Small commercial vehicle – India's little elephant

advertisement

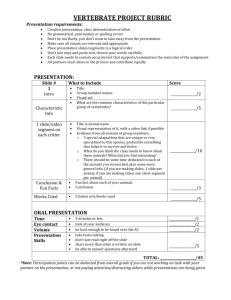

Small commercial

vehicle – India's little

elephant

September, 2014

Contents

Page

A. Overview in a nutshell

3

B. Rapid growth & high dynamism are the hallmarks of the Indian SCV market

6

C. Demand drivers to trump short to mid term challenges

20

D. Solid growth expected but not across all sub segments

25

E. Choose wisely where to play and drive government engagement

27

This document shall be treated as confidential. It has been compiled for the exclusive, internal use by our client and is not complete without the underlying detail analyses and the oral presentation. It may

not be passed on and/or may not be made available to third parties without prior written consent from Roland Berger Strategy Consultants. RBSC does not assume any responsibility for the completeness

and accuracy of the statements made in this document.

© Roland Berger Strategy Consultants

SCV Knowledge Paper_201409010_vf.pptx

2

A. Overview in a

nutshell

SCV Knowledge Paper_201409010_vf.pptx

3

SCV segment is the largest segment in the CV industry in terms of

volume and will continue to remain so over the next 6 years

Executive summary [1/2]

> Current scenario

– The SCV segment is the largest segment within the CV industry with sales of ~432k units in FY2014 contributing 60%

to the overall industry. It has outperformed all other segments declining by ~1% CAGR only over the last 2 years

against the industry average of ~11% CAGR

– The SCV Cargo continues to be the biggest segment and will account for ~80+% of the total market by FY2020

– Within the SCV Cargo segment large pick-ups (2-3.5T) have been growing & account for ~54% of the segment

– SCV Passenger is a highly regulated segment and faces tough competition from 3 wheelers. Over the last year, the

segment has suffered extremely high delinquency rates

– Tata Motors and Mahindra & Mahindra continue to be the top 2 players in the industry

– Tata Motors leads the market in the sub 2T truck category and the SCV Passenger segment

– Mahindra & Mahindra is expected to do well in the 2-3.5 Ton category in the SCV Cargo segment due to its strong

hold in the Pick-up segment. It has also managed to attract ACE customers to higher tonnage Bolero Maxi Truck

– Ashok Leyland is one of the late entrants but has been successful with Dost cornering 14% market share in the 2-3.5

Ton category

Source: Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

4

SCV segment is the largest segment in the CV industry in terms of

volume and will continue to remain so over the next 6 years

Executive summary [2/2]

> Key demand drivers

– Need for last mile connectivity for both goods and people transportation. Supported by increasing rate of urbanization

– Better operating economics clubbed with better financing options making SCVs more lucrative for end customers

– New applications are being developed to expand the market prompting newer customers to buy SCVs. Poultry, milk

and water distribution industries are some of the new segments established over the last year

> Challenges

– OEMs need to continuously develop new applications and also educate the customers on the usage to continue

segment expansion

– SCV Passenger carriers rely heavily on permits issued by Government agencies. Therefore, there is a need to work

closely with the government which faces heavy lobbying from the strong 3-Wheeler unions

> Future projections

– We expect the market to get back to the growth trajectory sometime in the 3rd quarter of the current fiscal

– The SCV industry is expected to reach ~919,000 units by FY2020 growing at a CAGR of ~13% over the next 6 years

Source: Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

5

B. Rapid growth & high

dynamism are the

hallmarks of the

Indian SCV market

SCV Knowledge Paper_201409010_vf.pptx

6

Overall CV Industry

SCV is a relatively new segment in the Indian commercial vehicle

industry; rapid growth turned it into the largest volume segment

CV Industry growth by segment

CV Industry market evolution [Sales volume, '000 units]

CAGR [%]

-11%

+24%

893

729

580

7%

6%

7%

7%

6%

5%

6%

6%

6%

910

5%

5%

25%

34%

38%

FY

2010-12

FY

2012-14

19.8

-6.9

LCV Goods

12.8

-23.5

4%

4%

712

6%

5%

LCV Passenger

M&HCV Passenger

7.1

-11.5

24%

M&HCV Goods

21.7

-26.4

61%

SCV1)

30.4

-1.4

35%

50%

45%

FY 2010

61%

45%

FY 2011

FY 2012

FY 2013

> SCV segment was established in 2005

with the launch of ACE Truck in the sub

2 ton category. Since then it has grown

considerably

> SCV segment grew by ~30% CAGR

between 2010-2012 whereas it only

declined by ~1% CAGR over the last 2

years. During the same time overall

industry declined by ~11% CAGR

> The SCV segment has outperformed all

the other CV segments and now

accounts for more than 60% of the CV

industry

FY 2014

1) SCV segment includes Tata Magic/IRIS segment and also <3.5 ton cargo vehicles like ACE, Dost, Super Ace, etc For this comparison we have not included hard top vans

(e.g: Omni & Eco)

Source: SIAM, Roland Berger Analysis

SCV Knowledge Paper_201409010_vf.pptx

7

Overall SCV Industry

SCV industry has been impacted by the downturn declining by 22%

over last year; SCV Passenger has declined more than SCV Cargo

SCV1) Industry growth by segment

SCV Industry market evolution [Sales volume, '000 units]

+24%

444

+30%

552

Growth rates [%]

FY

2010-12

-22%

FY

2012-14

21%

432

19%

17%

SCV Passenger

30.4

-6.9

83%

SCV Cargo

30.4

-0.2

325

261

16%

19%

79%

81%

81%

FY 2010

84%

FY 2011

FY 2012

FY 2013

> SCV Cargo segment has outperformed

SCV Passenger segment driven by

growth in the 2 Ton – 3.5 Ton category

which includes the successful Bolero

Maxi Truck

> SCV passenger faces tough competition

from 3Ws which account for more than

~85% of the segment. Also, competition

from MPV/SUV for customers looking for

comfort whereas soft top vehicles are

more in demand for shared taxi

applications

> SCV Passenger segment suffered due

to high delinquency rate and limited

government support in terms of issuance

of new permits

FY 2014

1) SCV segment includes Tata Magic/IRIS segment and also <3.5 ton cargo vehicles like ACE, Dost, Super Ace, etc For this comparison we have not included hard top vans

(eg: Omni & Eco)

Source: SIAM, Roland Berger Analysis

SCV Knowledge Paper_201409010_vf.pptx

8

SCV Cargo

Tata reinforced its dominance in the <2T category by creating the

Zip segment positioned between Ace and the 3W segment

Market share development - Goods carrier <2T

Model wise segment share trend 2010-14

191

Trump 15

M&M Gio

3%

4%

251

3%

2%

1%

2%

3%

2%

1% 1% 1%

0%

15%

167

1%

1% 4%

Porter1000

Porter600

16%

19%

18%

Maxximo

247

14%

15%

8%

65%

70%

68%

Ace Zip

> Since product launch, Ace has remained the

market leader in the <2T segment

> The 0.5T payload category competes directly

with the 3W vehicles and is priced between the

0.75T segment and the 3-Wheelers. However, it

has not managed to create a threat for 3Wheelers as the 0.5T vehicles cost at least 40%

more than 3-Wheelers

> Piaggio regained its market share with the

launch of the Porter series – Ape truck failure

mainly attributed to the product related issues

63%

Ace

2010-11

Tata Motors

Source: SIAM; Roland Berger

Mahindra

2011-12

2012-13

Piaggio

2013-14

Force Motors

SCV Knowledge Paper_201409010_vf.pptx

9

SCV Cargo

3W Cargo

3W Cargo segment has managed to hold its ground even though it

faces tough competition from SCV Cargo segment

Market share development – 3W Cargo

Model wise segment share trend 2010-14

Force Motors

91

101

1%

13%

4%

7%

7%

9%

8%

56%

2009-10

Source: SIAM; Roland Berger

0%

7%

9%

12%

97

95

0%

0% 3% 0% 8%

9%

15%

17%

Bajaj

Scooters India

Atul Auto

19%

15%

Mahindra & Mahindra

107

61%

2010-11

18%

21%

23%

54%

53%

52%

2011-12

2012-13

2013-14

Piaggio Vehicles

> Overall 3W Cargo segment has increased by

CAGR ~1% over the last 5 years. However, it

declined by ~2.5% the last year

> This segment though faces more competition

than 3W passenger since there are no

regulations in terms of permits. However, they

have managed to sustain their volumes since

they also cost ~40% less than the SCV cargo

entry range vehicles (For eg: Tata Ace Zip)

> Piaggio continues to be a market leader in the

3W cargo segment and now accounts for ~52%

of the market

> Atul Auto has been a success story. It has

gained ~10% market share over the last 5 years

driven by the launch of rear mounted engines

and their focus towards Tier II & Tier III cities

SCV Knowledge Paper_201409010_vf.pptx

10

SCV Cargo

Rapid growth of Dost indicates significant opportunities exist for new

players. Right product and good network critical for success

Market share development - Goods carrier 2-3.5T

Model wise segment share trend 2010-14

82

Winner

Trump40

Trax Pick-up

1%

110

6%

16%

2%

4%

7%

1%

1% 1%

1% 0%

14%

0%

3%

7%

4%

7%

Dost

207

Xenon

10%

15%

12%

1%

13%

4%

25%

Bolero Maxi Truck

38%

Bolero Pick-up

7%

18%

193

18%

14%

3% 0%

190

Superace

Genio

18%

53%

43%

2010-11

Mahindra

Source: SIAM; Roland Berger

2011-12

Tata Motors

33%

2012-13

Ashok Leyland

> M&M dominates the pick-up segment with its

products derived from SUV/ MUV platforms

> M&M has also managed to attract customers

from less than 2T category by keeping the price

gap between Bolero Maxi Truck and lesser

tonnage ACE to less than INR 39,000 as a

result of which it has gained 12% market share

over the last 2 years

> Most OEMs provide loans through their

financing arms in order to increase penetration

in this segment

2013-14

Force motors

Hindustan Motors

SCV Knowledge Paper_201409010_vf.pptx

11

SCV Cargo

M&M has successfully managed to convert <2T customers by

reducing the price gap between Bolero Maxi Truck & ACE

Case study – Bolero Pickup & Bolero Maxi Truck

Annual volumes and market share

Segment

share (%)

72%

57%

51%

+27%

Volumes

('000 units)

Bolero Maxi Truck

Bolero Pickup

59

15

44

62

15

48

96

63%

121

CAGR

growth rate

48

47%

73

18%

34

62

FY 2011 FY 2012 FY 2013 FY 2014

Source: SIAM, press research, primary interviews, Roland Berger

> 1.5-2T truck customers are shifting to Bolero Maxi Truck

(BMT) due to the following reasons:

– Price differential: Tata Ace which is a market leader in sub

2T category is only cheaper by less than INR 40K from

Bolero Maxi Truck

– Product differential: Incremental product improvements

makes Bolero Maxi Truck even more attractive:

- Pay load increases from 1.5T to 2.5T

- Engine displacement increases from 705 cc to 2523 cc

- Power increases from 16 HP to 62 HP

> M&M also has managed to launch several customer centric

programs in order to retain and grow SCV customer loyalty

for example:

– In May 2014, M&M launched Uday under which following

benefits are being offered to customers:

- Discounted mobile recharge coupons

- Accidental insurance (upto INR 2 lakhs)

- Referral bonus in the form of free service benefit

- Discounts on labor and spare parts

SCV Knowledge Paper_201409010_vf.pptx

12

SCV Cargo

Backup

Ashok Leyland followed a partner based approach for its SCV entry

and has established a significant brand value with success of Dost

Case study – Dost

Annual volumes and market share

Segment

share (%)

n/a

7%

18%

14%

+89%

34,794

Volumes

(units)

27,080

> First product from the Ashok Leyland Nissan Joint Venture –

based on the Nissan Vanette

> Commercial launch of Dost in September 2011 – Phased

launch covering only 6 states in the first few months

> Dost product upgrade in July 2013 to marginally increase

engine power and cosmetic changes such as headlight, tail

light, guard, steering wheel, instrumental cluster, dashboard

and rear ventilated glass

> Commission of new plant delayed due to the current market

slowdown. Plant to have a capacity of 150,000 units once

completed

> Passenger carrier (Dost Express) based on the same

platform already under trials

> Plans to have annual sales of around 45,000 in the next

couple of years

7,593

n/a

FY11

FY12

Source: SIAM, press research, primary interviews, Roland Berger

FY13

FY14

SCV Knowledge Paper_201409010_vf.pptx

13

SCV Passenger

Preference for soft top vehicles for intra-city and rural applications

has resulted in market share growth for Tata and Mahindra

Market share development – Passenger carrier1)

Model wise segment share trend 2010-14

214

235

24%

3%

8%

4%

0%

20%

Trip

Venture

32%

3%

25%

237

7%

2%

12%

2010-11

Maruti Suzuki

36%

2011-12

Tata Motors

1%

5%

11%

27%

4%

1%

Maxximo

7%

Magic

2%

20%

Soft top:

72,116 units

Maxximo

minivan

Eeco

Hard top:

118,628 units

30%

34%

2012-13

2013-14

Mahindra

Gio

Iris

21%

17%

43%

191

Omni

> Customers are increasingly

preferring soft top 4W vehicles over

the conventional 3W for urban share

taxi application

> Hard top vans are being replaced by

MPVs as end users demand more

comfort

> As a result, both Tata Motors and

M&M have managed to grow their

market share. Tata Motors owns

more than 30% of the market

> However, 4Ws have not managed to

topple 3Ws as they cost ~40% more

than 3W and weigh almost double

making them less fuel efficient

Force Motors

1) SCV segment includes Tata Magic/IRIS segment . However, for comparing purposes we have included hard top segment

Source: SIAM; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

14

SCV Passenger

3W Passenger

SCV Passenger segment has not been able to create in roads into

the 3W passenger segment where Bajaj Auto is the market leader

Market share development – 3W Passenger carrier

Model wise segment share trend 2010-14

350

425

406

441

385

2%

5%

2%

2%

3%

3%

2%

4%

4%

2%

3%

5%

10%

12%

10%

11%

Atul Auto

37%

33%

31%

30%

Piaggio

47%

47%

48%

51%

49%

Bajaj

2009-10

2010-11

2011-12

2012-13

2013-14

Force Motors

4%

1%

9%

Mahindra & Mahindra

Source: SIAM; Roland Berger

30%

Scooters India

TVS

> Overall 3W Passenger segment has

increased by CAGR ~2.4% over the last 5

years. However, it has declined by ~13%

the last year

> This segment continues to remain highly

regulated with most routes requiring

permits from government authorities

> Bajaj Auto continues to be a market leader

in the 3W passenger segment and

continues to account for ~49% of the

market

> This segment has managed to keep the

competition off from SCV Passengers

mainly due to the price gap (~40% less

than SCV Passenger). Also, they enjoy

strong lobbying with the government

bodies through the unions

SCV Knowledge Paper_201409010_vf.pptx

15

SCV Passenger

Backup

Negative growth in passenger carriers is driven by the increasing

preference for MPVs over hard top vans

Historical and projected sales, SCV passenger segment, 2011 – 2020 ['000]

Segment volumes 2011-20 – Passenger carriers1)

235

237

CAGR +1%

214

191

152

Hard tops

123

Segment share - MPV vs. Van

205

38

161

322

29%

27%

434

348

45%

45%

465

119

83

52

2011

-17%

300

70% MPV

167

Soft tops

CAGR

14-20

2012

+15%

71%

73%

55%

114

55%

72

2013

20141)

30% Van

2020

2011

2012

2013

2014

2020

> Hard top vans (primarily used as personal vehicle and as taxis) expected to have a negative growth due to shift towards MPVs and soft tops

> MPVs are preferred over conventional vans due to customer preference for better comfort and vehicle features

> Soft top vans used for intra city transport as an alternative for 3–wheelers expected to have a positive growth rate of 15% CAGR

1) SCV segment includes Tata Magic/IRIS segment . However, for comparing purposes we have included hard top segment

Source: IHS; SIAM; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

16

SCV product landscape

Key players augment their volumes by having presence across all

sub-segments in the SCV space

Product overview

GVW <1.5T

<2T

GVW

1.5-2.0T

Gio

Zip

Porter 600

Trump 151)

Maxximo

Ace

Porter 1000

Trump 40

Bolero maxi Truck

Superace

Mini truck

2-3.5T

Dost

Winner

Pickup

Trax Pickup

Passenger

carrier

Trip1)

Genio

Gio

Bolero Pickup

207

Xenon

Maxximo

Iris

Magic

Omni

Eeco

1) Not in production

Source: SIAM; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

17

SCV Industry expansion plans

Most OEMs have aggressive expansion plans in India. Significant

overcapacities to increase margin pressures in SCV

Investment landscape

SCV installed capacities ['000 units]

Selected future OEM investments in India [INR cr]

3,000

2,500

1,500

750

500,000

Isuzu

260,0001)

24,000

27,000

115,000

12,000

36,000

Total capacity : 974 k units

1) Estimated combined SCV/pickups production capacity across plants

2) Tata Motors: overall future investments in CV

Source: Company websites; Press research; Roland Berger

Ashok Leyland

Tata2)

Mahindra

250

Eicher

> Isuzu investment of 3000 Cr. for production of both SUVs and LCVs

(pickups) – Plant capacity of 100,000 in its AP plant

> Ashok Leyland Nissan JV total investment of 2500 Cr. of which 50% has

been spent already. Plant with capacity of 150,000 being built

> Tata Motors overall investment of 1500 Cr. for FY14-15. Investments

only for new product development. No additional capacity being planned

> Mahindra to invest 250 Cr. for expanding capacity in AP for SCV and

PV. Additional 500 Cr. for new product in ICV and LCV product

refreshes

> Eicher to invest 250 Cr. in the JV with Polaris. Potential additional

investments for own SCV models

SCV Knowledge Paper_201409010_vf.pptx

18

SCV applications

SCV Cargo is used in several industries across multiple

applications. SCV passenger support last mile connectivity

Application examples1)

SCV

cargo

Construction Material

delivery

Closed container

SCV

Passen-ger

School van

Cold drink/water

delivery

Cash van

Black & yellow taxi

Electrical goods

customer delivery

Mobile billboard

Private office pickup &

drop

1) Not exhaustive: Other applications include delivery vehicles for paint industry, poultry and mobile food vans etc.

Source: Company websites

Vegetable selling

Milk/water tanker

Intercity travel like

metro station pickup &

drop

SCV Knowledge Paper_201409010_vf.pptx

19

C. Demand drivers to

trump short to mid

term challenges

SCV Knowledge Paper_201409010_vf.pptx

20

Demand drivers

Growth of SCV segment will be driven by volume shift from other

vehicle segments and increasing need for last mile connectivity

Key demand drivers [1/2]

1

2

3

100%

100%

69%

63%

31%

37%

’10

’25

Need for last mile connectivity

> Increase in rural consumption drives growth in the light CV segment – SCVs form an integral

part of the hub & spoke model – SCVs required to reach the last mile

> Increasing urbanization and stringent traffic regulations in major cities limiting movement of

higher tonnage vehicles also aids the growth of the LCV/SCV segment

> Metro rail network is planned/under development in as many as 10 cities across India

amounting to ~650 km of metro lines further expanding market for last mile connectivity

Urban population ratio [%]

Better operating economics

> Preference for 4-Wheel higher tonnage vehicles over the smaller 3-Wheel vehicles primarily

due to the higher profitability with the 4W vehicle

> Within the SCV segment 2-3.5T is being preferred more due to the higher tonnage while the

.75T payload category (Zip/Gio) still remains a small volume segment

Margins

4W

3W

EBITDA

31.0%

15.5%

PAT

6.8%

2.3%

RoE

19.7%

7.9%

Availability of finance/interest rates

> SCV sales depend on the ease of availability of loan, % LTV and interest rates

> Higher delinquency rates in CV loans have led to tightening of lending norms - reducing LTVs,

more stringent due diligence processes and focusing only on large fleet operators with clean

track record

Rural

Urban

Delinquency rates

4.0%

2012

2011

2.0%

2009

2010

0.0%

1

6

11

Months since issuance

Source: RBI; UN; Analyst reports; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

21

Demand drivers

Growth of SCV segment will be driven by volume shift from other

vehicle segments and increasing need for last mile connectivity

Key demand drivers [2/2]

4

5

Better product quality than 3W

> Small commercial vehicles offer more headroom, leg room and cargo area

> Small commercial vehicles also have independent strut suspensions which help in reducing

vibrations, noise, waggling and shakes while traveling. It has coil-springs with semi-trailing arm

at the rear. These features gives it a car-like driving comfort and riding comfort

> SCVs come with doors and 4Ws are considered safer than 3Ws

> As a result products like Ace Zip (0.5 T) are growing at a rate ~10-15%

Specs

4W

3W

Power

11-60 HP 8-15 HP

GVW

0.5-3T

Mileage ~10-281)

(Kmpl)

< 0.5T

~30

Development of new applications for SCVs

> OEMs have been developing several applications for the SCVs in order to increase penetration

across industries

> Some of the new applications include paint industry, poultry, small water tankers, garbage

disposals, etc.

> This has helped in expanding the market for SCVs

1) Mileage varies by tonnage category

Source: Expert Interviews, Analyst reports; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

22

Challenges

Several challenges need to be overtaken in order to achieve higher

penetration of SCV Cargo and Passenger carriers

Major challenges

SCV Cargo

> This is a relatively new segment and

not many customers are aware about

its applications

> As a result it is the responsibility of the

OEM to develop and educate

customers on the various applications

> Last mile delivery system is highly

unorganized still depending greatly on

3Ws and other traditional modes of

transportation

Overall

> Most drivers are first time users of any

automobile. As a result considerable

effort is needed to train/educate them

about the vehicle/applications, etc.

> Lack of financing options: Drivers lack

credible credit history and it becomes

difficult for banks, etc, to give them

loans

> High delinquency rates: Tough

economic situation has lead to really

high delinquency rates (especially in

SCV passenger )

SCV Passenger

> This segment relies primarily on

government permits. Therefore, it

becomes extremely important to liaise

with government authorities to procure

the permits

> 3-wheeler lobby is extremely strong

and manages to take the bigger pie of

the permits

> There is a price gap of ~INR 90k

between SCV Passenger and 3Wheelers making it difficult for 3Wheeler customers to graduate to 4Wheeler carriers (Sales 3W: ~480k,

SCV P: ~72k)

> Considerable effort still needed to improve the penetration of SCV Cargo and Passenger carriers like better financing

schemes

> Need to develop an eco system around this segment including driver training schools, SCV Passenger carrier

unions/associations to counter the powerful 3W lobby and actively liaise with Government authorities

Source: Expert interviews, Roland Berger Analysis

SCV Knowledge Paper_201409010_vf.pptx

23

Challenges

Backup

Strong 3-Wheelers unions lobbying and lack of coordination

between government bodies impact SCV passenger carriers

Press clips

Source: Press clips

SCV Knowledge Paper_201409010_vf.pptx

24

D. Solid growth

expected but not

across all sub

segments

SCV Knowledge Paper_201409010_vf.pptx

25

Future outlook & projections

SCV industry will grow at a CAGR of ~13% till FY 2020 driven by

demand for better quality last mile connectivity/delivery vehicles

SCV Industry projected market evolution

['000 units]

Growth rates

[%]

> Growth projections are based on the regression

analysis based on GDP growth as SCV

FY

2013-20

FY

2014-20

> Rise in demand of SCVs in the rural sector driven

by better connectivity, rising income levels and

further urbanization of tier 3/4 towns and cities

5.6

15.1

> OEMs will continue to focus on this high growth

sector due to low penetration and huge potential

customer base

919

+13%

18%

SCV Passenger

552

21%

79%

FY

2013

432

17%

82%

83%

FY

2014

SCV Cargo

> Steady government for the next 5 years that is

focused on infrastructure development like metro

rail network and other growth related policies

8.0

13.1

> Customer preferences will continue to evolve

(soft tops, MPV/SUV, higher tonnage vehicles)

ensuring OEMs continue to innovate to develop &

market products as demanded

FY

2020

1) SCV segment includes Tata Magic/IRIS segment and also <3.5 ton cargo vehicles like ACE, Dost, Super Ace, etc For this comparison we have not included hard top vans (eg: Omni & Eco)

Source: SIAM, Roland Berger Analysis

SCV Knowledge Paper_201409010_vf.pptx

26

E. Choose wisely

where to play and

drive government

engagement

SCV Knowledge Paper_201409010_vf.pptx

27

Recommendations

OEMs need to focus on developing applications, understanding

customer needs and liaising with government authorities

Recommendations

> Understand the customer requirements as they keep on evolving. For example: Over the last 2 years customers

have moved to higher tonnage pickups. Important to pre-empt these trends and adapt

> Liaise with the local government authorities in order to further promote SCV Passengers

OEM

> Continue to spread awareness around the benefits, applications etc among its potential customers to further

grow the market

> Develop new applications in order to expand the market. Paint distribution, gas cylinders, water, waste disposal

examples of some of the new applications

> Develop drivers for this segment as majority of the end users belong to lower economic section of the society

and most likely will be the first time users of any kind of automobile

> Start investing and promoting infrastructure projects like Metro rail networks across the various congested cities.

This will help create opportunities for last mile connectivity

Government

> Streamline the Permit issuance system for SCV passenger carriers and create an environment for healthy

competition between SCV Passenger carriers & 3-Wheelers

> Come up with schemes like cheaper financing options to promote the usage of SCVs, specially in the rural

segment in order to further promote connectivity of rural areas with urban centers

Source: VECV; Roland Berger

SCV Knowledge Paper_201409010_vf.pptx

28

Please contact us in person if you have any questions

Your contact at Roland Berger Strategy Consultants

Dr. Wilfried Aulbur

Jeffry Jacob

Managing Partner

Senior

Project Manager

E-mail:

wilfried.aulbur@rolandberger.com

E-mail:

jeffry.jacob@ rolandberger.com

Mobile:

+91 9920 6301 31

Mobile:

+91 8879 3876 35

MUMBAI OFFICE:

7th Floor, VIBGYOR Tower

Bandra Kurla Complex, Bandra (E),

Mumbai 400 051

DELHI OFFICE:

Level 18, DLF Cyber City

Building No. 5, Tower A,

Gurgaon 122 002,

PUNE OFFICE:

4th Floor, ALAINA Building

Lane 8, Koregaon Park,

Pune - 411001

SCV Knowledge Paper_201409010_vf.pptx

29