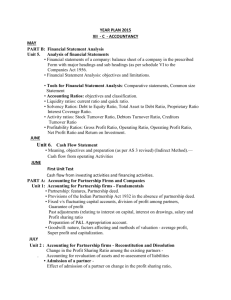

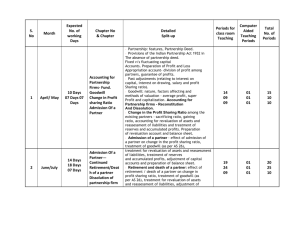

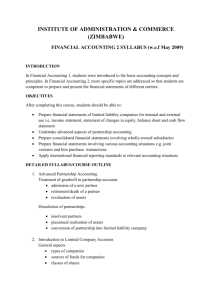

Support Material

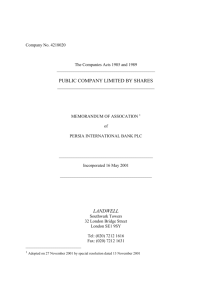

advertisement