Attached files

advertisement

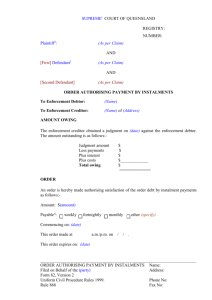

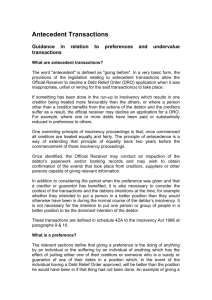

Rules and Conditions of Scheduling Public Treasury Receivables* * These rules and conditions have been issued by the Ministry of Justice circular No. 13/T/2723, dated 7.1.1426 AH, pursuant to the Council of Ministers resolution No. 202 dated 1.8.1426 AH. Rules and Conditions of Scheduling Public Treasury Receivables The Council of Ministers, Upon reviewing the documents received from the Bureau of the Presidency of the Council of Ministers under No. 3/B/23645, dated 9.5.1425 AH and dated 6.3.1424 AH concerning the proposed approval of the scheduling of public treasury receivables from citizens unable to pay them in one installment; and Upon reviewing the State Money Collection Law issued by Royal Order No. 41/3/2, dated 12.4.1395 AH; and Upon reviewing article 20 of the Civil Service Law issued by Royal Decree No. M/49, dated 10.7.1397 AH; and Upon reviewing articles 17 and 32 of the Civil Retirement Law issued by Royal Decree No. M/41 dated 26.7.1393 AH; and Upon reviewing the Council of Ministers Resolution No. 504 dated 17.4.1393 AH; and Upon reviewing minutes of meeting No. 419 dated 23.11.1425 AH and minutes of meeting No. 211, dated 4.6.1426 AH prepared at the Commission of Experts; and Upon reviewing the two recommendations of the General Board of the Council of Ministers No. 685, dated 27.12.1425 AH and No. 335 dated 12.6.1426 Ah. Resolves as follows: Approval of scheduling of the public treasury receivables due from citizens unable to pay them in one installment and exempting them from these debts in case of insolvency or bankruptcy in accordance with the following rules: 1. The debtor shall apply to the creditor department requesting installment of the debt payable from him stating his inability to pay it in one installment. In case the debtor is an establishment or a company, the said application shall be accompanied by balance sheets approved by a chartered accountant along with statements of the movements of his accounts with all banks for the last two years. However, if the debtor is an individual, it is sufficient to submit the movements of his accounts with all banks for the last two years. 2. The creditor department shall review the application of the debtor to ensure that all accompanying documents are complete and to propose the installments and their amounts in agreement with the debtor. The 272 Al-Adl (43) Rules and Conditions of Scheduling Public Treasury Receivables installments shall be estimated as per the debtor's balance sheet, commercial movements, contractual obligations with the state or otherwise provided that the period of installments shall not exceed ten years. The suitable method of the collection of debts shall be determined either in cash, by cheques, promissory notes or deductions from the amounts payable to the debtor or the like. 3. After having been studied by the creditor department, applications and supporting documents shall be forwarded to the Ministry of Finance to double check the required documents and bank accounts statements submitted by the debtor and to check his balances with banks through the Saudi Arabian Monetary Agency. 4. After obtaining approval from the Ministry of Finance on the instalment of the debt based on the result of the study of the application by the committee provided for under article 18 of the State Money Collection Law comprising a representative of the Ministry of Finance, a representative from the creditor department and a legal advisor from the Ministry of Finance, the creditor department shall notify the debtor of the approval of his application, follow up payment of instalments, informing him of their dates before they are mature and take necessary accounting actions to document payment of instalments. 5. If the debtor delays payment of any mature instalment, he shall be served with a written notice, and after the lapse of fifteen days, he shall be served another written notice. If he fails to report within fifteen days to pay the instalment payable from him or to produce justifications explaining the reasons for stopping payments, the instalment scheme will be cancelled and the remaining instalments shall become payable. The creditor department shall claim payment of the debt in one instalment and apply the provisions of the confiscation procedures manual issued by the Ministry of Finance circular No. 9/2/67192, dated 15.11.1424 AH. 6. After coordination with the Ministry of Finance, the creditor department may reschedule the instalments if convinced of the reasons produced by the debtor if he delays payment of the instalments due from him. 7. The rules of scheduling under the previous paragraphs shall not be applied to the debts paid in the form of instalments under relevant 273 Al-Adl (43) Rules and Conditions of Scheduling Public Treasury Receivables contracts until the contractual relationship is terminated or the debts resulting from theft or forgery. 8. If five years lapse since the maturity date of the payment of the debt, if all follow up procedures provided for in the Ministry of Finance circular No. 9/2/67192, dated 15.11.1424 AH are exhausted, if no agreement with the debtor to schedule the debt is reached in a manner that renders it definitely impossible to collect it or part of it and if the debtor fails to pay the debt, he will be dealt with as follows: a. If the amount of debt is not more than one hundred thousand riyals, the creditor department shall forward the subject to the Ministry of Finance to submit to the committee provided for under paragraph 4 hereinabove to study the application and consider releasing the debtor from the said debt. b. If the amount of debt is more than one hundred thousand riyals and the debtor submits to the creditor department legal proofs of insolvency in accordance with the Sharee'ah Law of Procedure or his bankruptcy, the creditor department shall forward the whole subject to the Ministry of Finance to submit to the committee provided for under paragraph 4 hereinabove to check the correctness of the procedures and legal supporting documents. The committee shall issue its executive decision and provide pertinent authorities with copies thereof. 9. If the debtor dies and it is legally proved that he has left no estate to be charged with the debt, he shall be released from the debt. 10. Exemptions for those convicted of theft, forgery or fraud crimes shall not be considered. Prime Minister 274 Al-Adl (43)