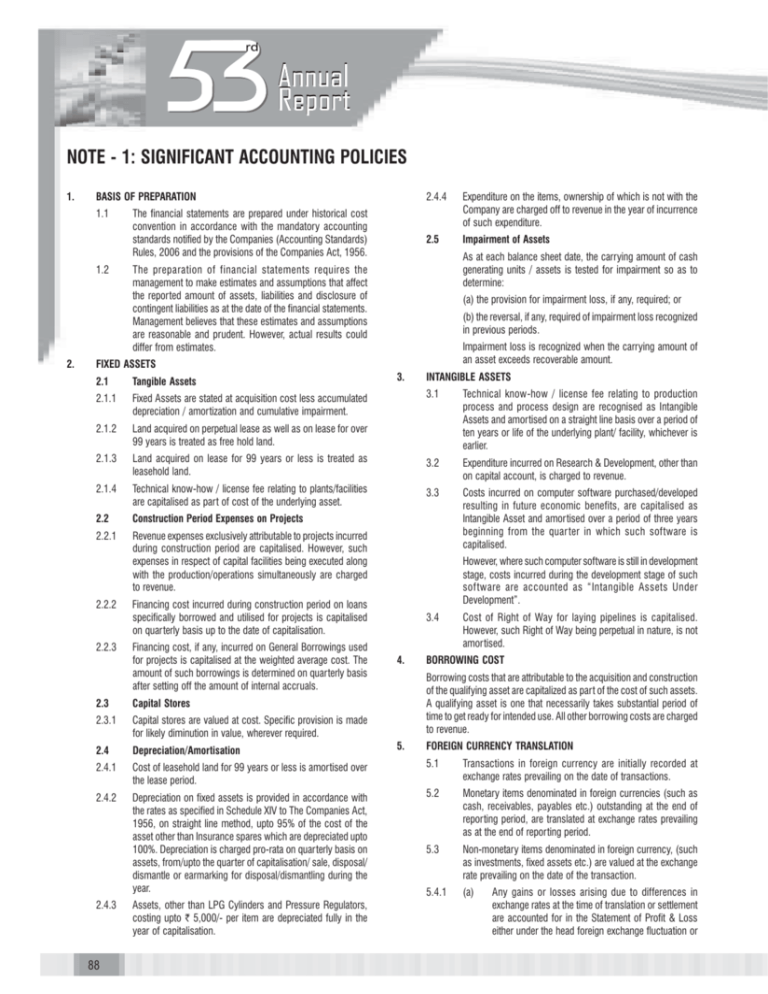

note - 1: significant accounting policies

advertisement