www.pwc.co.uk/fsrr

26 March 2015

Stand out for the right reasons

Financial Services Risk and Regulation

Hot topic

Solvency II Long Term

Guarantee Package Update

Highlights

On 20 March 2015 the PRA

published Supervisory

Statement 17/15: Solvency II:

Transitional Measures on the

risk-free interest rates and

technical provisions, as part

of a wider Solvency II Policy

Statement, covering the

implementation of

transitional measures. In

addition, on 21 March 2015,

the PRA released

supplementary information

forms on the transitional

measure applications.

On 20 March 2015 the PRA

published Consultation Paper

11/15: Solvency II:

supervisory approval for the

volatility adjustment

covering the approval

process for firms intending to

apply the VA.

The publication of the Her Majesty’s Treasury Statutory Instrument1 (‘the Statutory

Instrument’) in March formalises a number of Solvency II regulations and its

application in the UK. This includes the need for firms to gain approval from the

Prudential Regulation Authority (the ‘PRA’) in order to use the Volatility Adjustment

and the clarification on how transitional measures should be applied. Following on

from this, the PRA has published a policy statement along with a number of

supervisory statements and consultation papers on various aspect of

Solvency II implementation.

PwC believes that UK insurers are now in a position to understand the cost and

implications of applying each aspect of the Long Term Guarantee (‘LTG’) package,

and will need to mobilise resources swiftly to finalise the required applications. This

paper provides an update of the latest regulatory developments on the three

components of the LTG package:

Volatility Adjustment (‘VA’)

Transitional Measures

Matching Adjustment (‘MA’)

The approval process runs parallel for all three components and will likely place

significant pressure on resources for firms wishing to apply for all aspects of the

LTG package.

In this paper we summarise the content of the latest regulatory updates.

These releases provide clarity

for insurers wishing to

optimise their LTG package.

1

http://legislation.data.gov.uk/uksi/2015/575/made/data.htm?wrap=true

Volatility adjustment

On 20 March 2015 the PRA published Consultation

Paper 11/15: Solvency II: supervisory approval for the

volatility adjustment2 (‘the Consultation’) covering the

approval process for firms intending to apply the VA.

The VA provides an uplift in the discount rate used to

calculate best estimate liabilities and may be of

particular interest for insurers for whom the MA is

not appropriate. The Consultation is open for

comments until 20 April 2015.

Summary

Firms wishing to apply the VA to their portfolio will

have to seek approval from the PRA. The approval

process opens on 1 April 2015, before the end of the

consultation period.

The Statutory Instrument sets out three statutory

conditions that firms need to demonstrate compliance

with in order to gain approval from the PRA to

use VA.

Firms intending to proceed with the application

process will need to ensure that there are processes

and governance in place to comply with the statutory

conditions, as well as detailed quantitative analysis on

the balance sheet impact of using VA.

Approval process for the VA

Firms should notify the PRA at the earliest

opportunity should they wish to apply for the VA. All

insurers will be able to send to the PRA a formal

application from 1 April 2015. This overlaps with the

consultation period which may indicate that the PRA

is not expecting material changes to the proposal set

out in the Consultation. It is unclear how long the

PRA will have to confirm the application is complete

although we note that the standard period is 30 days.

For the majority of insurers, the PRA will have 6

months from the date of receipt of the complete

application to assess it and communicate the results

of the assessment to the insurer.

For insurers whose VA application is independent of

other approval decisions, such as internal model

applications, the PRA will endeavour to communicate

decisions within 6 weeks.

For insurers intending to use the VA as a contingency

option should another application be rejected, the

PRA is willing to consider these applications in

parallel. Whilst this will help provide certainty to

firms whose applications are interdependent, the

timescale available for those firms considering an

early application may need to be evaluated given the

short time available to develop their VA application.

http://www.bankofengland.co.uk/pra/Pages/publications/

cp/2015/cp1115.aspx

2

2 Hot Topic Financial Services Risk and Regulation

When submitting this application insurers should

inform the PRA of any other approvals for which they

have applied and are also encouraged to include

details of other approvals they intend to apply for

within the next year.

The Consultation does not mention the need for

sensitivity tests to be carried out showing the impact

on the VA if other applications are rejected. This may

indicate a belief from the PRA that this information

will be available in other applications.

Content of the VA application

The application should allow the PRA to be satisfied

that the regulation as set out in the Statutory

Instrument has been met, namely:

1. The VA is correctly applied to the relevant risk-free

interest rate term structure in order to calculate

the best estimate liabilities;

2. The application of the VA does not create an

incentive for firms to engage in pro-cyclical

investment behaviour; and

3. The firm does not breach a regulatory requirement

as a result or consequence of applying the VA.

The Consultation specifies that the VA application

should include the following:

1. The written policy on risk management including

the criteria for application of the VA as well as the

required assessment of sensitivity;

2. The liquidity plan in relation to the assets and

liabilities subject to the VA;

3. An assessment of the impact when VA is reduced

to zero. Where this results in non-compliance with

the Solvency Capital Requirement, an analysis of

the measures that could be used to restore

compliance; and

4. An assessment, as part of the Own Risk and

Solvency Assessment, of compliance with capital

requirements with and without taking into account

the VA.

Key considerations for the VA

application

Firms will need to adapt their current risk

management framework, process and governance to

include ongoing compliance with the criteria as set

out in the application. This will include ensuring that

the criteria are aligned with how the portfolio is

managed and do not cause excessive disruption to

business. The implementation of these is likely to

incur additional initial and ongoing costs.

Whilst the Consultation does not specify the type of

liabilities eligible for VA, the focus is on the liquidity

of the liabilities. The need to demonstrate that

cashflows are sufficiently predictable means that it

may be difficult to gain approval on a range of

liabilities, for example unit linked.

The quantitative assessment needs to demonstrate

that use of the VA is in line with the investment

policy. Management may wish to consider how the VA

may impact on the portfolio investment strategy and

the basis risk between the reference portfolio and the

current portfolio, in particular the need to maintain a

portfolio yield that will ensure the discount rate is

representative. Insurers will also need to consider

carefully actions that will be taken under stress, which

may confine freedom of management to react

appropriately to market conditions.

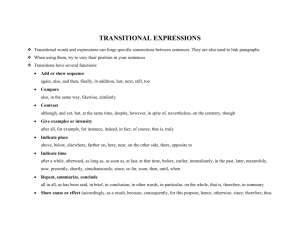

Transitional measures

On 20 March 2015 the PRA published Supervisory

Statement 17/15: Solvency II: Transitional Measures

on the risk-free interest rates and technical

provisions3 (‘the Statement’), as part of a wider

Solvency II Policy Statement4, covering the

implementation of transitional measures. In addition,

on 21 March 2015, the PRA released supplementary

information forms on the transitional

measure applications5.

The transitional measures give insurers the

opportunity to delay some of the impact of moving

from Solvency I to Solvency II. However there are a

number of implications to consider and it is critical

that firms fully understand how to apply the

transitional measures and how to embed these into

the business plan.

Summary

Firms wishing to apply transitional measures will

need to seek approval from the PRA. Both transitional

measures decrease linearly for up to a maximum of

16 years.

Firms may apply to dynamically recalculate the

Technical Provisions (‘TP’) transitional measure.

The amount of the TP transitional measure is limited

at legal entity level to ensure the Financial Resources

Requirement (‘FRR’) under the transitioned

Solvency II position is greater than or equal to the

FRR under Solvency I.

The TP transitional measure can be applied at

Homogenous Risk Group (‘HRG’) level.

http://www.bankofengland.co.uk/pra/Pages/publications/ss/2015/

ss1715.aspx

4 http://www.bankofengland.co.uk/pra/Pages/publications/ps/2015/

ps215.aspx

5 http://www.bankofengland.co.uk/pra/Pages/authorisations/siiapprovals/

applying.aspx

3

3 Hot Topic Financial Services Risk and Regulation

The risk free rate (‘RFR’) transitional can only be

applied to liabilities which are not included in the

MA calculation.

Technical provisions transitional

A transitional deduction should be calculated as the

difference between the Solvency II TPs and the

Solvency I Pillar 2 (ICA) TPs. This deduction is

limited by the FRR test which reduces the transitional

adjustment to ensure the FRR under the transitioned

Solvency II position is greater than or equal to that

under Solvency I.

The FRR test should be calculated based on all

liabilities at entity level, and firms should explain why

any non-technical reserves have been removed for the

calculation of the technical provisions.

The transitional deduction calculated as at 31

December 2015 is not expected to be assessed again

except in the following cases:

The firm has received approval from the PRA to

recalculate the deduction;

A material change in the firm’s risk profile or

market conditions has occurred; and

At the instruction of the PRA.

For firms applying the TP transitional measure at

homogenous risk group level, this can be no more

granular than the HRG used to segment the TPs

under Solvency II.

Risk-free interest rate transitional

The transitional adjustment for the risk-free rate

(‘RFR’) transitional is calculated as at 31 December

2015 and is the difference between the Pillar 1 interest

rate (calculated in line with INSPRU 3.1) and the

single discount rate that, when applied, will result in a

value equal to the best estimate of the portfolio using

the Solvency II risk-free rate, adjusted for the VA

(where firms have been granted approval).

Implications for insurers seeking to

apply the transitional measures

Approval process

Firms should notify the PRA at the earliest

opportunity should they wish to apply for the

transitional measures. Formal application opens on

1 April 2015. The PRA will have 30 days to confirm

the application is complete. Applications will take

6 months for the PRA to review.

Insurer should inform the PRA of any other

approvals in progress, or planned for the coming

12 months, with a sensitivity of the impact of the

transitional measures if other applications

are rejected.

The PRA has provided more guidance on the

application for the TP transitional compared to

the RFR transitional. Hence firms may wish to

infer the information the PRA may require for the

RFR transitional application based upon the TP

transitional guidance.

The PRA may request firms to obtain external

validation of the calculations performed.

The guidance for the content of the TP

transitional measure application includes a

calculation template, notes on the application and

supplementary information requested. The focus

is on the explanation and justification of

the calculations.

The application should be made based on figures

as at 31 December 2014, with an explanation for

why these figures are appropriate. If the risk

profile of the firm is likely to materially change

during 2015, firms are asked to estimate the

figures for the calculation at 31 December 2015.

Recalculation

Firms using the TP transitional need to decide

whether to apply to recalculate the transitional.

Should the transitional adjustment remain static,

firms will be exposed to relative movements between

the credit spreads over time which could create

significant balance sheet volatility.

In any case, the requirement to re-assess the level of

TP deduction under a material change in risk profile,

or at the insistence of the PRA could introduce a

considerable practical burden for firms; it will likely

require that the Pillar 1 and ICA models and

assumptions are kept up-to-date and re-run each year

for the assessment.

Deciding on the right group of liabilities

Applying the TP transitional at HRG level introduces

additional complexity for calculations. Firms must

demonstrate the calculations at HRG level are

consistent with calculations for the entity as a whole.

Firms must consider how to limit each HRG to allow

for the FRR limit being applied at legal entity rather

than HRG level, taking into account the contribution

to the TP transitional measure from that HRG and the

effect on the level of policyholder protection.

Validation of the calculations

There may not be time for the year end 2015 technical

provisions to be validated prior to using them to

calculate the transitional and applying it to the

Solvency II balance sheet in Q1 2016. Firms need to

factor this into their plans for external validation.

The PRA also appears to have opened the door for

firms to discuss the appropriateness of any existing ICA

margins/ICG where these are felt to no longer be

appropriate. Firms should discuss this with their usual

supervisory contact before completing their application

and factor this into the critical path.

Impact on the business plan

There are wider implications of using transitional

measures on the asset hedging and new

business strategies.

The relative benefits between different firms of using the

transitional measures will be a function of the internal

structures and HRG liabilities held at legal entity level.

Matching adjustment

The following recent regulatory updates have continued

to inform firms preparing their MA final application:

Letter on Equity Release Mortgage6 published by the

PRA on 20 February 2015;

Risk Free Rate technical documentation7 published

by EIOPA on 23 February 2015; and

Letter on Matching Adjustment published8 by the

PRA on 9 March 2015.

We note however that there continues to be high level of

uncertainty within the papers published as well as on the

criteria for MA approval.

Firms who have submitted a pre-application document

will receive feedback from the PRA on 28 March 2015,

with the approval process commencing on

1 April 2015.

http://www.bankofengland.co.uk/pra/Documents/solvency2/

fisherermletterfeb15.pdf

7 https://eiopa.europa.eu/regulation-supervision/insurance/

solvency-ii-technical-information/risk-free-interest-rate-term-structures

8 http://www.bankofengland.co.uk/pra/Documents/solvency2/

intmodmaupdatemar2015.pdf

6

4 Hot Topic Financial Services Risk and Regulation

How PwC can help you understand the implications for your business

Our team has a significant amount of expertise working with insurers on the various components of the LTG

package. We can work with you on:

Understanding the impact on your balance sheet of the various components, such as investment strategy

and capital;

Develop application documents for regulatory approval; and

Update the systems that will need to be in place to implement the measures.

Contacts

Shazia Azim

James Tuley

Scott McNeill

Nicola Kenyon

T: +44 (0)20 7213 2096

E: shazia.azim@uk.pwc.com

T: +44 (0)20 7804 7343

E: james.tuley@uk.pwc.com

T: +44 (0)131 260 4341

E: scott.mcneill@uk.pwc.com

T: +44 (0)20 7804 4931

E: nicola.kenyon@uk.pwc.com

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the

information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the

accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members,

employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to

act, in reliance on the information contained in this publication or for any decision based on it.

© 2015 PricewaterhouseCoopers LLP. All rights reserved. In this document, “PwC” refers to PricewaterhouseCoopers LLP (a limited liability partnership in the

United Kingdom), which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity.

150326-115302-NK-OS

Stand out for the right reasons

Financial services risk and

regulation is an opportunity.

At PwC we work with you to embrace

change in a way that delivers value to your

customers, and long-term growth and

profits for your business. With our help,

you won’t just avoid potential problems,

you’ll also get ahead.

We support you in four key areas.

By alerting you to financial and

regulatory risks we help you to

understand the position you’re in and

how to comply with regulations. You

can then turn risk and regulation to

your advantage.

We help you to prepare for issues such

as technical difficulties, operational

failure or cyber attacks. By working

with you to develop the systems and

processes that protect your business

you can become more resilient, reliable

and effective.

Adapting your business to achieve

cultural change is right for your

customers and your people. By

equipping you with the insights and

tools you need, we will help transform

your business and turn uncertainty

into opportunity.

Even the best processes or products

sometimes fail. We help repair any

damage swiftly to build even greater

levels of trust and confidence.

Working with PwC brings a clearer

understanding of where you are and

where you want to be. Together, we can

develop transparent and compelling

business strategies for customers,

regulators, employees and stakeholders.

By adding our skills, experience and

expertise to yours, your business can

stand out for the right reasons.

For more information on how we can help

you to stand out visit www.pwc.co.uk