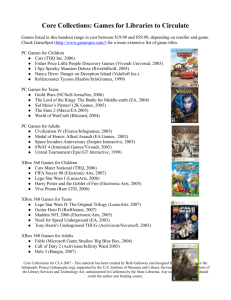

Nintendo Wii's Ecosystem Strategy

advertisement

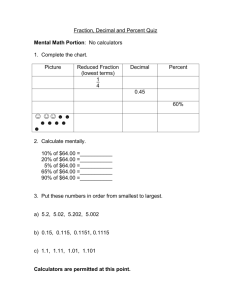

Nintendo Wii’s Ecosystem Strategy By: Dallemagne, Cedric L. Malhotra, Hemant Ryu, Kyunghwan Shi, Zhu Vashist, Rajesh Zhang, Wenxuan Introduction On September 14th 2006 Nintendo launched its seventh generation home video game console Wii. This console was supposed to be in direct competition with yet to be released Sony Playstation 3 and Microsoft Xbox360. But instead of competing with them head-on on current competitive lines of graphics and accessories like movie player for current gaming customers, Wii targeted much broader demographics. The main features that Wii promotes are its Remote which can be used as a handheld pointing device and detect movement in three dimensions and The Party and Fun Games specifically developed for non gamers. For Wii to attract non-gamers it had to not only make and sell the consoles but develop the full Eco-system as shown in Figure-1. It had to firstly ensure reliable suppliers then involve game developers and retailers to really develop the value proposition and finally involve journalists and magazines to convey that value proposition to end customers. In this report we analyze how the fun gaming value proposition was created and conveyed for non-gamers by the Wii Ecosystem. Figure 1 Nintendo Company and Its Role as the Console Manufacturer Wii is revolutionary because it is the only game console that has successfully reached not only to the bedroom of hardcore gamers, the focus of previous-generation game console manufacturers, but also the living room of hard-to-reach segments such as housewives, busy professionals, and almost anyone who is ready to have some fun with friends. Different from users of PS3 and Xbox 360, who all sit tight in their sofa and stare at the screen, Wii gamers become the secondary source of laughter on a Friday night – snowboarding is really fun to play, but it might be more entertaining to watch your nerdy friends move in ways you never thought they would in public! This is the charisma of Wii. The key difference here is that you need to use your entire body, besides your fingers, to play the games. This strategy fundamentally changes the competitive battlefield--sitting for hours in sofa might not be appealing to busy professionals who already spent hours in front of work computers, but the idea of getting your workout while playing games has invaded people's mindset like nothing else before. Instead of having dry eyes and stiff lower back afterwards, Wii players can do Yoga, tennis, boxing, etc, all promoting a more healthy lifestyle. All of a sudden, Wii Sports and Wii Fit become the new standard of having fun and having a workout. The key component that made it possible is the motion-detection system that Wii develops, which includes the Wii Console, the sensor bar, the classic controller, the Wii remote and the "Nunchuk". This system allows the gamers' motions to be tracked to control the games, in a rather precise fashion. A noticeable departure of Wii from competitors is that the game leverages accessories more than any other game console manufacturer has done before. With this comes an innovative source of revenue, including but not limited to Wii Zapper, Wii Speak, Wii Wheel, Wii Balance Board and Wii MotionPlus. The accessories are freed from the supportive role. Instead, combined with accessory-enabled games, the accessories elevate their status and become cash-generators. In a sense, as a traditional force in the gaming console market, Nintendo plays an untraditional battle against its competition. From many aspects, it didn’t follow the industry standards and became the first of its kind into a new market segment. It focuses on the uncharted mass market instead of hardcore gamers, it uses intuitive motion-detection system instead of complicated classic controller, it emphasizes fun and health elements instead of violent fights/battles, and it uses accessories as a new stream of revenue. How does it achieve these? How does it control the many risks associated with manufacturers who outsource hardware components? The answer is that, Nintendo develops and manufactures its own hardware components. As a result, it can ensure the gamer-friendly interface and quality of the system. It reduces/eliminates the risk associated with subcontractors, which strategy fully supports its marketing and selling efforts. Core Components Manufacturers On Mar. 11, 2009, AMD (former ATI) announced that the fifty millionth ATI “Hollywood” graphics processor for the Nintendo Wii game console was shipped. With fifty million units delivered, the ATI graphics processor code-named “Hollywood” becomes the most successful AMD game console chip to date in terms of unit sales. On Mar 13, 2009, IBM also announced that it had reached a significant milestone as the microprocessor supplier for Nintendo Co., Ltd., by completing the shipment of 50 million processors for the Wii(TM) game system. As Brian Connors, VP of games and power platforms for IBM Microelectronics said:"We are proud to have achieved this important milestone …, IBM has a long, successful relationship with Nintendo … to deliver winning products." Without question, Wii is one of the most successful game consoles in the history. However, when most people focus on the competition between Wii, PS3 and Xbox 360, one of the biggest winners behind this “game” is chip manufacturers. As reported by VGChartz, one of the largest worldwide publishers providing a detailed view of the videogame industry, AMD occupies 77.5% of share on global GPU market, far ahead of its long-term rival Nvidia, who is the GPU provider for PS3. In AMD’s 77.5%, 48.4% thanks to Wii and 29.1% attributes to Xbox 360. Without Wii, no one could imagine how AMD can grab most of the market share in such a short period. From this standpoint, it is very easy for us to conclude that the success of one game console will not only bring huge profit to its own manufacturer, such as Nintendo, but also dramatically change the competitive landscape of its up-stream suppliers. On the other hand, we have to point out that the success of Wii also largely depends on the supports from its key chip manufacturers. Two years before the launch of Wii, ATI had already started its design development for Wii’s GPU. Furthermore, ATI had made the first GPU chip and started to prepare the shipping to Nintendo for finial assembly three months in advance of finial launch. Until the launch date, ATI and IBM had each manufactured more than 5 million chips for Nintendo and ensured Wii’s huge success in the market. However, the unprecedented sales spur in demand after the launch did not allow them to increase production immediately. The short of stock situation had lasted for more than one and half year and finally was solved in 2008. Software Publishers Software publishers take on a number of important roles within the electronic gaming industry. They finance creation and game development, manage relationship with retailers and platform manufacturers, package and market games to consumers. They create versions of their games for competing consoles like Wii, PS3, and XBOX360. Large publishers, like EA, NamCo and Ubisoft, have created their own production facilities for content development and software Development. Content development is the process of creating new concepts for games (storyline, game genres, characters etc) with or without the use of licensing to assist in the general appeal for the game. In the mid-1990s around 40% of the titles sold contained licensed content. Software development is called “production” in the video game industry. It means taking the ideas generated by the content development stage and creating the end product, including writing the code and developing the software platform. Most large publishers, like EA, NamCo and Ubisoft, have their own production facilities. Such big integrated publishers create and produce most of their games internally. Nintendo is one of the biggest publishers of games, which helps it reduce its dependence on third party software publishers. For the Wii, Nintendo ensured enough gaming content by making it backward compatible with earlier generation of gaming consoles. Nintendo also launched the Virtual Console which allowed players to purchase and play games originally released for the older gaming consoles. This allowed Nintendo to leverage its existing franchises, like Super Mario, Pokemon and Metroid. Nintendo also launched the Play Control! Line, a selection of enhanced GameCube games for the Wii featuring updated controls. At the same time, Nintendo build strong third party support by working closely with prominent publishers like EA, Ubisoft, Sega, Square Enix, etc. Their partnership help develop more exclusive games for Wii than what were available for XBOX or PS3. Strong presence in the software publishing business, backward compatibility with older gaming platforms and strong relationship with 3rd party game developers, helped Nintendo successfully manage this important component of their ecosystem. Retailer Retailers are the last point of the value chain before the customers, and therefore play a major role in new consoles’ adoption and success. While console manufacturers’ marketing effort may inform consumers of the arrival of their new game platform to create anticipation and generate an early demand pull for the product, retailers will request manufacturers to alleviate the risk inerrant to referencing a new product. Console manufacturers will therefore often provide free products, and product displays, to help the innovation diffusion. Professor Everett Rogers suggested five factors in innovation diffusion: relative advantage, compatibility, complexity, triability, and observability. Having consoles on display in major retail chains therefore allows console manufacturers to demonstrate their relative advantage, by enabling potential buyers or users to try and observe the product, which partly explains retailers’ critical role. Just as any other business, retailers tend to be risk averse. Since retail space is a cost to the retailers, they are very mindful of maximizing their store space allocation. Adding a new console, with its derivative products – games & accessories – will often take shelf space away from existing products. The retailers therefore will be careful to not fully alienate the sales of the existing other consoles with the arrival of a new platform. Adoption rates being unequal among user types (“early adopters, early majority, late majority and laggards” Everett Rogers, Diffusion of Innovations (1995), p. 262), the space allocation will often mirror the expected sales per console associated products. New consoles will therefore take up less space at the beginning, as the retailer continues to go through its other products’ inventory and will progressively shift its inventory to the new console as the adoption increases. The shift in inventory is also to the benefit of the Game Developers. While in order to be successful, consoles need to provide several games right from their introduction, there is no need to launch the product with as many games as the consoles being replaced. Game Developers can therefore sequence game releases. Departing from industry standards, Nintendo was taking a major bet with Wii by targeting the “mainstream gamers”, and possibly new category adopters (understanding none video game users). Thanks to a successful pre-launch PR campaign, having the games being repeatedly discussed in the mass media, the product adoption was instantaneous and the early demand far exceeded the company’s available capacity. The scarcity of the supply ended up created a vacuum of demand that ensured the success of the console. While little is known on the trust the retailers had in the product prior to its launch, it would be reasonable to assume that Nintendo past success enabled the company to secure some retail space for the Wii’s launch. However, the console departure from targeting “hard core gamers” and a perceived limited relative advantage compared to industry standards likely brought some skepticism among retailers. The demand pull and product scarcity therefore brought tremendous appeal to consumers and shifted the power dynamic between the retailers and Nintendo, allowing the console manufacturer to negotiate better retail space, and displace some of its competitors in store displays. Furthermore, the company’s demographic target change implied that regular mass merchandisers such as Best Buys, Targets, and others, grew in importance over the traditional fragmented specialized video game stores like Macromedia, Play.com for Nintendo. This shift increased the product visibility, and simplified distribution issues by leveraging major retailers’ well run infrastructures and systems. Bringing the focus to the mass market channels was also a way to possibly alleviate the product objections from specialized stores, who may have continued to base their product evaluation on more prevalent industry standards. Journalists as advocates While Nintendo’s success with the Wii is undeniable after the fact, the company took a risky bet by departing from industry norms. One of the critical keys for the product’s success was to rapidly reach a mass appeal, by having it validated by opinion leaders. With nurses voted most trusted professions for seven years running in Gallup’s annual ranking – other medical professions also being at the top of the list – what could be a better product validation than having the medical profession’s endorsement. Nintendo was therefore very clever to put its new console in the hands of the medical profession, and be sure that journalists would soon unveil the profession’s endorsement for the game. Videos as this one were fast to be published: http://www.youtube.com/watch?v=nFkdah6O-vA By promoting an active life style and providing that appeal with a video game, Nintendo was essentially addressing the concerns and objections each parent around the world had for video games and responding to the growing aspiration for “wellness”. Parents therefore became advocates themselves. This shift was part of the brilliance of Nintendo’s strategy. While children were expected to be the Wii consumers; parents, young adults, elderly generations, and families in general were Nintendo’s customers. The new value proposition Nintendo brought to market was brilliant, but Nintendo needed to broadcast its message rapidly and distinctively. The PS3 and new generation Xbox were about to be unveiled, and Nintendo needed to differentiate itself early on. The use of the general media was therefore critical. Anecdotal stories such as nursing homes using the product, or simply having TV show hosts play during their shows were enough to demonstrate the product relative advantage, lack of complexity and observability. This strategy was deadly effective. Naturally, the traditional specialized media were also leveraged to promote the product, but the key factor of success for Nintendo was to broaden its new product appeal to the largest audience possible, which is why its PR campaign was so effective. Customers Customers are the final end point in any eco-system. Since Nintendo is targeting to sell Wii to new segment groups which have not been interested in playing games before, the company needs to come up with unique strategies so that they open their wallets and buy “innovative” consoles. What have been preventing them from buying consoles such as Xbox360 or PS3? People in 60s and 80s are too old to understand complicated games. People in 30s and 50s may have a lot to enjoy other than just sitting in front of a screen and wasting time in virtual world. Further, they have purchasing power and do not want to buy another console for their children. That is why Nintendo chooses Wii Sports as its first game title to promote and put it inside the Wii console as a package. The first commercial (http://www.youtube.com/watch?v=OWZYIDj2ob0) came out with a scene that every family member enjoyed Wii Sports together. First, it is sports game, having five games in one title. Most of people in 30s and 50s like golf, baseball and/or tennis. Games are virtual, but when raining outside or before going out for sports, they can practice swing or throwing with a motionsensitive controller. Also, Nintendo’s second game title, Wii Fit, is a perfect fit to weightconscious women, a used-to-be non-traditional target for gaming industry. This is a somewhat similar strategy when Nintendo launched Nintendo DS with Brain Training and Nintendogs as their first game titles, changing images gaming has had and making people buy consoles. Once they buy a console, they will purchase other game titles to utilize it, and that is why RPG games and shooting games, traditional games only hard core, younger generation like, come out later. Second, Wii sports games are so simple and easy to play. Even people in 60s and 80s can learn quickly and play games. When Nintendo launched Wii, one of their PR strategies was to mention that Wii is a perfect entertainment system in nursing home: old people in wheelchairs can enjoy their time in playing Wii Sports. Lastly, almost everyone from young children to old people likes sports. With simplicity and easiness, it became a family game. A Father now can play tennis with his son, who never learned to play outside. This is the value Nintendo Wii can give to users, which Xbox360 or PS3 have never imagined to promote to their target segments. Conclusion In the end if we see the Wii Ecosystem strategy as shown in Figure 2 Figure 2: A Modification of Michael Olenick strategy (valueinnovation.net) Wii has used the Fun, accessories, ease of play and existing Game Library as main components for value proposition rather than the conventional Movies, Graphics and Physics required by the conventional gamers. To push this innovation in the Eco-system as we saw Nintendo had to act as the main driver for it and thus initially developed both games and hardware in house and did direct advertising in the mass-media rather than relying on conventional gaming magazines. The result as shown in Figure 3 was that sales of Wii have been consistently higher than Playstation 3 and Xbox360 and its strategy was a success in the market. Figure 3