Information Note on Reviewing Compliance

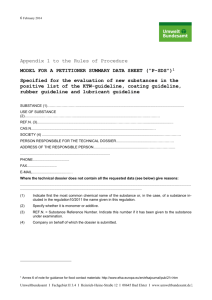

advertisement