link between foreign direct investment, export and economic growth in Sudan, 1970-2012: An application of Granger causality”, University of Bakht Alruda Scientific Journal, No.12, pp.406-425. 120) Edmore Mahembe (2014). “Foreign direct investment inflows and economic growth in SADC countries-A panel data approach”, Master of Commerce, Department: Economics, University of South Africa. 121) Udoh M. Dominic (2014). “The impacts of foreign direct investment (FDI) and oil export on economic growth in Nigeria from 1970 -2011”, Research on Humanities and Social Sciences, Vol.4, No.24, pp.113-123. 122) Sung-Hyun Jung, and Kim Seok (2014). “ASEAN foreign direct investment inflows and other major Nations, economic growth and economic integration-correlation studies”, Korea International Management Conference proceedings. 123) Zuzana Szkorupova (2014). “A causal relationship between foreign direct investment, economic growth and export for Slovakia”, Procedia Economics and Finance, Vol.15, pp.123128. 124) Sang Hyuck Kim, Jae Hoon Yang (2014). “Reexamining determinants of FDI using dynamic panel quantile regression analysis: Evidence of Korea”, Journal of Korea Trade, Vol.18, No.4, pp.29-46. 125) Bhatt, P.R (2014). “Foreign direct investment in Asean countries, 1990-2012”, Revista Galega de Economia/Economic Review of Galicia, Vol.23, No.4, pp.133-144. 126) Abheet Aggarwal, Anurag Sharma, Tathagat Gupta, Md. Enayat Ullah, K. V. Sameer Raja, and Shivam Khandelwal (2014). “Time series analysis for causal relationship between Trade, Foreign Direct Investment and Economic Growth of India”, Working Paper. • Dritsaki C., Vazakides A., Adamopoulos A (2004). "Exports, investments and economic growth: an empirical investigation of the three Baltic countries". Baltic Journal of Economics, Vol. 4, No 2, pp.72–79. (Impact Factor). 127) D. Kenourgios, A. Samitas (2007). “Financial development and economic growth in a transition economy: Evidence for Poland”, The Journal of Financial Decision Making, Vol.3, No.1, pp. 35–48. 128) Eldar Madumarov (2007). “External factors of economic growth in the transition economies of the Baltics and Central Asia”, PhD Thesis, Carl von Ossietzky Universitat Oldenburg, 2007. 129) Chung-Hua Shen and Chang-Ping Lin (2009). “The role of financial development to economic growth – dynamic panel threshold model”, Taipei Economic Inquiry, Vol.45, No.2, pp.143–188. • Anastassiou. T., Dritsaki C (2005). "Tax revenues and economic growth: An empirical investigation for Greece using causality analysis", Journal of Social Sciences, Vol. 1, No. 2, pp. 99–105. (ISI Web of Science). 130) M. Durkaya, S. Ceylan., Maliye Dergisi (2006). “Tax revenues and economic growth”, Haziran, Vol. 150, / Ocak – Kasim, pp.79–89. 131) Dilek Temiz (2008). “The relationship between tax revenues and economic growth in Turkey: The Period of 1960 – 2006”, Working Paper, Cankaya Universitesi. 17 132) Mehmet Mucuk and Volkan Alptekin (2008). “Turkiye’ de vergi ve ekonomik buyume iliskisi: VAR analizi (1975–2006)”, Maliye Dergisi, Sayi155, Temimuz-Aralik, 2008. 133) Ekanayake, E. M., Halkides, Mihalis (2008). “Do remittances and foreign direct investment promote growth? Evidence from developing countries” Journal of International Business and Economics, Vol.8, No.1, pp.201-202. 134) Ekrem. Gul and Baris Kenar (2009). “The relationship between tax revenues and economic growth in EU countries and Turkey: 1960–2008”, Working Paper, Sakarya Universitesi. 135) Harold Ngalawa, Khaled Ahmedyand and Alan Whiteside (2010). “Public health expenditure implications of the Southern African customs union revenue volatility in BLNS countries”, Working Paper, Prepared for HEARD, University of KwaZulu-Natal. 136) Masood Mashkoor, Sohaib Tahya and Syed Ammad Ali (2010). “Tax revenue and economic growth: An empirical analysis for Pakistan”, World Applied Sciences Journal, Vol. 10, No.11, pp.1283–1289. 137) Damian Nwosu (2010). “Tax structure and economic growth in Nigeria: Master’s Thesis, University of Ibadan. 138) Mercan, Mehmet, Gocer, İsmet, Bulut, Şahin and Dam, M. Metin (2010) The relationship between economic growth and tax revenue: Bounds testing. in: 2nd International Symposium on Sustainable Development, June 8-9 2010, Sarajevo. 139) Taufik Abdul Hakim, and Imbarine Bujang (2011). “The impact and consequences of tax revenues’ components on economic indicators: Evidence from panel group data”, International Research Journal of Finance and Economics, Vol.63, pp. 82– 95. 140) Mia, M.S., Begum, R.A., Er, A.-C., Abidin, R.D.Z.R.Z., and Pereira, J.J. (2011). “Malaria and climate change: discussion on economic impacts”, American Journal of Environmental Sciences, Vol.7, No.1, pp.73-82. 141) Mohebi, M. and Rahim, K.A. (2012). “Tourism equilibrium price trends”, American Journal of Applied Sciences, Vol.9, No.4, pp.472-477. 142) Taufik Abdul Hakim, and Imbarine Bujang (2012). “The Impact and Consequences of tax revenues’ components on economic indicators: Evidence from panel group data”, Book, Chapter 5, International Trade from Economic and Policy Perspective, http://dx.doi.org/ 10.5772/48415. 143) Yeşim Helhel, and Yakup Demir (2012). “The relationship between tax revenue and economic growth in Turkey: The period of 1975-2011”, 3rd International Symposium on Sustainable Development, May 31 - June 01 2012, Sarajevo. 144) Richard Atta Twumasi (2012). “The impact of fiscal policy on economic growth in Ghana”, MSc Thesis, Department of Economics, Kwame Nkrumah University. 145) Muhammad Masood Azeem, Madhia Saqi , Khal id Mushtaq and Abdus Samie (2013). “An empirical analysis of tax rate and economic growth linkages of Pakistan”, Pakistan Journal of Life and Social Sciences, Vol.11, No.1, pp.14-18. 146) İsmail ÇELİK, Hakan TUNÇ, and Murat KAYA (2013). “The role of tax discount in local economic growth and a case study for Burdur”, Mehmet Akif Ersoy Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, Yıl: 5 Sayı: 8 2013 Bahar. 147) Cengiz Arikan, and Yeliz Yalcinz (2013). “Determining the exogeneity of tax components with respect to GDP”, Internation Journal of Academic Research in Accounding, Finance and Management Science, Vol.3, No.3, pp.242-255. 148) Luo Yifan (2013). “The linkage between the taxes and GDP in China”, MSc Thesis, Department of Finance, Saint Mary’s University. 149) Harold P. E. Ngalawa (2014). “Anatomy of the Southern African customs union: Structure and revenue volatility”, International Business & Economics Research Journal, Vol.13, No.1, pp.145-156. 18 150) Hammed Adetola Adefeso, Timothy Olaniyi Tawose (2014). “Tax policy reforms and economic growth in Nigeria” Acta Universitatis Danubius. Œconomica, Vol.10, No.3, pp.1-9. 151) Vykintas Glodenis (2014). “Effect of type of political regime on taxation rates”, Bachelor Thesis: Economics and Politics. Vilnius, ISM University of Management and Economics. 152) Saima Saqib, Tariq Ali, Muhammad Faraz Riaz, Sofia Anwar, and Amir Aslam (2014). “Taxation Effects on Economic Activity in Pakistan”, Journal of Finance and Economics, Vol. 2, No. 6, p.215-219. • Dritsaki, C., Dritsaki, M. (2005). "The causal relationship between stock, credit market and economic development: An empirical evidence for Greece", Economic Change and Restructuring, Special Issue, pp. 113–127. Springer. (Impact Factor). 153) Alper Ozun and Atilla Cifter (2007). “Industrial production as a credit driver in banking sector: An empirical study with wavelets”, Banks and Bank System, Vol.2, No.2, pp.69–80. 154) Koutromanidis Th, Zafeiriou E, and Sp. Sofios (2008). “Market and economic development: An empirical evidence for transition economies; The case of Bulgaria”, Working Paper. 155) Ρήγας Ν, Μπλάνας Γ, και Γ. Ρήγας (2008). “Η ισχύς του νόµου του Okun: Μια εµπειρική έρευνα για τις χώρες της ζώνης του Ευρώ”, Working Paper. 156) Joydeep Biswas (2008). “Does finance lead to economic growth? An empirical assessment of 12 Asian economies”, The Journal of Applied Economic Research, Vol.2, No.3, pp.229–246. 157) Takashi Shibuya, Tatsuya Harada, and Yasuo Kuniyoshi (2009). “Causality quantification and its applications: Structuring and modeling of multivariate time series”, Proceedings of the ACM SIGKDD, International Conference on Knowledge Discovery and Data Mining, pp.787–795. 158) Umar Bida Ndako (2009). “Stock markets, banks and economic growth: A time-series evidence from South Africa”, Working Paper, University of Leicester. 159) Fenny Pratiwi (2009). “Analisis kausalitas antara kredit investasi yang di salurkan bank umum dengan pertumbuhan ekonomi di Sumatera Utara”, MSc Thesis, Fakultas Economi, Universitas Sumatera Utara, Indonesia. 160) Mohammad Jumil (2010). “Impact of financial markets development and stock market volatility on economic growth: A dynamic panel data analysis”, Working Paper, Department of Economic, University of Vienna. 161) Umar Bida Ndako (2010). “Financial development, economic growth and stock market volatility: Evidence from Nigeria and South Africa” Thesis submitted for the degree of Doctor of Philosophy at the University of Leicester. 162) Rita Maria Ribeiro Bastiao (2010). “Stock markets and their relationship with expectations” Thesis submitted for the degree of Doctor of Philosophy,Universidade de Aveiro, Departamento de Economia, Gestão e Engenharia Industrial. 163) Adeniyi O. Adenuga (2010). “Stock market development indicators and economic growth in Nigeria (1990-2009): Empirical investigations”, Central Bank of Nigeria, Economic and Financial Review,, Vol.48, No.1, pp.33-70. 164) Malay Kanti Roy, Hirak Ray and Joydeep Biswas (2010). “Finance and growth: Theory and international evidence”, IIMS Journal of Management Science, Vol.1, No.2, pp. 106-128. 165) Algis Zvirblis (2011). “Principles and models of forecasting of the essential indicators of stock mutual funds” Issues of Business and Law, Vol.3, pp.62-72. 166) Mansor H. Ibrahim (2011). “Stock market development and macroeconomic performance in Thailand”, Inzinerine Ekonomika-Engineering Economics, Vol.22, No.3, pp. 230-240. 19 167) Eman F. Abu-Mhareb, and Nedal A. Al-Fayoumi (2011). “Stock market, banks and economic growth: Empirical evidence from Jordan” Working Paper. 168) Izolda Joksiene, and Algis Zvirblis (2011). “Principles of evaluation of the impact of economic and social factors on investment funds” Issues of Business and Law, Vol.6, No.2, pp. 335-348. 169) Rigas.J, Theodosiou.G, Rigas N, and Blanas.G (2011). “The validity of the Okun’s law: An empirical investigation for the Greek economy” Journal of European Economy, Vol.10, No.1, pp. 16-28. 170) Rudra. P. Pradhan (2011). “Financial development, growth and stock market development: The trilateral analysis in India”, Journal of Quantitative Economics, Vol.9, No.1, pp.134-145. 171) Ogbonnaya Ijeoma, Ch. Paramaiah, and Ramaele Moshoeshoe (2011). “Financial development, savings and economic growth in Lesotho: Evidence from trivariate causality test” International Journal of Economics and Business Studies, Vol.1, No.2, pp. 41-55. 172) Mohammad Jumil (2011). “Essays on financial markets volatility”, Doctor of Philosophy, Department of Economic, University of Vienna. 173) Gurgul, Henryk and Lukasz , Lach (2012). “Financial development and economic growth in Poland in transition: causality analysis”, Finance a Uver - Czech Journal of Economics and Finance, Vol.62, No.4, pp.347-367. 174) Afaque. Memon, Niaz. Ahmed. Bhutto, Ranjeeta. Sadhwani, Hazoor Bux, and Falahuddin Butt (2012). «Financial development and economic growth in SAARC Countries», Working Paper. 175) Eme A. Dada (2012). “Inflation targeting monetary policy and output in Nigeria”, Working Paper. 176) Marcin Kędzior (2012). “The development of capital markets and the banking industry vs the values of selected macroeconomic indicators. The results of empirical research’, Polskie Towarzystwo Ekonomizne, No.12, pp.107-117, Uniwersytet Ekonomiczny w Krakowie. 177) Sultan Alabdulkarim (2012). “An evaluation of investor protection in secondary securities markets”, A thesis submitted for the degree of Doctor of Philosophy, Newcastle Law School, Newcastle University. 178) Siddhartha Sarkar (2012). “International Journal of Economics and Business Studies” Book, Brown Walker Press, USA. 179) Ade. O. Adenuga (2012). “Stock market development and economic growth in Nigeria: A vector error-correction approach” Journal of Monetary and Economic Integration, Vol.11, No.1, pp.95-124. 180) Cindy Alvarado (2012). “Greece and the euro zone” Bauer Global Studies Undergraduate Business Journal, Vol.1, Spring 2012. 181) Pradhan, R.P. and Bagchi, T.P. (2013). “Effect of transportation infrastructure on economic growth in India: The VECM approach”, Research in Transportation Economics, Vol.38, No.1, pp.139-148. 182) H.A. Adefeso, H.A, T. Egbetunde, and I. Alley. (2013). “Stock market development and growth in Nigeria: A causal analysis’, Arabian Journal of Business and Management Review (OMAN Chapter), Vol.2, No.6, pp.78-94. 183) Azeem, M.M. , Saqi, M., Mushtaq, K., and Samie. A (2013). “An empirical analysis of tax rate and economic growth linkages of Pakistan”. Pakistan Journal of Life and Social Sciences, Vol.11, No.1, pp.14-18. 184) Abdur Rehman, Ahmed Raza Cheema (2013). “An exploration of the finance-growth nexus: Long run and causality evidences from selected countries of SAARC region” Journal of Economics and Sustainable Development, Vol.4, No.11, pp.18-31. 20 185) Nicholas M. Odhiambo (2013). “Financial systems and economic growth in South Africa: A dynamic complementarity test”. International Review of Applied Economics, http://dx.doi.org/10.1080/02692171.2013.828681. 186) Khadijat Adenola Yahaya, Oyebola Fatima Etudaiye-Muhtar, Abdulrasheed Abulraheem, and Sulu Babaita Isiaka (2013). “Stock market development and economic growth in Nigeria (1980-2009).” Babcock Journal of Management and Social Sciences, Vol. 11, No.1, pp.10-32. 187) Edame, Greg Ekpung Okoro, Uchenna (2013). “The impact of capital market and economic growth in Nigeria”, Public Policy and Administration Research, Vol.3, No.9, pp.715. 188) Ali Polat and Muhammad Shahbaz and Ijaz Ur Rehman and Saqlain Latif Satti (2013). “Revisiting linkages between financial development, trade openness and economyic growth in South Africa: Fresh evidence from combined cointegration test”, MPRA Paper No.51724. 189) Edame, Greg E and Okoro, Uchenna (2013). “An analysis of the Nigerian capital market performance and economic growth in Nigeria”, Journal of Poverty, Investment and Development, Vol.1, pp.57-64. 190) Meshaal J. Alshammary (2014). “An Investigation of the Relationship between Capital Market Development and Economic Growth: The Case of Saudi Arabia”, A thesis submitted for the degree of Doctor of Business Administration, School of Accounting and Finance, College of Business, Victoria University, Melbourne, Australia. 191) Eleni Zafeiriou, Christos Karelakis, Chrisovalantis Malesios, and Theodoros Koutroumanidis (2014). “Market and economic development in Bulgaria” Economic Crisis in Europe and the Balkans Contributions to Economics, pp.211-226. 192) Odhiambo,N.M (2014). “Financial systems and economic growth in South Africa: A dynamic complementarity test”, International Review of Applied Economics Vol.28, No.1, pp. 83-101. 193) Rudra P Pradhan, Mak Arvin, Neville R Norman, John H Hall, (2014). “The dynamics of banking sector and stock market maturity and the performance of Asian economies: time series evidence”, Journal of Economic and Administrative Sciences, Vol.30, No.1. 194) Meshel Chibvongodze, Farai Kwenda, and Mabutho Sibanda (2014). “The relationship between banks, stock market and economic growth: Evidence from South Africa”, Acta Universitatis Danubius. Œconomica, Vol.10, No.2, pp.229-240. 195) Meshaal J. Alshammary (2014). “Financial development and economic growth in developing countries: Evidence from Saudi Arabia”, Corporate Ownership & Control, Vol.11, No.2, pp.718-742. 196) Meshaal J. Alshammary (2014). “Stock market development and economic growth in developing countries: Evidence from Saudi Arabia”, Corporate Ownership & Control, Vol.11, No.3, pp.193-216. 197) Ajagbawa O. Henry (2014). “Entrepreneurship, financial, and economic development: A literary review”. IOSR Journal Of Humanities And Social Science, Vol.19, No.6, pp.85-118. 198) Rudra P. Pradhan, Mak B. Arvin, John H. Hall, and Sahar Bahmani (2014). “Causal nexus between economic growth, banking sector development, stock market development, and other macroeconomic variables: The case of ASEAN countries”, Review of Financial Economics. 199) Ibadin Ayemere Lawrence, Mathew Osedebamhen Moni, and Daniel Ehi Eikhomun (2014). “Development of Financial System and Economic Growth: An Empirical Evidence from Nigeria”, European Journal of Business and Management, Vol.6, No.30, pp.137-152. 200) Suna Korkmaz (2015). “Impact of bank credits on economic growth and inflation”, Journal of Applied Finance & Banking, Vol.5, No.1, pp.51-63. 21 201) N.P. Ravindra Deyshappriya (2015). “Stock market-growth nexuses: An application of dynamic panel data analysis for developed and emerging markets”, Proceedings of the Research Symposium of Uva Wellassa University, pp.8-11. • Dritsaki C., Adamopoulos A. (2005). "A causal relationship and macroeconomic activity: Empirical results from European Union", American Journal of Applied Sciences, Vol. 2, No 2, pp. 504–507. (Scopus, ISI Web of Science). 202) Donatas Pilinkus (2009). “Stock market and macroeconomic variables: Evidences from Lithuania”, Economics and Management, Vol.14, pp. 884–891. 203) Donatas Pilinkus and Vytautas Bouguslauskas (2009). “The short-run relationship between stock market prices and macroeconomic variables in Lithuania: An application of the impulse response function”, Engineering Economics, Vol.5, No.65, pp.26–34. 204) Donatas Pilinkus (2010). “Macroeconomic indicators and their impact on stock market performance in the short and long run: The case of the Baltic States” Techological and Economic Development of Economy, Vol.16, No.2, pp.291–304. 205) Singh, S.K., Sabharwal, S., Gupta, J.P. (2010). “An event-based methodology to generate class diagrams and its empirical evaluation”, Journal of Computer Science, Vol.6, No. 11, pp.1301–1325. 206) Pisit Leeahtam, Songsak Sriboonchitta, Jittaporn Sriboonjit, Prasert Chaitip, Chukiat Chaiboonsri, and Arreyah Chatip (2011). “A panel cointegration analysis: An application to South East Asia macroeconomic recessions” International Journal Finance and Accounting, Vol.1, No.1, pp.85-104. 207) Algis Zvirblis (2011). “Principles and models of forecasting of the essential indicators of stock mutual funds” Issues of Business and Law, Vol.3, pp.62-72. 208) Fair Bilques, Tahir Mukhtaz, and Sidra Sahail (2012). “Dynamic causal interaction of money, prices, interest rate and output in Pakistan” Journal of Economic Cooperation and Development, Vol.33, No.3, pp.37-64. 209) Muhammad Tariq (2012). “Exchange rate fluctuations and its impact on output growth, price level and foreign exchange reserves in Pakistan (1973-2008)”. Ph.D Scholar, Department of Economics, University of Peshawar Khyber Pakhtunkwa Pakistan. 210) Singh Shivangi and Jotwani Naresh (2012). “The effect of macroeconomic variables on stock prices: A conceptual framework of the arbitrage pricing theory” Journal of Management and Research,Vol.5, pp.1-16. 211) Nina Ivanovna Larionova, Tatiana Valerievna Yalyalieva and Dmitry Leonidovich Napolskikh (2014). “Ensuring efficiency control of institutional environment of the cluster” American Journal of Applied Sciences, Vol.11, No.9, pp.1594-1597. 212) Nina Ivanovna Larionova, Tatiana Valerievna Yalyalieva, Dmitry Leonidovich Napolskikh and Victor Evgenevich Shebashev (2014). “Governmental control of the formation efficiency of educational clusters at the regional level”, American Journal of Applied Sciences, Vol.11, No.10, pp.1761-1765. • Dritsaki C., Gialetaki K. (2005). "Taxes and economic indicators: An empirical investigation for Greece", Spoudai, Vol.55, No.3, pp.34–54. (EconLit). 213) Taufik Abd Hakim, Imbarine Bujang (2013). “Do taxes generate more on economic development? Evidence from income’s group and OECD countries” International Journal of Business and Economic Development, Vol.1, No.1, pp.1-12. 22 • ∆ριτσάκη Χ., ∆ριτσάκη Μ., Αδαµόπουλος Α. (2006). "Πληθωρισµός και παραγωγικότητα: Μια εµπειρική έρευνα για την Ελλάδα µε την ανάλυση της αιτιότητας", Επιστηµονική Επετηρίδα Παν/µίου Μακεδονίας, Τιµητικός Τόµος Μαρίας ∆ελιβάνη, σελ. 119–132. 214) Tipri Rose Kartika, Noer Azam Achsani, Adler Haymans Manurung, and Nunung Nuryartono (2012). “Transmission of stock return volatility in Indonesis (IHSG) towards USA (DJIA), HongKong (HSII), and Singapore (STI)”Finance and Banking Journal, Vol.14 No.1, pp.16-29. • Dritsaki, C. and Dritsakis N. (2009). “Okun’s coefficient for four Mediterranean member countries of EU: An empirical study”, International Journal of Business and Management, Vol.4, No.5, pp.18–26. (Google Scholar). 215) Petre Caraiani (2010). “Bayesian linear estimation of Okun coefficient for Romania: sensitivity to priors distributions”, The Romanian Economic Journal, Vol.13, No.38, pp.53–65 216) Thomas Boulton (2010). “Test of Okuns law for the 10 Eastern European countries”, Working Paper, London Metropolitan Business School. 217) Chletsos, M. (2011). “Examination of Okum’s law in Greece: Preliminary results”, Statistical Review, Vol.4, No.1, pp.69 – 78. 218) Κιούρκος Σ. (2011). “Ο νόµος του Okun, θεωρητική θεµελίωση, διεθνής εµπειρία και η εφαρµογή του στην περίπτωση της Ελλάδος”, Master’s Thesis, University of Patras. 219) Giovanni. Busetta, and Dario. Corso, (2012). “Labor productivity and Okun’s law:An empirical application to Italian regional panel data”, Rivista Italiana Degli Economisti, Vol.17, No.2, pp.279-298. 220) Hany Elshamy (2013). “The relationship between unemployment and output in Egypt”, Procedia - Social and Behavioral Sciences, Vol.81, pp.22-28. 221) Abiodun S. Bankole, Basiru Oyeniran Fatai (2013). “Empirical test of Okun’s law in Nigeria”, International Journal of Economic Practices and Theories, Vol.3, No.3, pp.227-231. 222) Syh Han Ang, and Nanthakumar Loganathan (2013). “Interactions between economic growth and unemployment condition in Asian region”, International Journal of Economics and Empirical Research, Vol.1, No.12, pp.135-146. 223) Ntebogang Moroke, Gontse Patricia Leballo, and David Mbathi Mello (2014). “An empirical robustness of Okun’s law in South Africa: An error correction modelling approach”, Mediterranean Journal of Social Sciences, Vol.5, No.23, pp.435-443. • Dritsaki, C. (2009). “The life cycle of agro tourist enterprises”, Tourismos: An International Multidisciplinary Journal of Tourism, Vol. 4, No. 2, pp. 149-154. (Scopus). 224) Maria Alebaki, and Olga Iakovidou (2011). “Market segmentation in wine tourism: A comparison of approaches” Tourismos: An International Multidisciplinary Journal of Tourism, Vol.6, No.1, pp.123-140. 225) Azizan Marzuki, Abdul Aziz Hussin, Badaruddin Mohamed, Abdul Ghapar Othman, and Ahmad Puad Mat Som (2011). “Assessment of nature-based tourism in South Kelantan, Malaysia” Tourismos: An International Multidisciplinary Journal of Tourism, Vol.6, No.1, pp. 281-295. 226) Maria Teresa Gomes da Costa, and Luísa Margarida Cagica Carvalho (2011). “The sustainability of tourism supply chain: A case study research” Tourismos: An International Multidisciplinary Journal of Tourism, Vol.6, No.2, pp.393-404. 227) Bitsani, E. And Kavoura, A (2012). “Accessibility versus advertising for mountain tourism: The case of nafpaktia”, Tourismos: An International Multidisciplinary Journal of Tourism, Vol.7, No.2, pp.217-236. 23 228) Jalan P.B. Sudirman (2014). “Community based agro-tourism as an innovative integrated farming system development model towards sustainable agriculture and tourism in Bali”, J. ISSAAS Vol.20, No.1, pp.29-40. 229) Mohammadzadeh Larijani (2014). “Assessing the consequences of tourism on the environment second homes in rural areas: Eastern part of bungalow villages the city of Babylon”, Journal of geography and regional development, Vol.11, No.20, pp.187-192. • Dritsaki, C. (2009). “Real wages as determinant of labour productivity in tourism”, Tourism and Hospitality Management, Vol.15, No.1, pp.101–105. (EconLit). 230) Marlena Bednarska, and Grzegorz Golembski (2012). “Cechy rynku pracy w turystyce jako bariery rozwoju gospodarki turystycznei, Gospodarki turystycznej, Zeszyty naukowe UE e-wydawnictwo, eu. • Dritsaki C., Dritsaki M. (2010). "Government expenditure and national income: causality tests for twelve new members of E.E", Romanian Economic Journal, Vol.13, No.38, pp.67 – 89. (Impact Factor). 231) Honoré Ahishakiye (2011). “Hétérogénéité de la causalité entre dépenses publiques et croissance économique dans les pays de l’EAC”, Revue de l’Institut de Développement Economique (RIDEC), pp.1-34. 232) Ana-Maria ŢEPUŞ (2012) “The Wagner hypothesis from the perspective of the Romanian Economy”, Theoretical and Applied Economics, Vol.14, No.8, pp.135-152. 233) Wildan Shohabi (2014). “Kausalitas pengeluaran pemerintah, inflasi, dan pendapatan nasional di Indonesia”, Jurnal Ilmiah Mahasiswa, Fakultas Ekonomi dan Bisnis, Universitas Brawijaya, Malang. 234) Gaston_ls Lonzo Lubu and Desir_e Avom (2014). “Nonlinear effects of spending on economic growth in Dr Congo” MPRA Paper No.60716. • Dritsaki, C. (2011). “The random walk hypothesis and correlation in the visegrad countries emerging stock markets", Romanian Economic Journal, Vol.14, No.40, pp.25–56. (Impact Factor). 235) Victor Dragola and Elena Valentina Tilica (2013). “Market efficiency of the post communist East European stock markets”, Central European Journal of Operations Research, July 2013. 236) Kang Chun kit, Koh Wei Hin, Lau Hoi Yan, Ng Chun Yuen, and Tan Ken Long (2014). “ The nexus between stock market performance and gold price: The case of hang seng index”, Working Paper. • Dritsaki C., Dritsaki. M. (2012). “Money demand stability: Some evidence from Turkey”, The IUP Journal of Bank Management, Vol. XI, No. 4, pp. 7-28. (Impact Factor). 237) Forget Mingiri Kapingura (2014). “The stability of the money demand function in South Africa: A -VAR based approach”, International Business & Economics Research Journal, Vol.13, No.6, pp.1471-1480. • Dritsaki. M., Dritsaki, C. (2013). “The bound testing approach for cointegration and causality between financial development, trade openness and economic growth in Bulgaria”, The IUP Journal of Applied Economics, Vol.12, No.1, pp.1-18. (Impact Factor). 238) Lucas Nigel Phua (2014). “The relationship of government expenditure, population, exchange rate, trade openness and economic growth in Malaysia”, Master of Business Administration, University Tunku Abdul Rahman. 24 239) Serenis, D and N. Tsounis (2015). “The effects of exchange rate volatility on sectoral exports evidence from Sweden, UK, and Germany”, International Journal Computational Economics and Econometrics, Vol.5, No.1, pp.71-107. • Dritsaki C., (2013). “Causal nexus between economic growth, export and government debt: The case of Greece” ICOAE, Istanbul, Turkey, 28-30 June 2013, Procedia Economics and Finance, Vol.5, pp.251-259. (Elsevier). 240) Leon Podkaminer (2014). “Does trade drive global output growth?”, journal Bank i Kredyt Vol.45, No.4, pp.311–330. 241) Gisele Mah, Itumeleng P. Mongale, Janine Mukuddem-Petersen and Mark A. Petersen (2014). “Government debt in Greece: An empirical analysis”, Journal of Governance and Regulation, Vol.3, No.2, pp.7-17. 242) S. Korkmaz (2014). “Causality relationship between export and economic growth in Turkish economy”, Business and Economics Research Journal, Vol.5, No.4 pp.119-128. 243) M. Hamulczuk, J. Kulawik, W. Łopaciuk, R. Mroczek, I. Szczepaniak, B. Wieliczko (2014). “Eksport rolno-spożywczy a budżet państwa i dług publiczny”, Zagadnienia ekonomiki rolnej, No.4(341), pp.7-30. • Dritsaki C., Dritsaki M. (2013). "Hysteresis in unemployment: an empirical research for three member states of the European Union”, Theoretical and Applied Economics, Vol.XX, No.4(581), pp.35-46. (Impact Factor). 244) Scott Sutherland (2014). “Fiscal austerity and equilibrium unemployment”,Department of Economics, Lund University, Sweden, Working Paper. 245) Furuoka, Fumitaka (2014). “Unemployment hysteresis in central Asia”, MPRA Paper No.60323, pp.1-18. • Dritsaki C., Dritsaki M. (2014). “Causal relationship between energy consumption, economic growth and CO2 emissions: A dynamic panel data approach”, International Journal of Energy Economics and Policy, Vol.4, No.2, pp.125-136. (Scopus, Impact Factor). 246) Cemil Serhat Akin (2014). “The impact of foreign trade, energy consumption and income on CO2 emissions”, International Journal of Energy Economics and Policy, Vol.4, No.3, pp.465-475. 247) Bilal Mehmood, Syed Hassan Raza, Mahwish Rana, Huma Sohaib, and Muhammad Azhar Khan (2014). “Triangular relationship between energy consumption, price index and national income in Asian countries: A pooled mean group approach in presence of structural breaks”, International Journal of Energy Economics and Policy, Vol.4, No.4, pp.610-620. 248) Profillidis, V., Botzoris, G, and A. T. Galanis (2014). “Environmental effects and externalities from the transport sector and sustainable transportation planning – A review”, International Journal of Energy Economics and Policy, Vol.4, No.4, pp.647-661. 249) Nuno Carlos Leitão (2015). “Energy consumption and foreign direct investment: A panel data analysis for Portugal”, International Journal of Energy Economics and Policy, Vol.5, No.1, pp.138-147. 250) Faris Nasif AL-Shubiri (2015). “The Impact of Economic and Financial Variables on Cash Conversion Cycle of Energy, Oil and Gas Sectors Listed in Muscat Security Market”, International Journal of Energy Economics and Policy, Vol.5, No.1, pp.174-181. 25 5. REVIEWER (JOURNALS – CONFERENCES) 1. 2. 3. 4. 5. 6. 7. 8. 9. Annals of Tourism Research (Impact Factor). African Journal of Economic and Management Studies (Impact Factor). Tourism Economics (Impact Factor). Southern Economic Journal (Impact Factor). Review of Economics & Finance (American Economic Association). Net Journal of Business Management. International Journal of Computational Economics and Econometrics (EconLit). International Journal of Economic Sciences and Applied Research (Impact Factor). Global Business and Economics Review (Scopus). DISTINCTIONS - Excellence and merit awards for outstanding performance in every secondary school class, 1992-1998. FOREIGN LANGUAGES – COMPUTER LITERACY - Holder of the Certificate of Proficiency in English by the University of Michigan / holder of IELTS - Holder of an ELT (English Language Teaching) licence to practise - Italian (elementary) - Holder of a the Microsoft Office 2000 certificate of computer use - Knowledge of software for econometric analysis (Microfit, E-Views, SPSS) ACTIVITIES - Member of the Economic Chamber of Greece - Member of the Society of Economists in Thessalonica - Member of the Scientific Committee in International Conference on Applied Economics (ICOAE). February 2015 26