Volume 34

Scan this code

for breaking

news and the

latest markets!

A

May 30, 2014

Social media, customization

are Millennial marketing keys

By Emily King

INSIDE

✦ Guest column:

‘Tribute to a friend

and colleague …

Carol Christison.’

For details, see page 4.

✦ World Food Championships

to feature cheese as key

category ingredient.

For details, see page 5.

✦ USDA updates safeguard

trigger levels for imports.

For details, see page 18.

✦ Exclusive: CMN’s

annual ‘Key Players.’

For details, see pages 21-68.

Number 19

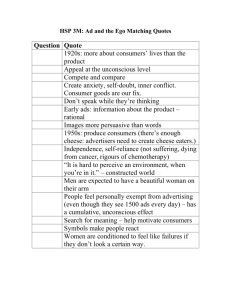

MADISON, Wis. — Marketers

have long utilized generational

segmentation to target specific

customers. The maturation of

mega-generations, the Millennials (born between 1982 and

2001) and the Baby Boomers

(born between 1946 and 1964),

has the potential to usher in a

new, chaotic marketplace, according to the report, “Trouble

in Aisle 5,” by Jeffries Alix

Partners.

By the year 2020, Millennials over the age of 25 will

account for approximately

20 percent of the population,

compared to 5 percent presently. The entirety of the Baby

Boomers will fall to account

Our Exclusive Annual Profile of

Who’s Who in the Cheese Business

By the staff of Cheese Market News

Cheese Market News’ “2014 Key Players,” our exclusive profile on

who’s who in the North American cheese business, takes an inside look

at what 52 cheese companies have accomplished in the past year and

their plans for the months ahead.

“Key Players” is not a ranking of companies. While we provide production and sales data whenever possible, instead of focusing on how

large a company is, each year this publication celebrates the successes

of cheese companies large and small. All of the companies profiled are

making important and distinct contributions to the growth of the dairy

industry as a whole, whether that means crafting an award-winning

cheese, generating new packaging and product styles, or developing or

increasing product lines that cater to growing international demand

as the United States set a new cheese export record in 2013.

While each profile within “Key Players” provides insight into a

specific company, in its entirety “Key Players” provides you with a

snapshot of the industry in 2014. This year, you will find some common

themes, including the growing emphasis on exports and more and more

companies focusing on environmental sustainability. “Flavor” is a word

that you will see many times throughout “Key Players” as companies

respond to consumers’ increasing demand for high-end products with

a flavor punch. And, as in years past, you will learn about companies

both expanding and consolidating operations as they watch their bottom lines and efficiently grow their businesses.

To find out more about the profiled companies’ past year and where

they are headed, please read on …

Turn to KEY PLAYERS, page 21 D

for less than 20 percent of the

population in that same time

period, the report says.

Jeffries Alix Partners cites

age 25 as a milestone — a time

when income and household

formation begin to accelerate and create the catalyst

for increased consumption.

Concurrently, Baby Boomers’

purchasing power will begin

to dwindle.

“The Millennial generation

is the most culinary aware generation in history, so it makes

sense that any food company

makes sure their products, messages and marketing align with

their wants and needs,” says

Jennifer Giambroni, director

of communications, California

Milk Advisory Board. “For the

cheese industry, this means

being where they spend their

time, whether online gaming

or on social media, and also

making products that support

their desire for healthy eating.”

U.S. Millennials already account for $1.3 trillion in direct

annual spending, of which

$430 billion is non-essential

spending, according to “The

Reciprocity Principle: How

Millennials Are Changing the

Face of Marketing Forever,” by

the Boston Consulting Group

(BCG).

A Mintel survey shows that says Eric Godlove, marketing

55 percent of Millennials are specialist, Yancey’s Fancy.

willing to spend more money “With all of the information

in grocery stores for the high- instantly available to them,

est quality ingredients, and they can be more jaded.”

Delineating the Millennials

retailers have been responding. For example, the Nielsen is not without its challenges

Perishables Group, a fresh as even their moniker fluctufood consulting company, found ates from Generation Y, to the

that the number of deli cheese technology generation, to the

flavors increased 57 percent be- first multicultural generation.

tween 2005 and 2010. The most And — as Jeffries Alix Partfrequent purchasers of specialty ners indicates — they’re just

cheeses are under 34 years old. different.

“Wisconsin Milk MarketAccording to “Trouble in

ing Board (WMMB) recently Aisle 5,” U.S. Millennials are the

conducted new awareness and most culturally diverse group in

perception research among history, with approximately 35

Wisconsin residents, targeting percent representing minority

Millennials who will be key groups. This generation also

future decision makers, with was born into a rapidly changthe hopes to encourage and ing world where information is

engage our dairy messages available almost instantaneousand content to develop a con- ly. Technology has accelerated

nection and understanding of the marketplace. Millennials

the Wisconsin dairy industry,” want what they want — when

says Heather Porter Engwall, and where they want it.

director of national product

“The Millennials are excommunications at WMMB.

tremely comfortable with

Taking into account the technology and tend to own and

burgeoning presence of the use multiple devices to connect

Millennials, it is imperative for with peers and brands,” Porter

the cheese industry to modify Engwall says. “They are also

existing marketing plans to suit highly engaged with the conthis younger generation.

tent they choose to view and

“This generation needs to tend to have more long-term

be addressed with a certain support for brands with active

amount of respect and honesty,” Turn to MILLENNIAL, page 16 D

Industry voices concerns

over market access, GIs

WASHINGTON — Trade ministers from the United States and 11

other countries last week completed a series of meetings to discuss

the ongoing negotiations of the Trans-Pacific Partnership (TPP).

“In a series of positive meetings we cemented our shared

views on what is needed to bring negotiations to a close,” the

ministers say in a joint statement released May 20 following the

two-day ministerial meeting held in Singapore. “We focused in

particular on making meaningful progress on market access and

also advanced outstanding rules issues in an effort to narrow our

remaining differences.”

Dairy and other industry groups, however, fear that significant

differences still remain before TPP can become a truly comprehensive agreement that will benefit U.S. agriculture. According

to several reports, Japan’s Minister of the Economy Akira Amari

Turn to MARKET, page 19 D

Bill would allow

more flexibility

for school meals

WASHINGTON — The

House Appropriations Committee on Thursday passed

on a vote of 31-18 a fiscal

year 2015 agriculture appropriations bill that includes

language allowing schools

under economic hardship

to seek a temporary waiver

from compliance with USDA’s new school meal regulations during the upcoming

school year.

Turn to SCHOOL, page 20 D

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

2

CHEESE MARKET NEWS® — May 30, 2014

MARKET INDICATORS

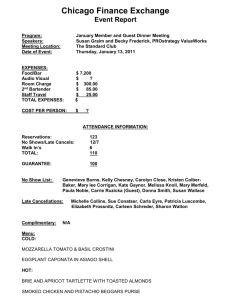

Chicago Mercantile Exchange

CHEESE FUTURES* for the week ending May 29, 2014

Cash prices for the week ended May 30, 2014

(Listings for each day by month, settling price and open interest)

Monday

May 26

Cheese Barrels

Price

Change

Cheese 40-lb. block

Price

Change

Markets

Closed

Tuesday

May 27

Wednesday

May 28

Thursday

May 29

Friday

May 30

$2.0325

+1 1/4

$1.9450

-8 3/4

$1.9200

-2 1/2

$1.9325

+1 1/4

$2.0000

-2

$2.0200

NC

$1.9600

-4

$1.9600

NC

Weekly average (May 27-30): Barrels: $1.9575(-.0265); 40-lb. Blocks: $1.9850(-.0030).

Weekly ave. one year ago (May 28-31, 2013): Barrels: $1.7113; 40-lb. Blocks: $1.7450.

Grade A NDM

Price

Change

$1.7975

+1/2

Markets

Closed

$1.8325

+1

$1.8225

+2 1/2

$1.8450

+1 1/4

$2.2950

NC

$2.2950

+4 1/2

$2.2500

+7

Markets

Closed

2.172

2.008

1.990

1.970

1.982

1.970

1.923

1.870

1.840

1.825

1.840

1.832

1.830

1.830

1.830

1.830

1,696

1,790

1,471

1,331

1,239

1,224

1,282

1,320

224

180

159

150

138

181

89

79

$2.3000

+1/2

Weekly average (May 27-30): Grade AA: $2.2850(+.1180).

Class II Cream (Major Northeast Cities): $2.7087(-.0362)–$2.9254(-.0616).

Total Contracts Traded/

Open Interest 77/12,658

Weekly Cold Storage Holdings

Butter

Cheese

22,229

87,700

+707

+44

May 26, 2014

Change since May 1

Pounds

Percent

+957

+1,597

+4

+2

Last Year

Pounds

Change

17,756

112,424

+4,473

-24,724

(These data, which include government stocks and are reported in thousands of pounds, are based on reports from

a limited sample of cold storage centers across the country. This chart is designed to help the dairy industry see the

trends in cold storage between the release of the National Agricultural Statistics Service’s monthly cold storage reports.)

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

67.65

66.50

62.88

61.75

59.78

59.00

58.25

56.28

55.00

53.48

52.50

52.00

52.00

435

477

369

340

264

191

174

234

82

29

49

34

31

19.32

10.78

14.50

13.48

17.05

18.14

21.15

17.03

9.31

14.28

17.00

16.06

17.25

23.35

18.00

10.44

12.78

19.40

15.72

16.93

23.33

16.76

10.78

12.92

16.87

15.72

17.59

24.31

18.18

9.84

13.38

16.52

15.23

18.52

20.25

9.97

13.62

19.11

15.63

18.02

18.24

9.97

13.74

21.39

16.68

17.38

Mon., May 26

Markets

Closed

17.32

11.20

15.18

21.67

17.73

17.91

16.28

12.11

16.26

19.07

19.00

18.14

17.06

12.82

16.94

18.03

21.02

18.22

15.51

14.08

15.44

19.07

20.83

18.83

15.28

14.98

13.83

18.77

18.66

18.95

SUBSCRIPTION INFORMATION

Susan Quarne, Publisher

(PH 608/831-6002; FAX 608/831-1004)

e-mail: squarne@cheesemarketnews.com

Kate Sander, Editorial Director

(PH 509/962-4026; FAX 509/962-4027)

e-mail: ksander@cheesemarketnews.com

Alyssa Mitchell, Senior Editor

(PH 608/288-9090; FAX 608/288-9093)

e-mail: amitchell@cheesemarketnews.com

Rena Archwamety, News/Web Editor

(PH 608/288-9090; FAX 608/288-9093)

e-mail: rena@cheesemarketnews.com

Emily King, Assistant Editor

(PH 608/288-9090; FAX 608/288-9093)

e-mail: eking@cheesemarketnews.com

Cheese Market News®, Publication #0598-030, (ISSN 08911509), is published weekly by Quarne Publishing LLC, 4692

Signature Drive, Middleton, WI 53562; Phone 608/831-6002;

FAX 608/831-1004. Periodicals postage paid at Madison, WI.

Circulation records are maintained by Quarne Publishing LLC,

4692 Signature Drive, Middleton, WI 53562. POSTMASTER:

SUBSCRIPTIONS & BUSINESS STAFF

Subscription/advertising rates available upon request

Contact: Susan Quarne - Publisher

P.O. Box 628254, Middleton, WI 53562

0(/.%s&!8

2.171

1.974

1.951

1.968

1.985

1.978

1.929

1.886

1.840

1.825

1.840

1.830

1.830

1.830

1.835

1.830

1,689

1,777

1,499

1,471

1,264

1,247

1,307

1,345

250

203

182

165

150

186

89

79

124/13,008

442/13,000

Tues., May 27

67.65

66.50

62.88

61.75

59.78

59.00

58.25

56.28

55.00

53.48

52.50

52.00

52.00

435

475

369

340

264

191

174

234

82

29

49

34

31

Wed., May 28

66.95

65.50

62.00

59.50

59.68

58.95

57.55

56.05

55.00

53.48

52.50

52.00

52.00

4/2,809

Send address changes to Cheese Market News®, Subscriber

Services, P. O. Box 628254, Middleton, WI 53562; Form

3579 requested; or call direct at 608/831-6002. All rights

reserved under the United States International and PanAmerican Copyright Conventions. No part of this publication

may be reproduced, stored in a retrieval system or transmitted

in any form or by any means, mechanical, photocopying,

electronic recording or otherwise, without the prior written

permission of Quarne Publishing LLC. Opinions expressed

in articles are those of the authors and do not necessarily

UHÁHFWWKRVHRI4XDUQH3XEOLVKLQJ//&GED&KHHVH0DUNHW

News®. Cheese Market News® does not endorse the products

of any advertiser and does not assume and hereby disclaims

any liability to any person for any loss or damage caused by

errors or omissions in the material contained herein, regardless of whether such errors result from negligence, accident

or any other cause whatsoever. Copyright 2014 by Quarne

Publishing LLC.

Subscriptions: $135 for U.S., second-class delivery; $190

IRU86ÀUVWFODVVGHOLYHU\LQFOXGLQJ&DQDGDDQG,QWHUnational rate to all others. Printed in U.S.A.

WEBSITE: www.cheesemarketnews.com

Thurs., May 29

435

476

375

353

264

191

176

241

82

29

49

34

31

66.95

65.25

62.00

59.25

58.25

58.75

57.55

56.50

54.95

54.45

52.50

52.00

52.00

60/2,850

Dry Products*

STAFF

John Umhoefer, FCStone, International Dairy Foods

Association, National Milk Producers Federation, U.S.

Dairy Export Council, Eric Meyer, Rice Dairy

Thurs., May 29

1,689

1,788

1,511

1,471

1,247

1,235

1,307

1,343

250

203

182

165

150

186

89

79

2.171

2.008

1.980

1.968

1.986

1.962

1.930

1.886

1.840

1.825

1.840

1.830

1.830

1.830

1.830

1.830

435

469

382

347

263

193

179

252

84

31

49

34

31

115/2,863

Daily market prices are available by visiting CME’s online statistics sites at http://www.cmegroup.com.

*Total Contracts Traded/Open Interest reflect additional months not included in this chart.

May 30, 2014

NONFAT DRY MILK

Central & East:

low/medium heat $1.7500(+1)-$1.9425(-4 1/4);

mostly $1.7500(+1)-$1.8650(-5 1/4).

high heat $1.9300(-2)-$1.9925(-4 1/4).

West:

low/medium heat $1.7600-$1.9600(-4);

mostly $1.7650-$1.8975(-4).

high heat $1.9500(-4 3/4)-$2.0650(-2 1/2).

Calif. manufacturing plants: extra grade/grade A weighted ave. $1.7723(-.0561)

based on 23,754,750 lbs. Sales to CCC: 0 lbs.

WHOLE MILK POWDER (National):

REGULAR CONTRIBUTORS

Wed., May 28

97/12,722

Total Contracts Traded/

Open Interest

3/2,811

CLASS III PRICE

(Dollars per hundredweight, 3.5% butterfat test)

YEAR JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

2008

2009

2010

2011

2012

2013

2014

1,694

1,796

1,470

1,344

1,247

1,226

1,290

1,333

224

180

159

160

145

181

89

79

2.172

2.083

2.055

2.020

2.020

1.975

1.940

1.888

1.840

1.825

1.840

1.830

1.830

1.830

1.830

1.830

DRY WHEY FUTURES* for the week ended May 29, 2014

Fri., May 23

Week

Change

Markets

Closed

Tues., May 27

(Listings for each day by month, settling price and open interest)

Sign up for our daily fax or e-mail service for just $104 a year. Call us at 608-288-9090.

On hand

Monday

Mon., May 26

Daily market prices are available by visiting CME’s online statistics sites at http://www.cmegroup.com.

*Total Contracts Traded/Open Interest reflect additional months not included in this chart.

Weekly average (May 27-30): Grade A: $1.8244(+.0329).

Grade AA Butter

Price

Change

Fri., May 23

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

JUN15

JUL15

AUG15

$2.0500-$2.1000.

EDIBLE LACTOSE

(FOB)Central and West: $.4300-$.6875; mostly $.5400-$.6325.

DRY WHEY

Central:

West:

(FOB) Northeast:

nonhygroscopic $.6425-$.7400(-1);

mostly $.6450(-1/2)-$.6850(+1/4).

nonhygroscopic $.5950(-1)-$.7325(+1 1/4);

mostly $.6250(-1/2)-$.6950.

extra grade/grade A $.6975(+1/2)-$.7575(+1 1/2).

ANIMAL FEED (Central): Whey spray milk replacer $.5200(+3 1/4)-$.6475.

WHEY PROTEIN CONCENTRATE (34 percent): $1.5200(-3)-$1.8900(-2);

mostly $1.6600-$1.8100(-1).

DRY BUTTERMILK

(FOB)Central & East: $1.8000-$1.8975(-1 3/4).

(FOB) West:

$1.7500-$1.9675; mostly $1.8200-$1.9050(-3/4).

CASEIN:

Rennet $4.7500-$5.2000; Acid $4.9000(-10)-$5.4000.

*Source: USDA’s Dairy Market News

DISCLAIMER: Cheese Market News® has made every effort to provide accurate current as well as historical market information. However, we do not guarantee the accuracy of these data and do not assume liability for errors or omissions.

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

May 30, 2014 — CHEESE MARKET NEWS®

MARKET INDICATORS

NEWS/BUSINESS

National Dairy Products Sales Report

For the week ended:

Cheese 40-lb. Blocks:

Average price1

Sales volume2

Cheese 500-lb. Barrels:

Average price1

Adj. price to 38% moisture

Sales volume2

Moisture content

Butter:

Average price1

Sales volume2

Nonfat Dry Milk:

Average price1

Sales volume2

Dry Whey:

Average price1

Sales volume2

5/24/14

5/17/14

5/10/14

5/3/14

$2.1128

*$2.1603

13,015,421 *13,196,519

$2.2125

12,368,048

$2.2460

11,318,467

$2.1978

$2.0959

8,604,343

34.99

$2.2730

$2.1651

10,115,480

34.91

$2.3326

$2.2299

9,178,463

35.14

$2.3554

$2.2556

10,329,392

35.26

$2.1192

5,440,889

*$2.0580

*3,537,062

*$1.9897

4,410,235

$1.9042

3,856,954

$1.8143

*$1.8554

36,265,429 *29,360,118

$1.8983

29,032,948

*$1.9473

*28,150,286

$0.6721

9,424,719

$0.6751

*8,212,183

$0.6808

8,224,028

*$0.6724

*8,907,590

*

/Revised. 1/Prices weighted by volumes reported. 2/Sales as reported by participating manufacturers.

Reported in pounds. More information is available by calling AMS at 202-720-4392.

CME FUTURES for the week ended May 29, 2014

Class III Milk*

Fri., May 23

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

APR15

MAY15

JUN15

JUL15

22.58

21.06

20.58

20.23

20.31

19.99

19.49

18.94

18.47

18.23

18.15

18.14

18.13

18.06

18.07

4,769

4,761

3,573

2,955

2,624

2,127

1,991

1,822

828

641

578

283

247

228

100

Mon., May 26

Tues., May 27

22.57

21.78

21.32

20.76

20.70

20.25

19.65

19.10

18.49

18.25

18.18

18.15

18.15

18.10

18.07

Markets

Closed

Total Contracts Traded/

Open Interest 990/27,977

4,744

4,818

3,551

2,957

1,651

2,180

2,000

1,894

829

649

589

291

280

231

101

1,864/28,222

Wed., May 28

22.57

21.03

20.57

20.12

20.34

20.00

19.58

19.00

18.47

18.21

18.18

18.15

18.15

18.15

18.07

4,746

4,711

3,610

3,135

2,659

2,192

2,013

1,901

826

661

583

302

290

233

101

1,721/28,420

Thurs., May 29

22.53

20.58

20.24

20.15

20.28

20.04

19.50

19.00

18.49

18.21

18.18

18.15

18.15

18.15

18.07

4,724

4,691

3,681

3,139

2,684

2,207

2,017

1,921

826

662

586

303

315

241

101

1,242/28,555

Class IV Milk*

Fri., May 23

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

MAR15

22.65

22.55

22.32

22.04

21.75

21.50

21.17

20.65

19.79

19.25

19.15

1,678

1,507

1,169

1,097

980

837

800

726

126

78

77

Mon., May 26

Markets

Closed

Total Contracts Traded/

Open Interest 134/9,102

Tues., May 27

1,678

1,526

1,193

1,134

1,002

855

816

758

163

111

109

22.65

22.60

22.50

22.27

22.10

21.70

21.40

20.85

20.03

19.40

19.15

3

Wed., May 28

1,670

1,536

1,194

1,151

1,008

869

819

762

167

114

112

22.75

22.60

22.49

22.23

22.09

21.70

21.35

20.81

20.03

19.40

19.15

496/9,393

112/9,450

Thurs., May 29

22.70

22.55

22.30

22.09

21.94

21.55

21.19

20.59

19.97

19.40

19.15

1,660

1,567

1,211

1,161

1,018

879

829

782

167

114

112

FDA extends comment period 60 days for

proposed food sanitary transportation rule

WASHINGTON — FDA recently announced it is extending the comment

period for the proposed rule on the

sanitary transportation of human and

animal food, required by the FDA Food

Safety Modernization Act (FSMA). With

a 60-day extension, the new comment

period will end July 30, 2014.

The rule will regulate the transportation of human and animal food

products to protect them from foodsafety hazards during transport.

The International Dairy Foods

Association (IDFA) says it believes

most dairy operations already are

practicing what is required by the

proposed rule, but they may need to

address recordkeeping requirements.

FDA has proposed a waiver for

transportation activities that are

performed under the authority of a

National Conference of Interstate

Milk Shipments permit. Some ambiguity exists, however, about whether

the waiver would apply to outbound

Grade A product shipments and

whether the inclusion of non-Grade

A products, such as orange juice,

on the same outbound shipments

would defeat the waiver, IDFA notes.

“IDFA is hopeful that common

sense will prevail and the waiver

will be applied in the fullest sense,”

says Clay Detlefsen, IDFA vice

president of regulatory affairs.

In addition, IDFA believes that

outbound shipments of finished

ice cream products should not be

within the scope of the rule. Even

if those products are subjected to

temperature abuse, they will not become adulterated; instead they will

become products that can’t be sold

because melting and refreezing alters

product quality, the organization says.

“The proposed rule will establish

requirements for vehicles and transportation equipment, transportation

operations, information exchange,

training, records and waivers,”

Detlefsen says. “It is intended to

eliminate food safety risks, like

improper refrigeration of food,

inadequate cleaning of vehicles between loads and failure to properly

protect food during transportation.”

IDFA says it will submit comments

on this rule.

FDA also recently announced that

is extending the comment period on

its proposed rule to revise the Nutrition and Supplemental Facts labels.

In the March 3 Federal Register,

FDA published a proposed rule titled

“Food Labeling: Revision of the Nutrition and Supplemental Facts Labels”

with a 90-day comment period to

request comments on amending its

regulations for conventional foods

and dietary supplements to provide

updated nutrition information on the

label to assist consumers in maintaining healthy dietary practices. (See

“FDA unveils proposal to update

Nutrition Facts label on foods” in

the Feb. 28, 2014, issue of Cheese

Market News.)

The deadline for comments now is

Aug. 1. Comments may be submitted

online at www.regulations.gov. CMN

161/9,580

Cash-Settled NDM*

Fri., May 23

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

187.65

180.25

180.03

181.00

181.00

179.00

177.08

174.13

168.78

747

621

486

399

421

356

338

306

41

Mon., May 26

Markets

Closed

Tues., May 27

187.75

180.75

180.00

181.08

181.30

179.50

178.00

175.50

169.25

Total Contracts Traded/

Open Interest

79/3,740

744

623

493

409

414

359

345

308

54

Wed., May 28

188.00

180.75

181.00

181.40

182.00

180.20

178.00

175.00

169.00

741

631

502

420

420

364

343

312

59

121/3,826

121/3,774

Thurs., May 29

186.75

179.75

179.75

180.80

180.48

178.75

176.80

173.50

169.00

741

653

496

416

414

365

349

329

59

150/3,870

Cash-Settled Butter*

Fri., May 23

MAY14

JUN14

JUL14

AUG14

SEP14

OCT14

NOV14

DEC14

JAN15

FEB15

204.90

216.50

210.00

201.63

199.75

194.00

191.75

189.00

178.75

179.75

1,069

1,110

925

859

765

570

536

351

23

29

Total Contracts Traded/

Open Interest

150/6,296

Mon., May 26

Markets

Closed

Tues., May 27

205.50

219.98

215.00

206.63

204.75

199.00

194.75

191.00

181.00

180.20

1,068

1,117

910

852

768

586

547

358

27

29

153/6,321

Wed., May 28

Thurs., May 29

1,065

1,120

908

861

775

588

563

358

30

29

205.25 1,063

219.98 1,136

210.00 912

205.40 861

201.25 778

195.50 592

192.50 576

187.30 360

30

180.50

30

177.00

121/6,356

105/6,410

205.25

219.75

212.00

206.98

203.25

196.50

193.00

188.25

180.50

180.20

Daily market prices are available by visiting CME’s online statistics sites at http://www.cmegroup.com.

*Total Contracts Traded/Open Interest reflect additional months not included in this chart.

For more information please visit www.nelsonjameson.com

DISCLAIMER: Cheese Market News® has made every effort to provide accurate current as well as historical market information. However, we do not guarantee the accuracy of these data and do not assume liability for errors or omissions.

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

4

CHEESE MARKET NEWS® — May 30, 2014

GUEST COLUMNIST

CMN Exclusive!

Perspective:

In Memoriam

Andrea Neu is a past president and

director of IDDBA and previously

served as vice president of marketing

services for the Wisconsin Milk

Marketing Board. She is the owner

of Image Maker and continues to

work as a marketing/brand strategy

consultant. Neu contributes this

column exclusively for Cheese

Market News®.

Tribute to a colleague

and friend … Carol Christison

The International Dairy-Deli-Bakery

Association’s (IDDBA) 50-year anniversary of its Seminar & Expo will not be the

celebration it might have been without

the association’s incredible leader, Carol

Christison, who passed away March 4

after a brave and determined fight with

cancer. But fortunately Carol did receive

accolades and highly earned recognition

for her 30-year anniversary as executive

director of the association from present

and past board members and staff during

last year’s expo, and we are thankful for

that celebration.

Carol’s life, aside from her deep

dedication to family and friends, was

totally devoted to the continuous growth

and services of IDDBA to heighten the

business successes of the dairy, deli and

bakery segments of the food industry.

When she was selected to take the

reins of the International Cheese &

Deli Association (ICDA) in December

1982, from Bill Reese and the Wiscon-

sin Department of Agriculture, Carol

brought an extensive background in

managing nonprofit organizations, but

her experience with this segment of

the food industry was limited. However,

in an amazingly short period of time,

because she was a stellar business

professional and an insatiable reader

and scholar, Carol quickly understood

and embraced this dynamic U.S. food

business and the association’s purpose.

1983 is when I had the privilege

of connecting with Carol, as an ICDA

member representing the Wisconsin

Milk Marketing Board. From the beginning it was obvious she was a strategic

thinker as well as a savvy marketer,

educator and determined leader. The

organization thrived, beginning with

Carol and a part-time bookkeeper, and

gradually growing to a current staff of 30

effective and committed team members,

hired, guided and mentored by Carol to

achieve the mission of IDDBA. In 1982

the corporate membership, primarily

dairy/cheese related, was not quite 100.

Today it is more than 1,500 members,

and the annual Seminar & Expo has

grown from less than 1,000 attendees

to nearly 9,000. And as always, staff will

expect to break another record this year

for both attendees and exhibitors.

With the ongoing support of the

board of directors, Carol changed the

organization’s structure, programs and

services to meet the dynamic needs

of our industry. She continually found

new opportunities to be financially

sound and self-sufficient, managing

the IDDBA budgets and finances as

frugally and sensibly as she managed

her personal finances. To diversify

IDDBA’s revenue sources she created

a portfolio of educational programs,

training materials and on-trend topics

presented initially by distinguished

speakers at the annual expo seminars.

This led to the What’s In Store annual

publication driven by Carol’s research

for her popular Marketplace Trends

presentation each year. Board members

and show attendees recognized her as

a “visionary and disciplined strategic

thinker” combined with her compelling

sense of humor and creative marketing

approaches. Carol’s constant search

for market intelligence and her recognition of the dairy, deli and bakery

industries need for primary market

research provided the foundation for

several research seminars at every annual expo, as well as the database for

IDDBA’s research publications offered

as educational products in the portfolio

of member services.

As the expo trade show floor grew

each year, the exhibitor’s booths were

organized around the unique Show &

Sell center … an extension of Carol’s

vision and ongoing goal to bring education and training onto the expo floor

for show attendees. The center also

In Loving Memory of

Carol L. Christison

Carol leaves a lasting legacy of

leadership, friendship, creativity, wit,

humor and wisdom. Carol’s exceptional

professionalism, service and support

of the IDDBA will be forever appreciated

and cherished.

“A life that touches others

goes on forever.”

provided an additional opportunity for

exhibitors to showcase their new dairy,

deli and bakery products that were displayed and creatively merchandised by

talented retail and supplier members

as they competed within the Show &

Sell area for recognition as innovative and outstanding merchandisers.

This educational center also provided

another source of revenue for the association and hands-on educational

tools for the membership beyond the

Seminar & Expo.

“I am not sure how one

could begin to measure

the value of Carol

Christison’s many

contributions to the

dairy, deli and bakery

industries... ”

Andrea Neu

IMAGE MAKER

Carol’s strategies led the International Dairy-Deli Association to become

IDDBA in 1991, resulting in exponential

growth as Carol and staff also focused

on fulfilling the needs of the bakery

industry, recognizing that most retailbuyer-members were managing and

responsible for both the deli and bakery

departments within the changing supermarket segments. Carol leveraged

this situation as a new opportunity for

additional products and services as well

as the association’s membership growth

and reputation.

Carol was a role model and mentor

for both staff and many members, and a

friend to board members … especially

present and past board presidents because of the length of the board terms

to serve on the Executive Committee.

Her gratitude for their board service and

her creative, personalized “induction

ceremonies” for incoming and outgoing

presidents will always be memorable!

I am not sure how one could begin to

measure the value of Carol Christison’s

many contributions to the dairy, deli

and bakery industries, or for those

people she has touched and benefitted

through her work, dedication and love

for this industry, but surely this is the

time and an opportunity to express our

appreciation for her devotion to IDDBA.

Thank you Carol for being a friend

to many, an inspiration to people who

worked with you, and for the legacy you

have created for those who will follow

you through this food industry in the future. We all are proud to have been associated with you and will miss you. CMN

The views expressed by CMN’s guest

columnists are their own opinions

and do not necessarily reflect those of

Cheese Market News®.

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

May 30, 2014 — CHEESE MARKET NEWS®

5

NEWS/BUSINESS

World Food Championships in Vegas to feature cheese as key ingredient in recipe category

By Alyssa Mitchell

LAS VEGAS, Nev. — The third annual “World Food Championships:

The Ultimate Food Fight” will be held

Nov. 12-18, 2014, in Las Vegas, with a

“World Recipe Championship” category

featuring cheese as the key ingredient

this year.

The World Food Championships

(WFC) is a yearlong, worldwide search

for the best team, cook or chefs in competition food sport that culminates in

a multi-day high-stakes “food fight” to

name the ultimate World Food Champion and award hundreds of thousands

of dollars in cash and prizes, says Larry

Oliphant, senior vice president of strategic partnerships, WFC.

“Food is America’s true obsession.

Online and local recipe competitions

give home cooks a venue for showing

off their best stuff and competing

with their own culinary creations,”

Oliphant says.

The World Food Championships

will select 50 winners from branded

competitions, online recipe contests

and live cookoffs to receive automatic

invitations to enter and compete at

WFC Nov. 12-18 in downtown Las Vegas.

To keep competitors, judges and

volunteers close to the action, WFC has

developed partnerships and special hotel packages with the D Las Vegas Casino

Hotel and Golden Nugget Las Vegas.

“Las Vegas is an excellent location

to host the World Food Championships,” says Mike McCloud, president,

WFC. “We have found the opportunities

available, specifically in downtown

Las Vegas, to be beneficial in helping

us build our event into the multi-day

culinary festival and spectacle it has

become.”

The field for the 2014 World Food

Championships has been expanded to

nine categories with 550 competitor

spots. Returning categories include:

Barbecue, Chili, Sandwich, Burger,

Dessert, Bacon and Recipe, while Pasta

and Seafood have been added as the

two new categories.

There is a “tournament-style” cookoff process for all WFC category competitions. The competition structure will

be split into multiple rounds, including

an opening “Challenger” round and a

Category Finals round, after which each

category champion will advance to the

Final Table for the WFC Champion to

be named Nov. 18.

As in years past, the Recipe category

has a specific ingredient, with this

year’s theme of cheese. Competitors in

the World Recipe Championship, held

Nov. 13-15, will be creating dishes that

focus on cheese, and the champion will

earn their right to fight for the grand

prize and the coveted title of World

Food Champion at the Final Table,

Oliphant says.

“We decided cheese is too big to

simply be the ‘window dressing’ for

other categories,” he says.

He notes that in the first round,

competitors will make their own signature dish with cheese. In Round 2,

contestants will all be given the same

recipe with which to craft their own

interpretation. The top 10 finalists will

go on to a final round and will be given

an additional ingredient to use.

Registration for competitors ends

on Oct. 20 with an entry fee of $200.

Potential competitors must qualify to

compete in Las Vegas.

In addition, WFC will run seven Food

Champ Challenges online recipe contests on Kenmore’s cookmore.com this

summer to qualify five competitors with

free entry to WFC. A grand prize winner

for each contest also will get $500 and

a free trip ($1000 travel stipend) to Las

Vegas. The Cheese-themed Challenge

begins July 31.

The competition panel also is seeking judges for various categories including the Recipe competition at WFC and

currently is accepting applications.

According to Jeff Morris, communication/media director, WFC, World

Food Championships is judged on its

own proprietary EAT Judging Method.

“This method is specific enough to

treat each entry with the respect it

deserves, but broad enough that any

food category/dish can be judged using

the same method,” Morris says.

EAT stands for Execution, Appearance and Taste, Morris notes. When

evaluating with this method, judges

look for:

• Appearance — Does it look right?

Does it look appetizing? Has it been presented in a visually appealing manner?

• Taste — Does it taste right? Is

there an appropriate balance of flavor

and ingredient? Does the aroma match

the taste? Is there an interesting or

complex or appealing build of flavors?

• Execution — Did it all come together? After reviewing the recipe, was

the chef successful with their execution

of the dish?

Onsite training of WFC’s EAT

method will occur for all chosen judges

prior to each competition, Morris notes.

For more information, visit www.

worldfoodchampionships.com. CMN

IDFA launches the NextGEN Dairy Network

initiative for dairy industry professionals

WASHINGTON — This week the International Dairy Foods Association

(IDFA) launched the NextGEN Dairy

Network, an initiative focused on helping up-and-coming dairy industry professionals build their careers. Through

online forums, networking and targeted

training sessions, the NextGEN Dairy

Network will provide professionals who

have less than 15 years of dairy experience with access to the information,

tools and expertise necessary to be

successful in the industry.

“The NextGEN Dairy Network

enables industry professionals at all

levels to grow, collaborate, network,

solve problems and develop the skills

necessary to hold leadership positions

in their companies, as well as in IDFA

and its constituent organizations,” says

Clay Hough, IDFA senior group vice

president and general counsel.

The NextGEN Dairy Network will

encourage members to:

• Network with industry peers who

also are building their careers;

• Gain a better understanding of hot

topics and emerging issues;

• Participate in online career development forums and have specific access

to articles and interviews with IDFA and

dairy industry leaders;

• Learn how industry peers solve

challenges and advance their careers;

• Receive special invitations to

and discounts for IDFA trainings and

events that will help develop the skills

and knowledge necessary for careerbuilding;

• Participate in a range of special

activities that will help participants

build the skills necessary to prepare

for leadership opportunities in their

respective organizations; and

• Connect in person at meetings

sponsored by IDFA throughout the year.

“Dairy is a unique and exciting industry. There’s a certain camaraderie that

you do not find in other industries,” says

David Ahlem, chief operating officer,

Hilmar Cheese Co. and a board member

of the National Cheese Institute who

serves as an advisor to the NextGEN

Dairy Network.

“NextGEN Dairy takes advantage of

this camaraderie to help grow our next

generation of plant managers, marketing executives, R&D professionals and

other individuals who continue to make

our industry great,” he says.

The network is open to all employees

of IDFA member companies and business partners who have less than 15

years of experience in the dairy industry.

There is no cost to join. For more

information, visit www.idfa.org/next

gen or contact IDFA’s Robin Cornelison

at; rcornelison@idfa.org.

CMN

RMC

Superior Cooling, Shape,

Production, and Flexibility

With the highest production volume in the

world, the RMC (Rotary Molder Chiller)

forms and cools large volumes of

mozzarella, provolone, and pizza

cheese in various shapes based on

your requirements.

Available in multiple sizes with quickly

interchangeable molds to accommodate

your production demands.

FOR MORE INFORMATION, VISIT US ON THE WEB AT

www.johnsonindint.com

For more information please visit www.johnsonindint.com

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

6

CHEESE MARKET NEWS® — May 30, 2014

GUEST COLUMNIST

Perspective:

Dairy Marketing

As director of communications for

the California Milk Advisory Board,

Jennifer

Giambroni

oversees

consumer, trade and industry outreach to build awareness and demand for Real California Milk and

dairy products.

The many platforms for showing,

selling and telling the dairy story

includes everything from flavorful refrigerator dips to healthy spreads and

innovative ways to enjoy our favorite

food — cheese. And I’m sure you’ll

see an appearance or two by our pal

yogurt who keeps popping up in all

sorts of new places.

Much like the IDDBA Show & Sell

Center, over the years CMAB’s IDDBA

booth has put an increased emphasis

Once again the International DairyDeli-Bake show is upon us and whether

you’re a dairy processor, retailer or

marketer like me, you’re likely excited

about the new products and information that will be presented during the

show. Like our partners and competitors, each year we put great care into

putting together the very best that

California has to offer. This year that

not just on the selling but also the

telling. We’ve created bigger platforms

for our experts to offer ideas for pairing cheeses and other dairy foods to

tap into trendy new flavor profiles

or to showcase how a small amount

of specialty cheese and other dairy

ingredients can add big flavor (and

profits) to service deli offerings. As

retailers compete more and more with

fast-casual restaurants, these ideas are

appreciated by our partners.

According to a recent report from

Technomic, three areas of growth for

the fast-casual category include bakery/café, sandwiches and pizza. These

are all areas where retailers are and

will continue to compete for customers with dairy leading the way. It’s no

secret many consumers want it quick,

convenient and portable but they are

placing an increasing focus on quality

ingredients, diverse options and unique

flavors. That’s right in the wheelhouse

for dairy foods and ingredients, which

also bring a level of functionality that’s

hard to replicate.

Beyond offering a myriad of ideas

for sampling and showcasing dairy

products in the Real California Pairing

Station and Pizza Kitchen, we will play

host to a large group of marketing representatives and dairy buyers from the

11 Asian countries where we’re actively

promoting California dairy, making the

program truly international. The CMAB

booth also will give attendees a sneak

preview of our new online look and feel

that will launch with the “Califarmia”

website at the end of June.

Like our booth and “Street of Dairy,”

Califarmia is more than a destination

for consumers and food professionals

to access information about California

dairy products. It captures the meaning and messages behind the Real

California Milk and Cheese seals, the

“Intel Inside” for dairy processors that

source California milk. It’s about the

farmers, the cows, the land and the

food that comes from the “Land of

Milk & Sunny.” Our partners who use

the seals on their packages not only

tap into this heritage and the history

of innovation behind California dairy

but the marketing programs and support that come from using 100 percent

California milk.

Although we saw a 75 percent increase in website traffic last year from

the year prior, what really is going to

matter moving forward is engagement.

While our television and digital advertising campaigns work to drive awareness and affinity for the Real California

Turn to GIAMBRONI, page 7 D

®

Visit the CMAB Street of Dairy to meet the following Artisans:

9th Street Cheese, Inc., Booth 4847

Bellwether Farms, Booth 4944

Cacique, Booth 5042

California Dairies, Inc., Booth 4850

Challenge Dairy Products, Inc., Booth 4948

Crystal Creamery, Booth 4945

Dairy Farmers of America, Booth 4648

Di Stefano Cheese Co., Booth 4747

Fiscalini Cheese Co., Booth 4947

Joseph Farms, Booth 4849

Karoun Dairies, Booth 4742

Marin French Cheese Co., Booth 4646

Pacific Cheese Co., Booth 4649

Point Reyes Farmstead Cheese Co., Booth 4745

Rizo Lopez Foods, Booth 4844

Rumiano Cheese Co., Booth 4848

Santini Foods, Inc., Booth 4746

Sierra Nevada Cheese Co., Booth 4950

Smithway Foods, Booth 4647

Sweet Chills, Booth 4645

Valley Ford Cheese Co., Booth 4949

World Grocer, Booth 4748

For more information please visit www.realcaliforniamilk.com

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

May 30, 2014 — CHEESE MARKET NEWS®

7

NEWS/BUSINESS

Australian dairy groups partner in successful trial to ship fresh fluid milk to China

SOUTH LISMORE, Australia — Dairy

Connect, Norco Cooperative Ltd. and

Peloris Global Sourcing Pty Ltd. (PGS)

have jointly confirmed a successful trial

shipment of fresh fluid milk to China

from Australian dairy farms.

International export consulting

company PGS, in collaboration with

nonprofit dairy industry promotion and

support organization Dairy Connect

and farmer-owned dairy cooperative

Norco, implemented a quarantine

clearance agreement with China to

bring the delivery time to seven days,

well within the shelf life of pasteurized

fluid milk from Australia.

George Davey, chairman of Dairy

Connect, says this commercially viable cold chain pipeline will open the

door for millions of liters of fresh milk

exports from Australia to China each

year. To date, he says, export efforts had

been hampered by lengthy testing and

quarantine processes before shipment,

and again upon arrival. Previously the

export lead time ranged from 14 to 21

days, which was not compatible with

the normal shelf life for pasteurized

milk.

The breakthrough came after 12

months of collaboration between

PGS and Chinese officials to develop

rigorous quality assurance protocols

that now have been fully tested and

temperature at all times during transit and that it incorporates a product

security system which identifies and

tracks the location of individual units.

Following the recent success of the

trial shipment, Norco now has plans underway to begin commercial shipments

of its full range of fresh milk products.

“This opens the door for Norco

to access the burgeoning demand

from Chinese consumers for Australian fresh milk products,” says Greg

McNamera, Norco chairman. “The

pipeline has the capacity to deliver

more than 20 million liters of fresh

milk to consumers in China within the

first 12 months of operation.” CMN

officially sanctioned by the relevant

Chinese agencies. As a result, the PGS

cold chain pipeline has been supported

by changes to existing Chinese import

clearance procedures to accommodate

the limited shelf life of fresh milk imports from Australia. A trial shipment

of almost 1,000 liters of Norco’s fresh

fluid milk was successfully completed

in March.

Peter Verry, managing director

for PGS, says the cold chain pipeline

solution includes quality assurance

controls that ensure that the milk

meets or exceeds China’s food health

and safety standards. It also ensures the

product is maintained at the optimal

GIAMBRONI

Continued from page 6

seals through consumer impressions

and engagement, Califarmia will connect with our social media channels to

forge deeper relationships and affinity for the seals through content that

people want to share.

Outside of IDDBA and the launch of

Califarmia, June brings us the opportunity to amplify the conversation about

dairy amongst many audiences with

Dairy Month activities. Each year we

celebrate “Real California Milk Month”

in the state with blogger partnerships,

couponing, recipes and sharable ideas

for using dairy every day. Those activities

will continue. This year, however, we’re

leveraging the dairy month platform to

build awareness of the bigger conversation about hunger and access to healthy

foods like milk by supporting the Great

American Milk Drive in California.

Our dairy farm families, together with

our processor and nutrition education

partners at the California Fluid Milk

Processor Board and Dairy Council of

California, will use June to promote

the need for quality dairy nutrition at

every table. We’ll do this in a real and

tangible way by getting out into the

community with service days at local

food banks and providing matching

funds up to $30,000 for California milk

donations throughout the month, when

low-income children and families who

aren’t able to participate in school nutrition programs are especially vulnerable.

We’re so fortunate to enjoy the

bounty of dairy products from the milk

we pour on our cereal and stir into our

coffee in the morning to the cheese that

holds our lunchtime sandwich together,

the butter we sauté our fish in at dinner

and the frozen ice cream goodness that

ends the day. We hope to share some

of this bounty with you at IDDBA or a

June Dairy Month celebration. CMN

The views expressed by CMN’s guest

columnists are their own opinions

and do not necessarily reflect those

of Cheese Market News®.

Flavours of

The Swiss Mountains

Drawing upon the traditions and methods of

highly regional Swiss cheesemakers, Mifroma

introduces three new products that represent

Swiss regional cheesemaking expertise.

As fresh and vibrant as the Alpine valleys they hail

from, Edel Suisse, Gottardo and Swiss Flower are

defined by their depth of flavor, delightful appearance, or suitability for particular wines or food.

Edel Suisse is sweet, spicy and beautifully carved

with folkloric motifs, sure to make a stunning

statement on any cheese board. Gottardo is

the pinnacle of Swiss Italian cheese, made with

savory milk from the Leventina mountain valley.

The highly original Swiss Flower, scattered with

Alpine flowers, is matched in appearance by a

delightfully soft, floral texture.

Mifroma is pleased to present these lesser

known yet highly renowned regional cheeses to

the delight of all your gourmet customers.

Discover our complete range of authentic cheeses from Switzerland at www.mifroma.com

For more information please visit www.mirfroma.com

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

8

CHEESE MARKET NEWS® — May 30, 2014

GUEST COLUMNIST

Perspective:

Dairy Marketing

James Robson is CEO of the

Wisconsin Milk Marketing Board

where, since 2001, he leads the

farmer-funded organization charged

with building demand for Wisconsin

milk.

A year of anniversaries,

decades of accomplishments

This year’s Show of Shows seminar

and expo celebrates the 50-year anniversary of the organization that is today

the International Dairy-Deli-Bakery Association (IDDBA). With a membership

of more than 1,450 companies, IDDBA

has grown to be a powerful retailing

force representing small independents,

regional chains and national and international supermarkets. Additionally,

its membership attracts a full range

of food manufacturers, brokers and

distributors from small entrepreneurial

companies to some of the largest multinational food companies in the world.

Those of us who exhibit annually in

the show are among the more than 8,000

registrants who visit 1,600-plus booths

to take in an amazing array of products

and state-of-the-art merchandising

ideas, learn from a host of educational

seminars and hear from speakers at

the highest levels of government and

industry. What was founded in 1964

as the Wisconsin Cheese Seminar has

become an influential trade association,

and Wisconsin Milk Marketing Board, a

firm believer in food industry partnerships, is proud to have played a role

in building this dynamic organization

over the years.

So much of IDDBA’s growth and vitality is due to the leadership of the gifted

Carol Christison, who was at its helm

for more than 30 years. Not only was

she an executive of vision, intelligence

and keen wit, Carol had the ability to

draw a full house time after time for

her annual 8:15 a.m. “industry trends”

speech on Monday of the conference.

You simply couldn’t afford to miss that.

Her death came too soon, and we join

the countless others who are saluting

her achievements at this year’s show.

Coincidental to this 50-year birthday

for IDDBA, Wisconsin Milk Marketing

Board (WMMB) also is celebrating

anniversaries this year. Two programs

with important relevance to marketing and retailing — the Wisconsin

Master Cheesemakers program and

the What’s New from Wisconsin new

product bulletin — are marking their

20th years. These two efforts launched

in 1994 in many ways anticipated the

now well-established importance of

identifying a product’s place of origin.

Consumers increasingly want to know

where their food comes from and related

information.

The Wisconsin Master Cheesemaker

program, similar to European master programs and the only one of its kind in the

United States, is advanced educational

training for active, licensed Wisconsin

cheesemakers with at least 10 years’

experience. To enroll in a program for

certification for a single cheese, the

cheesemaker must have been making

the variety for a minimum of 5 years.

The program is jointly sponsored by

WMMB, the Wisconsin Center for Dairy

Research and UW-Extension. In 1994,

four Wisconsin cheesemakers enrolled

in this stringent curriculum that involves classroom education, a 40-hour

written final exam and instructor visits

to plants for product evaluation. As of

today, more than 60 masters have been

graduated, working in a combined total

of 33 Wisconsin cheese companies. They

represent 36 different varieties of cheese.

Not only does the Master’s curriculum produce superior skills and cheeses,

it offers additional advantages to retailers. A Master’s Mark logo, as well as the

familiar Wisconsin Cheese logo, has

been developed for use on packaging of

certified cheeses, clearly identifying the

product’s Wisconsin origin, a location

that cheese shoppers value, according

to WMMB research. A recent study

conducted by Information Resources

Inc. for WMMB in partnership with

a Wisconsin cheesemaking company

found that adding the Wisconsin logo

and the word Wisconsin to packaging

resulted in a 5.9 percent increase in

volume sales. Additional consumer

research has found significantly higher

purchase interest as well as perceived

overall quality and value for Wisconsin

identified cheese.

The What’s New from Wisconsin

publication was developed by WMMB

in 1994 to introduce new Wisconsin

product entries to the marketplace and

is currently mailed to some 8,000 food

industry professionals as well as appearing on WMMB’s website, eatwisconsincheese.com. The circulation reflects a

major emphasis on grocer retailers and

is used not only for information but

for sourcing, according to evaluative

WMMB research. Each product featured

in the issue must display Wisconsin

identification on its packaging, such

as the trademarked WMMB cheese

logo. In its 20 years, What’s New from

Wisconsin has introduced almost 600

products from America’s Dairyland.

IDDBA and WMMB anniversaries

remind us of just how much the cheese

market has expanded over the decades.

What’s in Store, IDDBA’s signature

publication now in its 28th year, has

reported and predicted growth and

change over the decades as it profiles

consumer lifestyle trends, cheese at

retail, the dairy department, deli department and bakery department. Since

IDDBA was founded as the Wisconsin

Cheese Seminar in 1964, per capita

cheese consumption in the United

States has risen from 9.4 pounds in 1964

to 33.5 today (USDA), an increase of 256

percent. In the last almost 20 years, the

number of in-store delis has increased

from 23,008 in 1993 to 30,300 in 2012

(Progressive Grocer Deli Update). In

1993, retail supermarket cheese sales

(exact weight and random weight

scanned sales) were estimated at $4.7

billion (What’s in Store, Progressive

Grocer) while in 2013 retail cheese

sales in traditional grocery stores were

at $13.3 billion (IRI, Freshlook). That’s

an average growth rate of 5.3 percent.

We’ve witnessed the rise in American-made specialty and artisan

cheeses, increasing food savvy and

curiosity among consumers, new food

distribution vehicles, the emergence

and influence of social media and

entry of big box and super centers,

among other events. There have been

proliferation in digitalized customer

information, including shopping habits

and preferences; the development of

sophisticated prepared food sections;

an increase of boutique “cheese stores”

within the store; accelerated check-out

technology; and burgeoning ethnic and

“healthy” food sections, to name just a

few of the developments that have been

noted and analyzed by What’s in Store.

IDDBA’s first 50 years have been

quite a ride, and the journey is only

beginning. We encourage all IDDBA registrants to celebrate and

toast the anniversaries with WMMB

and Wisconsin cheesemakers at the

annual Monday night IDDBA cheese

extravaganza party to be held at Sports

Authority Field at Mile High, home of

the Denver Broncos. So get your game

face on — we’ll see you there! CMN

The views expressed by CMN’s guest

columnists are their own opinions

and do not necessarily reflect those of

Cheese Market News®.

NEWS/BUSINESS

Cheese ad volume tops all surveyed dairy

products, AMS says in biweekly report

WASHINGTON — Though overall cheese

ads decreased 7 percent from two weeks

ago, national cheese ad volume still tops

all surveyed dairy products, according to

the latest biweekly National Dairy Retail

Report released Thursday by USDA’s

Agricultural Marketing Service (AMS).

The weighted average advertised

price of 8-ounce shredded natural

cheese, $2.37, was down from $2.52 in

the last report but up from $2.25 last

year, AMS reports. The average price of

8-ounce block cheese in natural varieties

was $2.44, down from $2.48 two weeks

ago but up 16 cents from $2.28 last year.

Natural varieties of 1-pound shredded

cheese had a weighted average price of

$3.42 this week, down from $4.46 two

weeks ago and $3.64 last year. One-pound

natural cheese blocks averaged $4.32,

down from $4.58 two weeks ago but up

from $3.80 last year. The weighted average price for natural varieties of 2-pound

cheese blocks was $7.55 this week, up

from $7.48 two weeks ago and $7.12 last

year, AMS says.

The volume of butter ads was one

of the biggest percentage category

gainers this week. One-pound retail

butter averaged $3.14 per pound, up 42

cents from $2.72 two weeks ago and up

37 cents from $2.77 last year.

CMN

Tetra Pak planning to relocate headquarters

DENTON, Texas — Effective June

30, Tetra Pak Inc. is moving its North

American Headquarters to 3300 Airport

Road, Denton, Texas.

The new headquarters will house

all Tetra Pak functions under one roof,

including packaging material manufacturing, technical services, commercial

and marketing functions, and its R&D

pilot plant.

In addition, Tetra Pak’s processing

offices previously located in Lake Geneva, Wis., and its current office in Vernon

Hills, Ill., will move to one integrated facility. Effective June 30, Tetra Pak’s processing, spare parts distribution center

and HR Service Center will be located in

a new facility in Vernon Hills, Ill. CMN

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

May 30, 2014 — CHEESE MARKET NEWS®

9

NEWS/BUSINESS

Study finds proposed Nutrition Facts label updates may be more effective than current label

WASHINGTON — A study recently

conducted by the Georgetown Institute

for Consumer Research finds that consumers find recently-proposed updates

to Nutrition Facts labels by FDA are

easier to read in less time.

The last time FDA changed the labels

for the nutritional information of foods

was 1993, the study notes. Much has

changed since then in terms of nutrition

and food consumption. Most notably,

there have been significant increases

in the rates of overweight and obese

Americans. In the years between 1988

and 1994, approximately 23 percent

of the population was obese and 55

percent was overweight, but by 2010,

36 percent were obese and 69 percent

were overweight.

Currently, almost all packaged

products in the United States require

nutritional labels, the study adds. Despite this, many Americans still fail to

make healthy dietary choices. While

there are many reasons for this, FDA has

suggested that better labeling, that is

clearer and easier to comprehend, could

help improve consumers’ decisions.

To improve nutrition labels on foods,

FDA has proposed two significant

changes to the current standards.

One is a reformatting of the current

nutritional facts layout, which would

emphasize calories and serving size;

the other change would be adjusting

serving sizes to reflect what consumers

actually consume. (See “FDA unveils

proposal to update Nutrition Facts

label on foods” in the Feb. 28, 2014,

issue of Cheese Market News.)

To assess the effectiveness of the

proposed changes to label formats and

serving sizes, Chris Hydock and Anne

Wilson, researchers with the Georgetown Institute for Consumer Research,

conducted a study in March in which

consumers evaluated the healthiness

of foods and the helpfulness of the

proposed labels as well as the current

labels.

The study presented consumers with

three food items: a 20-ounce bottle of

soda, a frozen pizza and an 8-ounce bag

of chips. Consumers were presented

with a picture of each product followed

by a picture of its nutritional facts label.

Consumers were randomly assigned to

view the current label, the proposed

label or an alternate proposed label.

Each label also was presented with

nutritional information for the existing

serving size values or nutritional information for 1.5 times the existing serving

size, which is closer to the proposed

FDA serving size adjustments.

Lastly, nutritional label information

was presented for either 10 seconds,

to mimic an in-store viewing, or for

an unlimited quantity of time to allow

for careful review. Consumers then

indicated how healthy they perceived

each item to be and how informative or

helpful they found the labels.

Researchers note that two important

patterns emerged in the results:

• When consumers viewed labels

that depicted the larger serving sizes,

consumers perceived the food to be

less healthy. This result is consistent

with the goals of FDA; foods labeled

with larger serving sizes will increase

perceptions of unhealthiness and in

turn hopefully decrease the amounts

Americans consume.

• Consumers found the proposed label and alternate label to be more helpful when allowed only a brief, 10-second

view. But when given unlimited time to

look at the label, consumers found the

original label to be more helpful than

the proposed and alternate labels. This

result is particularly important because

consumers typically only briefly look at

nutritional labels when shopping, and

labels should be designed accordingly,

the study says.

Researchers say these results have

important implications for future

policy on nutritional labeling. The most

important impending change to nutritional labels seems to be the proposed

change to serving size. This will likely

come as a welcome change to consumer

advocates who often argue that smallerthan-reality serving sizes can be seen as

a method of deceiving consumers into

believing products are less healthy than

they are in reality, they add.

Also notable is the fact that the

newly-proposed label presentations

were rated as more helpful in the

brief viewing scenario. This can be attributed to the fact that the proposed

labels achieve their goal by prominently displaying the most important

information on nutritional labels,

the study says. Additionally, the brief

viewing scenario was independently

determined to closely match how long

consumers actually spend looking at

labels. Together, these results support

FDA’s proposed changes to nutritional

labeling, according to researchers. CMN

W

e are your custom sourcing specialists for procuring Quality Cheddar Cheese to meet

your specific needs. Celebrating 12 years in business and staffed with over 108 Years

Combined Experience in the cheese industry. Please contact a “WAG” employee today for

more info. We are here to meet your needs. Visit us on the web at www.wagcheese.com

Monitored Set Aside Cheddar Programs

40# Colored & White

640# Colored & White

Cheddar Cheese Aging Programs

40# White & Colored; 640# Colored & White

Cheddar Spot Sales (colored & white)

Fresh to 10 years. Available in LTL & T/L's

Grading Services

FIVE Licensed WI Cheese Graders

2nd & 3rd Generations

Flavor & Functionality Profiling

Mild, Medium, Sharp, XSharp & Beyond

Chunk, Shred, Slice, Dry, Process, Etc.

Warehouse & Financing Available

Throughtout Wisconsin

3051 Progress Way, Suite 206, Kaukauna, Wisconsin 54130

P: 920.759.1534 F: 920.759.1529

Ken Neumeier, President & CEO, ken@wagcheese.com

Kate Neumeier Clarke, V.P. & COO, kate@wagcheese.com

photo copyright WMMB

For more information please visit www.wagcheese.com

For more information please visit www.theciaa.org

Reprinted with permission from the May 30, 2014, edition of CHEESE MARKET NEWS®© Copyright 2014 Quarne Publishing LLC; PH: (509) 962-4026; www.cheesemarketnews.com

10

CHEESE MARKET NEWS® — May 30, 2014

PEOPLE

Foremost Farms names its 2014 agricultural education scholars

BARABOO, Wis. — The 2014 winners of

Foremost Farms USA’s agricultural education scholarships are pursuing degrees in

dairy science, herd management, veterinary medicine and agriculture education.

Ten children of Foremost Farms

USA members have won scholarships

worth $2,000 each. Applicants for

the scholarship must be pursuing an

agriculture-related curriculum. The

scholarship is funded by the Foremost

Farms USA Charitable Foundation.

•Collegiate scholars

Laura Crosby, Greensburg, Ind., will be

a sophomore this fall at Purdue University,

West Lafayette, Ind., working toward a

degree in agricultural education.

Danielle Hegemann, Union Grove, Wis.,

will be a sophomore this fall at the University of Wisconsin-Platteville, studying animal science with a minor in science and an

emphasis in a pre-veterinary curriculum.

Adam Schumm, Willshire, Ohio, is a

member-owner and will be a sophomore

this fall at the University of Northwestern

Ohio, Lima, Ohio, where he is studying

agriculture equipment technology.

Samantha Van Deurzen, De Pere,

Wis., will be a sophomore this fall at

the University of Wisconsin-River Falls

studying agriculture education.

•High school scholars

Logan Voigts, Platteville, Wis., plans