Chapter 1 Accounting in action What is Accounting

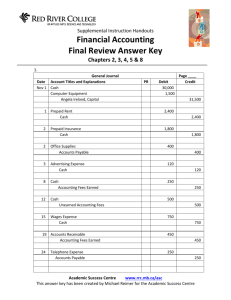

advertisement

Chapter 1 Accounting in action What is Accounting Accounting is the financial information system that consists of three basic activities-it identifies , records , and communicates the economic events of an organization to interested users. Identification Recording Identify economic event s Record,classify,and summarize (transactions) Communication s Prepare accounting reports Analyze and interpret for users Who uses accounting data ? Internal users Internal users of accounting information are managers who plan,organize,and run the business.These include marketing managers,production supervisors,finance directors, and company officers. Managerial accounting provides internal reports to help users make decisions about their companies. Questions Asked by Internal Users Finance Is cash sufficient to pay dividends to SAP shareholders? Marketing Human Resources Management What price for product will maximize the company’s net income? Can we afford to give employees pay raises this year? Which product line is the most profitable?Should any product lines be eliminated? External users External users are individuals and organizations outside a company who want financial information about the company.the two most common types are investors and creditors.Investors(owners) use accounting information to make decisions to buy,hold,sell ownership shares of a company.Creditors(such as suppliers and bankers)use accounting information to evaluate the risks of granting credit or lending money. Financial accounting provides economic and financial information for investors,creditors,and other external users. Questions Asked by External Users Investors Is that Company earning satisfactory income? Investors How does A Company compare in size and profitability with B company? Creditors Will A company be able to pay its debts as they come due? The Basic Accounting Equation Assets = Liabilities + Equity Assets-something that belongs to you or something you own. Current Assets(used within a year) -Cash -Accounts receivables(A/R)means you will receive the money from the customer in the future,it is an oral promise.A promise in spoken word only. -Notes receivables(N/R) is a written promise from customer that you will receive the money in the future. -Prepaid expenses are expense that are paid in advance.It means the money is paid before the expense actually happens. -Office Supplies Non-Current Assets(used for more than a year) -Building -Furniture -Vehicles -Land -Equipment Liabilities- something that does not belong to you or something that you owe. Current Liabilities(for less than a year) -Accounts Payables(A/P)are the opposite of Accounts Receivable.It means you will pay the money to the supplier in the future.It is also a promise made in spoken words only. -Notes Payables(N/P)are the opposite of Note Receivable.It is written promise to pay the money to the supplier in the future. -Interest Payables -Wages Payables -Tax Payables -Unearned Revenue mean to collect the money first and do the service later in the future. Non-Current Liabilities(for more than a year) -Mortgage Payable -Bank Loans Stockholder’s Equity(the share holder’s portion of the assets of company) the capital investment with which a company starts doing business. -Share capital(ordinary)is the amounts paid in by share holders for the ordinary shares they purchase. Is -Retained Earning:revenues increase equity,expense decrease equity and Dividends decrease equity. Transaction Analysis :Transactions-business activities that involve the circulation of money ,e.g. buying,selling,etc. Transaction 1 2 3 4 5 6 7 8 9 10 Bal. Cash +15000 -7000 Assets Accounts + Receivable + Supplies = + Equipment = Liabilities + Accounts Share Payable + Capital + + 15000 Equity Retained Earnings Rev. -Exp. -Div. +7000 +1600 +1600 +1200 +1200 +250 +1500 -1700 -250 +600 -1300 8050 -250 +2000 +3500 -600 -900 -200 -250 -600 + 1400 + 1600 + 7000 = 1600 + 15000 18050 + 4700 -1950 18050 Transaction 1: Mr.A open a computer programming company as Softbyte Inc.On September 1,2014 ,he invests 1500$ cash in the business. 2:Softbyte Inc. purchases computer equipment for $7000 cash. 3:Softbyte Inc. purchases for $1600 from B Supply Company computer paper and agree that allow Softbyte to pay this bill in October. 4:Softbyte Inc. receives $1200 cash from customer for services it have provided. 5:Softbyte receives a bill for $250 for advertising but postpones payment until a later date. 6:Softbyte Inc. provides $3500 of services for customers.the company receives cash for $1500 and it bills the balance of $2000 on account. 7:Softbyte Inc. pays the following expenses in cash for September:rent $600 ,salaries $900,and utilities $200. 8:Softbyte Inc. pay its $250 advertising bill in cash.(in Transaction5). 9:Softbyte receives $600 in cash from customer who had been billed(in Transaction6) 10:the corporation pays a dividend $1300 in cash to Mr.A. -1300 -1300 Financial Statements Softbyte Inc. Income statement For the month ended September 30,2014 Revenue Service revenue Expenses Salaries and wages expense Rent expense Advertising expense Utilities expenses Total expenses Net income $4700 $900 600 250 200 1950 $2750 Softbyte Inc. Retained Earnings Statement For the month ended September 30,2014 Retained earnings , September 1 Add:Net income Less:Dividends Retained earnings , September 30 $0 2750 2750 1300 $1450 Softbyte Inc. Statement of Financial Position September 30,2014 Assets Equipment Supplies Accounts Receivable Cash Total assets $7000 1600 1400 8050 $18050 Equity and Liabilities Equity Share capital-ordinary Retained earnings Liabilities Accounts payable Total equity and liabilities $15000 1450 $16450 1600 $18050 Steps in Accounting: 1.Record the transaction 2.Classify into:-Assets –Liabilities –Revenue –Expense –Common Stock –Dividend ,etc. 3.Prepare Financial Statement: -Income statement :to know profit or loss -Retained Earnings Statement:to know the capital situation of the company -Balance Sheet:A=L+SE 4.Interpret:to understand if the company is doing well or not and what can be done to improve the present situation to help make future decision. Chapter 2 The Recording Process The Account An accounting is an individual accounting record of increases and decreases in a specific asset, liabilities, or equity item.In tis simplest from,an account consists of three parts : (1) a title, (2) a left or debit side, and (3) a right or credit side as a T-account. Title of Account Left or debit side Assets Debit increase Credit decrease Right or credit side Liabilities Debit decrease Credit increase Share Capital-Ordinary Debit decrease Credit increase Expenses Debit increase Credit decrease Dividends Debit increase Credit decrease Retained Earnings Debit decrease Credit increase Revenues Debit decrease Credit increase Steps in the Recording Process Three basic steps in the recording process: 1.Analyze each transaction for its effects on the accounts. 2.Enter the transaction information in a journal. 3.transfer the journal in formation to appropriate accounts in the ledger. The Journal -is referred to as the book of original entry. Entering transaction data in the journal is known as journalizing. A complete entry consists of(1) the date of the transaction,(2) the accounts and amounts to be debited and credited,and (3) a brief explanation of the transaction. The Ledger –the entire group of accounts maintained by a company The Trial balance –is a list of accounts and their balance at a given time.The steps for preparing are (1)List the account titles and their balances,(2)Total the debit and credit columns,and(3)Prove the equality of the two columns. Example: A group of investors opened Laundromat Inc. on September 1 ,2014.During the first month of operations, the following transactions occurred. Sept. 1 Shareholders invested $200000 cash in the business. 2 Paid $10000 cash for store rent for the month September. 3 Purchased washers and dryers for $250000,paying $100000 in cash and signing a $150000,6 month ,12% note payable. 4 Paid $ 12000 for a one year accident insurance policy. 10 Received a bill for advertising $2000. 20 Declared and paid a cash dividend to shareholders $7000. 30 Determined that cash receipts for laundry fees for the month were $62000. The chart of accounts are cash(101),Accounts receivable(112),Supplies(126),Prepaid Insurance(130),Equipment(157),Accumulatede Depreciation-Equipment(158),Notes Payable(200),Accounts Payable(201),Unearned service revenue(209),Salaries and wages payable(212),Interest Payable(230),Share Capital-Ordinary(311),Retained Earnings(320),Dividends(332),Income Summary(350),Service Revenue(400),Advertising Expense(610),Supplies Expense(631),Depreciation Expense(711),Insurance Expense(722),Salaries and wages Expense(726),Rent Expense(729),Utilities Expense(732),and Interest Expense(905). General Journal J1 Date Account Titles and Explanation 2014 Sept.1 Cash Share Capital-Ordinary (Shareholders’ investment of cash in the business) 2 Rent Expense Cash (Paid September rent) 3 Equipment Cash Note Payable (Purchased laundry equipment for cash and 6 month ,12% note payable) 4 Prepaid Insurance Cash (Paid one year insurance policy) 10 Advertising Expense Accounts Payable (Received bill for advertising) 20 Dividends Cash (Declared and paid a cash dividend) 30 Cash Service Revunue (Received cash for services provided) Ref. Debit 101 311 200000 729 101 10000 157 101 200 250000 130 101 12000 610 201 2000 332 101 7000 101 400 62000 Credit 200000 10000 100000 150000 12000 2000 7000 62000 General Ledger Cash Ref. Date Explanation Debit 2014 Sep.1 J1 200000 2 J1 3 J1 4 J1 20 J1 30 J1 62000 Prepaid Insurance Date Explanation Ref. Debit 2014 Sep.4 J1 12000 Equipment Date Explanation Ref. Debit 2014 Sep.3 J1 250000 Credit No.101 Balance Credit 200000 190000 90000 78000 71000 133000 No.130 Balance Credit 12000 No.157 Balance 10000 100000 12000 7000 250000 Date 2014 Sep.3 Date 2014 Sep.10 Date 2014 Sep.1 Date 2014 Sep.30 Notes Payable Explanation Ref. Debit J1 Accounts Payable Explanation Ref. Debit J1 Share Capital-Ordinary Explanation Ref. Debit J1 Service Revenue Explanation Ref. Debit J1 Credit 150000 No.200 Balance Credit 150000 No.201 Balance 2000 2000 Credit No.311 Balance 200000 Credit 200000 No.400 Balance 62000 62000 Date Dividends Explanation Ref. Debit Credit No.332 Balance 2014 Sep.20 Date Date Advertising Expense Explanation Ref. Debit Credit 2014 J1 7000 Rent Expense Explanation Ref. Debit Credit 7000 No.729 Balance Sep.10 J1 2000 2014 Sep.2 No.610 Balance J1 10000 10000 Laundromat Inc. Trial Balance September 30,2014 Cash Prepaid Insurance Equipment Notes Payable Accounts Payable Share Capital-Ordinary Dividends Service Revenue Advertising Expense Rent Expense Debit $133000 12000 250000 Credit 150000 2000 200000 7000 62000 2000 10000 $414000 $414000 Chapter 3 Adjusting the Accounts The Basics of Adjusting Entries Ensure that the revenue recognition and expense recognition principles are followed. An accounting year (Fiscal year)can start on other dates as well. 1)Adjusting entries are always prepared at the end of the present accounting period. 2) Adjusting entries are always prepared when a transaction affects 2 accounting periods ,that is the present and future accounting periods. 3)Adjusting entries are prepared in order to know how much Revenue and Expenses belong to the present period and how belong to the future accounting period. 2000 Types of Adjusting Entries Classified as either deferrals or accruals. Deferrals: 1.Prepaid expenses:Expenses paid in cash before they are used or consumed. 2.Unearned revenues:Cash received before service are performed. Accruals: 1.Accrued revenues:Revenues for for services performed but not yet received in cash or recorded. 2.Accrued expenses:Expenses incurred but not yet paid in cash or recorded. Adjusting Entries for Deferrals Deferrals are costs or revenues that are recognized at a date later than point when cash was originally exchanged. Prepaid Expenses Asset Unadjusted Balance Expense Credit Adjusting Entry(-) Debit Adjusting Entry(+) Unearned Revenues Liabilities Debit Adjusting Entry(-) Revenue Unadjusted Balance Credit Adjusting Entry(+) Adjusting Entries for Accruals This will increase both a statement of financial position and an income statement account. Accrued Revenues means Revenues for service performed but not yet recorded at the statement date are accrued revenues. Accrued Expenses means Expense incurred but not yet paid or recorded at the statement date. Accrued Revenues Asset Debit Adjusting Entry(+) Revenue Credit Adjusting Entry(+) Accrued Expenses Expense Liabilities Debit Adjusting Entry(+) Credit Adjusting Entry(+) Chapter 4 Completing the Accounting cycle Using Worksheet Worksheet is a multiple-column form used in the adjustment process and in preparing financial statements. Steps in preparing worksheet 1)Prepare a trial balance on the worksheet 2)Enter the adjustments in the Adjustments columns 3)Enter adjusted balances in the adjusted trial balance columns 4)Extend adjusted trial balance amounts to appropriate financial statement columns to appropriate financial statement columns 5)Total the statement columns,compute the net income (or net loss),and complete the worksheet Preparing Financial Statements from a worksheet The income statement is prepared from the income statement columns. The statement of financial position and retained earnings statement are prepared from the statement of financial position columns. Preparing Adjusting Entries from a Worksheet The adjusting entries are prepared from the adjustments columns of the worksheet. Closing the Books At the end of the accounting period,the company makes the accounts ready for the next period. Temporary accounts relate only to a given accounting period and be closed at the end of the period. Permanent accounts relate to one or more future accounting periods and be not closed from period to period. Preparing Closing Entries Directly from the adjusted balances in the ledger by following four entries accomplish the desired result more efficiently: 1)Debit each revenue account for its balance, and credit income summary for total revenues. 2)Debit income summary for total expenses,and credit each expense account for its balance. 3)Debit income summary and credit retained earnings for the amount of net income. 4)Debit retained earnings for the balance in the dividends account,and credit dividends for the same amount. Posting Closing Entries The post closing trial balance is to prove the equality of the permanent account balances carried forward into the next accounting period. Example Watson Answering Service Inc. Trial Balance August 31,2014 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Notes Payable Accounts Payable Share Capital-Ordinary Dividends Service Revenue Salaries and wages Expense Utilities Expense Advertising Expense Debit $5400 2800 1300 2400 60000 Credit $40000 2400 30000 1000 4900 3200 800 400 $77300 Other data: a).Insurance expires at the rate of $200 per month. b).$1000 of supplies are on hand at August 31. c).Monthly depreciation on the equipment is $900. d).Interest of $500 in the notes payable has accrued during August. $77300 Watson Answering Service Inc. Worksheet for the Month Ended August 31,2014 Trial Balance Account Titles Cash AccountsReceivable Supplies Prepaid Insurance Equipment Notes Payable Accounts Payable ShareCapitalOrdinary Dividends Service Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Totals Insurance Expense Supplies Expense DepreciationExpense Accumulated Depreciation-Equipment Interest Expense Interest Payable Totals Net loss Totals Dr. 5400 2800 1300 2400 60000 Cr. Adjustments Dr. Cr. (b)300 (a)200 40000 2400 30000 1000 4900 3200 800 400 77300 Adjusted Trial Balance Dr. Cr. 5400 2800 1000 2200 60000 40000 2400 30000 1000 4900 Income Statement Dr. Cr. Statement of Financial Position Dr. Cr. 5400 2800 1000 2200 60000 40000 2400 30000 1000 4900 3200 800 400 3200 800 400 200 300 900 200 300 900 77300 (a)200 (b)300 (c)900 (c)900 (d)500 1900 900 500 (d)500 1900 78700 900 500 500 78700 6300 6300 4900 1400 6300 72400 1400 73800 500 73800 73800 Watson Answering Service Inc. Statement of Financial Position August 31,2014 Assets Property,plant, and equipment Equipment Less:Accumulated depreciation-equipment Current assets Prepaid insurance Supplies Accounts receivable Cash Total assets $60000 900 $59100 2200 1000 2800 5400 11400 $70500 Equity and Liabilities Equity Share capital-ordinary Retained earnings Non-Current Liabilities Notes payable Current liabilities Notes payable Accounts payable Interest payable Total equity and liabilities Aug.31 Service Revenue Income Summary (To Close revenue account) 31 Income Summary Salaries and Wages Expense Depreciation Expense Utilities Expense Interest Expense Advertising Expense Supplies Expense Insurance Expense (To Close net loss to retained earnings) 31 Retained Earnings Income Summary (To Close net loss to retained earnings) 31 Retained Earnings Dividends (To Close dividends to retained earnings) $30000 2400 $27600 35000 5000 2400 500 7900 $70500 4900 4900 6300 3200 900 800 500 400 300 200 1400 1400 1000 1000 Chapter 5 Accounting for purchase and sale of merchandise Merchandise business is engaged in the buying and selling of articles or goods. The articles they buy and sell are called merchandise. Anything we buy to use in the business is asset. Computation of discount (purchase discount or sales discount) (Purchase or sell - return) x FOB Shipping point means buyer must pay transportation or freight on merchandise purchased (freight in) FOB destination means seller is responsible for freight charges on sale of merchandise (delivery expense or freight out) TRANSACTIONS Purchase Merchandise Return the merchandise Transportation charges On merchandise purchased Pay for merchandise within discount period Sell merchandise to customer Customer return the merchandise sold PERPETUAL SYSTEM Merchandise Inventory Cash / Acc payable JOURNAL ENTRIES PERIODIC SYSTEM XX Purchase XX Cash / Acc Payable Cash / Acc payable XX Merchandise Inventory XX Merchandise Inventory Cash / Acc payable XX XX Acc Payable XX Cash Merchandise Inventory 1.Cash / Acc receivable XX Sale 2. Cost of Goods Sold XX Merchandise Inventory (cost) 2.Jornal entries 1.Sales Return and Allowance Cash / Acc payable (selling price) XX XX XX XX Cash / Acc Payable Purchase Return And allowances Freight – in or Transportation – in Cash / Acc payable Acc payable Cash Purchase Discount 1. Journal entry only Cash / Acc Receivable Sale (Selling price) XX XX XX XX XX XX XX XX XX XX XX 1.Journal entry only XX XX Transportation charge on merchandise sold 2.Merchandise Inventory XX Cost of Goods Sold XX (cost) Delivery expense XX Cash / Account Payable XX Collect account Receivable within discount period Cash Sales Discount Acc Receivable XX XX XX 1.Slaes return and Allowance XX Cash / Acc receivable XX (Freight out) Delivery Expense XX Cash /Account Payable XX Cash XX Sales Discount XX Acc Receivable XX Chapter 6 Inventory is the stock of goods which a business keeps for sales. Ending inventory is the unsold stock of merchandise on the last day of an accounting period (usually December 31). The ending inventory of one year (December 31) is the beginning inventory (January 1) of the next year. Usually ending inventory comes from different purchase. So it is rather difficult to decide the cost of it. The business should include cost of ending inventory in the Income statement and balance sheet. If ending inventory is overstated. Then net income will be overstated under value ending inventory cost will understate net income. There are two main systems to compute cost of ending inventory. 1. Periodic system 2. Perceptual system Periodic system (a) First In first out (FIFO) (b) Weighted average method (c) Lower of cost or market price (LCM) method We must decide the cost of ending inventory. First we must find out the ending inventory in units. The following format we can to get the ending inventory in units. Date Details Beginning Inventory 1st purchase 2nd purchase Less purchase return 3rd purchase 4th purchase Total Unit Unit Sold Ending Inventory (units) Computation of units sold Units sold XX Units sold XX Less sales return (units) Total units sold (XX) XX Units XX XX XX XX XX XX XX (XX) XX Unit Cost XX XX XX XX XX XX Total Cost XX XX XX (XX) XX XX XXX (a) First in first out Under this method merchandise purchased first will be sold first. So ending inventory comes from the last purchase (newest purchase) Cost of ending inventory Cost of goods sold = Total cost – cost od ending inventory (b) Weighted average method Cost of ending inventory = x ending inventory (units) (c) Lower of cost or market price (LCM) method Under this method compute cost price of ending inventory and total market price. Compute both and take the lower one as the cost of ending inventory. Chapter 7 Bank Reconciliation Now a day almost all business units open bank account and deposit all the cash in the bank and make payments by check. But usually the bank account of cash balance may be differed from its own cash record in the business. Bank reconciliation statement is prepared by business to make the cash balance as per business records equal to its bank balance The common items causing the difference in cash balance as per business record and bank statement are; 1.Deposit in transit = Cash received by the business and given to bank for deposit, but the bank not yet recorded the deposit 2.Outstanding checks = These are check issued by the business but not yet paid by bank 3.Credit memo items =These are usually revenue items on which cash was collected by bank for the business and recorded in the deposit column of bank statement but these item are not yet recorded in the business records. 4.Debit memo items = These are expenses paid by bank on behalf of the business but not recorded in the business cash payment journal. 5.NSF cheque = This is a check received by the business from a customer, which is the given to the bank to collect cash from the bank of the customer. But the customers’ bank refuses to pay money on the check saying that there is not sufficient fund in the customer account 6.Stop order check = this is a check issued by the business, then later told the bank not to pat cash on that check but the bank paid cash by mistake Format of bank reconciliation statement Name of Business Bank Reconciliation As on ………….. 1)balance as per book Add deposit in transit XXX XXX XXX XXX XXX Less Outstanding Check No. XXX XXX (XXX) Adjusted Balance XXX 2)Balance as per book XXX Add credit memo items. XXX XXX XXX XXX Less debit memo items XXX XXX (XXX) XXX