entire 2008 Annual Report

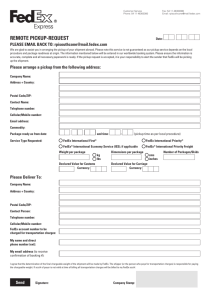

advertisement