BCW Capital Supreme Venture's Analysis

advertisement

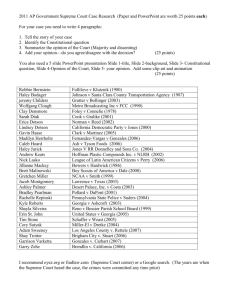

Supreme Ventures Ltd. Analysis BCW Research SUPREME VENTURE’S ANALYSIS 2013 Company Description: The company is a gambling establishment that provides the facilities and means for gamblers and betters to make wager on lotteries drawings and special events. Through electronic means the company is able to offer to the Jamaican and wider Caribbean markets the opportunities to post wager on electronic drawings of numbers (lotteries), wager on sporting event, and Relative Value: 2009-2013 The company has an average of 2,637,255,000 Ordinary Shares outstanding Average traded price over the last five years: $2.56 per share 5 Year Price Range: $3.00 - $2.01 Average EPS (five years): $0.25 Trailing P/E = 11.15x, P/B =1.96 Both the P/E ratio and the P/BV ratio of this company are fair when compared to similar companies that are listed on the NYSE. By these metrics the company seems fairly valued. Dividend policy: Supreme Ventures pays a minimum of 76% of profits as dividends, subject to the need for reinvestment in the company, over the last five years (2009-13). This, we believe, is an attractive dividend policy. The dividend, compared to other listed securities on the JSE, is very attractive and will provide a source of cash to its investors. 1 Supreme Ventures Ltd. Analysis Free Cash Flow Chart (Supreme Ventures Ltd) Financial Ratios Ratio Debt/Equity Current Ratio Return on Equity Profit Margin Operating Profit Margin EPS Based on FY ended Dec 2013 0.46x 1.30x 20.92% 2.44% 3.08% $0.183 Ratio Analysis With a Debt/Equity ratio less than 1 the company is not highly leveraged. Seemingly, assets are financed primarily through equity which could prove favourable for SVL, especially in a time of rising interest rates and liquidity tightness. The current ratio of 1.3x indicates that SVL is very liquid. This excess liquidity is indicative of an inefficient use of cash. However, it could be an effort by management to build up its reserves in anticipation of capital investments. Therefore we expect to see management employing a more efficient use of cash. The ROE of the company would be among the highest on the market, which shows a very good use of shareholders’ equity 2 Supreme Ventures Ltd. Analysis S.W.O.T. Analysis Strength • Company is the largest gambling institution in the English speaking Caribbean. • Company offers customized products for the region’s betters and wagers. • It successfully launched a popular Caribbean wide product. • The company faces little competition in the market as there is only one competitor. Opportunity • Listing on the JSE and TTSE could increase brand awareness. • Introduction of new products due to impending legislation (agent network) and the World Cup. Weakness • Shares are tightly held by four controlling rights (app.76%) Threats • Sluggish economic environment • Heavily subjected to government regulations • Threat of illegal gambling based on SVL drawings. • Competition to the VLT business line. Gambling Industry is sized at J$35 billion. The Lottery Product is 71.02%, Horse racing is 20.50% and VLT is 8.48%. Supreme Venture Ltd. has the exclusive license to operate a lottery system in Jamaica. Outlook: The macro economy of Jamaica is under strain now with the persistent devaluation of the Jamaican currency and liquidity tightness in the economy. With this macro-economic constraint we may see the increase in illegal gambling and increased cost of necessary equipment and technology to keep the distribution networks operate with fair efficiency. Though the government has introduced new taxes and now remits unclaimed winnings to the public purse it is not expected that gambling habits will suffer any long term decline. The company has expanded its betting offering by (1) having betting on Sundays and Public holidays, (2) new select (small winnings) games, (3) the betting on the world Cup Football Competition and (4) four drawings per day. 3 Supreme Ventures Ltd. Analysis The company has further restructured its operation by selling off its financial services arm and closing and or refurbished several of its gambling houses. This will cut cost and improve leanness. The use of funds is credible and could lead to further revenue and profit growth. The company’s intention to expand operations in the wider Caribbean, could prove favourable for its top line. We expect this stock to perform well in the future. Forecasted Value Within this context, the net earnings for the 2014 financial year end may be $878.00M (E.P.S. of $0.3329). Assuming a forward P/E ratio of 9.90 times for the 2014 financial year (4-year average is 9.97 times and the trailing P/E is 7 times); the intrinsic value for Supreme Ventures Limited’s share based on estimated earnings is approximately $3.29. Sources: Company Financial statements, Jamaica Stock Exchange Prepared by: BCW Capital Research: June 2014 Disclaimer: This Research Paper is for information purposes only. The information stated herein may reflect the opinion and views of BCW Capital in relation to market conditions and does not constitute any representation or warranties in relation to investment returns and the credibility of the sources of information relied upon in the preparation of this report, without further research and verification. 4