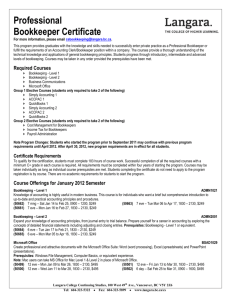

Professional Accounting Certificate

advertisement

Professional Accounting Certificate The Professional Accounting Certificate Program helps you develop the knowledge and skills required to effectively communicate, manage and lead in today’s business environment. The program integrates accounting with general business and information technology tools to allow you to maximize your contribution to the success of your organization. Required Courses (49.8 CEUs, 498 Hours): • • • • • • • Business Communications Business Law in Canada Economics – Micro & Macro Finance 1 – Part 1 Finance 1 – Part 2 Financial Accounting 1 – Part 1 Financial Accounting 1 – Part 2 3.6 CEUs 3.6 CEUs 3.9 CEUs 3.9 CEUs 3.9 CEUs 3.9 CEUs 3.9 CEUs • • • • • • Financial Accounting 2 Financial Accounting 3 Management Accounting 1 Management Communications Management Information Systems 1 Quantitative Methods 1 3.9 CEUs 3.9 CEUs 3.9 CEUs 3.6 CEUs 3.9 CEUs 3.9 CEUs • • Sage 300-1 ACCPAC 1 Sage 300-2 ACCPAC 2 1.8 CEUs 1.8 CEUs Elective Courses (minimum 3.6 CEUs, 36 Hours): Choose between Sage 50-1 and Sage 50-2 OR Sage 300-1 and Sage 300-2 • Sage 50-1 Simply Accounting 1 1.8 CEUs • Sage 50-2 Simply Accounting 2 1.8 CEUs Certificate Requirements To qualify for the certification, students must complete 534 hours of course work. Courses may be taken individually as long as individual course prerequisites have been met. Students with previous post-secondary education and would like to have courses approved for prerequisites or exemptions must provide official transcripts along with the Exemption/Prerequisite Approval Form to the Program Coordinator for approval. Upon successful completion of all the required courses with a minimum C+ grade requirement, students will need to complete an Application for Graduation Form. All requirements must be completed within five years of starting the program. Recognition by Accounting Bodies Courses are recognized by all Canadian accounting associations including: • Certified General Accountants Association of British Columbia (www.cga-bc.org) • Certified Management Accountants of British Columbia (www.cmabc.com) • CA School of Business (www.casb.com) • Chartered Professional Accountants of BC (www.gocpabc.ca) Each designation may have their own select requirements, so students are recommended to contact the association directly to ensure you meet any other requirements. September 2014 Course Offerings Note: There will be no classes running during Thanksgiving long weekend (October 11-13) and Remembrance Day (November 11). Financial Accounting 1 – Part 1 BSAD1084 This introductory course in financial accounting reviews the accounting cycle and the preparation of financial statements. Topics include: Accounting concepts, recording transactions, adjusting accounts, preparing the statements and completing the accounting cycle, accounting for merchandising activities, and inventories and special journals. (70410) 13 eve – Wed Sep 10 to Dec 03, 1830 – 2130, $615 Financial Accounting 1 – Part 2 BSAD1085 This introductory course in financial accounting reviews the accounting cycle and the preparation of financial statements. Topics include: internal controls and accounting for cash, temporary investments, and receivables; capital assets; current and long-term liabilities; accounting for partnerships and corporations; cash flow statements; and the conceptual framework of accounting. Prerequisites: Financial Accounting 1 - Part 1 or equivalent (minimum C+ or 65% required) (70411) 13 eve – Tue Sep 09 to Dec 09, 1830 – 2130, $615 Langara College Continuing Studies, 100 West 49th Ave., Vancouver, BC V5Y 2Z6 Tel: 604-323-5322 • Fax: 604-323-5899 • www.langara.bc.ca/csaccounting Business Communications GBSC1004 This course introduces the fundamentals of interpersonal and group interaction, including written, verbal, and non-verbal communication. Topics include options in presentation preparation and delivery techniques, awareness of tone, consideration of audience, and selection of indirect and direct message organization. (70419) 12 eve – Mon Sep 08 to Dec 01, 1830 – 2130, $405 (70420) 12 eve – Tue Sep 09 to Dec 02, 1830 – 2130, $405 (70421) 6 day – Sat Sep 13 to Oct 25, 0900 – 1600, $405 Management Communications GBSC1007 Take your communication skills to the next level. Learn the techniques of writing documentation and procedures both clearly and effectively. Learn to deliver brief business presentations that are commonplace in a supervisory role. This course will take an in-depth approach to writing report conventions and documenting sources, as well as writing summaries, reports, instructions and procedures. Prerequisites: Business Communications or equivalent (minimum C+ or 65% required) (70422) 6 day – Sat Nov 01 to Dec 06, 0900 – 1600, $405 Business Law in Canada BSAD1005 Gain knowledge about the legal aspects of doing business in Canada. Topics include an introduction to: the Canadian legal system, statutory and common law principles; contract law; tort (negligence) law; public and private company law; commercial law; banking law; debtor-creditor relations; agency theory; real and personal property law; and intellectual property law. Apply legal principles and analysis to every-day challenges faced by Canadian businesses. Note: Final exam scheduled between December 1 and 12. (70401) 13 eve – Thu Sep 04 to Nov 27, 1830 – 2130, $405 (70402) 12 mng – Sat Sep 06 to Nov 29, 0930 – 1230, $405 Financial Accounting 2 BSAD1086 This course focuses on the asset side of the balance sheet. The first part of the course covers financial reporting and accounting concepts, income statement and balance sheet presentation, the cash flow statement, and revenue and expense recognition. The second half of the course covers current monetary balances, inventory and cost of goods sold, temporary and long-term investments, and capital assets. Prerequisites: Financial Accounting 1 - Part 1 and Part 2 or equivalent (minimum C+ or 65% required) (70412) 13 eve – Mon Sep 15 to Dec 15, 1830 – 2130, $615 Financial Accounting 3 BSAD2088 This intermediate financial accounting course focuses on liabilities and equities. Topics include legal and financial aspects of partnerships and corporations, current and long-term liabilities, shareholder’s equity, complex debt and equity instruments, leases, accounting for income taxes, pension and other post-employment benefits, accounting changes, cash flow statement, and the analysis of financial statements. Prerequisites: Financial Accounting 2 or equivalent (minimum C+ or 65% required) (70413) 13 eve – Thu Sep 11 to Dec 04, 1830 – 2130, $615 Management Accounting 1 BSAD1087 Learn the foundational concepts and practices of management accounting. Topics include costing accounting fundamentals, job and process costing, cost-volume-profit analysis, budgeting and control, inventory costing, and information for management control and decision analysis. Prerequisites: Financial Accounting 1 – Part 1 and Part 2 or equivalent (minimum C+ or 65% required) (70414) 13 mng – Sat Sep 06 to Dec 06, 0900 – 1200, $615 Management Information Systems BSAD1090 Explore the different types of hardware and software necessary to an organization’s effective working environment. Explore ways to successfully obtain and process information to enhance business performance by integrating network topologies, files, and database methods. Learn to make sound decisions and solve problems by taking a closer look at each step of the life cycles of information systems for successful implementation. (70417) 13 eve – Wed Sep 10 to Dec 03, 1830 – 2130, $615 Finance 1 – Part 1 BSAD1089 This foundation course in managerial finance focuses on the major decisions made by the financial executive. Content includes analysis of the financial environment and its components; security valuation; the determinants of interest rates; strategic decisions in capital budgeting, cash flow estimation, and the cost of capital; working capital management; and financial planning. Prerequisites: Financial Accounting 1 - Part 1 & Part 2 and Quantitative Methods or equivalent (minimum C+ or 65% required) (70416) 13 eve – Tue Sep 09 to Dec 09, 1830 – 2130, $615 Finance 1 – Part 2 BSAD2089 Course provides an in-depth study of issues and tools that assist financial managers in decision-making. Topics include: capital budgeting under uncertainty; long-term sources of funds; capital structure; dividend policy; special financing and investment decisions; futures, forwards, options and swamps; treasury risk management; financial planning; and long-term planning strategic issues in finance. Prerequisites: Finance 1 - Part 1 or equivalent (minimum C+ or 65% required) Note: Course available January 2015. Langara College Continuing Studies, 100 West 49th Ave., Vancouver, BC V5Y 2Z6 Tel: 604-323-5322 • Fax: 604-323-5899 • www.langara.bc.ca/csaccounting Economics – Micro & Macro BSAD1088 This is an introduction to the issues, concepts, and theories of microeconomics and macroeconomics. It provides practice in applying economic reasoning to decision-making and forecasting problems in business, industry and government. (70415) 14 eve – Tue Sep 02 to Dec 09, 1830 – 2130, $615 Quantitative Methods 1 BSAD1083 Topics covered in this course include data and data presentation; probability; decision analysis; sampling distributions; applications of sampling and risk analysis; statistical estimation, hypothesis testing; regression and correlation; multiple regression; index numbers; time series; statistical decision theory; and an introduction to linear programming. Prerequisites: Basic Probability and Statistics or equivalent (minimum C+ or 65% required) Note: Course available January 2015. Basic Probability & Statistics BSAD1123 Topics covered include the collection, classification, analysis and presentation of numerical data; measures of location and variability; probability; random samples and sampling distributions; estimation of parameters; testing hypotheses; regression and chi-square. This course is followed by the Quantitative Methods 1 course. Note: Final exam scheduled between December 1 and 12. (70409) 25 eve – Tue and Thu Sep 02 to Nov 27, 1830 – 2030, $405 Public Speaking BSAD1113 Learn to deliver brief business presentations that are commonplace in a supervisory role. Students will learn to develop oral communications skills in a mutually supportive environment. This course will help students become more confident with public speaking. Note: Students can take this course to receive the Public Speaking completion for the CGA program if the Communication requirement has been accepted by CGA. (70423) 8 eve – Thu Oct 02 to Nov 20, 1830 – 2130, $279 Sage 50-1 Simply Accounting 1 CSFW1000 Design a new company file and enter transactions for general ledger, accounts receivables, accounts payable, inventory, and the managing of capital expenses. Prerequisites: Financial Accounting 1 Part 1 or equivalent (minimum C+ or 65% required) (70534) 6 eve – Mon Sep 08 to Oct 20, 1830 – 2130, $309 (70609) 3 day – Sat Nov 15 to Nov 29, 0900 – 1600, $309 Sage 50-2 Simply Accounting 2 CSFW2001 Build on your knowledge from Simply Accounting 1 by adding multi-currency transactions, bank reconciliations, payroll, customized reporting features, credit card payment, and receipts. Enter company histories and learn such topics as network security, projects and setting budgets. Prerequisites: Simply Accounting 1 or equivalent (minimum C+ or 65% required) (70555) 6 eve – Mon Oct 27 to Dec 08, 1830 – 2130, $309 (no class Nov 10) Sage 300-1 ACCPAC 1 CSFW1004 This course covers the implementation and set up of ACCPAC Advantage Series Corporate Edition General Ledger (G/L) system. Topics include creating accounts, adding and editing transactions in batches, posting batches to the ledger and printing various financial reports. Prerequisites: Financial Accounting 1 Part 1 or equivalent (minimum C+ or 65% required) (70535) 6 eve – Thu Sep 11 to Oct 16, 1830 – 2130, $309 Sage 300-2 ACCPAC 2 CSFW2011 Explore the accounts receivable and accounts payable features of ACCPAC. This includes setup, data entry, balancing, cheque preparation, reconciliation and printing reports. This course also covers the A/P and A/R interface to ACCPAC Advantage Series General Ledger. The entire cycle of accounts receivable and accounts payable from setup to producing management reports is examined. Prerequisites: ACCPAC 1 or equivalent (minimum C+ or 65% required) (70560) 6 eve – Thu Oct 30 to Dec 04, 1830 – 2130, $309 HOW TO REGISTER Registration for the September 2014 semester starts July 16, 2014 at 9:00am. Classes fill quickly and only receipt of payment guarantees a place in a class. All students who are registering for courses must ensure they meet individual course prerequisites. Students must supply official transcripts in order to be eligible to enrol if prerequisite was completed at another institution. Visit our website for more information: www.langara.bc.ca/csaccounting Langara College offers a variety of registration methods: ONLINE www.langara.bc.ca (Student ID required) PHONE IN 604-323-5322 DROP IN Langara College Continuing Studies 100 West 49th Ave, Vancouver, BC V5Y 2Z6 OFFICE HOURS Monday to Thursday 9:00am – 7:00pm FOR REGISTRATION Friday 9:00am – 4:00pm Saturday 9:00am – 3:00pm Langara College Continuing Studies, 100 West 49th Ave., Vancouver, BC V5Y 2Z6 Tel: 604-323-5322 • Fax: 604-323-5899 • www.langara.bc.ca/csaccounting