2014 Income Tax Newsletter for Graduate Students

advertisement

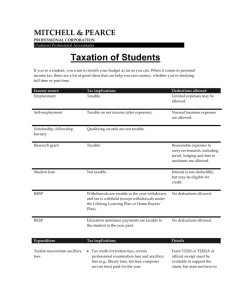

2014 Income Tax Newsletter for Graduate Students Michael A. King, CPA, CA (519) 679-8391 mike@michaelkingca.ca www.michaelkingca.ca INTRODUCTION: This newsletter is designed to provide assistance in completing 2014 income tax returns for graduate students. Information on certain types of income, the taxation of these income sources, and some other helpful hints are provided. The newsletter analyses three common types of income of graduate students (employment, scholarship and research grants) and their tax implications under different situations. Please note that the marginal tax rates and provincial tax credits are Ontario based. This newsletter is intended to be a helpful resource in completing the income tax return and not a complete information package. Although every reasonable effort has been made to ensure the information contained in this newsletter is accurate and current, no individual or organization involved in either the publication or distribution of this publication accepts liability for its contents or for any consequences arising from its use. Given the complexity of tax law and the summary nature of this publication, readers are advised to seek professional advice to ensure that suggested tax strategies within this overview publication are appropriate to their individual circumstances. INCOME SUBJECT TO TAX: Employment Income: The full amount reported in box 14 of the T4 slip received from your employer is taxable. You have to report any income earned even if a T4 is not provided. This includes any tips or gratuities you receive during the year. Scholarship Income: This includes amounts received as a scholarship, fellowship, bursary and a prize received for achievement in a field of endeavour ordinarily carried on by the recipient (“achievement prize”). The full amount is NON-TAXABLE if you are eligible to claim the full-time education amount! If you can claim the part-time education amount, you will be able to deduct the amount of tuition paid and $500 from the amount received. If you do not qualify for the education amount, you are still able to deduct the $500 amount. At no time can you deduct more than the award amount. Research Grant: Include in income the net amount of research grants received after deducting allowable expenses related to the research grant. The allowable expenses you may deduct cannot exceed the total research grants received. Therefore, you cannot apply a loss from your research grant activity to reduce income from other sources. Expenses you may claim (if you have not been reimbursed) include: 1) Travelling expenses, including meals and lodging while away from home in the course of your research work. You may not claim the travelling expenses of your spouse or children; 2) Expenses for travel between your permanent residence and a place where you temporarily reside while engaged in the research work. As noted above you may claim meals and lodging while travelling away from home in the course of your research work. However, Canada Revenue Agency interprets that if you are temporarily residing in a place, amounts paid for meals and lodging in that place are considered to be personal and living expenses rather than travel expenses and therefore are not allowable expenses for deduction against research grants received. If you are moving from a place where you previously ordinarily resided to a new place where you ordinarily reside also consider the applicability of the moving expense deduction. We outline the moving expense deduction later in this newsletter. 3) Cost of supplies; 4) Cost of equipment purchased for purposes of carrying on the research work. Based upon a Canada Revenue Agency Technical Interpretation, it is our understanding that you are allowed to deduct the full amount of a capital expenditure incurred in the year the research grant is received; 5) Fees paid to assistants. For an example of a research grant statement refer to Appendix A that outlines a sample income and expense statement. The net research grant is included in the calculation of “earned income” for RRSP purposes and, as such, creates RRSP deduction room for you. The calculation of your RRSP deduction room is discussed more fully below. The payor of a research grant, scholarship, fellowship, bursary or “Achievement prize” is required to report the amount paid to you on a T4A slip. Tax does not have to be withheld at source from these amounts. A net research grant is not subject to employment insurance (EI) premiums and as such there is no entitlement to collect EI in respect of the research grant activity. However, a student in full time attendance at university is not eligible to collect EI anyway. The net research grant is also not pensionable earnings for the Canada Pension Plan. Therefore, no CPP premiums are deducted from the research grant received. REGISTERED RETIREMENT SAVINGS PLAN (RRSP) Your RRSP contribution room is calculated based on 18% of your prior year “earned income” to a maximum limit ($24,270 for the 2014 year). The RRSP contribution room calculated is reduced by a pension adjustment (PA) and a past service pension adjustment (PSPA) and is increased by a pension adjustment reversal (PAR). The pension adjustment reduces your RRSP contribution room for pension entitlements vested to you under a registered pension plan. Since 1991, if you do not fully utilize your RRSP contribution room in a year, the unused contribution room is available for carry forward to future years indefinitely. You would have received an assessment notice after filing your 2013 return, which states how much you can contribute to your RRSP. If you have misplaced this notice, then you can still find out your contribution limit by calling 1-800-267-6999 (make sure you have your social insurance number and what you reported on line 150 of your 2013 income tax return). You have 60 days after December 31 to contribute to your RRSP and still be able to deduct the contribution in the previous year. The RRSP deduction is significant as it is one of the few tax deferral measures still available and encourages savings for retirement. The major advantages to RRSP’s are as follows: 1) Funds contributed earn income on a tax-deferred basis until withdrawn. Therefore, taxes which you would pay on investment income (i.e. interest, dividends and capital gains) earned outside an RRSP are deferred when earned within an RRSP. This allows you to earn additional income on the funds retained in the RRSP. 2) The ability to carryforward unused RRSP contribution room to future years, provides flexibility with respect to the timing of your RRSP contribution and the timing of claiming an RRSP deduction in your tax return. For example, you may wish to apply your cash flow towards repayment of debt in years where your income is low and make contributions to your RRSP (based on your carried forward unused RRSP contribution room) in later higher income years. A tax planning strategy to be considered is to claim your RRSP deduction to reduce income which is subject to high graduated rates of tax. The marginal rate of tax on income earned up to $40,120 is approximately 20.05%. The marginal tax rate increases significantly on income over $44,701 to approximately 31.15% and rising to a top marginal tax rate of approximately 46.41% once income rises to $138.586. As such there is a significant tax saving opportunity where your RRSP contribution is applied as a deduction in your higher income years. Of course, if your cash flow permits (after paying debts etc) it is beneficial to make your RRSP contribution as early as possible. The RRSP contribution can be invested in the plan (earning tax deferred income) and you can defer claiming your RRSP deduction until a high income year. 3) You may over contribute up to $2,000 to your RRSP without being subject to interest or penalties in respect of the over contributed amount. A tax deduction is not available in respect of the $2,000 over contribution amount. However, the additional $2,000 invested in the plan is able to earn income on a tax deferred basis. An important consideration in respect of this tax planning strategy is that you must be able to eliminate or “draw down” the over contribution against RRSP contribution room created in a future year. Otherwise, the RRSP over contribution will be taxable when ultimately withdrawn from the plan without having received an RRSP deduction in respect of the amount. 4) Under the “Home Buyer’s Plan” up to $25,000 can be “borrowed” from your RRSP towards the purchase of a home in Canada. The withdrawal from the RRSP is not subject to income tax provided you use the correct Canada Revenue Agency form (Form T1036) and satisfy the stipulations of the Home Buyer’s Plan. The money borrowed from your RRSP must be repaid to an RRSP in annual instalments over a 15 year period (commencing with the second year following the year of withdrawal). 5) You may be able to withdraw up to $10,000 per year from an RRSP, without the withdrawal being subject to tax, provided you or your spouse are enrolled in fulltime training or higher education for at least 3 months during the year. The total withdrawal is capped at $20,000 over a 4 year period. This program was introduced in the 1998 Federal Budget to assist individuals with financing life long learning. RRSP withdrawals under this plan are repayable to the individual’s RRSP in equal instalments over a 10 year period. There are several stipulations to be satisfied in respect of this withdrawal from your RRSP and you should review the requirements of the program prior to making an RRSP withdrawal. As noted above, RRSP contribution room is based upon 18% of “earned income”. There are several components to the calculation of earned income for RRSP purposes. With respect to the three sources of income discussed previously (employment income, scholarship income and research grants) we have noted below whether the income source is included in earned income for RRSP purposes. Employment Income: The full amount reported is considered earned income for RRSP purposes. Scholarship Income: Does not qualify as earned income for RRSP purposes. Research Grant: The net research grant (amount reported after deducting allowable expenses) is included in earned income for RRSP purposes. MOVING EXPENSES The Income Tax Act allows a deduction for eligible moving expenses where an individual changes residences because of starting to carry on a business, to be employed at a new work location or to begin full-time attendance at an educational institution. In order to deduct moving expenses you must move at least 40 kilometers closer than your former residence to the educational institution or the new work location. The maximum amount allowed to be claimed as moving expenses may not exceed income earned from employment, business, scholarships and net research grants earned at the new location. However, the unused amount of moving expenses can be carried forward and deducted against such income earned at the new location in the year following the year of the move. In order to claim moving expenses a completed Form T1-M (available from Canada Revenue Agency), must be submitted with your tax return for the year of the move. Where the eligible moving expenses are incurred in respect of a move to commence carrying on a business or to be employed at a new work location, you must move from a residence in Canada to a new residence in Canada. However, the requirement for the move to be within Canada does not apply where an individual is absent from Canada but is still considered a resident of Canada for income tax purposes. In this case, an individual could move to a location outside of Canada to carry on business or to be employed outside of Canada and (provided the other requirements are met) still be able to deduct their moving expenses. This would apply to individuals who are “deemed” resident in Canada because they have “sojourned” in Canada for greater than 183 days in a year and to individuals who are considered to retain Canadian resident status for income tax purposes because they have maintained residential ties with Canada. With regard to an individual that moves to a new residence in order to begin full-time attendance at a university, college or other post secondary educational institution, they may deduct eligible moving expenses incurred with respect to moves within Canada, for moves into or out of Canada and for changing residence outside of Canada. EXPENSES: Employment Income: In order to claim employment expenses that were incurred in performing your duties of employment you must have a completed Canada Revenue Agency Form T2200 signed by your employer. Employment expenses are claimed as a deduction in your tax return by completing Form T777, which is also available from Canada Revenue Agency. Scholarship Income: The deductions are described earlier. Research Grant: Allowable expenses are claimed against research grant income. There is no exemption amount as there is for scholarship income. RESEARCH GRANT EXPENSES: 1) Workspace In Home Expenses: As discussed previously, you may deduct from a research grant received the expenses incurred by you in the year for the purpose of carrying on the research work, other than personal or living expenses. While you specifically cannot deduct personal or living expense from your research grant income, it may be possible to claim a portion of the costs associated with your residence as a deduction against your research grant income if you can substantiate that a portion of the cost of the residence was specifically incurred to enable you to carry on your research activity. The Income Tax Act contains specific provisions concerning the deduction of workspace in home expenses in respect of employment income and business income. However, these provisions do not apply to the provisions of the Income Tax Act regarding research grants. Generally, where you are claiming workspace in home expense in respect of employment or business income, you make a determination of the expenses to be deducted based on a reasonable apportionment of the expenses to your workspace in the home. Generally, Canada Revenue Agency accepts an allocation based on the square footage of the workspace in the home to the total square footage of the residence. It may be appropriate to apply a similar calculation to allocate costs to a workspace in your home in respect of your research activities provided again that this workspace was necessary for carrying out the research activity. You may wish to review such a claim with your professional advisor to determine whether it is appropriate in your circumstances. 2) Meals and entertainment: Canada Revenue Agency only allows the deduction of 50% for meals and entertainment expenses incurred in respect of earning business income, employment income and research grant income. 3) Documentation: As with any expenses claimed, documentation is very important. Make sure that all receipts are available for review in case Canada Revenue Agency wants to verify any of the deductions claimed. Receipts are not required to be submitted with the income tax return. OTHER ITEMS Childcare Expense Deduction: A childcare expense deduction may be available to you where you have incurred childcare expenses in order to permit you or a supporting person of the child to: i) ii) iii) iv) perform employment duties; to carry on a business; to carry on research in respect of which a grant is received; or to attend a designated educational institution or a secondary school where you are enrolled in a program of not less than three consecutive weeks duration that provides you spend not less than twelve (12) hours per month on courses in the program. Generally, the childcare expense deduction is claimed by the parent with the lower income. The childcare expense deduction is limited to the lesser of: a) The actual amount expended on childcare; b) $7,000 per child not yet 7 years old at the end of the year plus $4,000 per child for children who are between 7 years old and 16 years old at the end of the year or $10,000 in respect of a disabled child; and c) 2/3 of your “earned income” for the year. Earned income for purposes of the childcare expense deduction includes employment income, business income, the taxable portion of scholarships, fellowships, bursaries and “achievement prizes” and net research grants (as well as certain other income amounts). A childcare expense deduction may be claimed by the higher income spouse in certain specified circumstances. Generally, the claim by the higher income spouse is based upon the number of weeks in the year throughout which the lower income individual is: i) ii) iii) iv) v) separated from the higher income spouse; infirm; confined to a bed or a wheelchair: in prison; or in attendance at a secondary school or designated educational institution. The claim by the higher income spouse is further restricted to: $175 per child per week for children who are not 7 years old at the end of the year; $250 per child per week if they have a severe and prolonged physical or mental infirmity; $100 per child per week for unimpaired children who were between 7 years old and 16 years old at the end of the year, for each week throughout which the higher income individual is eligible to make the claim for expenses that relate to a stay in a boarding school or an overnight camp (including an overnight sports school). Where you or your spouse are in attendance at a designated educational institution or a secondary school, where the higher income spouse may claim childcare expenses. Generally, again, the claim is limited for each month you, your spouse, or both, you and your spouse are in attendance at a designated educational institution or secondary school. The childcare deduction is claimed by completing Form T778, which may be obtained from Canada Revenue Agency’s website which is: www.ccra.gc.ca/forms. Tuition Fees and Education Amount: In order to claim tuition fees as a non-refundable tax credit they must be higher than $100 to any one educational institution. In addition to the tuition fee credit, there is a further non-refundable tax credit of $400 per month for each month or part month that you are in full-time attendance at a designated educational institution and enrolled in a qualifying education program. Part-time students can claim an education amount of $120 for each whole or part month that they are enrolled. Remember if these credits are not required to bring your taxes to zero, up to the first $5,000 can be transferred to your spouse, parents or grandparents. Commencing with the 1997 year, you can carry forward the education and tuition credits which you did not deduct in the year to reduce your own tax to nil and which you did not designate for transfer to your spouse, parent or grandparent. You must use the carryforward amount immediately in future years as you have sufficient income in those years to require utilizing the credit to reduce your tax payable to nil. The T2202A form received from the university does not need to be submitted with the tax return and is usually available through the institution's website. Keep this form on file in case Canada Revenue Agency requests to see it. Textbook Amount: Students are eligible to claim an amount for textbooks only if you are entitled to claim the education amount mentioned previously. The amount that you can claim, if eligible, is $65 for each month you qualify for the full-time education amount and $20 for each month you qualify for the part-time education amount. Interest on Student Loans: There is a non-refundable tax credit for interest paid on student loans through the Canada Student Loans Act, the Canada Student Financial Assistance Act, or similar provincial or territorial government laws. If this credit is not needed in reducing your income taxes payable to nil, than this credit may be carried forward for a maximum of five years. Canada Employment Amount: Employees are eligible to claim an employment amount which is equal to the lesser of: 1. $1,127 2. Total of the employment income you reported on line 101 and line 104 of your return. Public Transit Passes Amount: You can claim the cost of monthly public transit passes or passes of longer duration such as an annual pass. Other Credits: Don’t forget to claim: • • the Ontario Trillium tax credit for rent/property taxes paid; the Federal basic personal credit of $11,138 and the Ontario basic personal credit of $9,670. For general enquiries, you can call the taxation office at 1-800-959-8281 or visit the website at: www.ccra.gc.ca Appendix A Name: Social Insurance Number: Year: Research Grant Statement of Income and Expenses Revenue from research grant $___________ Expenses: Accounting Conferences: Travel Meals (50%) Lodging Capital acquisitions: Computer software Furniture and equipment Computer hardware Supplies Other travel costs Meals (50%) Mileage Lodging Office rent Office expenses ____________ Total expenses ____________ Net income from research grant $____________