restructuring zale corporation - Turnaround Management Association

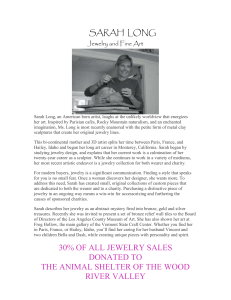

advertisement