Chapter 2 Classic Mechanism Design

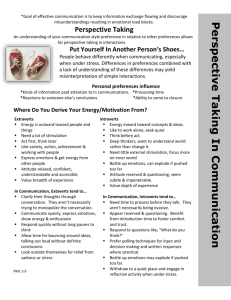

advertisement