JCR-VIS Credit Rating Company Limited

Rating Report

Technical Partner – IIRA, Bahrain | JV Partner – CRISL, Bangladesh

RATING REPORT

Engro Foods Limited

REPORT DATE:

December 14, 2015

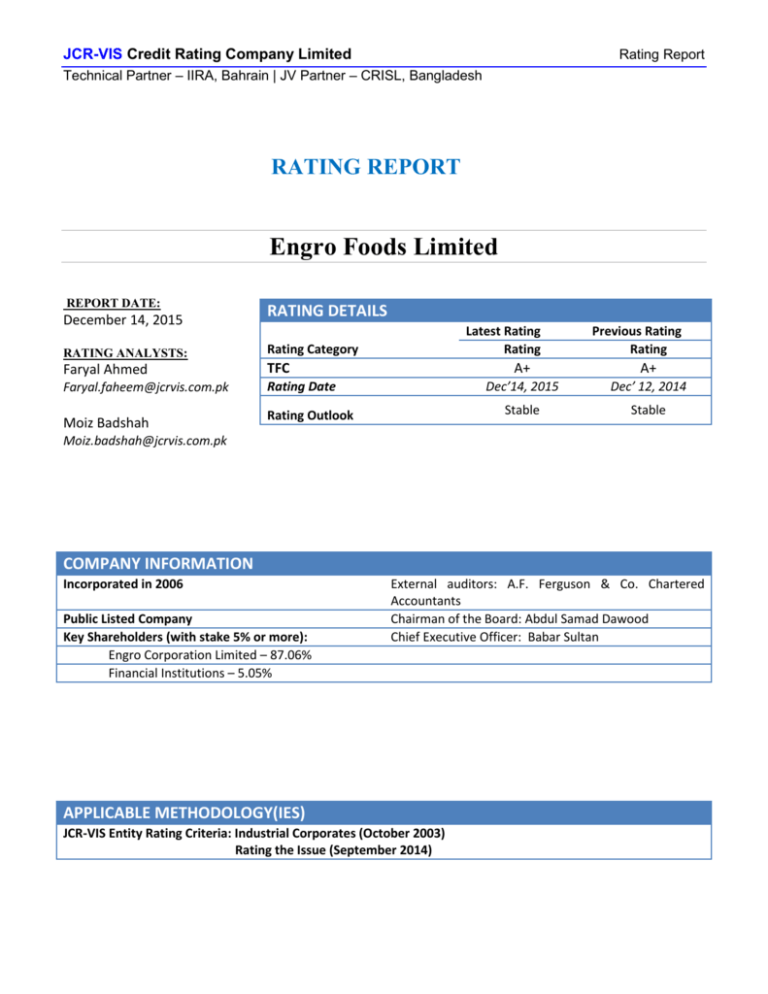

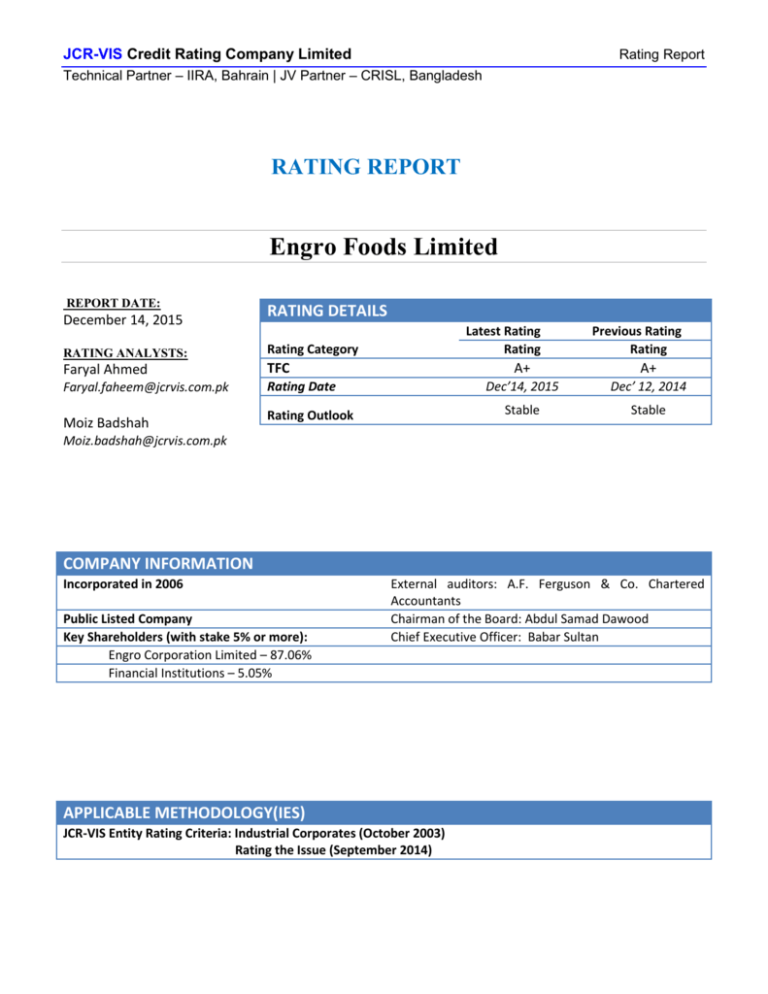

RATING DETAILS

RATING ANALYSTS:

Rating Category

Faryal Ahmed

TFC

Faryal.faheem@jcrvis.com.pk

Rating Date

Moiz Badshah

Rating Outlook

Latest Rating

Rating

Previous Rating

Rating

A+

A+

Dec’14, 2015

Dec’ 12, 2014

Stable

Stable

Moiz.badshah@jcrvis.com.pk

COMPANY INFORMATION

Incorporated in 2006

Public Listed Company

Key Shareholders (with stake 5% or more):

Engro Corporation Limited – 87.06%

Financial Institutions – 5.05%

External auditors: A.F. Ferguson & Co. Chartered

Accountants

Chairman of the Board: Abdul Samad Dawood

Chief Executive Officer: Babar Sultan

APPLICABLE METHODOLOGY(IES)

JCR-VIS Entity Rating Criteria: Industrial Corporates (October 2003)

Rating the Issue (September 2014)

JCR-VIS Credit Rating Company Limited

Rating Report

Technical Partner – IIRA, Bahrain | JV Partner – CRISL, Bangladesh

Engro Foods Limited

OVERVIEW OF THE

INSTITUTION

EFL

was

incorporated in as a

wholly

owned

subsidiary of Engro

Corporation Limited

in 2006, but was later

partially listed on the

Karachi, Lahore, and

Islamabad

stock

exchanges.

The

company operates in

the Consumer Good

sector; primarily in

dairy and ice cream /

frozen

desserts

products.

RATING RATIONALE

Engro Foods Limited (EFL) is a subsidiary entity of Engro Corporation Limited, operating

in the consumer goods sector. EFL through innovative marketing, branding and

competitive pricing has acquired substantial market shares in the domestic dairy, beverage,

ice cream & desserts market. The company has developed key flagship brands such as

Olper’s milk, Tarang tea whitener and Omore ice cream.

The top line of the company has shown significant improvement as compared to the

preceding year with gross sales reaching Rs. 43b for 2014. The Q-o-Q trend of gross

margins during 2015 has followed a declining trend as witnessed during 2014, though

higher as compared to the corresponding period. During 3Q15, increase in international

whole milk powder prices placed pressure on margins. However smart inventory

management coupled with growth in gross sales improved 9M15 gross margins to 25% as

compared to the period before (9M14: 18.53%). This growth impacted the company’s

internal cash generation which experienced a substantial jump to Rs. 4.4b for 9M15 (9M14:

Rs. 1.1b). This was reflected in the bottom line of the company whose profit before tax

followed a similar trend (9M15: Rs. 3.5b, 9M14: Loss of Rs. 0.16b). EFL’s debt servicing

coverage has reached a healthy level with growth in funds from operations and with final

impairment taken on EF Netherlands (subsidiary); the company’s bottom line is expected

to improve.

Improvement in internal cash generation has reduced the company’s need to make use of

running finance facilities. This was shown with a decrease in total debt to Rs. 7.6b at end9M15 of which 23% was short term in nature. EFL had reversed their position on running

finance facilities in order to meet working capital requirements, which also received support

from internal cash generation.

The company has taken on capital expenditures in improving power facilities at their North

plant in Sahiwal. This includes launch of a 10+ MW HFO (Heavy Fuel Oil) Power Plant

and the use of two third-party Biomass energy plants, to alleviate the plant’s dependency on

gas for steam. Further expenses have been made in EFL’s vital marketing campaign to

create awareness and help maintain product market share. With long term financing

principal repayments cumulatively amounting to Rs. 4.88b falling due in 2016 and 2017,

these years are significantly crucial for the company. The company will need to be cautious

of their market presence and margins going forward, focusing on their ability to meet

repayments. Further emphasis has been laid on the Board’s selection of a new Chief

Executive Officer who can lead the company through this period.

EFL issued a Sukuk in July 2009 amounting to Rs. 950m with a tenor of 8 years. The first

principal repayment was completed in July 2015 (Rs. 71.25m) while two are due in 2016

(accumulating to Rs. 475m) and the final during 2017 amounting to Rs. 403.75m.

JCR-VIS Credit Rating Company Limited

Technical Partner – IIRA, Bahrain | JV Partner – CRISL, Bangladesh

Engro Foods Limited

Appendix II

FINANCIAL SUMMARY

(amounts in PKR millions)

BALANCE SHEET

Fixed Assets (Property, plant and equipment)

SEPT 30, 2015

DEC 31, 2014

DEC 31, 2013

14,336.24

15,021.52

14,504.77

4,901.18

93.20

276.20

28,118.88

4,128.59

5,829.22

1,752.16

14,469.92

3,697.79

95.96

196.90

25,699.51

3,519.18

7,082.59

2,331.89

11,577.62

597.29

3,083.58

153.57

557.27

24,045.56

3,623.35

8,159.00

10,715.21

INCOME STATEMENT

Net Sales

Gross Profit

Operating Profit

Profit After Tax

SEPT 30, 2015

37,664.09

9,413.24

4,262.45

2,601.13

DEC 31, 2014

43,027.38

8,101.25

2,126.50

888.83

DEC 31, 2013

37,890.69

8,143.10

2,189.51

210.96

RATIO ANALYSIS

Gross Margin (%)

Net Working Capital

FFO to Total Debt (x)

FFO to Long Term Debt (x)

Debt Servicing Coverage Ratio (x)

ROAA (%)

ROAE (%)

SEPT 30, 2015

24.99%

3,576.65

0.78

1.01

2.61

12.35%

26.53%

DEC 31, 2014

18.83%

2,028.68

0.20

0.27

1.40

3.57%

7.97%

DEC 31, 2013

21.57%

3,356.84

0.29

0.29

1.26

0.91%

2.03%

Investments

Stock-in-Trade

Trade Debts

Cash & Bank Balances

Total Assets

Trade and Other Payables

Long Term Debt (*incl. current maturity)

Short Term Debt

Total Equity

JCR-VIS Credit Rating Company Limited

Technical Partner – IIRA, Bahrain | JV Partner – CRISL, Bangladesh

ISSUE/ISSUER RATING SCALE & DEFINITIONS

Appendix II

JCR-VIS Credit Rating Company Limited

Technical Partner – IIRA, Bahrain | JV Partner – CRISL, Bangladesh

REGULATORY DISCLOSURES

Name of Rated Entity

Sector

Type of Relationship

Purpose of Rating

Rating History

Appendix III

Engro Foods Limited

Consumer Goods

Solicited

TFC rating

Rating Date

12/14/2015

12/31/2014

1/21/2013

4/26/2011

1/7/2010

1/6/2009

8/13/2008

Instrument Structure

Medium

to

Short Rating

Long Term Term Outlook

RATING TYPE: TFC

A+

Stable

A+

Stable

A+

Stable

A

Stable

APositive

AStable

AStable

Rating Action

Reaffirmed

Reaffirmed

Upgrade

Upgrade

Maintained

Final

Preliminary

Instrument was issued in July 2009 with certificates amounting to Rs. 950m at a

mark-up rate of 6M-KIBOR plus 0.69% and a tenor of 8 years. The issue is secured

by a first pari passu floating charge over all present and future fixed assets of the

company with a 20% margin. Principal repayments are to be made in four semiannual unequal installments which began from July 2015.

Statement by the Rating JCR-VIS, the analysts involved in the rating process and members of its rating

Team

committee do not have any conflict of interest relating to the credit rating(s)

mentioned herein. This rating is an opinion on credit quality only and is not a

recommendation to buy or sell any securities.

Probability of Default

JCR-VIS’ ratings opinions express ordinal ranking of risk, from strongest to

weakest, within a universe of credit risk. Ratings are not intended as guarantees

of credit quality or as exact measures of the probability that a particular issuer or

particular debt issue will default.

Disclaimer

Information herein was obtained from sources believed to be accurate and

reliable; however, JCR-VIS does not guarantee the accuracy, adequacy or

completeness of any information and is not responsible for any errors or

omissions or for the results obtained from the use of such information. JCR-VIS is

not an NRSRO and its ratings are not NRSRO credit ratings. Copyright 2015 JCR-VIS

Credit Rating Company Limited. All rights reserved. Contents may be used by

news media with credit to JCR-VIS.