Control of Corporate Decisions: Shareholders vs. Management

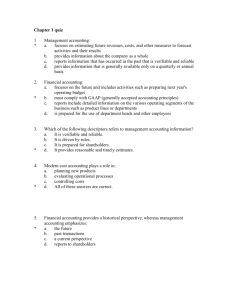

advertisement